Institutional Insights - Citi US Election Cheatsheet

Mind the markets.

Our FX trader warns if initial results indicate Harris doing better than expected, there will likely be a panicky unwind of USD longs (tariff trades like USD vs EUR, CNH, MXN, KRW). eTrading analysis confirms USDMXN liquidity density is historically the most impacted. We expect USDCNH and USDMXN to have the largest relative declines in liquidity density by 60-70% on average across the day based on our projections. Stu Kaiser, our equity trading strategist, says equity options imply a 1.8% SPX move 0 we see 2% as fair. We expect downward pressure on implied volatility post-election.

In APAC markets, turnover tends to be higher than usual on the day after election and stays high for the week after. Sleep on the Congress result. Republicans only need to net 1/2 seats to return to Senate majority - we expect to know the outcome based on OH and MT seats on the night. The House is a closer call, with toss up seats are concentrated in AZ, CA, MI, PA, NY, IA. We could know on the night of if “lean” districts on the east coast and MI/IA go against the grain. Our political experts identify these seats to watch early - NC-01; VA-07; OH-9; OH-13; MI-07; MI-08 for D and VA-02; IA-01; IA-03 for R. Otherwise, we could be waiting some time for slow counts in West Coast and even NY. The House outcome in 20222 mid-terms took over a week to officially call.

Bottom line: Trump trades may be partly priced, reflecting his better odds in both polling and prediction markets. But as this race remains essentially a toss up, we see positioning as relatively light into what is essentially a binary event. Citi Research expects investors to await the election outcome and quickly chase price action once there is some certainty. Trump trades will follow well-established themes of tariffs, tax, deregulation. Harris trades would be an unwind of these.

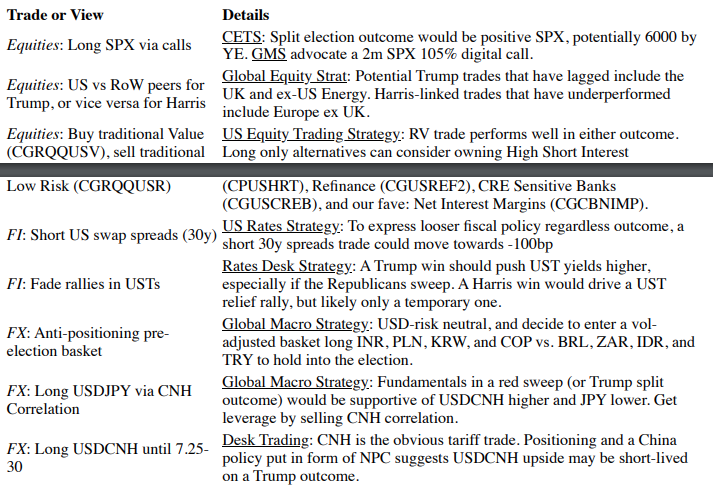

Beyond the obvious, our strategists explore ways to exploit current market pricing of the election and outcome-neutral trades. For example, Citi Commodities remain fundamentally bullish precious metals, bearish oil. We have less conviction on US FI this week, given a 30y auction Wed, FOMC on Thu and current levels but overall remain bearish on fiscal outlook. RV trades in equities and FX remain attractive, we like buying dollar dips.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!