Gold Hits Fresh Record Highs on Dovish Fed Bets

Gold Breaks Out

Gold prices are trading at fresh record highs ahead of the week. A downturn in the US Dollar through the back end of the week has allowed gold room to breakout. Following a muted market reaction to CPI data earlier in the week, above forecast US jobless claims and PPI data yesterday helped drive USD lower, creating support for gold. Additionally, dovish comments from former FOMC member Bill Dudley helped amplify bearish sentiment in USD. Dudley said that he would be pushing for a deeper cut next week were he still in the committee. These comments coincided with reports from the FT and WSJ, noting that a larger cut was being discussed and that it was a close call for the Fed In deciding between the two (.25% or .55 cut).

Bullish Risks for Gold

With the market now split over whether the Fed will cut by a deeper .5%, gold prices are rallying on heightened dovish risks. With the Fed now in its blackout period ahead of the FOMC next week, gold looks vulnerable to further upside as traders increase bearish bets on USD. Retail sales on Tuesday will be the final tier one data ahead of the release and if we see weakness in the figures as expected, this should further drive support for gold into the Fed meeting on Wednesday.

Technical Views

Gold

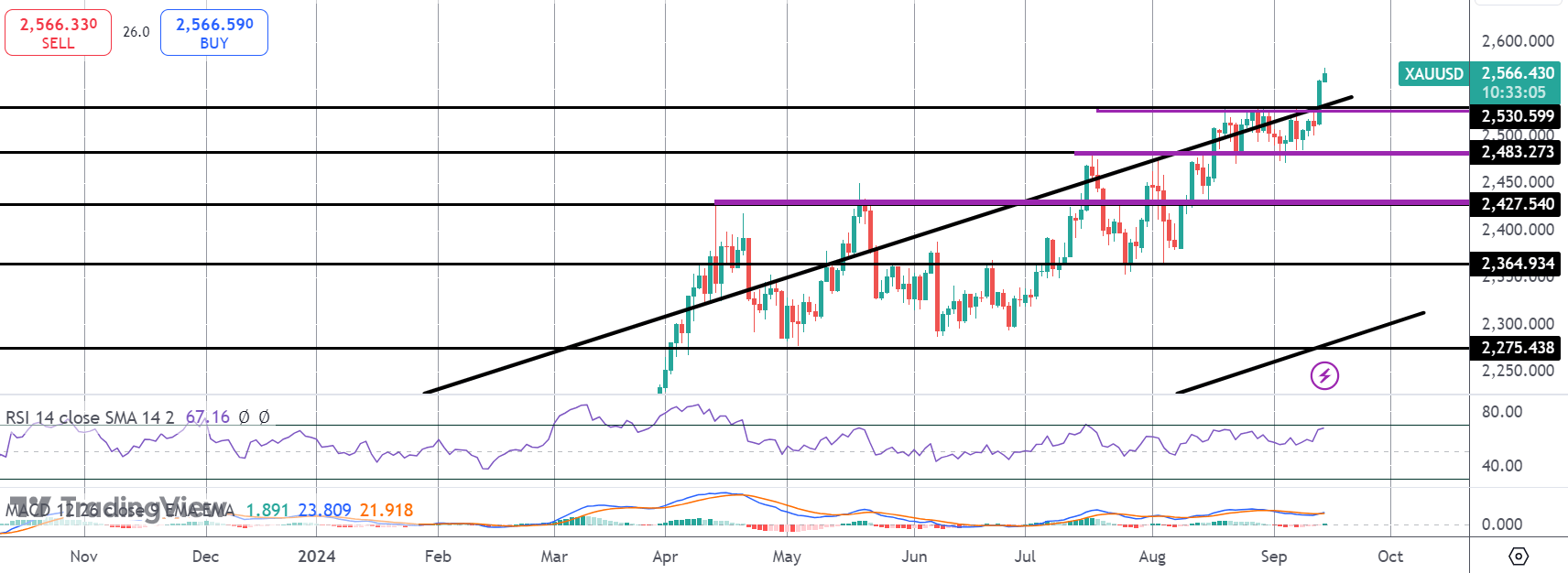

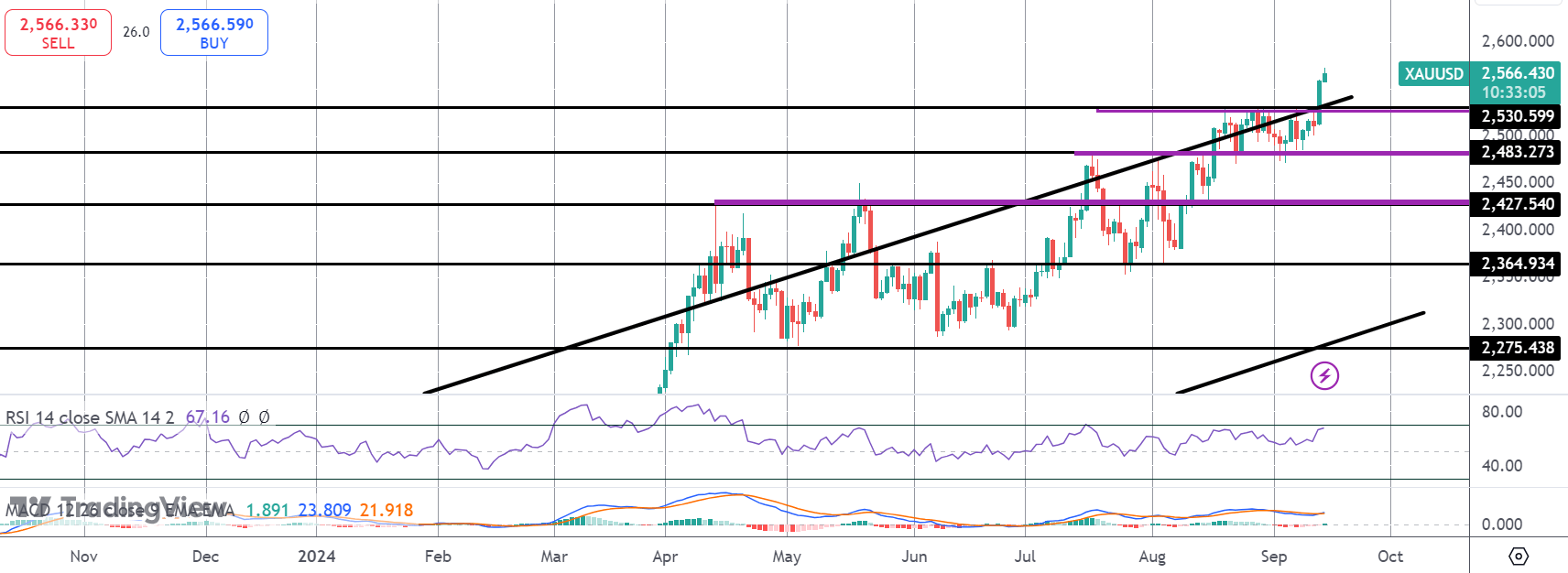

The rally in gold this week has seen the market breaking out above the bull channel highs and above the 2,350.59 level. With momentum studies bullish, focus is on a continued push higher while price holds above the 2,483.27 level. Should we correct below there, 2,427.54 will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.