Daily Market Outlook, October 1, 2020

Daily Market Outlook, October 1, 2020

Asian equity markets are mostly higher this morning, although a number are closed for holidays. US Treasury Secretary Mnuchin said that one more attempt would be made to pass a new fiscal stimulus bill before the November election. Meanwhile, Congress delayed a vote on more fiscal action to allow time for further negotiations between Democrats and Republicans. In Spain, a lockdown has been imposed in Madrid. UK PM Johnson confirmed that he would not hesitate to impose further restrictions in England.

Today’s September manufacturing PMIs are mostly updates to last week’s ‘flash’ estimates, although for some countries such as Italy and Spain they are first releases. In the Eurozone the initial readings showed a marked contrast between a rise in manufacturing and a pullback in services activity, possibly because the latter is more impacted by social distancing measures. Today’s ‘final’ readings for manufacturing are not expected to be revised. In the UK, the first September estimate for the manufacturing PMI slipped modestly in August but was still consistent with strong growth. Don’t expect a sizeable revision today. Also of interest in the Eurozone will be the latest unemployment data. Unemployment has not rise by much in most countries in the region due to government support measures. However, there are concerns that it may still accelerate and an increase is forecast for August to 8.1% (from a 7.9% in July).

In the US, the September ISM survey for manufacturing may post another gain. Certainly the already released PMI data point in that direction and rises in factory sector indicators elsewhere suggest that there has been an initial sharp rebound in global activity. Nevertheless, while manufacturing may be less directly impacted by social distancing than other sectors, output will probably still slow if overall economic growth falters.

There are a number of other releases of note today in a busy US data calendar. Weekly jobless claims have been suggesting for some time that the rebound in the labour market is slowing and that may again be the case with the latest numbers. US consumer spending has picked up sharply post-lockdown and August is expected to have seen another rise. That release will also contain the Fed’s preferred inflation measure, which is likely to still be well below target. Finally construction activity is forecast to be up in August led by housing.

Speakers from the US Fed, the BoE and the ECB are scheduled for today. However, judging by the titles of the sessions for the first two, they may not say anything about the near-term monetary policy outlook. ECB Chief Economist may be watched for further clues whether the ECB has any plans to allow inflation to overshoot its target following comments on this by ECB President Lagarde.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1600 (2.8BLN), 1.1650 (700M), 1.1680-85 (2BLN), 1.1700 (650M) 1.1750 (525M), 1.1775-80 (1BLN), 1.1800 (1.5BLN), 1.1805-15 (1BLN)

- USDJPY: 105.00 (1.6BLN), 105.30-35 (1.1BLN), 105.50 (450M), 105.70-80 (1.4BLN), 105.90-106.00 (950M), 106.10-15 (830M) 106.35-40 (700M), 106.60-70 (750M).

- GBPUSD: 1.2900 (191M), 1.3000 (284M), 1.3200 (481M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1750 Bullish above

EURUSD From a technical and trading perspective,test of 1.1750 trendline attracted fresh bids, as 1.18 now acts as interim support look for a test of offers and stops above 1.1950 UPDATE as 1.1700/50 acts as support expect continued rotation in 1.17/1.19 range, a breach of 1.17 would suggest a deeper correction underway to challenge bids at 1.16. UPDATE as 1.1750 now acts as resistance look a challenge of bids and stops below 1.16

Flow reports suggest downside bids limited through the 1.1620 area opening the downside through to the 1.1480-1.1500 level in the short, Topside offers likely to be limited now through the 1.1760 level but increasing in resistance into the 1.1780-1.1800 area with weak stops likely on a push through the 1.1820-30 area for a quick stab towards the 1.1850 area

GBPUSD Bias: Bearish below 1.2850 Bullish above

GBPUSD From a technical and trading perspective, test of the pivotal primary trendline support at 1.2830/50 stalls downside for now, however as 1.3000 acts as resistance look for renewed downside to target 1.2650 next UPDATE as 1.2850 acts as resistance look for a test of bids to 1.26/1.2570 UPDATE as 1.28 now acts as support lok for a test of 1.30, a breach of 1.2750 would suggest a false upside break and resumption of downtrend

Flow reports suggest topside offers light through to the 1.2900 level with offers congested through to the 1.2930 area before lighter offers begin to appear into the sentimental 1.2950 area stronger offers are then likely on any approach to the 1.3000 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2800 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

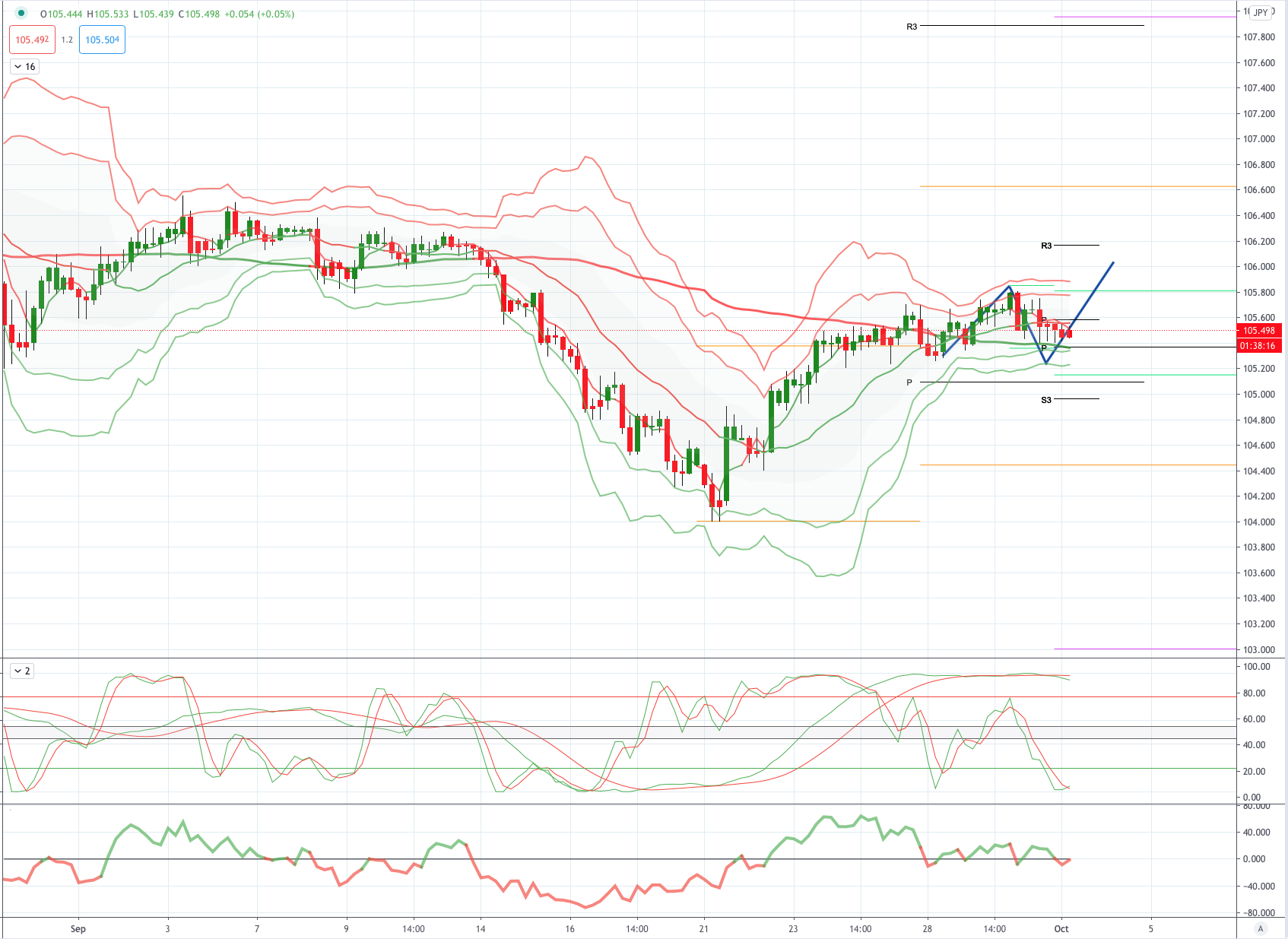

USDJPY Bias: Bearish below 105.50 Bullish above

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. UPDATE as 105.50 now acts as resistance look for a test of bids towards 103.80 as the next downside objective. UPDATE continued rotation around 105.50, as 105.10 supports look for a test of 106.00

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

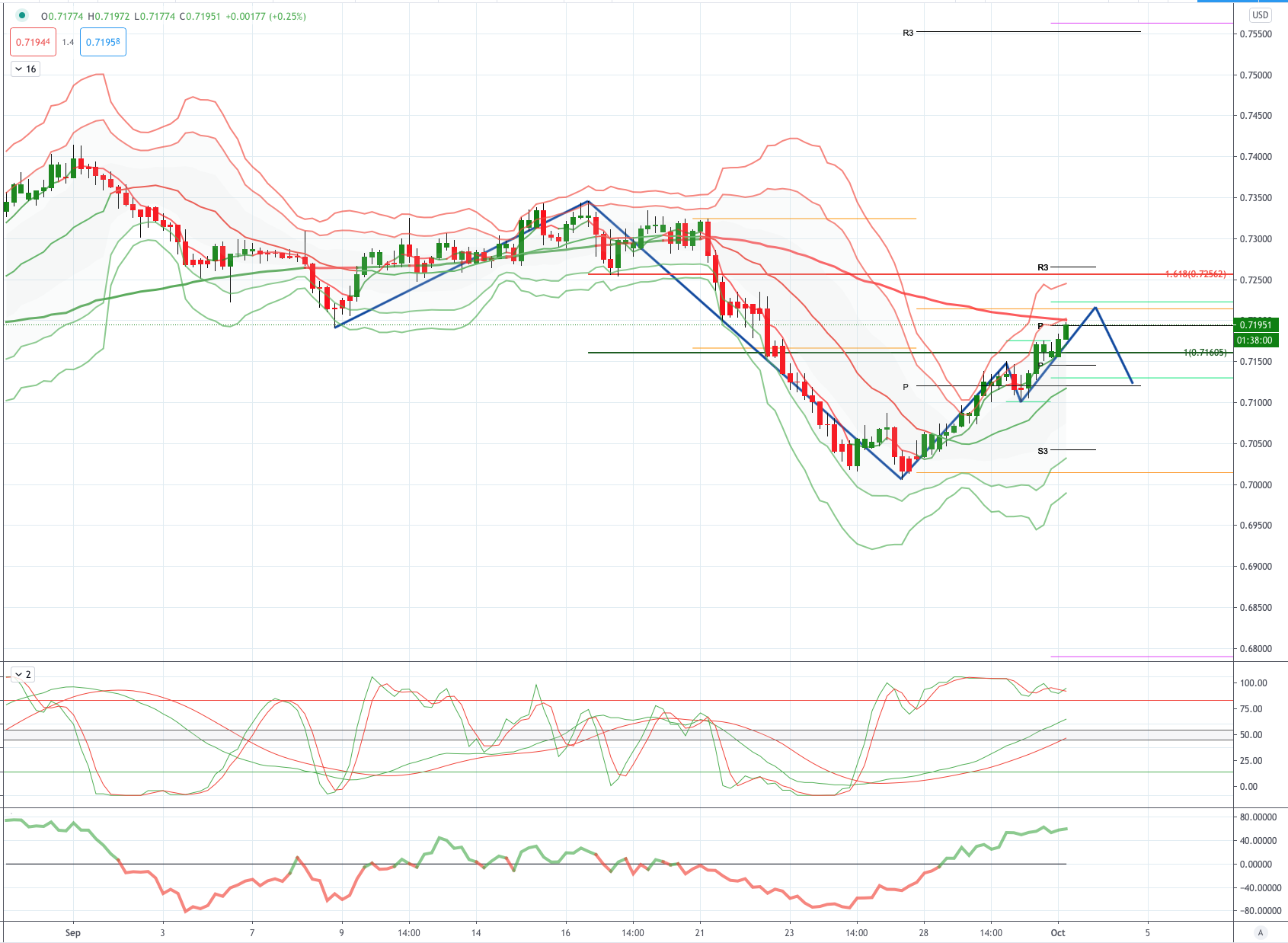

AUDUSD Bias: Bullish above .7150 Bearish below

AUDUSD From a technical and trading perspective, as .7220 now acts as support, look for a test of psychological .7500. Only a daily closing breach of .7220 would concern the bullish thesis opening a retest of .7100. UPDATE as .7220 now acts as resistance look for a test of bids to .7050 UPDATE as .7150 acts as resistance look for a test of bids and stops below .7000 UPDATE breach of .7150 opens a retest of .7220 from below

Flow reports suggest downside light bids through to the 0.7020 area with stronger bids starting to make an appearance and possible option related bids coming into play, a push through the 0.6980 level should see weak stops appearing and the market running into congestion on any push to the sentimental 0.6950 area and likely to continue through to 69 cents area, Topside offers light through to the 0.7160 level before sufficient offers appear to slow any further rise however, strong offers through to the 72 cents level are likely to stymie any further movement however, weak stops through the 0.7220 level could help it run a little higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!