FTSE 100 FINISH LINE 8/10/25

FTSE 100 FINISH LINE 8/10/25

The FTSE 100 in the UK soared to a fresh intraday high on Wednesday, fuelled by robust gains in major financial stocks. Meanwhile, gold mining companies saw a boost as gold prices surged to unprecedented levels. The financial sector took the spotlight with strong gains, as the banks index climbed 1.4%. Lloyds Banking Group saw an impressive 2.6% rise after London’s financial regulator suggested a redress package for motor finance mis-selling that was less severe than anticipated. Precious metal miners outshone their peers as gold prices surged beyond $4,000 per ounce for the first time ever. Endeavour Mining and Fresnillo stood out as top performers on the FTSE 100, with shares rising 2.1% and 1.5%, respectively. On the flip side, real estate stocks weighed down the mid-cap FTSE 250 index, which edged down by 0.1%. Unite Group suffered the largest setback on the FTSE 250, plunging 9.8% to its lowest level in over five years. The student accommodation developer reported rental growth of just 4% in Q3, a sharp decline from the 8.2% growth seen a year earlier. Investors also kept a close eye on trade developments as Prime Minister Keir Starmer embarked on a two-day visit to India. He emphasised the need to implement the trade deal agreed upon in July as quickly as possible. Last week, the FTSE 100 reached new record highs, achieving peaks in four out of five trading sessions. This rally was fuelled by a resurgence in healthcare stocks, which had lagged earlier in the year but are now driving momentum forward.

Lloyds Banking Group gave banking stocks a solid boost on Wednesday after the UK’s financial watchdog unveiled a surprisingly lower-than-expected compensation plan for motor finance mis-selling.The Financial Conduct Authority (FCA) released a hefty 360-page consultation document late Tuesday, estimating that the motor finance sector might face a redress bill of £8.2 billion ($11 billion) before factoring in operational costs. This announcement sent shares of Lloyds, a major player in motor finance, climbing 2.6% by 11:15 GMT. Other banking stocks also enjoyed a lift—Barclays saw its shares rise 1.3%, outperforming the broader FTSE 100 index, which gained 0.84%. Close Brothers’ shares initially surged at market open before settling with a 0.6% increase. While the redress figure is still substantial and underscores one of the most expensive scandals to hit the UK’s financial sector, it came in below the FCA’s earlier estimates of £9 billion to £18 billion. Analysts noted that this suggests a £2.5 billion improvement on the regulator’s initial central projection when factoring in an additional £2.8 billion in estimated operational costs. The news provided some relief for investors, who had braced for a potentially larger financial blow to the industry.

Shares of British student accommodation developer Unite Group experienced a significant decline, dropping 5.9% to 664.5 pence, the lowest level since March 2020. This downturn made it the biggest percentage loser on the FTSE mid-cap index, which itself fell by 0.2%. Unite reported a slowdown in rental growth, achieving only 4% by the end of the third quarter compared to a robust 8.2% in the same period last year. Despite these challenges, the company maintained its fiscal 2025 outlook for adjusted earnings per share, projecting a range of 47.5p to 48.25p. Analysts at Panmure Liberum noted that "Unite’s results and updates continue to reflect a challenging macroeconomic environment for purpose-built student accommodation." With today’s losses factored in, Unite's shares have plummeted 17.7% year-to-date, while the FTSE mid-cap index has seen a gain of 6.5% during the same timeframe.

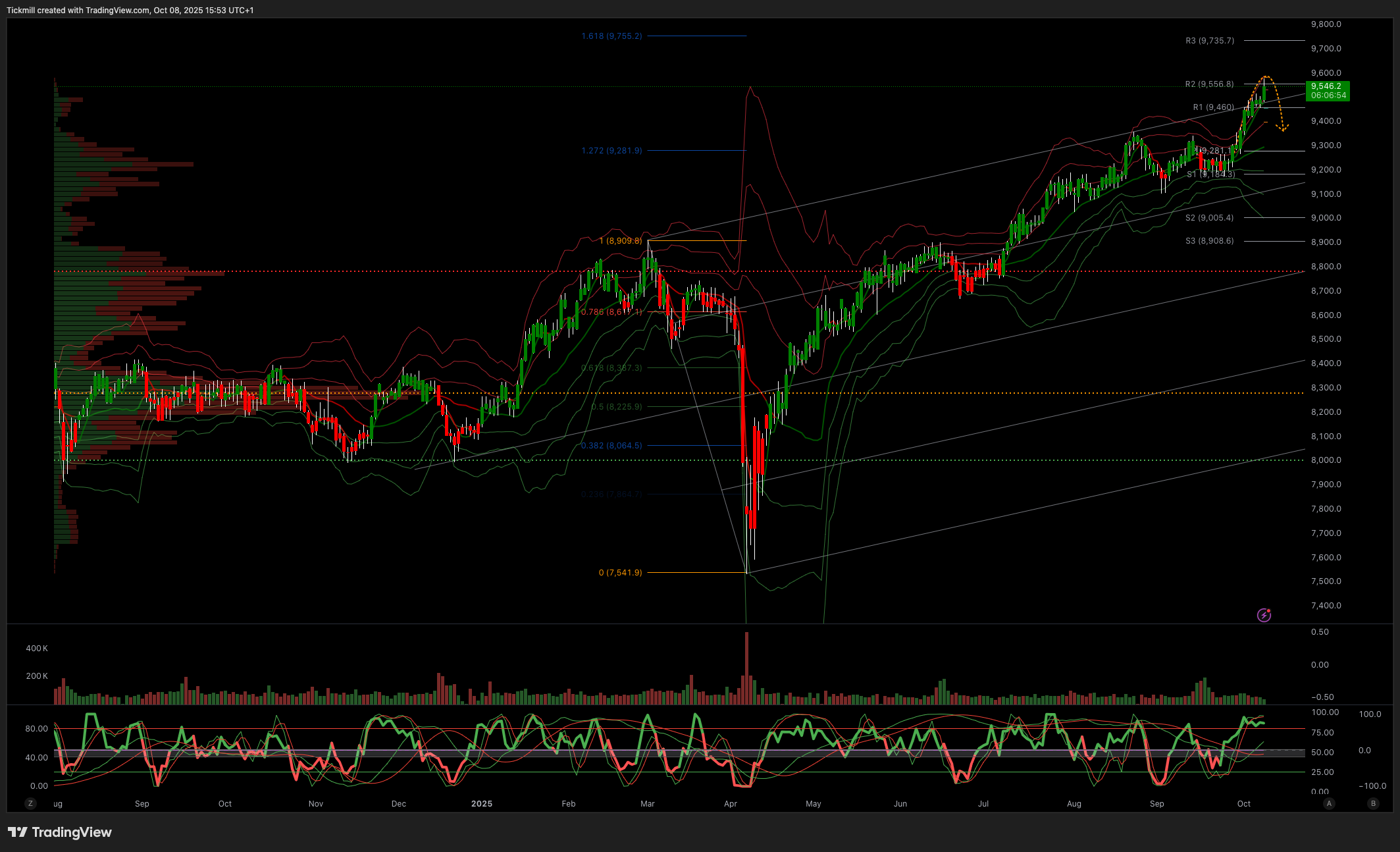

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9300

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!