Dollar Drops on Weak Data & FOMC Minutes

-1720092711.jpg)

Fresh US Data Weakness

The US Dollar is under heavy selling pressure today on the back of a slew of weaker-than-forecast US data yesterday. The ADP employment number came in at 150k, down from 157k prior, below the 163k the market was looking for. Jobless claims were seen jumping to 238k from 234k prior and expected while the ISM services PMI was seen dropping back into negative territory at 48.8 from 53.8 prior, well below the 53.6 the market was looking for. Following a weaker ISM manufacturing reading earlier in the week, the data adds to the view that the US economy is softening.

FOMC Minutes

Alongside the data, we also got the latest FOMC minutes last night. The minutes showed that policymakers acknowledged there had been progress on inflation but wanted to see further evidence before committing to a rate cut. The vast majority of members saw economic growth cooling with several members saying that the bank should be ready to respond with monetary policy accordingly. In all, the minutes were less hawkish than some were expecting, with CME pricing for a September cut jumping to around 67% from below 60% prior.

NFP On Watch

Looking ahead, tomorrow’s US jobs data will be the headline event. Given the bearish data we’ve seen this week and the reaction to those FOMC minutes, if we see any downside surprises tomorrow, this should drive USD firmly lower. Meanwhile, it will likely take a strong upside surprise to halt current USD selling.

Technical Views

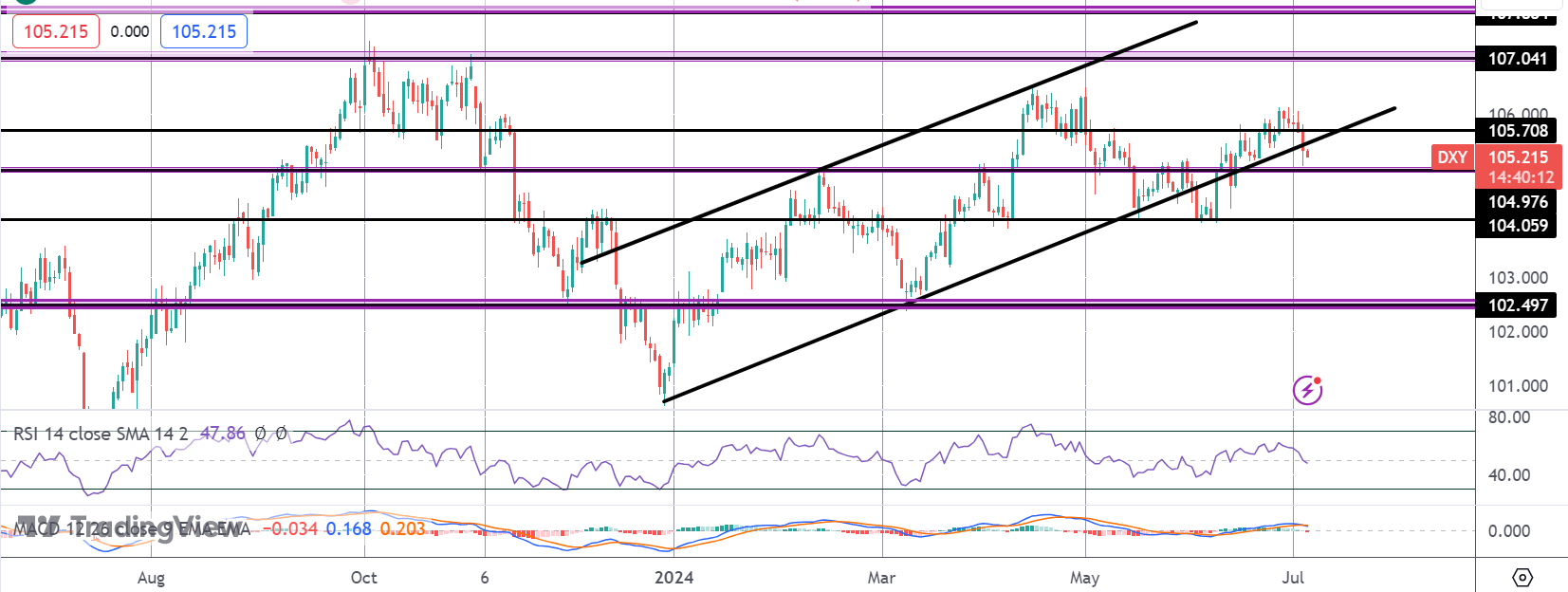

DXY

The sell off in the index has seen price breaking back under the 105.70 level and below the bull channel which has framed price action this year. Price is currently testing support at the 104.97 level. With momentum studies bearish, a break lower here opens the way for a test of 104.05 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.