FTSE 100 FINISH LINE 26/8/25

FTSE 100 FINISH LINE

UK stocks dropped on Tuesday as global markets adopted a risk-averse stance following U.S. President Donald Trump's announcement of the dismissal of Federal Reserve Governor Lisa Cook. Global risk assets declined following Trump's announcement of Cook's dismissal over purported wrongdoing in securing mortgage loans. In response, Cook asserted that the President lacks the power to oust her, although Trump's remarks revived worries regarding the independence of the Federal Reserve. In the UK, major banks had the largest impact on the FTSE 100, which fell by 1.7%. Leading banks HSBC and Standard Chartered dropped by 1.8% and 3.1%, respectively. Yields on British 30-year government bonds rose to their highest point since April 9, following an increase in U.S. Treasuries. A group of precious metal mining stocks rose by 1.4% as gold prices reached a peak not seen in over two weeks. Last week, the FTSE 100 momentarily reached an all-time high after Fed Chair Jerome Powell indicated a potential interest rate reduction at the Fed's meeting in September, which boosted risk assets.

Catherine Mann, a member of the Monetary Policy Committee of the Bank of England, stated on Tuesday that she believes there is a justification for keeping the Bank Rate steady for an extended period. However, she expressed her readiness to implement significant rate cuts if growth risks materialise. "Maintaining a persistent hold on the Bank Rate is suitable at this moment to sustain the current tight monetary policy stance, which is essential to counteract ongoing inflation pressures," Mann remarked in statements shared by the BoE. "Nonetheless, I am prepared to take decisive policy action through larger and more rapid cuts to the Bank Rate if risks to domestic demand start to emerge," she added. Mann, who opposed this month's quarter-point rate reduction, is scheduled to deliver her remarks later on Tuesday at a conference celebrating the 100th anniversary of the Bank of Mexico.

Deutsche Bank has revised price targets and downgraded several British retailers, indicating a more cautious outlook on the UK's consumer sector. The bank anticipates that the period ending in 2024 and early 2025 will be critical, as real wage growth is expected to slow and concerns over rising unemployment are increasing.

AB Foods has been downgraded from "hold" to "sell," with its price target reduced from 2,220p to 2,130p. The stock has dropped 4.3%, placing it at the bottom of the FTSE 100 index.

Wickes Group has also been downgraded from "hold" to "sell," with its price target decreased from 205p to 195p, making it the biggest loser among London stocks at an 8.2% decline.

Kingfisher's price target is now set at 280p, down from 320p, and it has been downgraded from "buy" to "hold," with the stock falling by 3.8%.

Marks & Spencer's price target has been lowered from 450p to 435p, resulting in a 1% decline in its stock. Year-to-date performance shows ABF up approximately 8%, WIX up about 34%, KGF up around 9%, while MKS has seen a decline of about 6%.

Shares of British retailer Debenhams rose by 3.6% to 15.1p. The company anticipates that its first-half adjusted EBITDA for continuing operations will surpass that of the previous year. It also reports that all its brands are currently profitable in terms of adjusted EBITDA. The company is considering a potential sale of PLT and is evaluating long-term strategies for its U.S. and Burnley distribution facilities. Year-to-date, shares have decreased by approximately 55%.

Shares of Bunzl, a distributor of business supplies, rose by 4.7% to 2,498 pence, making it the leading gainer on the FTSE 100. The company has resumed its £200 million ($270.18 million) share buyback program, which was previously paused in April. Additionally, Bunzl reaffirmed its forecast for the group in 2025 and its expectations for improved performance in the second half of the year. CEO Frank van Zanten mentioned, "The measures implemented in our largest North American business have revitalized the team, and we are beginning to see early signs of success." The company reported a 7.6% decline in its adjusted operating profit for the first half in constant currency. As of the last closing, the stock is down approximately 27%, compared to a 14.05% increase in the FTSE 100 index year-to-date.

Technical & Trade View

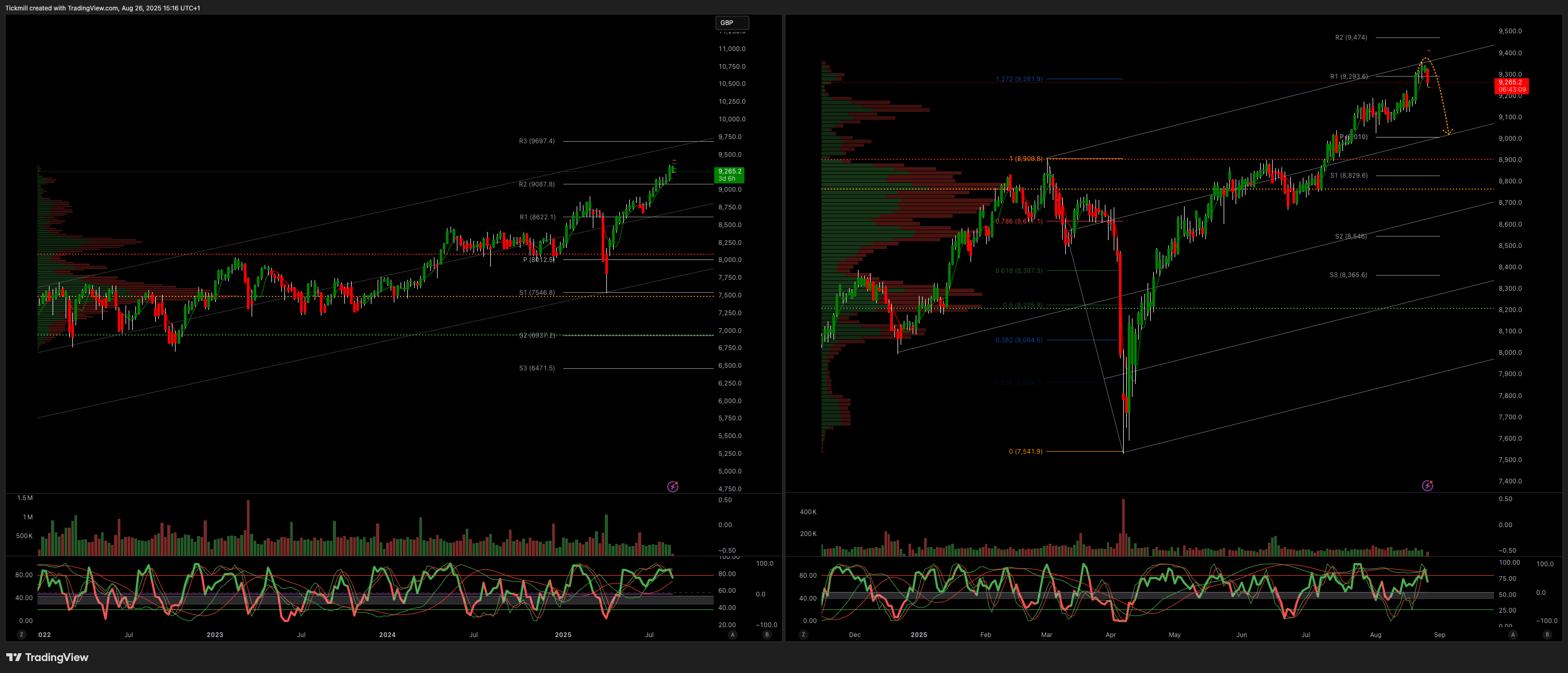

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!