Daily Market Outlook, November 7, 2022

“ A whipsaw end to the week in the US on Friday, following the mixed Non Farm payrolls release which saw the Dollar post one of its largest declines in the past seven years. Chinese authorities did little to boost risk appetite as they reaffirmed their commitment to zero Covid policies over the weekend, this restatement came as infections in the region rose to the highest levels since May. Overnight data out of China also confirmed a softer trade surplus as tepid global demand continues to weigh on exports, however, even against this backdrop Asian equity markets have retained a firmer tone overnight and US futures are pointing to a positive start to the week. The week ahead will be dominated by US midterm election results on Tuesday evening, followed by US inflation on Thursday. The midterm elections are seen as a close call, with the Republican party seen as favourites to secure control of the Congress, with the Senate race seen as too close to call, historically, markets prefer political gridlock, if the Republicans seize control of both houses this would significantly hamper Biden’s fiscal plans and likely put the ball back into the Fed’s court, with respect to providing economic support, this would most likely be interpreted as having dovish connotations for Fed policy and a positive for markets. Thursday’s CPI release is likely to confirm a month on month increase of 0.5% which will leave inflation as the Fed’s principal cover for higher rates for longer, for those looking for signs of peak inflation, prints closer to 0.2% month on month will be needed to confirm a turn, once again supporting the promise of a future Fed pivot, which has proved elusive so far…see more of my thoughts on the week ahead in my weekly market outlook video”

Overnight Headlines

Fed Watchers Put ‘Finger In The Air’ And See Rate Peak Above 5% - BBG

Economy Of Extremes Looms Over US Voters On Midterm Election Eve - BBG

Democrats Catch Up To GOP On Enthusiasm In Final Poll Before Midterms - NBC News

Following The Fed Goes Out Of Fashion In ‘Messier’ World Economy - BBG

BlackRock’s Rieder: Fed May ‘Overdo It’ With Rate Increases - BBG

Biden Predicts Democrat Midterms Win, Says Economy Improving - RTRS

Biden And Trump End Midterms On 2024 Collision Course - Politico

Dollar Gains As China Sticks To Stringent Covid Policy, Souring Risk Sentiment - RTRS

More Pound Pain Coming As BoE Shifts To Recession From Inflation - BBG

China Ends Stronger-Than-Expected Yuan Fixings Amid Covid Bets - BBG

Crypto ‘FOMO Effect’ Emboldens Bulls; Bitcoin Topped $21,000 Again - BBG

Ethereum Insiders To Get Fee Cuts That Others Won’t In Upgrade - BBG

Gold Retreats From Three-Week High As Firmer Dollar Dulls Appeal - RTRS

Technical & Trade View

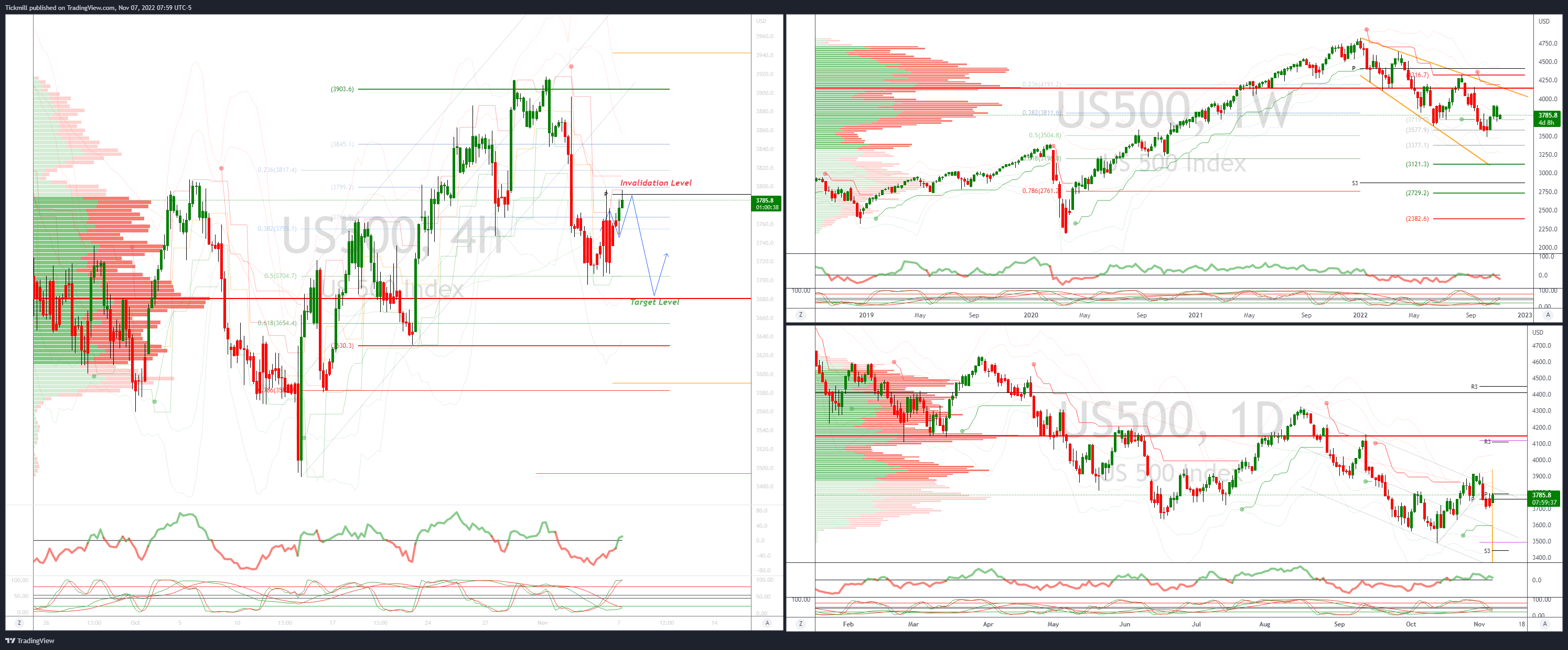

SP500 Bias: Intraday Bullish Above Bearish Below 3800

Technicals

Primary resistance is 3800

Primary downside objective is 3680

Next pattern confirmation, acceptance below 3700

Acceptance above 3810 opens a test of 3835

20 Day VWAP bullish, 5 Day VWAP bearish

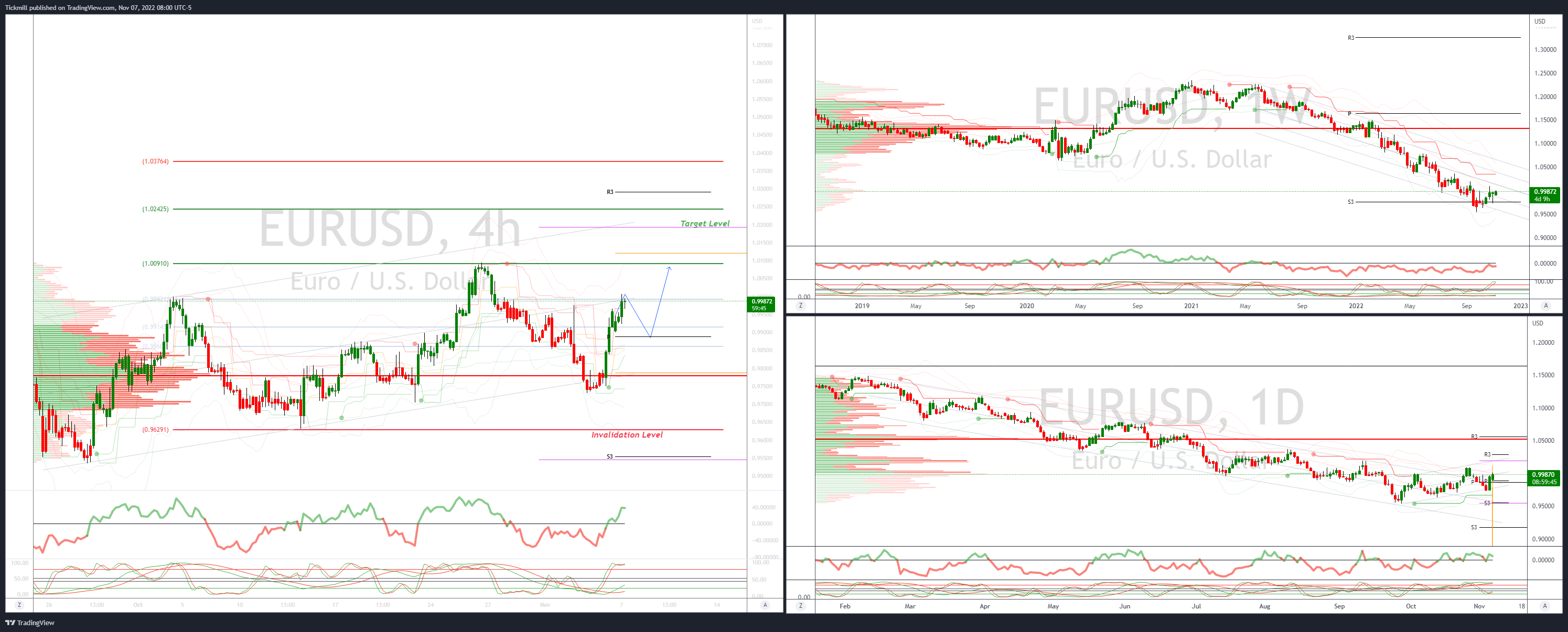

EURUSD Bias: Intraday Bullish Above Bearish below .9860

Option Expiries: 0.9750 (1.19BN), 0.9800 (1.88BN), 0.9820-25 (430M), 0.9850-60 (732M), 0.9880 (470M), 0.9935-45 (743M), 0.9950-55 (648M), 0.9975-80 (310M), 1.0000 (442M)

Technicals

Primary support is .9860

Primary upside objective is 1.02

Next pattern confirmation, acceptance above 1.00

Failure below .9700 opens a test of .9630

20 Day VWAP bearish, 5 Day VWAP bearish

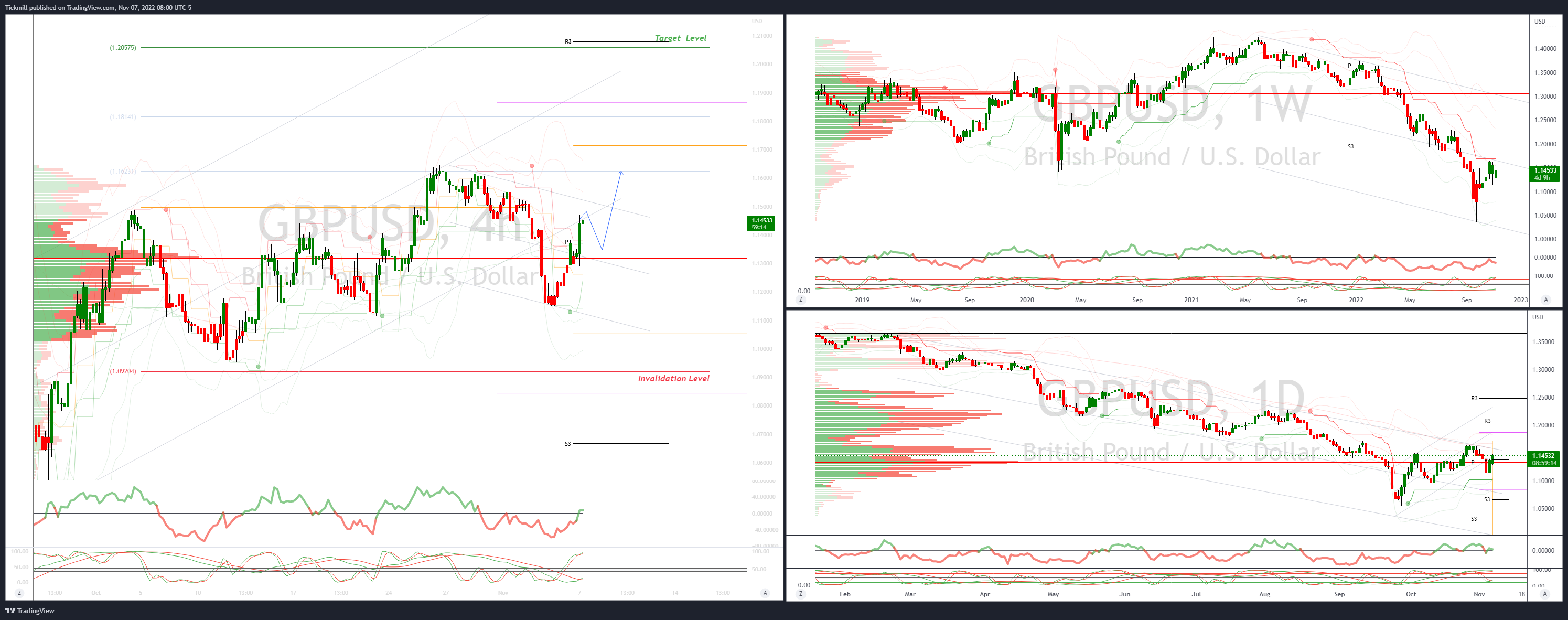

GBPUSD Bias: Intraday Bullish Above Bearish below 1.1260

Option Expiries: 1.1460-70 (493M), 1.1665-75 (494M)

Technicals

Primary support is 1.1260

Primary upside objective 1.20

Next pattern confirmation, acceptance above 1.15

Failure below 1.1240 opens a test of 1.1150

20 Day VWAP bearish, 5 Day VWAP bullish

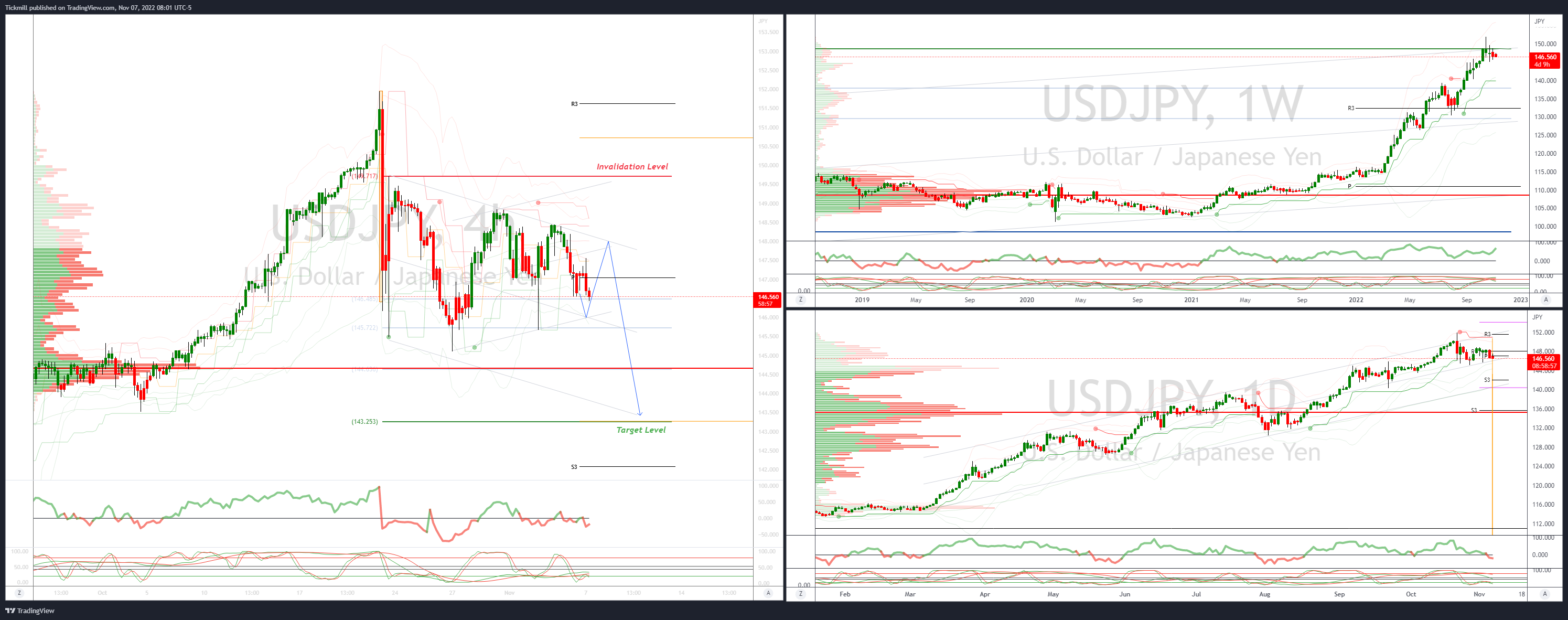

USDJPY Bias: Intraday Bullish above Bearish Below 148.10

Option Expiries: 148.00 (410M), 148.60-62 (730M)

Technicals

Primary resistance is 148.10

Primary downside objective is 143.25

Next pattern confirmation, acceptance below 146

Acceptance above 148.50 opens a test of 149.70

20 Day VWAP bearish, 5 Day VWAP bearish

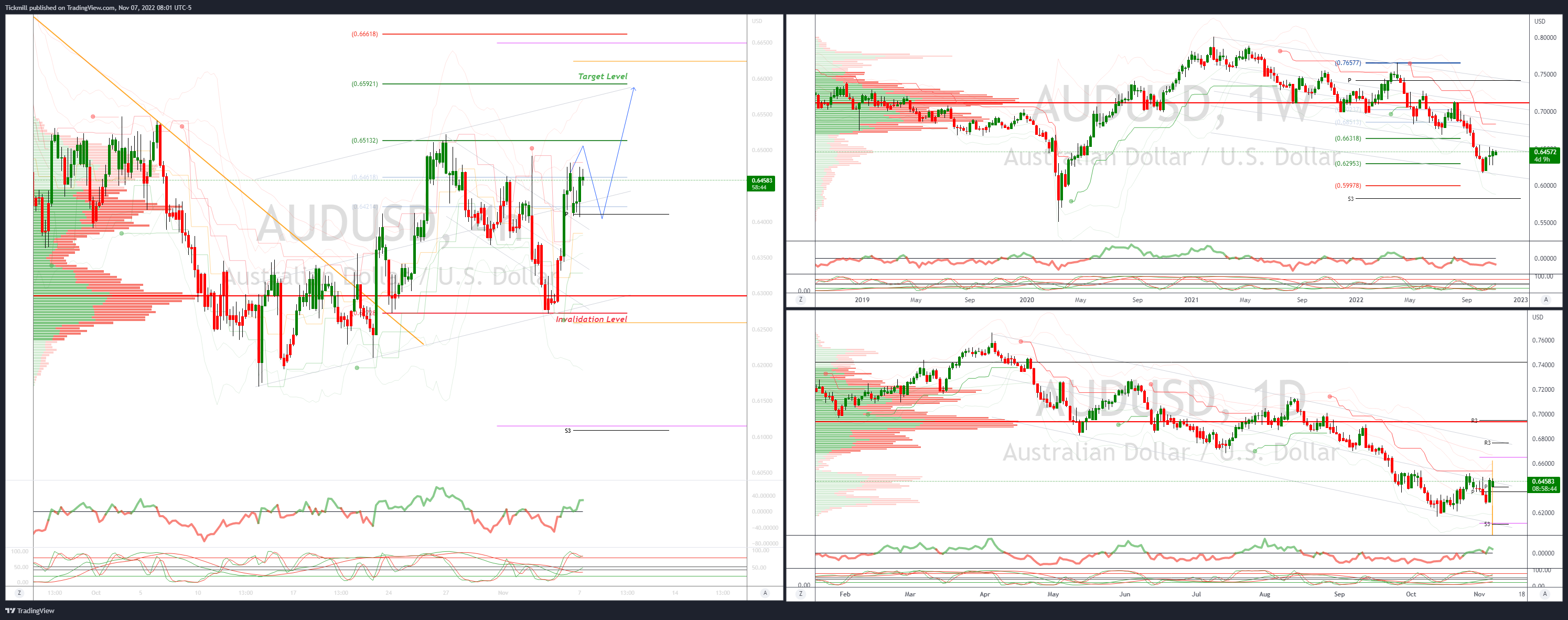

AUDUSD Bias: Intraday Bullish Above Bearish below .6380

Option Expiries: 0.6425-30 (990M), 0.6450 (650M), 0.6500 (308M)

Technicals

Primary support is .6380

Primary upside objective is .6590

Next pattern confirmation, acceptance above .6520

Failure below .6350 opens a test of .6280

20 Day VWAP bullish, 5 Day VWAP bullish

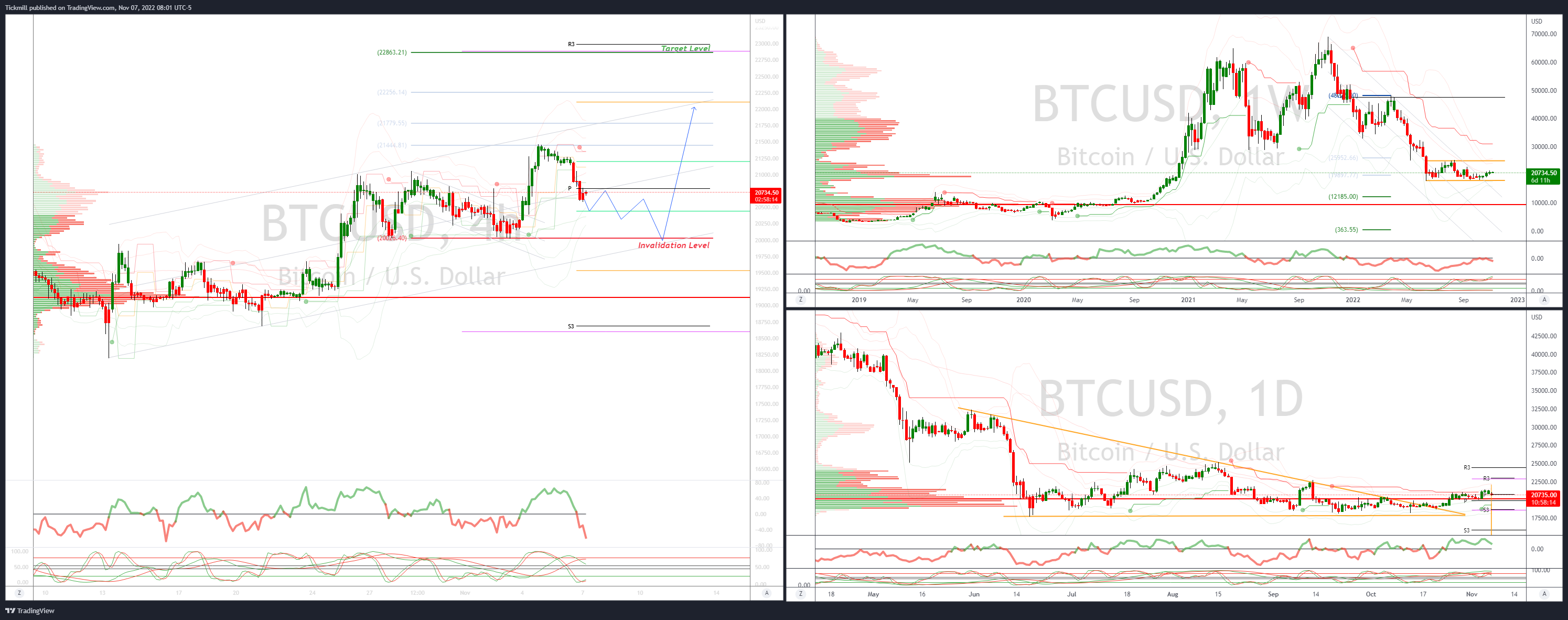

BTCUSD Bias: Intraday Bullish Above Bearish below 20000

21460 Target Achieved, New Pattern Developing

Technicals

Intraday 20000 is primary support

Primary upside objective is 22863

Next pattern confirmation, acceptance above 21460

Failure below 20000 opens a test of 19.750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!