Dollar On Watch As Key US Data Looms

Dollar Recovery Losing Steam?

The US Dollar has been grinding higher over recent days with the greenback deriving increased safe-haven support on the back of recent US political developments. Trump’s attempted assassination, followed by Biden stepping down from the Presidential elections race, have fed into a bullish USD narrative in recent days, taking the focus away from Fed easing expectations. Prior to these events unfolding, USD had fallen sharply in response to lower inflation and elevated September rate cut expectations.

US PMIs in Focus

Looking ahead today, however, focus is likely to turn back to Fed expectations with the latest set of US PMI data due. If fresh weakness is seen in today’s data, Q3/A4 easing expectations are likely to rise again, caping the USD rally. The market is currently pricing in a cut in September with a follow up cut in November seen at around 50%. Weakness in today’s data should see that number creeping up, bringing USD lower near-term. Tomorrow, focus will then shift to advance Q2 GDP and unemployment claims. Given the downside surprise we saw in growth last time, fresh weakness tomorrow would certainly be a dovish blow for USD opening the way for fresh downside.

Technical Views

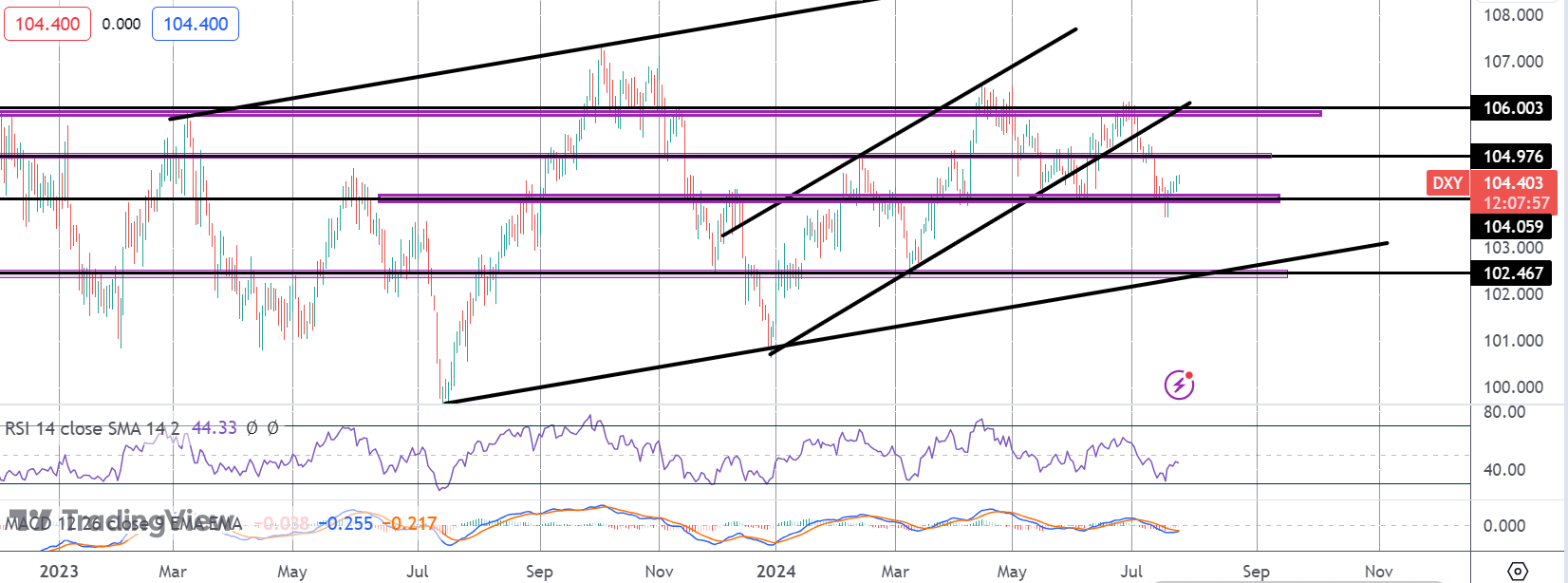

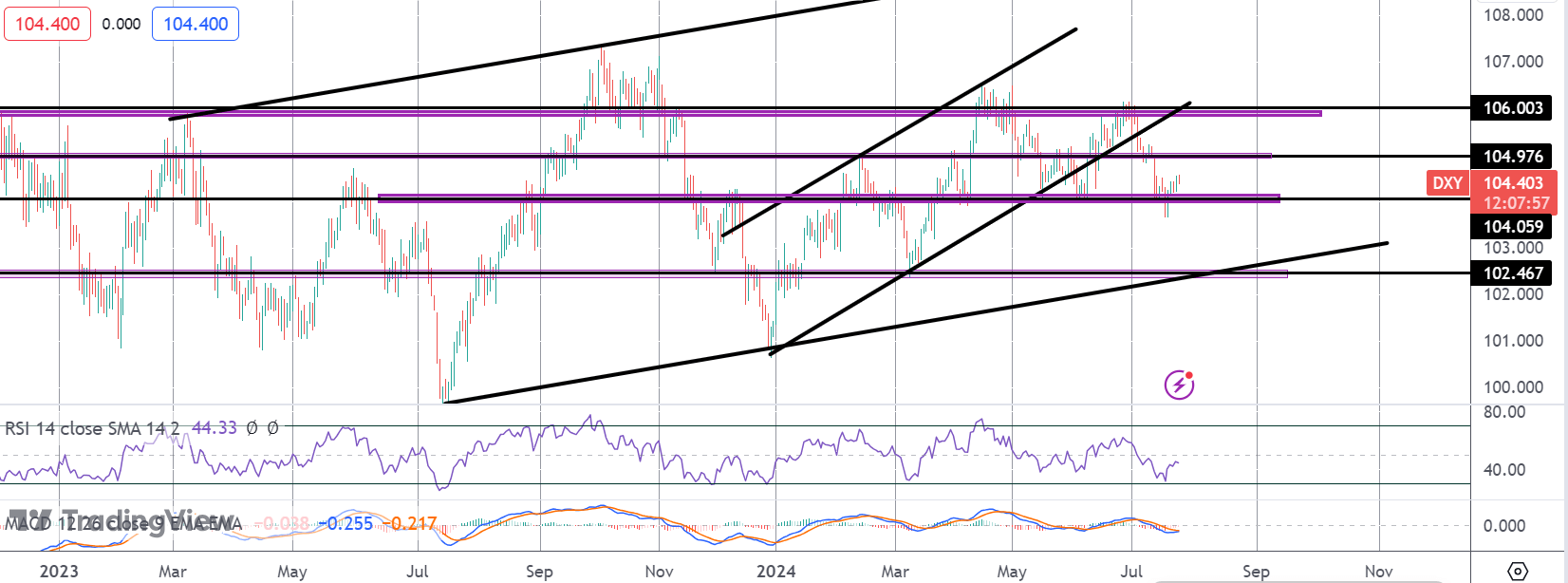

DXY

For now, the move lower in DXY has found support into the 104.05 level. However, on the back of the recent bull channel break, price remains vulnerable to further downside. Below that level, focus shifts to 102.46 next and the lows of the bigger bull channel in place since last summer.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.