Follow The Flow: CADCHF Breaking Lower

CHF Rallies on Safe-Haven Demand

The Swiss Franc has been the strongest currency over early European trading on Monday. As risk aversion sweeps across markets on the back of the SVB collapse last week, safe-haven demand for the Franc has increased heavily. Hawkish SNB expectations are also driving support for the Franc here. With inflation recently seen coming in above expectations and with SBN head Jordan warning that rates might need to continue higher as a result, CHF has been a firm favourite recently, gaining against currencies where central bank expectations have turned more dovish.

SNB/BOC Divergence

CAD has been among the weakest currencies today. The BOC recently held rates on hold, marking a cessation of its recent tightening campaign. With inflation cooling and the bank having signalled its intention to hold rates unchanged for the time-being, the divergence between the outlook from the SNB and the BOC is playing nicely into CADCHF downside. With the retail market holding a more than 90% long position in the pair, there is plenty of room for the current sell off to continue near-term.

Technical Views

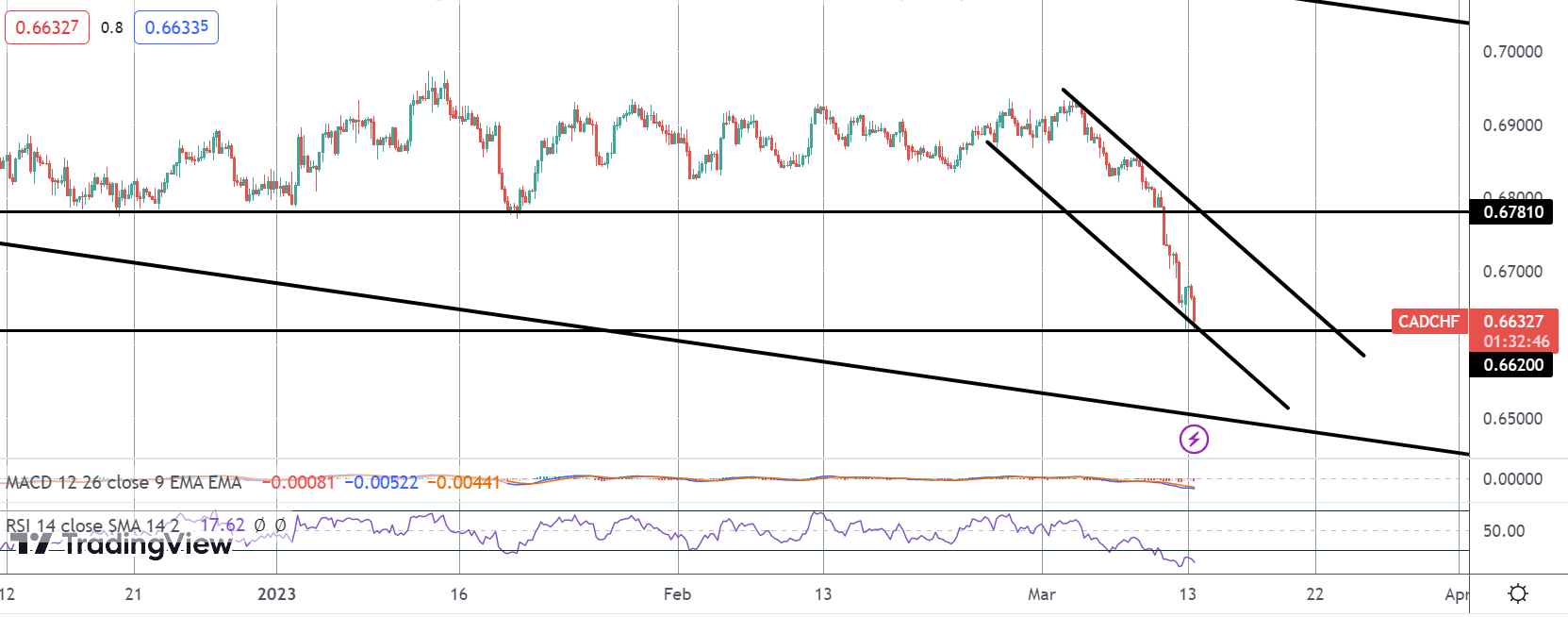

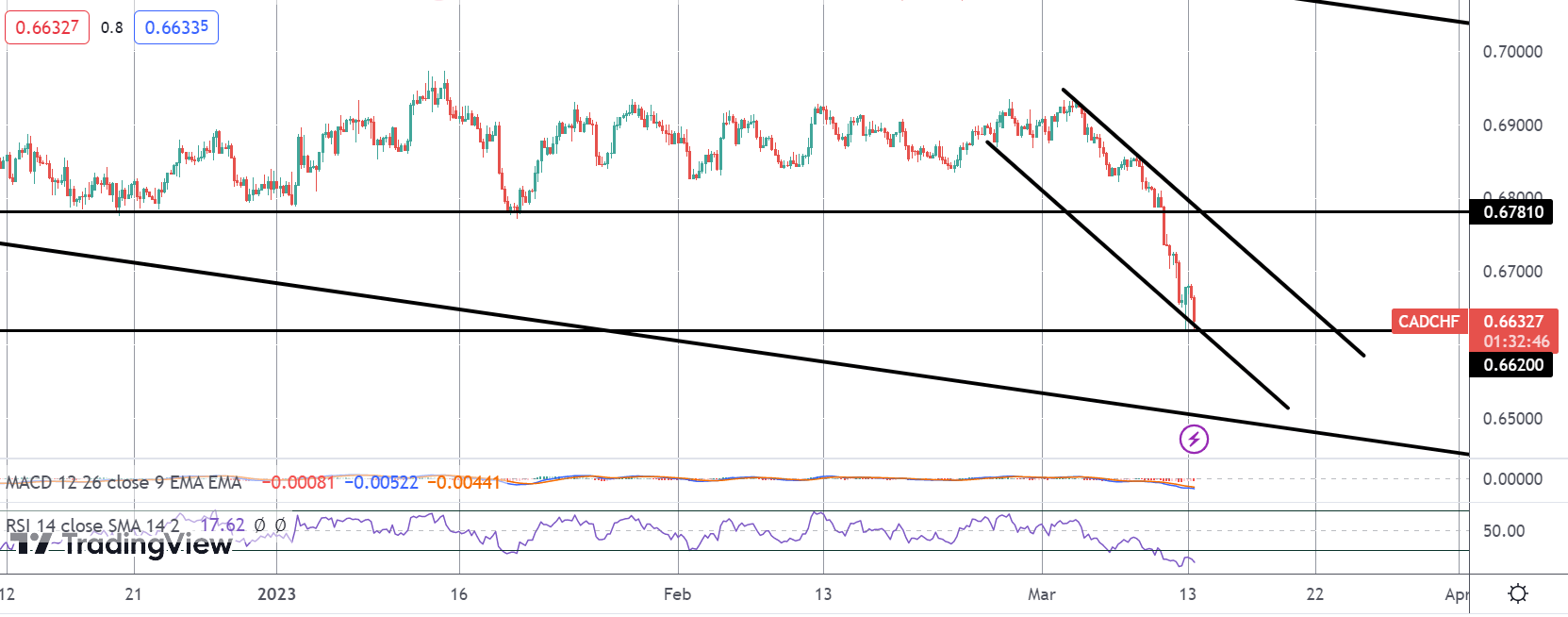

CADCHF

The breakdown below the .6781 level has seen the market continuing lower within a narrow bearish channel, marking new all-time lows for the pair. While below .6781 the focus is on a further push lower with a test of the longer-term bear channel the next downside target below current .6620 lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.