FTSE 100 FINISH LINE 4/9/25

FTSE 100 FINISH LINE

UK stocks saw a slight increase on Thursday, driven by advancements in consumer staples and utility shares, as investors evaluated corporate reports. Miners of precious metals declined as they mirrored the drop in gold prices, with Fresnillo down by 1.6%. Meanwhile, bond markets displayed some stability after a prior sell-off this week prompted by worries over Britain's financial situation and the government's capacity to manage it, which pushed yields on 30-year British government bonds, or gilts, to their peak since 1998. Nevertheless, investors remain wary of potential tax increases that might hinder economic growth, especially with Britain set to present its budget on November 26. In terms of economic data, activity in Britain's construction industry decreased for the eighth consecutive month in August, marking its most extended slump since 2020. A Bank of England survey indicated that British companies noted a slight increase in their inflation expectations for the coming year. Investors are now looking forward to the retail sales data for July, scheduled for release on Friday.

Major bank stocks also increased, with Lloyds seeing a 1.2% rise. Reports indicate that the bank is contemplating the potential termination of around 3,000 employees deemed to be within the lowest 5%.

Shares of Genus rise 28.8% to 3220p, among top gainers in the FTSE mid 250 index. The company is accelerating its strategic collaboration with Beijing Capital Agribusiness, receiving a $160 million payment. Genus reports an annual adjusted profit before tax of £74.3 million, a 38% increase. Peel Hunt notes strong cash performance and encouraging outlook from the China joint venture. The stock is up 77.1% YTD, compared to a 3.7% rise in the FTSE mid-cap index.

Shares of British motor retail company Vertu Motors increased by 1.9% to 60.1 pence. The company reports stable volume and margin levels for like-for-like used car sales, alongside significant growth in its aftersales sector over the five months ending July 31. They indicated that the new retail order book for September is slightly ahead of last year's figures. The company anticipates an adjusted pretax profit for FY26 to be in line with market expectations of between 26.5 million and 27.5 million pounds ($35.80 million - $37.15 million), as per a consensus compiled by the company. Year-to-date, VTU is down 0.14%.

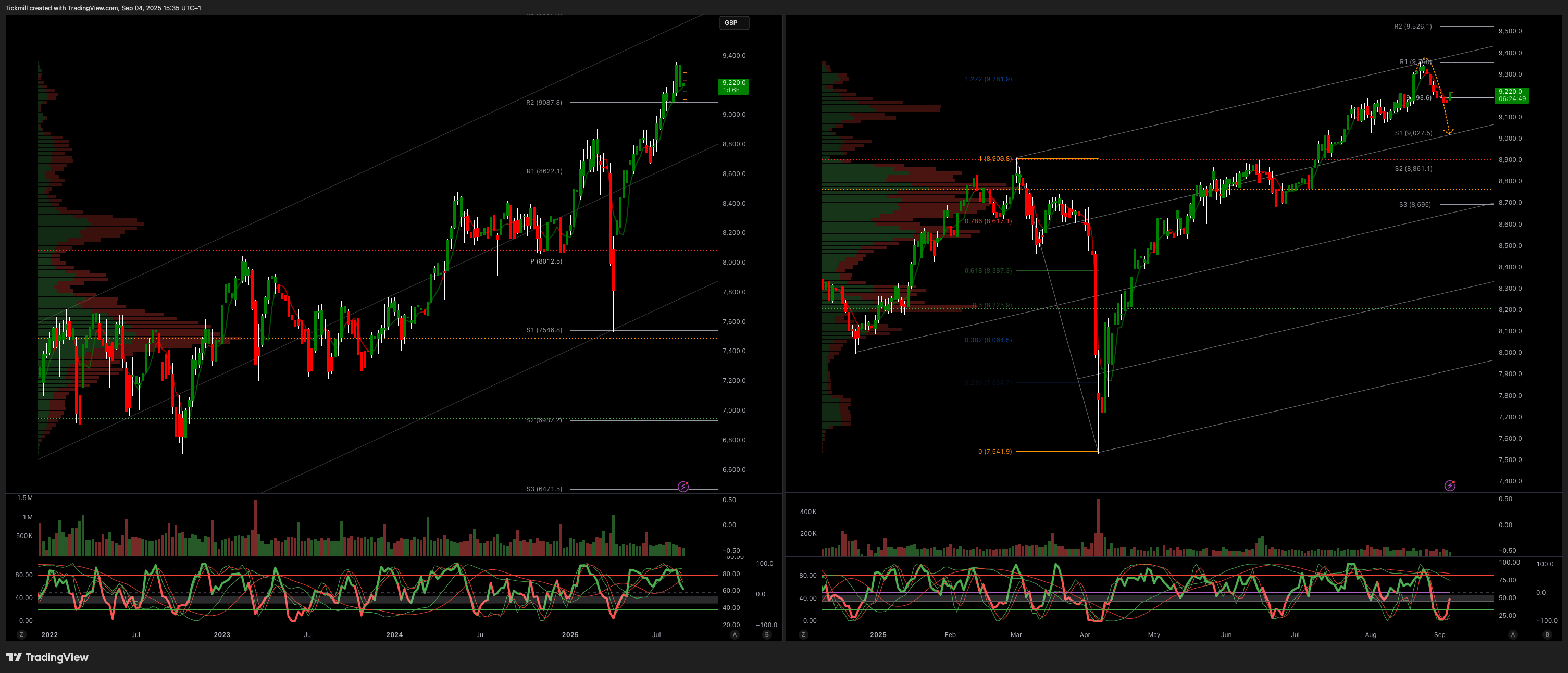

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!