Gold Prices Firmer As USD Weakens

Safe-Haven Fluctuations Impacting Gold

Gold prices continue to hover around the 2,604.56 level as we head through the back end of the week. Prices fell sharply on Monday but have since stabilised with the market seeing no further declines this week as the market awaits fresh drivers. News of an Israel-Hezbollah ceasefire in Lebanon is fuelling hopes of a similar agreement to be reached with Hamas in Gaza, diluting safe-haven demand for now. Still, the situation remains highly volatile with increasing uncertainty around the Russia/Ukraine war, gold remains vulnerable to upside spikes on increased safe-haven demand.

USD & The Fed

Away from geo-political uncertainty and safe-haven flows, USD moves and Fed expectations are also driving gold. An uptick in Fed easing expectations on the back of softer data this week, is helping keep gold prices supported. New home sales and durable goods were seen falling while advanced GDP and core PCE both printed in line with forecasts. If expectations for a further Fed cut in December continue to pull USD lower near-term, gold prices have room to recover retest highs in the coming month.

Looking ahead this week, with US traders out for Thanksgiving, flows are expected to be lighter. However, If USD continues to soften ahead of the weekend gold prices should find better demand into next week.

Technical Views

Gold

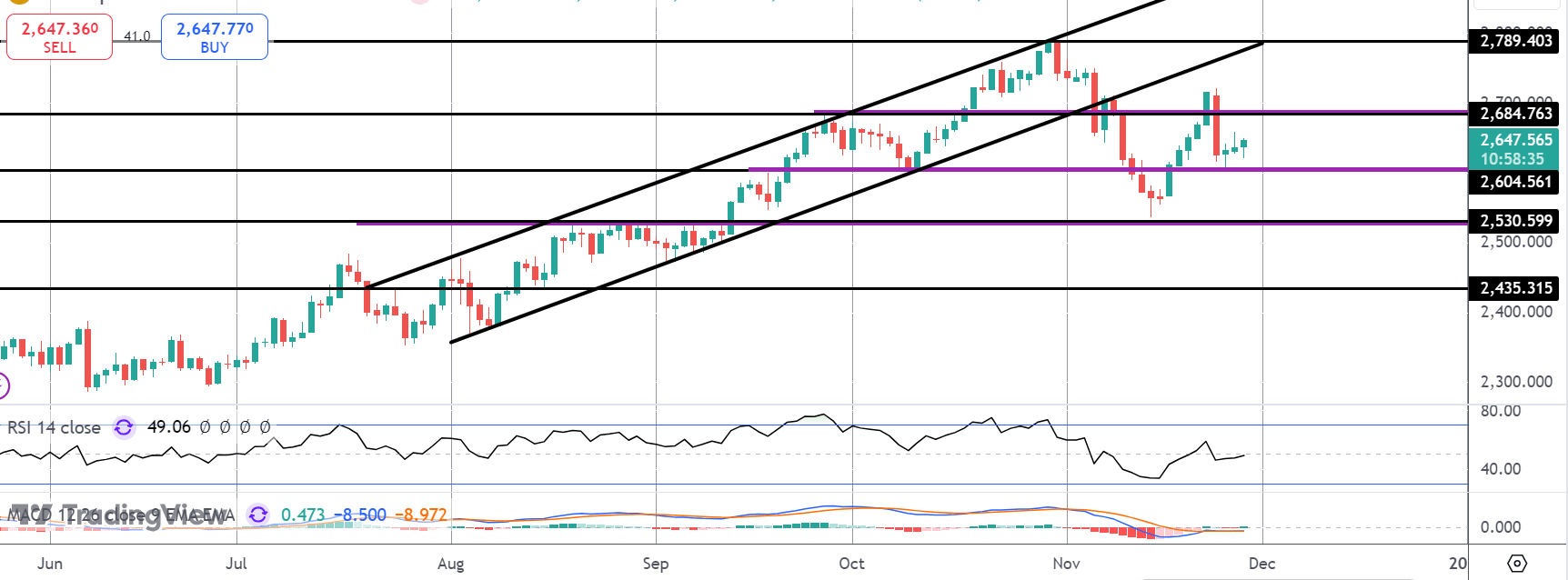

For now, the market is holding above the 2,604 level support and with momentum studies turning higher, focus is on a fresh test of 2,684.76 next with a return to YTD highs in sight above there. To the downside, 2,530.59 remains the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.