Institutional Insights: Alpine Macro-Basis Trade Mayhem: When Will The Fed Step In?

.png)

Basis Trade Mayhem: When Will The Fed Step In?

A rapid unwinding of the Treasury basis trade has caused Treasury yields to rise sharply today. This trade takes advantage of small pricing discrepancies between the cash and futures prices of Treasurys, with both risks and rewards significantly amplified by leverage.

The issue arises when extreme bond market volatility triggers margin calls related to the trade, leading to forced selling of Treasurys. If not addressed, these liquidity problems in the Treasury market could extend to the broader fixed-income sector as market-makers retreat.

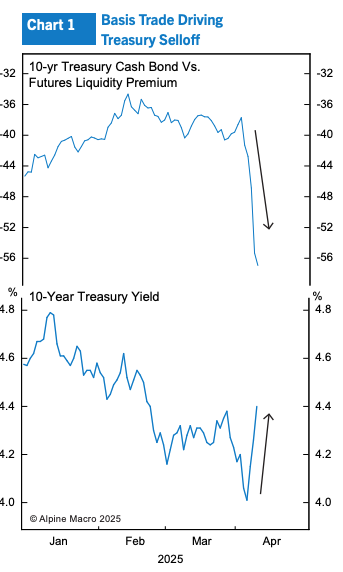

The top panel of Chart 1 illustrates that the gap between cash bond prices and futures prices has been widening since the announcement of reciprocal tariffs, but it notably expanded yesterday. This is a clear indication that the basis trade is unwinding.

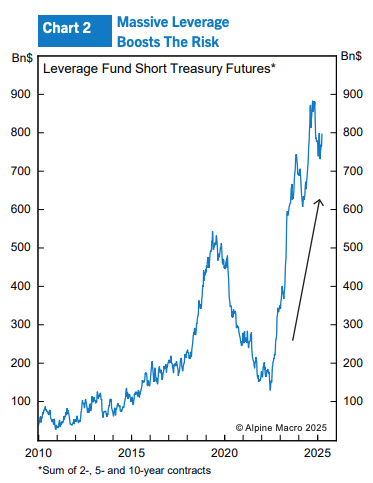

The last occurrence of this trade reversal was in 2020, when the Federal Reserve had to intervene to halt the Treasury market meltdown and prevent wider contagion. Currently, the risks are even greater because leverage has increased significantly (see Chart 2).

The extreme volatility disrupting the basis trade can likely be attributed to stagflation risks linked to the trade war. However, some analysts point to other potential triggers. One possibility is that China is selling Treasuries as part of the trade conflict. Another is that Japanese investors are offloading U.S. dollar assets in anticipation of a "Plaza Accord 2.0," which could lead to significant currency realignment.

A more comprehensive analysis of the Treasury market's turbulence will be featured in upcoming Alpine Macro reports. Meanwhile, here are some initial insights for our clients:

- Although the unwinding of the basis trade may seem technical, it poses a genuine threat to the economy and risk assets. It indicates a tightening of financial conditions and possibly stricter bank lending standards, both of which could hinder economic activity.

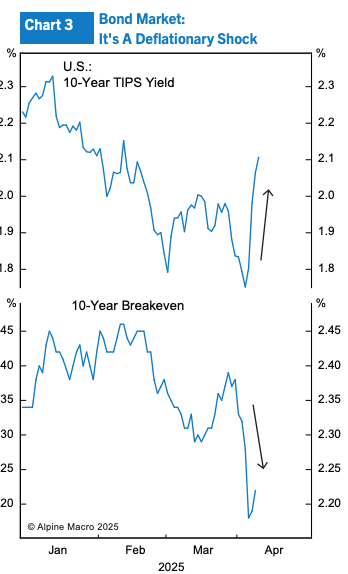

- The bond market interprets this as a deflationary shock. The rise in Treasury yields was primarily driven by the real component.

Long-term inflation expectations have decreased, and we concur with this analysis. Once the situation stabilizes, we anticipate that Treasury yields will decline as disappointing economic data emerges.

- For equities, the bond selloff raises concerns about the ability of Treasurys to act as a "relief valve" when stock prices fall, at least in the short term.

- Rising yields and a declining dollar also cast doubt on the U.S.'s exorbitant privilege and the dollar's status as the leading reserve currency.

- The Administration's capacity to stabilize the Treasury market is limited, with the Federal Reserve serving as the primary and ultimate line of defense.

- Despite inflation risks, the FOMC will need to act if the Treasury market issues worsen, as the Fed cannot allow widespread disruptions in fixed-income markets.

- However, we do not anticipate an intermeeting rate cut unless there is a significant drop in the equity market. Given that the current issue is within the Treasury market's infrastructure, we expect targeted short-term Treasury purchases to stabilize the market, rather than a new open-ended QE program.

- Based on market dynamics in 2020, we estimate that the Fed would intervene to support the market if the 10-year yield reaches 4.75%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!