Institutional Insights: BofA The Flow Show

Institutional Insights: BofA The Flow Show

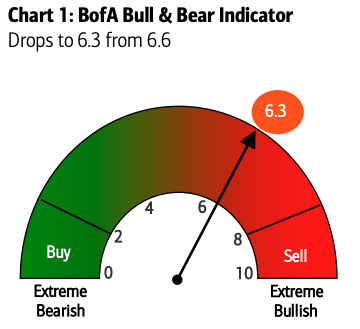

Below is an overivew of capital flows as analysed by Michale Hartnett of Bank of America

The Prime of Strife

Scores on the Doors: crypto 17.2%, gold 16.9%, stocks 8.9%, oil 6.3%, HY bonds 4.7%, commodities 3.3%, cash 3.2%, IG bonds 1.9%, US$ 1.9%, govt bonds -0.8% YTD.

Zeitgeist: "The Bank will continue to raise the policy interest rate going forward", BoJ July 31st; "The Bank will not raise its policy rates when markets unstable”, BoJ Aug 7th; painfully (biggest FX carry-trade loss since Mar'20 Wall St has now stopped BoJ hiking; Wall St's Aug/Sept goal now appears to be bossing the Fed into big rate cuts.

The Biggest Picture: lowest interest rate small businesses can borrow at is prime, and in real terms US prime rate is 6.5%, highest this century; higher-for-longer real rates slowly and decisively hurting US consumer & labor market; global rate cuts no longer question of "if" or "when", simply question of "will cuts work"; we say big cuts needed to work…note China 30-year bond yield at new all-time low.

The Price is Right: technical levels that would flip Wall St narrative from soft to hard landing have not been broken…4% on 30-year Treasury, 400bps on HY CDX, 5050 on S&P500…good news; important now for stock leaders SOX (4600) & big tech XLK (200) to hold 200dma levels…if levels break, traders then target 2021 highs (i.e. 10% lower).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!