FTSE 100 FINISH LINE 13/8/25

FTSE 100 FINISH LINE

On Wednesday, London stocks initially surged, with the blue-chip FTSE 100 index hitting a peak for the week during intraday trading, driven by hopes of a U.S. Federal Reserve interest rate cut that lifted global demand for riskier assets, however, sentiment shifted more sanguine into the close, turning red on the session.Investor focus is now turning to the high-stakes discussions scheduled for Friday between U.S. President Donald Trump and Russian President Vladimir Putin, which aim to negotiate a peace agreement to resolve the conflict in Ukraine. European and Ukrainian officials are set to speak with Trump on Wednesday to highlight the dangers of compromising Kyiv's interests in the quest for a ceasefire.At the same time, the financial sector faced challenges, with the non-life insurers index decreasing by 3.7%. Beazley saw a significant decline of 11% after it reduced its forecast for annual premium growth, impacted partly by weak demand for its cyber and property risk insurance. The housing sector also experienced a downturn, dropping by 0.9%, as homebuilder Persimmon fell 2.9% after voicing concerns about its margins for the upcoming year, although it anticipates higher home sales. Shell saw a slight decrease of 0.8%; the LNG giant announced on Tuesday that Venture Global has won a legal dispute against it regarding its failure to supply liquefied natural gas under long-term contracts beginning in 2023. Among other significant moves, infrastructure product manufacturer Hill & Smith led the midcap index gains, climbing 12% after reporting its half-year results and unveiling a £100 million ($135.70 million) share buyback initiative.

Shares of UK homebuilder Persimmon fell by 2.4% to 1108.7p, making it one of the biggest decliners on the FTSE 100 index, which rose by 0.4%. The company cautions that margin growth may face challenges due to cost inflation, persistent affordability issues, and rising industry-wide expenses. Richard Hunter, head of markets at interactive investor, noted that despite being a preferred choice in the sector, Persimmon is affected by broader issues beyond its control, including a struggling domestic economy. The company anticipates completing approximately 12,000 homes in 2026 and has maintained its 2025 target of delivering between 11,000 and 11,500 homes. Including recent movement, shares of Persimmon have declined by 7.4% year-to-date, while the FTSE 100 has increased by 12.3% year-to-date.

Beazley shares drop 6.1% to 856p, making it the biggest loser on the FTSE 100, which is up 0.33%. The British insurer reduced its full-year gross insurance written premium growth forecast to low-to-mid single digits from mid-single digits, and H1 pretax profit fell 31% to $502.5 million. Jefferies analysts note strong profits and a proactive approach but warn that growth concerns could weigh on shares. Year-to-date, the stock is up 11.7%, compared to nearly 12% for the FTSE 100.

Shares of Balfour Beatty, a global infrastructure firm, fell 3.6% to 547.5p, making it the biggest loser on the FTSE mid-cap index, which increased by 0.31%. The company's U.S. construction division reported a first-half loss from operations of 11 million pounds ($14.92 million), compared to a profit of 18 million pounds during the same period last year, mainly due to delays in a highway project in Texas. However, the company stated it remains on track to meet its full-year expectations. Jefferies analysts noted that any decline today presents a clear buying opportunity, emphasizing that Balfour Beatty's core business should bolster earnings. Year-to-date, including session changes, Balfour Beatty has risen approximately 20%, while the FTSE mid-cap index is up around 6%.

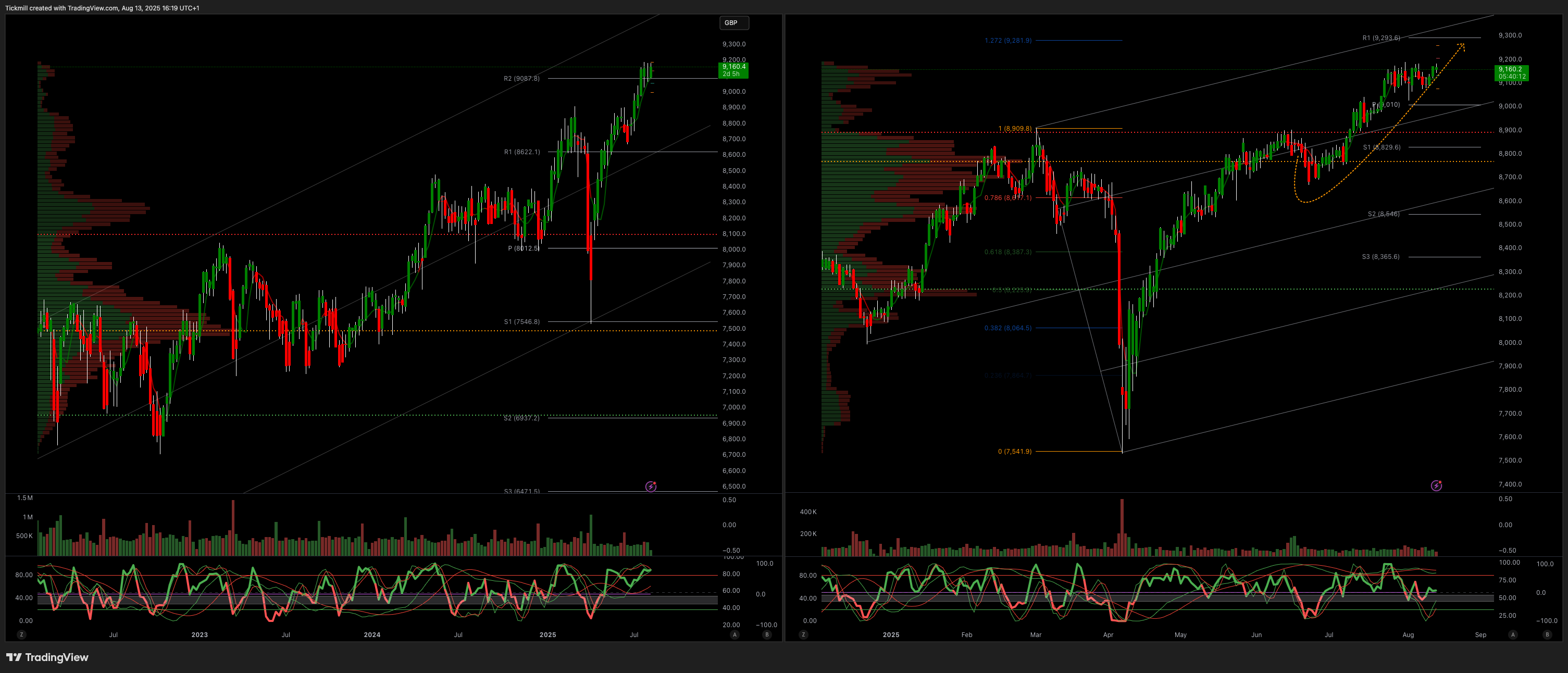

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!