Dollar Breaks Below Key Level As Bears Build Pressure

Dollar Drop Deepens

The US Dollar is falling heavily across the board today as traders ramp up their Fed easing expectations across the remainder of the year. Dovish comments from Fed’s Powell earlier in the week have amplified bearish USD sentiment on the back of last week’s US inflation data. Traders are now widely expecting the Fed to cut rates in September with at least one further cut through year end. Given the shift in tone from the Fed, however, traders clearly perceive the heightened likelihood of a quicker pace of easing should inflation and jobs continue to weaken.

Dovish Powell Comments

Speaking this week, Powell noted that the Fed doesn’t need to wait until inflation is back at target to begin cutting and now has full confidence once again that CPI is returning to target on the back of recent declines. Inflation has fallen for three straight months with jobs growth trending lower over that period also. While easing expectations continue to dominate market focus, USD looks vulnerable to further losses near-term.

Wider Market Impact

The broader impact on markets is that we’re seeing higher gold crypto and equities prices with FX undergoing an important shift also. However, the impact on commodities prices has been more muted, this is likely due to the impact of the growing expectation of a Trump election win and a return to the trade wars that underscored his prior presidency.

Technical Views

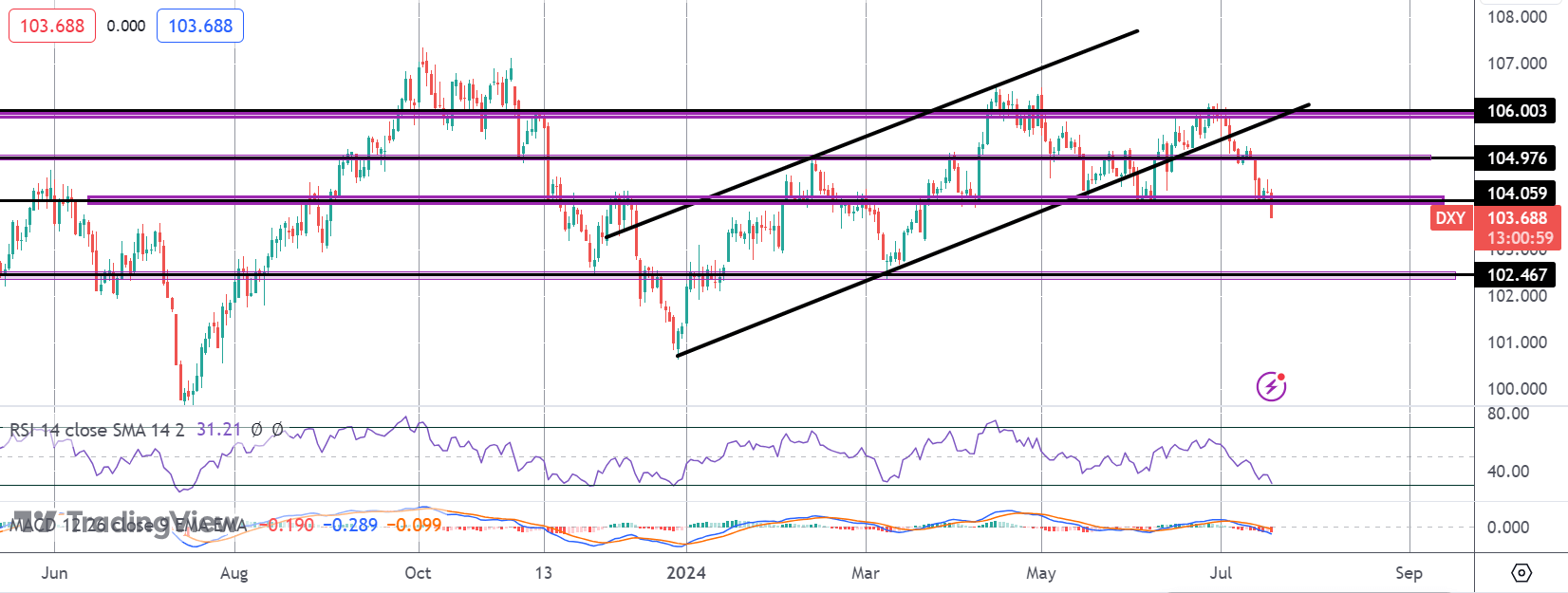

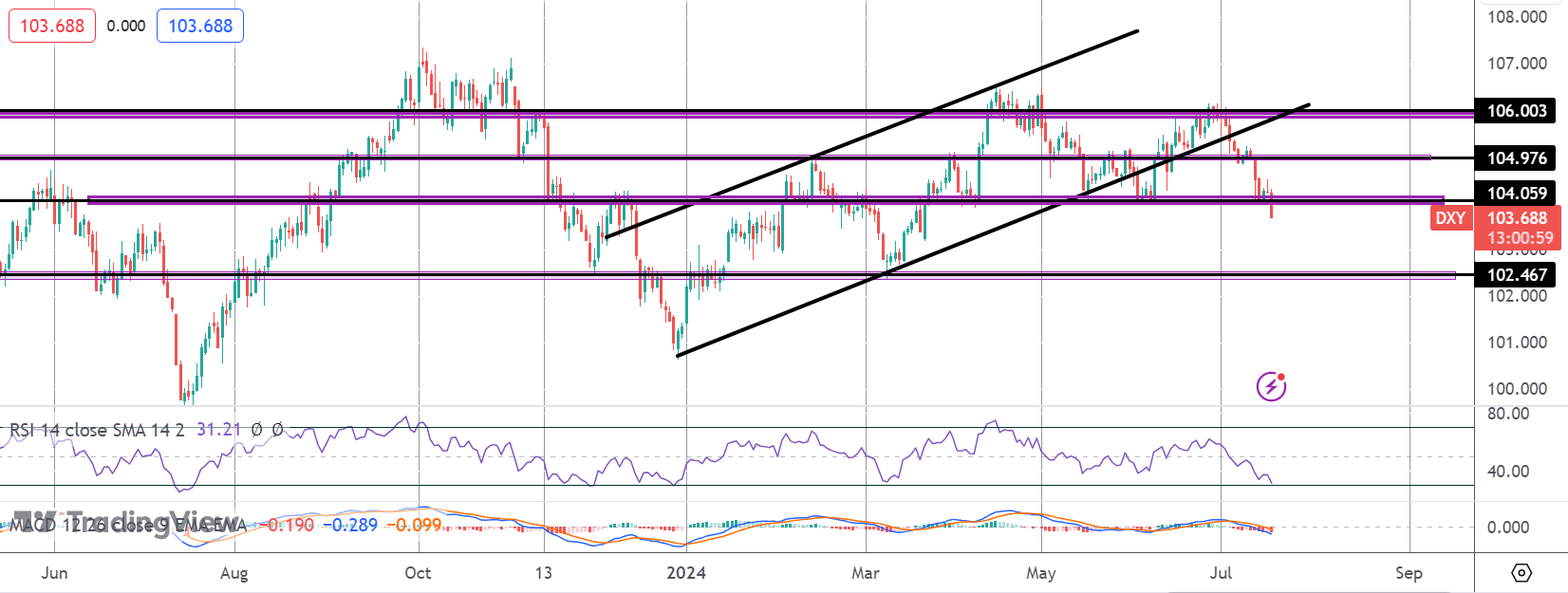

DXY

The sell off this week has seen the market breaking below the 104.05 support level for the first time since March. This is an important technical development, signalling a continuation of the channel break we saw earlier in the month. With momentum studies bearish, focus now turns to 102.46 as the next support level to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.