FX Options & Positioning

-1603712962.png)

FX Options & Positioning

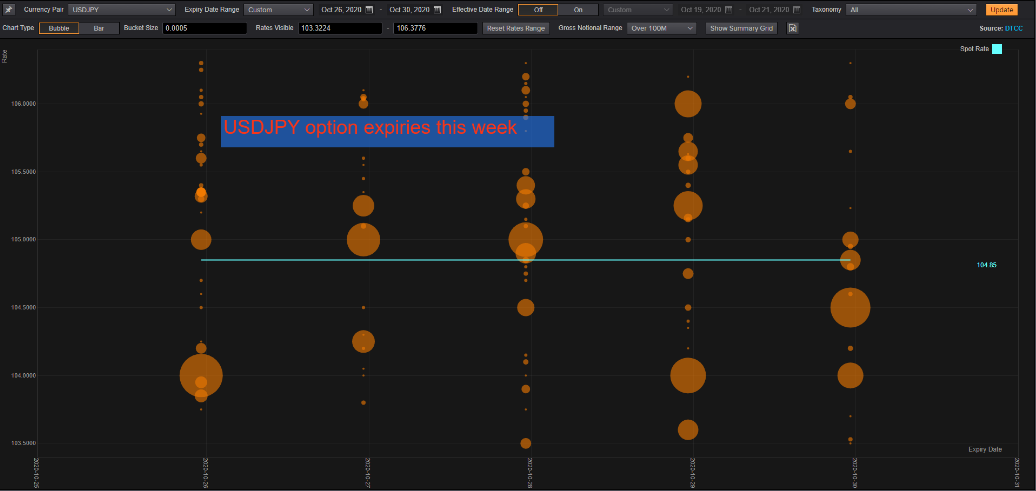

FX option expiries and related delta hedging flows can influence FX price action, so it's worth knowing where the bigger strikes reside, and there are plenty this week according to Reuters options reporting.

- EURUSD has 1 billion euros at 1.1835-40 Monday, 1.1 billion at 1.0800-05 Tuesday, 1.6 billion at 1.1800-05 and 1 billion at 1.1900 on Wednesday. Friday sees 1.4 billion euros at 1.1800, 1.2 billion at 1.1850, and 1.6 billion at 1.1950.

- EURSEK sees 2.2 billion euros of 10.40 strikes on Wednesday.

- USDJPY has $918 million at 105.00 and 1.3 billion at 105.30-35 Monday, Tuesday has $1 billion at 104.25, 1.5 billion at 105.00, and 1 billion at 105.25. Wednesday has $2.5 billion at 104.90-105.00, and Friday 1.8 billion at 104.50 and 2 billion between 104.85-105.00.

- GBPUSD stand-out strike this week are 529 billion pounds at 1.31 on Wednesday. EUR/GBP has 565 million euros at 0.9100 Monday, 900 million at 0.9135-45 on Tuesday, 800 million at 0.9085-0.9100 Wednesday, 840 million at 0.9050 and 622 million at 0.9110 Thursday.

- AUDUSD's biggest FX option expiry this week is Monday at 0.7100 on A$667 million, while Friday has 582 million at 0.7180 and 631 million at 0.7200. AUD/NZD has A$650 million at 1.0695-1.0700 and 1.2 billion at 1.0750 on Friday.

- AUDJPY has A$1 billion at 73.20 and 2.5 billion at 76.35-40 on Thursday, 601 million at 76.75 and A$1.1 billion at 77.45 on Friday.

- USDCAD's biggest strikes are Thursday between 1.3175-1.3200 on $1 billion and Friday at 1.3150 on $1 billion.

.png)

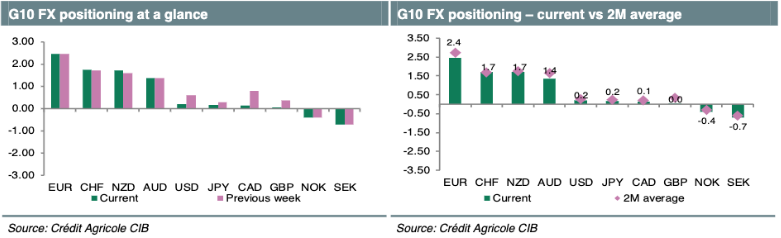

According to Credit Agricole’s FX positioning gauge, the USD was sold for most of the past week with speculative-oriented investors such as hedge funds as well as real money investors driving most of that development. This is at least implied by our in-house data. Publicly available IMM data is not fully in line with that assessment. All in all, however, it appears that sentiment has been in favour of selling USD rallies; presumably increased expectations of a decisive Democratic win at next week’s election has been one of the reasons. Most importantly, USD positioning is back to fully balanced territory. Hence, from a positioning point of view, there is no more room for position squaring-related downside. Such prospects coupled with weaker risk sentiment speak against chasing the USD lower, at least in the short term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!