Fed Meeting Digest: Extremely Bullish for Stocks, Bearish for USD

The Fed has kept monetary policy parameters unchanged and, despite the vaccine optimism, maintained a focus on the headwinds for the economy in 2021, both in statement and in Powell’s speech. Despite rising chances for the fiscal deal and global recovery (especially manufacturing rebound), the Fed hinted that it isn’t going to raise rates until 2024.

The Fed has kept the range of the federal funds rate at 0-0.25%. Yesterday, we discussed possible policy adjustments, for example, that the Fed increases QE or increases duration of monthly asset purchases (in order to contain the growth of long-term lending rates in the economy). But apparently the US Central Bank decided to save firepower for the next meetings. The US fiscal stimulus package, which Congress is due to pass in December, also helped the Fed to take its time with additional stimulus.

The accompanying statement has barely changed since the last meeting, which was the biggest surprise. The Fed did not believe in the vaccine, as the market believed in it and continued to point out high risks to the economy. In addition, the Fed has slightly clarified its plans for QE: The Central Bank will buy at least $ 80 billion in Treasuries and $ 40 billion in mortgage-backed securities per month and will do so until it sees progress towards achieving inflation and employment targets. These same plans were pointed out by Jeremy Powell during a press conference, saying that despite the progress with the vaccine, the economy continues to face challenges and they can do more if needed - hinting at increasing QE or containing long-term interest rates.

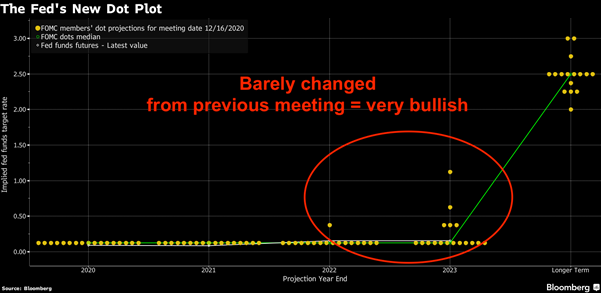

The Fed has updated its economic forecasts for 2021, taking into account strong data for the third quarter, however, the dot plot showed that most FOMC members are not going to vote for a rate hike until at least 2024. Only one FOMC member expects a rate hike in 2022 and 5 members in 2023:

The market initial reaction to the Fed's decision was mixed - gold fell and the dollar rose. However, then a powerful risk-on returned to the market, which continued on Wednesday. The dollar broke through the 90-point mark and went lower, in line with the technical idea I described in yesterday's post. Risk assets rallied higher, while search of yield pushed up alternative asset classes such as BTC, which posted an impressive parabolic 10% gain on Thursday, almost reaching $24K.

To recap: The Fed meeting turned out to be very positive for risky assets, since the Fed has made it clear that it is ready to bail out in the event of any shock by pumping more liquidity. into banking system and bond markets. It means that the dollar will continue to remain under pressure while risky assets found a solid support for growth.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.