Dissecting the Markets: US Dollar Strengthens as EUR/USD Drops Near 1.0500 ahead of CPI release

The US Dollar's rally has extended for the fourth consecutive day, with the US Dollar Index (DXY) surpassing 106.50, bouncing from the key ascending trendline:

This renewed strength comes ahead of the US inflation report and ECB decision later this week. The EUR/USD pair makes a renewed offensive on the crucial psychological bullish foothold of 1.0500, and a breakout may ignite further downside momentum as market sentiment shifts in favor of the Greenback.

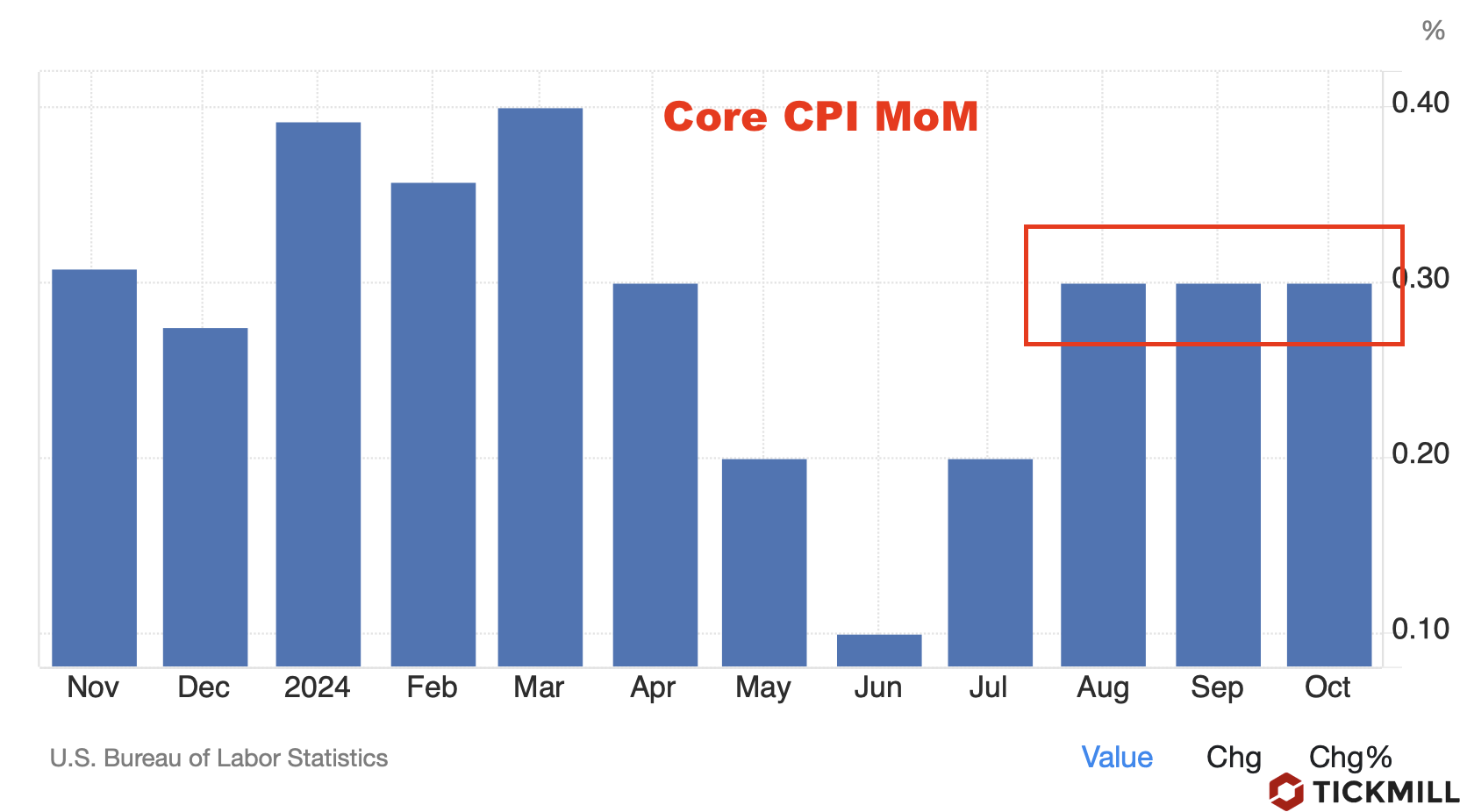

Market consensus centers around the expectation that the annual headline Consumer Price Index (CPI) for November will rise to 2.7% from October’s 2.6% reading. However, market participants are primarily focused on the core CPI, as it reflects the underlying inflation trend by excluding volatile components like food and energy and ignoring one-time factors. The core CPI is projected to remain steady at 3.3%. On a month-to-month basis, both headline and core CPI are expected to increase by 0.3%:

While the inflation figures are unlikely to cause a drastic shift in market expectations for the Federal Reserve's December 18 policy meeting, only a downbeat surprise below 0.3% MoM in core inflation may sway market sentiment regarding the Fed policy outlook. A reading in line with the forecast or above will likely lead to an acceleration of the dollar rally. Interest rate futures show that the implied probability of a rate cut is more than 90%. However, what matters more for the market is the guidance for the next year, which will likely be hawkish in light of recent US labor market and inflation developments.

Recent comments from Fed officials have highlighted confidence in inflation’s gradual return to the 2% target. Unless the CPI data shows a significant surprise, market participants believe the Fed’s path of measured rate cuts will continue. As a result, the US Dollar remains well-supported.

The Euro is facing selling pressure as traders anticipate that the ECB will cut its Deposit Facility rate by 25 bps to 3% during Thursday’s policy meeting. If confirmed, it would mark the ECB’s third consecutive rate reduction and the fourth this year.

Policymakers are increasingly convinced that inflation is under control, and weak business activity in the Eurozone is a growing concern. A reduction in interest rates would aim to support economic growth. Investors will focus on ECB President Christine Lagarde’s remarks at the post-meeting press conference. Market participants will seek clues on the future direction of monetary policy, especially amid political instability in Germany and France.

The British Pound’s recovery has stalled upon reaching a key medium-term resistance line, leaving the market in a state of indecision. This builds up downside risks as sentiment remains fragile amid a sparse UK economic calendar. Market attention is focused on next week’s Bank of England (BoE) policy meeting, with expectations that the central bank will keep rates steady at 4.75%:

Weakness in the UK labor market is becoming more evident. A BoE Decision Maker Panel (DMP) survey revealed that one-year forward employment growth expectations have fallen to a four-year low. This data could prompt the BoE to adopt a more dovish stance on interest rates.

Ahead of the BoE’s decision, crucial data points will be released, including employment figures for the three months ending in October and November’s CPI data. These releases could influence market expectations regarding the BoE’s policy direction.

Later this week, the UK’s monthly Gross Domestic Product (GDP) and Industrial and Manufacturing Production data for October will be published. Analysts expect an improvement in GDP and factory output after a decline in September. Stronger-than-expected data could offer some support to the Pound, while weaker results could heighten fears of a slowing economy.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.