FTSE 100 FINISH LINE 2/10/25

FTSE 100 FINISH LINE 2/10/25

The FTSE 100 in London is trading marginally lower on Thursday after two days of record highs, as declines in industrial stocks countered increases in financials, while Tesco's shares rose after the supermarket chain raised its annual profit forecast. Tesco's shares increased by 4.2% after the company updated its full-year profit outlook, benefiting from ongoing market share growth at the expense of competitors. Tesco's wide range of offerings for customers at various price levels is enabling it to maintain steady market share growth.

On Wednesday, the Financial Times reported that the UK plans to relieve investors from stamp duty on share acquisitions in newly listed UK firms, a move that market analysts view as positive but potentially insufficient. There are rising concerns about London’s declining attractiveness as a listing hub, a topic that remains a priority for policymakers as UK finance minister Rachel Reeves prepares her budget for November. The Financial Times states that the proposal would allow investors to avoid a 0.5% tax on buying shares of newly listed UK companies for an estimated period of two to three years.

Anticipation for the UK budget is rising with nearly eight weeks to go, especially as the Treasury awaits the first OBR forecast tomorrow, which will clarify the fiscal gap that needs addressing. Following the Labour Party conference, there may be renewed efforts for welfare reform or public spending restraint to help close this gap, although most of the solution is likely to involve increased taxes. Investors in the gilt market may be concerned about policy execution risks, given past issues with welfare reform plans. Additionally, reports suggest that retailers could be moved to lower business rates to avoid exacerbating inflation and hinder further Bank of England rate cuts. This move aims to mitigate food price inflation linked to higher supermarket rates. The potential scrapping of VAT on energy bills indicates that designing fiscal policy to lower inflation will be a key theme in this budget.

In the financial sector, 3i Group saw an increase of 3.1% after Bloomberg News reported that the private equity firm is considering divesting some of its assets, which includes the French IT maintenance company Evernex. Asset manager ICG led the FTSE 100 gainers, climbing 4.5% after revealing an anticipated one-off gain of between 65 million and 75 million pounds ($87.72 million-101.22 million) in the first half of the 2026 financial year, due to changes in the recognition of performance fee revenue. These stock gains contributed to a 1.6% rise in the investment banking index.

Credit data provider Experian has fallen by 6.2% to 3,447p, making it the biggest loser on the FTSE 100 index, which is down 0.14%. The credit scoring leader FICO has announced plans to introduce a direct licensing model for its credit score algorithm to resellers, which would reduce dependency on credit bureaus and lower costs. Credit bureaus like Experian, Equifax, and TransUnion offer credit data along with FICO scores in tri-merged reports. Analysts at Citi believe this shift could cut into the profits Experian makes from distributing FICO credit scores. Year-to-date, the stock has decreased by 0.12%.

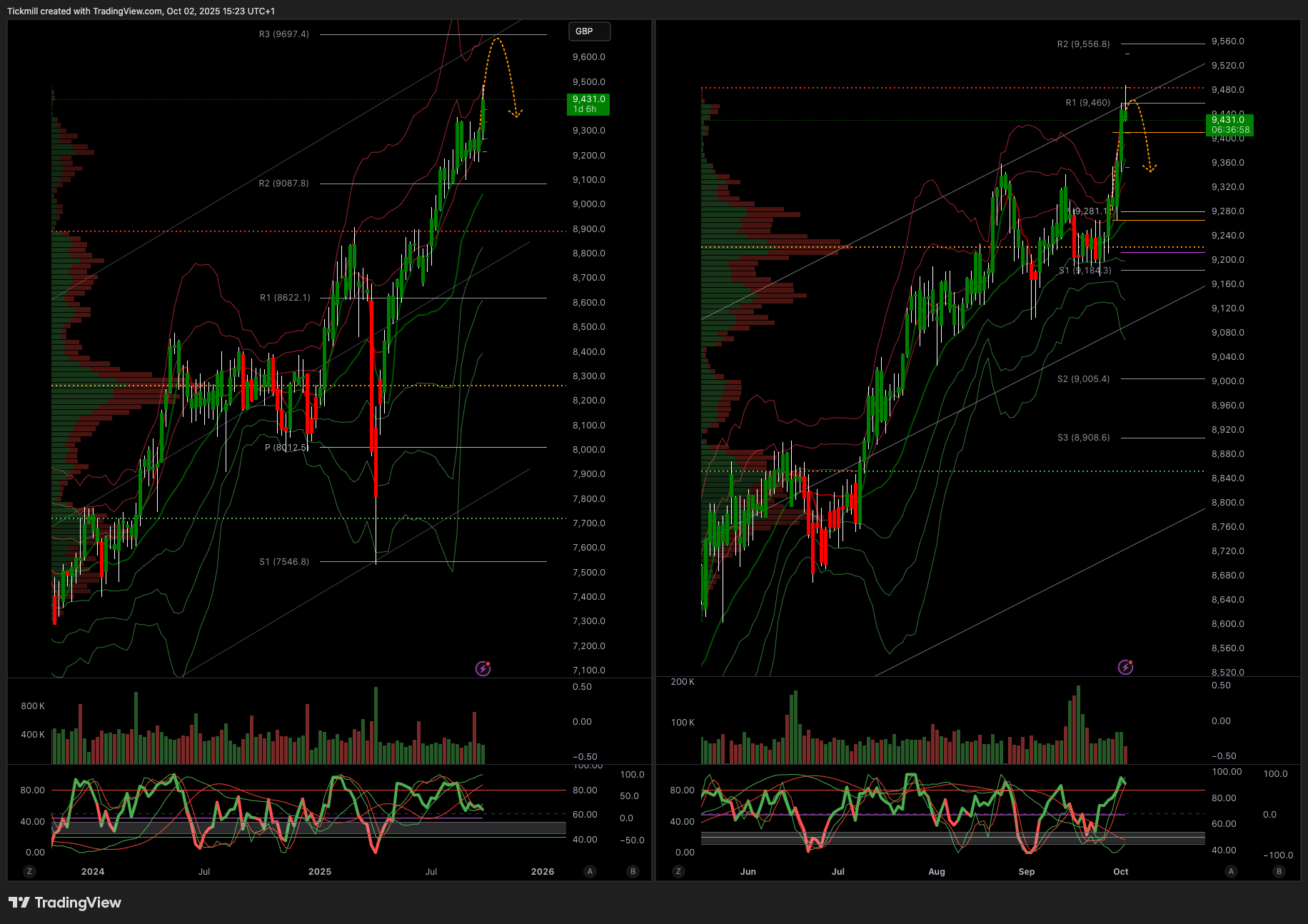

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!