Daily Market Outlook, November 16, 2020

Daily Market Outlook, November 16, 2020

News last week that a Covid-19 vaccine, described as 90% successful, may soon be ready has fuelled a resurgence in market sentiment. Equity markets, particularly in Europe, have risen sharply and in some cases are up more than 12% so far this month. This positive tone has continued this morning with stock markets across Asia trading higher. In part, this also reflects the signing of the Regional Comprehensive Economic Partnership over the weekend, which should provide a boost to trade amongst the APAC nations. Meanwhile, the release of October data from China provided further affirmation that the Chinese economy remains on the path to recovery. Industrial production growth held steady at 6.9%y/y, while the pace of retail sales activity gathered steam, picking up to 4.3% from 3.3% previously.

Despite the UK’s chief Brexit negotiator David Frost proclaiming that ‘good progress’ had been, trade negotiations between the EU and UK missed another informal deadline over the weekend. Optimism that a deal might be done by the middle of this week has given way to pessimism that the two sides are still far apart on some key issues. Mr Frost is expected to continue talks with his EU counterpart, Michel Barnier, in Brussels in the coming days with one EU diplomat describing the coming week’s talks as “crunch time”. With the deadline for the UK to leave the EU at the end of the year still in place, it is realised that any deal has to come in time for it to be ratified by both the EU and UK parliaments. However, what precisely that means for a final deadline date is still uncertain, although a UK official suggested that “we’ve got 10 more days, max”.

The impact of a ‘no deal’ Brexit, along with the economic challenges associated with managing the spread of Covid-19, are likely to feature highly in speeches by a number of ECB officials today. De Guindos, Hernandez, Mersch and President Lagarde are all due to speak at various events with markets likely to use their speeches to gauge the scale and extent of the stimulus package set to be announced at the December policy meeting.

Today’s data focus is limited to the US Empire State manufacturing survey for November. The headline balance is expected to pick up to 14.0 from 10.5, consistent with an acceleration in activity across the month. However, with the region likely to be subject to further targeted restrictions on activity, any improvement could reverse in December. Domestically, Bank of England policymaker Jonathan Haskel is due to speak at the All Parliamentary Group on Artificial Intelligence. However, given the likely limited commentary expected on the near-term outlook for both the UK economy and monetary policy, his remarks are likely to attract little interest from markets.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1830 (500M), 1.1870 (212M)

- USDJPY: 104.45 (400M), 104.70-75 (800M), 105.00 (1BLN)

- AUDUSD: 0.7300 (200M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.1750 targeting 1.20

EURUSD From a technical and trading perspective, as 1.1750 acts a support look for a retest of cycle highs at 1.20, failure below 1.1750 opens a retest of range support at 1.16

Flow reports suggest topside offers through to the 1.1920 level, even there where you’re likely to see weak stops you will find the same type of congestion continuing to the 1.1950 before weakening a little and increasing for any move to the 1.2000 level. Downside bids light through the 1.1800 area with weak stops on a dip through the 1.1780 area and opens the market for a renewed challenge of the 1.1700 area with light support from there

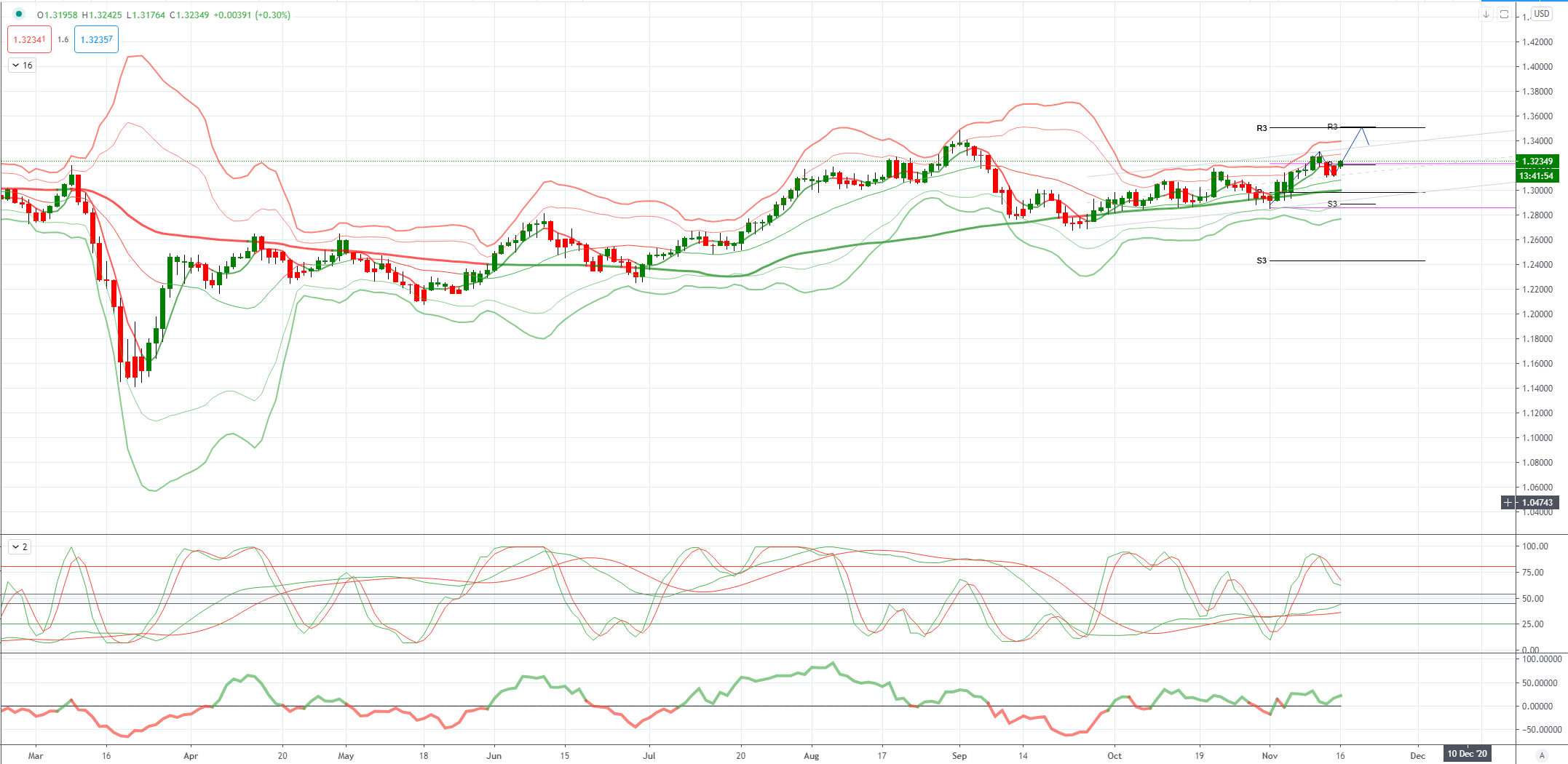

GBPUSD Bias: Bullish above 1.3150 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480

Flow reports suggest topside offers increasing through to the 1.3200 level with weak stops likely on a move through the level and becoming weaker on a break through to the 1.3260 area with limited offers once through the 1.3300 area, Downside bids light through the 1.3100 level before stronger bids start to appear and increase through to the 1.3050 area and likely to increase on any approach of the 1.3000 level with weak stops through the level opening a test to the 1.2950/00 areas

USDJPY Bias: Bearish below 104.30 bullish above

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50 UPDATE as 104.30 continues to attract buyers look for a breach of 105.50 to open a test of 106 next

Flow reports suggest downside bids light through the 104.50 level before beginning to thicken on any dip below the 104.00 level increasing on move through the 103.50 level with weak stops likely on a dip through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00.

AUDUSD Bias: Bearish below .7243 bullish above targeting .7400

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400

Flow reports suggest topside congestion through the 0.7300 area and likely to continue through to the 0.7320 area before a little less resistance through to 0.7350, however a push through this level is likely to see increasing offers into the 0.7380 level and continuing through to the 0.7420 and the highs since September, strong breakout stops likely on a move through the level and opening a larger move higher against the rub of the economics for the moment. Downside bids light through to the 0.7140 level before finding some light congestion with stronger bids into the 71 cents level to some extent however weak stops and then better bids through the 0.7050 area and increasing into the 70 cents level with short term profit taking likely

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!