Daily Market Outlook, May 31, 2022

Daily Market Outlook, May 31, 2022

Overnight Headlines

• China's factory activity falls at slower pace as COVID curbs ease

• CN May NBS Manufacturing PMI 49.6, 47.4 prev; Composite 48.4, 42.7 prev, NBS non-Mfg PMI 47.8, 41.9 prev

• China’s cabinet issues a series of policies to stabilize the economy- cabinet document

• China’s cabinet: Will guide actual lending rates lower

• EU, resolving a deadlock, in deal to cut most Russia oil imports

• Japan's April factory output slumps in worrying sign for economy

• JP Apr Industrial O/P Prelim MM SA, -1.3%, -0.2% f’cast, 0.3% prev; YY SA -3.3%, -0.8% prev

• JP Apr Retail Sales YY, 2.9%, 2.6% f’cast, 0.9% prev, 0.7% rvsd

• JP Apr Unemployment Rate, 2.5%, 2.6% f’cast, 2.6% prev; Jobs/Applicant Ratio 1.23, 1.23 f’cast, 1.22 prev

• Biden highlights Fed inflation role ahead of Powell meeting on Tuesday

• Fed's Waller backs 50 bps rate hikes until "substantial" reduction in inflation

• POLL-U.S. house price inflation to cool as buyers sidelined by higher rate

• Australia Q1 GDP up in the air as strong demand sucks in imports

• AU Q1 Current Account Balance SA, 7.5 bln, 13.4 bln f’cast, 12.7 bln; Net Exports Contribution, -1.7%, -1.4% f’cast, -0.2% prev

• AU Apr Building Approvals, -2.4%, 2.0% f’cast, -18.5% prev

• AU Q1 Business Inventories, 3.2%, 1.0% f’cast, 1.1% prev

• New Zealand business sentiment worsens as inflation remains intense, -55.6, -42.0 prev

The Day Ahead

- Asian equity markets are mixed this morning after yesterday’s gains. The easing of lockdown in Shanghai and better-than-expected PMI data underpinned Chinese stocks, but concerns about global central bank policy responses to inflation weighed on the broader market. Yesterday saw German May inflation rise significantly more than forecast to 8.7% on the EU-harmonised measure. Brent crude oil has risen above $124 a barrel, reflecting a partial EU ban on Russian oil imports. US 10-year Treasury yields increased by 10bp to 2.84%.

- The Lloyds Bank Business Barometer’s overall business confidence in May rose for the first time in three months, since Russia’s invasion of Ukraine, but it weakened in consumer-related sectors. The confidence index gained 5 points to 38%, while hiring intentions picked up and price and wage pressures remained elevated. Despite the confidence uplift, nearly half of businesses expressed concern about inflation or rising costs and about a third were worried about an economic slowdown.

- Later this morning, the Bank of England will release its latest credit data. Mortgage approvals may have edged lower in April from around 70k in recent months. Secured lending has continued to grow, while there has been a notable pickup in consumer credit, according to the BoE data. The BRC shop price index will be released in the early hours of tomorrow.

- The focus in the Eurozone will be on the flash estimate for CPI inflation in May. Yesterday’s surge in German inflation points to upside risks for Eurozone headline inflation to rise to a new high of 7.7%. The ECB is still doing QE but, in response to sharply rising inflation, President Lagarde has indicated that asset purchases will end in early July and that interest rate lift-off is likely to occur at its 21 July meeting with a 25bp increase, but more hawkish members will be calling for a larger rise.

- In the US session, markets will be looking for a fourth fall in five months in the Conference Board consumer confidence index. Expect the headline index to fall to 106.0, while the consensus forecast is for a deeper decline. Although the US labour market remains strong, real incomes are being dented by high inflation. US house price data will also attract attention as rising interest rates curtail activity in the sector.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0590-00 (8.31BLN), 1.0625-30 (1.57BLN)

- 1.0645-50 (1.3BLN), 1.0725-30 (490M), 1.0740-50 (650M)

- 1.0760 (854M), 1.0775-80 (590M), 1.0800 (1.12BLN)

- 1.0880 (1.12BLN)

- USD/JPY: 127.75-85 (740M), 129.65 (250M)

- GBP/USD: 1.2450 (878M), 1.2500 (258M), 1.2520-25 (615M)

- 1.2545-50 (3.82BLN), 1.2645 (2.29BLN), 1.2680 (835M)

- 1.2710 (303M)

- EUR/JPY: 133.50 (659M), 135.24 (240M)

- EUR/GBP: 0.8475 (270M), 0.8500 (551M), 0.8525 (205M)

- 0.8565-75 (570M, 0.8650 (244M))

- AUD/USD: 0.7000 (615M), 0.7090 (261M), 0.7120-25 (660M)

- 0.7150 (238M)

- USD/CAD: 1.2660-65 (286M), 1.2700 (407M), 1.2800 (329M)

- NZD/USD: 0.6475 (426M), 0.6515 (233M) 0.6600 (797M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD traded to the exact point to fulfill a tech correction then dropped

- A 38.2% retracement drop from 2022 high 1.1495 to 2022 low 1.0349 is 1.0787

- The target for a minimum technical correction of the down move was achieved

- May 30 EUR/USD reached 1.0787, then dipped, May 31 range 1.0734-77 EBS

- EUR/USD VWAP has turned bullish

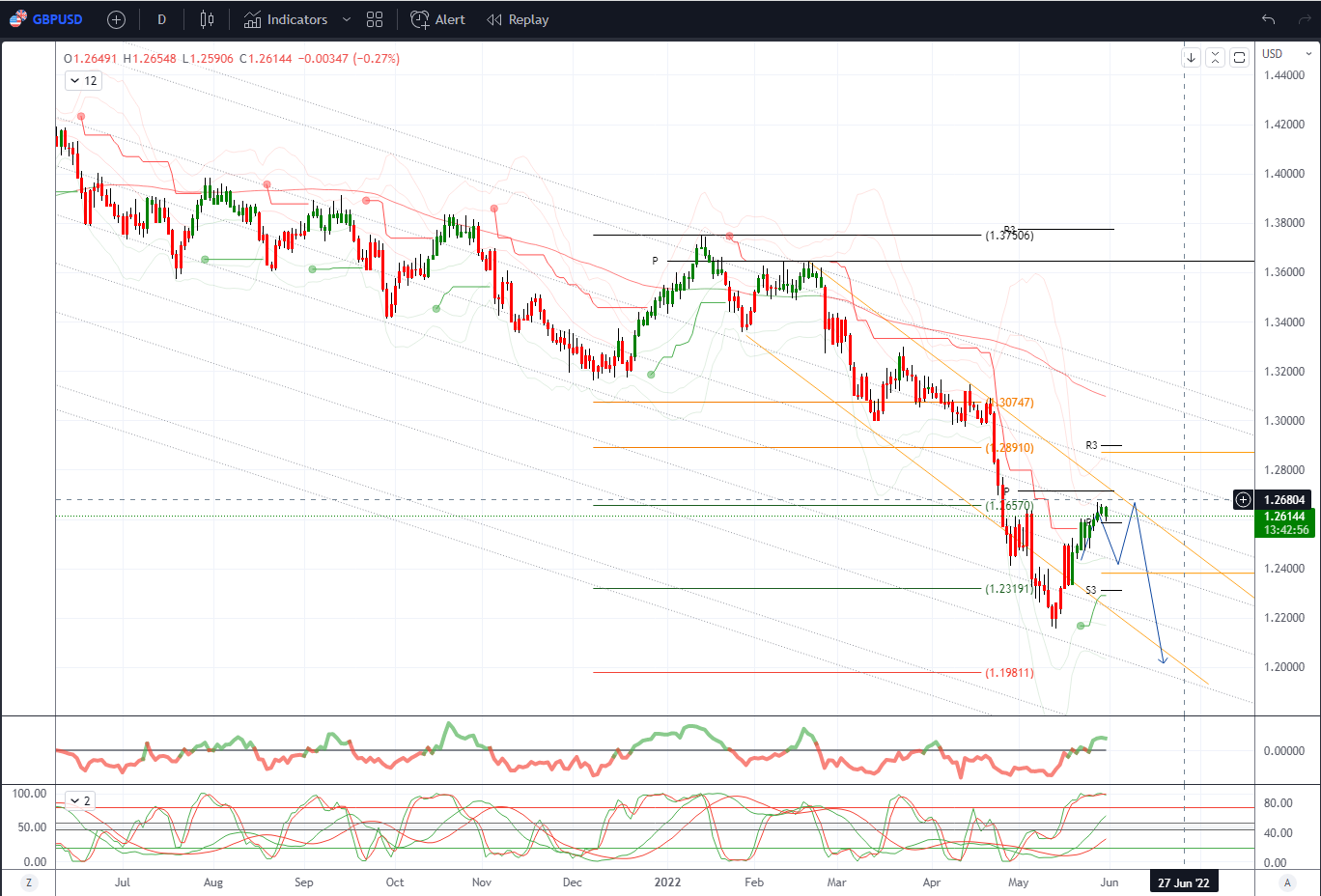

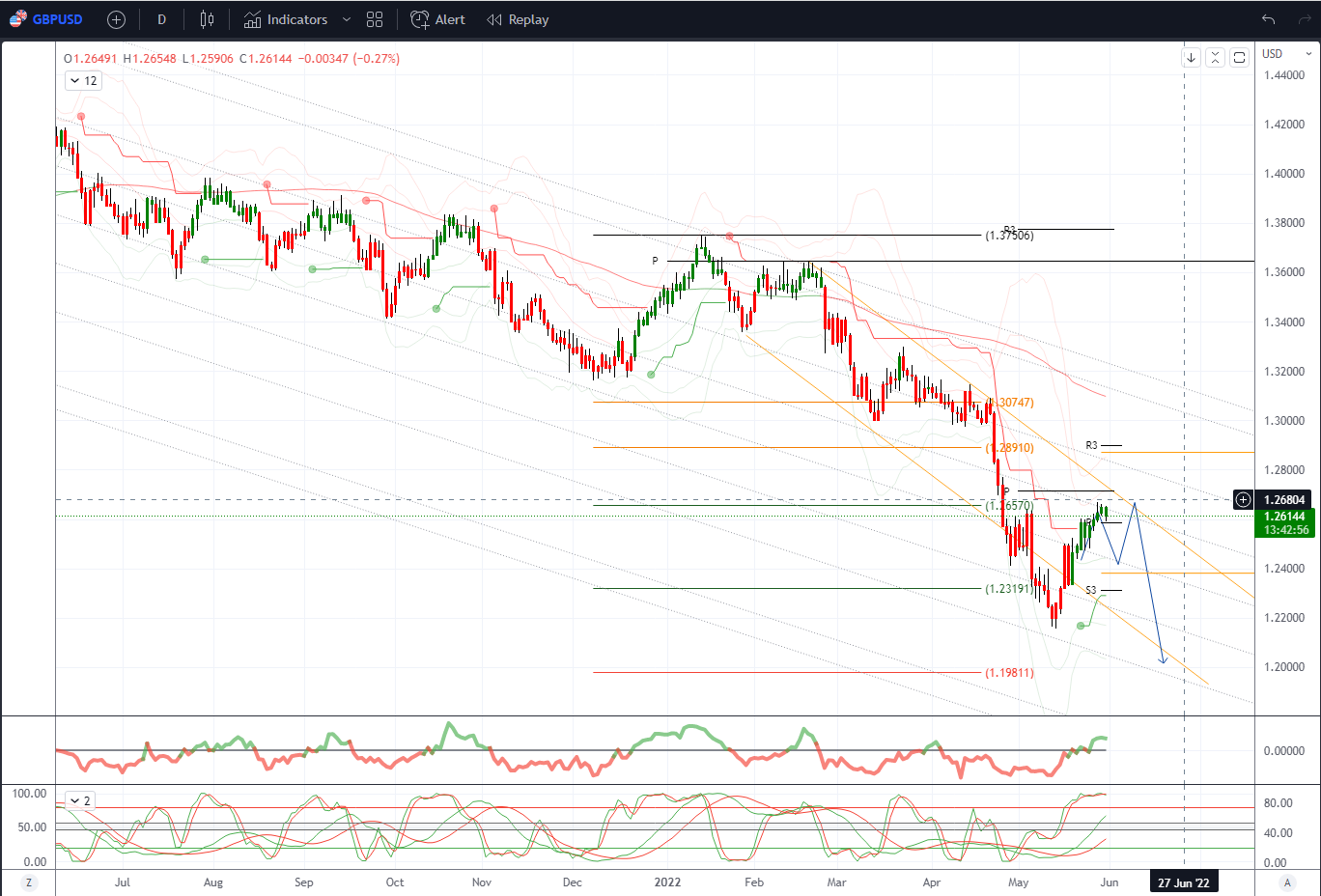

GBPUSD Bias: Bearish below 1.26 Bullish above.

- GBP/USD has rallied from May's 1.2156 low to 1.2666 in June

- This is a minor correction of a major decline

- GBP/USD previously dropped from 2022 high at 1.3749

- The drop that followed taper talk last year is 1.4250-1.2156

- Targets for resumption that decline: 1.20

- Daily VWAP has turned bullish

USDJPY Bias: Bullish above 127 Bearish below

- USD/JPY up 0.4%, rises to a more than 1-week high; Asia range 127.53-128.35

- Boosted by higher UST yields; 10 year yield jumps 11 bps on inflation fears

- German inflation, oil rally raises specter of aggressive global rate rises

- Fed's Waller backs 50 bps hikes until "substantial" reduction in inflation

- EU agrees to cut 90% of Russian oil imports by year-end

- Resistance 128.30-35, 128.50-60, support 127.75-80, 127.50-55

AUDUSD Bias: Bullish above .7200 Bearish below

- Muted reaction to improved China PMI

- AUD/USD little changed around 0.7170/75 following improved May China PMI

- AUD/USD fell as low as 0.7163 before the data as USD broadly moved higher

- Rise in US yields and month-end USD buying flows weighed on AUD/USD

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!