Daily Market Outlook, March 7, 2024

Munnelly’s Macro Minute…

“BoJ Official Murmurings Boost JPY, ECB On Watch Next”

In the Asian region, major stock market indices showed a mixed performance after positive closures in the US and Europe. Japanese stocks declined while the JPY rose, amid speculation about potential near-term increases in policy interest rates. Despite stronger-than-expected trade data, Chinese stocks gave up earlier gains. Meanwhile, Germany reported a significant decline in January factory orders earlier today.

The main focus today is on the European Central Bank's policy decision at 13:15GMT, followed by the press conference at 13:45GMT. It is expected that interest rates will remain unchanged, including the deposit facility rate at 4%. The release of new March economic forecasts is expected to lower the 2024 inflation forecast from December's 2.7%. However, close attention will be paid to the medium-term outlook, particularly as inflation was previously forecasted to reach the 2% target only by 2026 (at 1.9%). Growth projections for 2024 are also expected to be revised downwards from 0.8%. Despite these adjustments, ratesetters are likely to proceed cautiously, preferring to await additional information, including Q1 wage data, before considering interest rate cuts. This suggests a diminished probability of an initial rate cut at the upcoming April meeting, with June being a more plausible timing. Market observers will closely monitor President Lagarde's stance on the lingering expectations for an April rate cut during the press conference.

In the UK, today sees the release of the Bank of England's Decision Maker Panel (DMP) survey, which is closely monitored by policymakers to assess businesses' price and wage expectations. The previous survey indicated a decline in one-year-ahead CPI expectations to 3.4%, while wage growth is expected to moderate to approximately 5%.

US Fed Chair Powell's semi-annual testimony to Congress continues today in the Senate. He is expected to echo yesterday's House comments, reiterating the Fed's cautious approach towards interest rate cuts and emphasizing the need for more evidence of sustained inflation decline to target levels. Reflecting resilient economic growth signals, financial markets have recently scaled back expectations of US monetary policy easing, now fully pricing in three rate cuts in 2024, consistent with Fed policymakers' December forecast update (the 'dot plot'). Overall, Powell seems content with the current positioning of financial markets. Additionally, the Fed's Mester is scheduled to deliver a speech on the economic outlook today at 16:30GMT and later appear on CNBC at 18:15GMT. Being considered on the hawkish side of the spectrum, she may advise against premature interest rate cuts.

Overnight Newswire Updates of Note

Reports Some Japan Govt Officials Back Near-Term BoJ Rate Hike

BoJ's Nakagawa Signals Conviction Over Price Goal Achievement

Japan Jan Real Wages Fall But At Slowest Pace In 13 Months

China’s Export Growth Jumps In Positive Sign For Demand

Fed's Kashkari Sees Two Rate Cuts At Most This Year

Fed's Daly Says Rising Housing Costs Drive Inflation Higher

US House Approves $460 Bln Bill Ahead Of Shutdown Deadline

Biden To Request 1% Increase In 2025 Defense Budget Under Cap

UK Taxes Head For Highest Level Since 1948 Despite Hunt’s NI Cut

UK Debt Chief Sees Less Value In Long-Dated Gilt Issuance

ExxonMobil Seeks Arbitration Over Guyana Oil Find In Chevron’s Sights

Intel Stands To Win $3.5 Bln To Produce Chips For Military

Bayer Chief Rules Out Capital Increase As Investors Slam Turnaround Plan

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0820 (EU988.3m), 1.0825 (EU659.7m), 1.0835 (EU632.7m)

USD/JPY: 149.50 ($1.08b), 151.00 ($984m), 146.00 ($969.1m)

USD/CNY: 7.1940 ($676.7m), 7.2150 ($418.6m). 7.1950 ($400m)

USD/MXN: 21.00 ($1b), 16.68 ($1b), 17.83 ($803.9m)

USD/CAD: 1.3635 ($799.2m), 1.3315 ($436m), 1.3550 ($356.3m)

AUD/USD: 0.6600 (AUD672.9m), 0.6525 (AUD631.6m), 0.6750 (AUD578.7m)

GBP/USD: 1.2485 (GBP1.63b), 1.2500 (GBP560m), 1.2650 (GBP537.7m)

USD/BRL: 4.9315 ($328.4m)

FX option implied volatility has found support at long term lows, with potential value hunting due to upcoming central bank announcements and data risks. EUR/USD implied volatility has increased for the overnight expiry, but the break-even is still low. One-week expiry FX options have elevated implied volatilities due to upcoming U.S. NFP and CPI data. JPY related implied volatility and its risk reversals have increased amid a mild JPY recovery, especially for the 2-week date with growing expectations of the BoJ announcing an end to its negative interest rate policy.

CFTC Data As Of 27/02/24

Euro net long position is 62,854 contracts

Japanese yen net short position is -132,705 contracts

Swiss franc posts net short position of -11,981 contracts

British pound net long position is 46,358 contracts

Bitcoin net short position is -1,967 contracts

Equity fund managers cut S&P 500 CME net long position by 5,157 contracts to 942,123

Equity fund speculators increase S&P 500 CME net short position by 14,679 contracts to 434,512

Technical & Trade Views

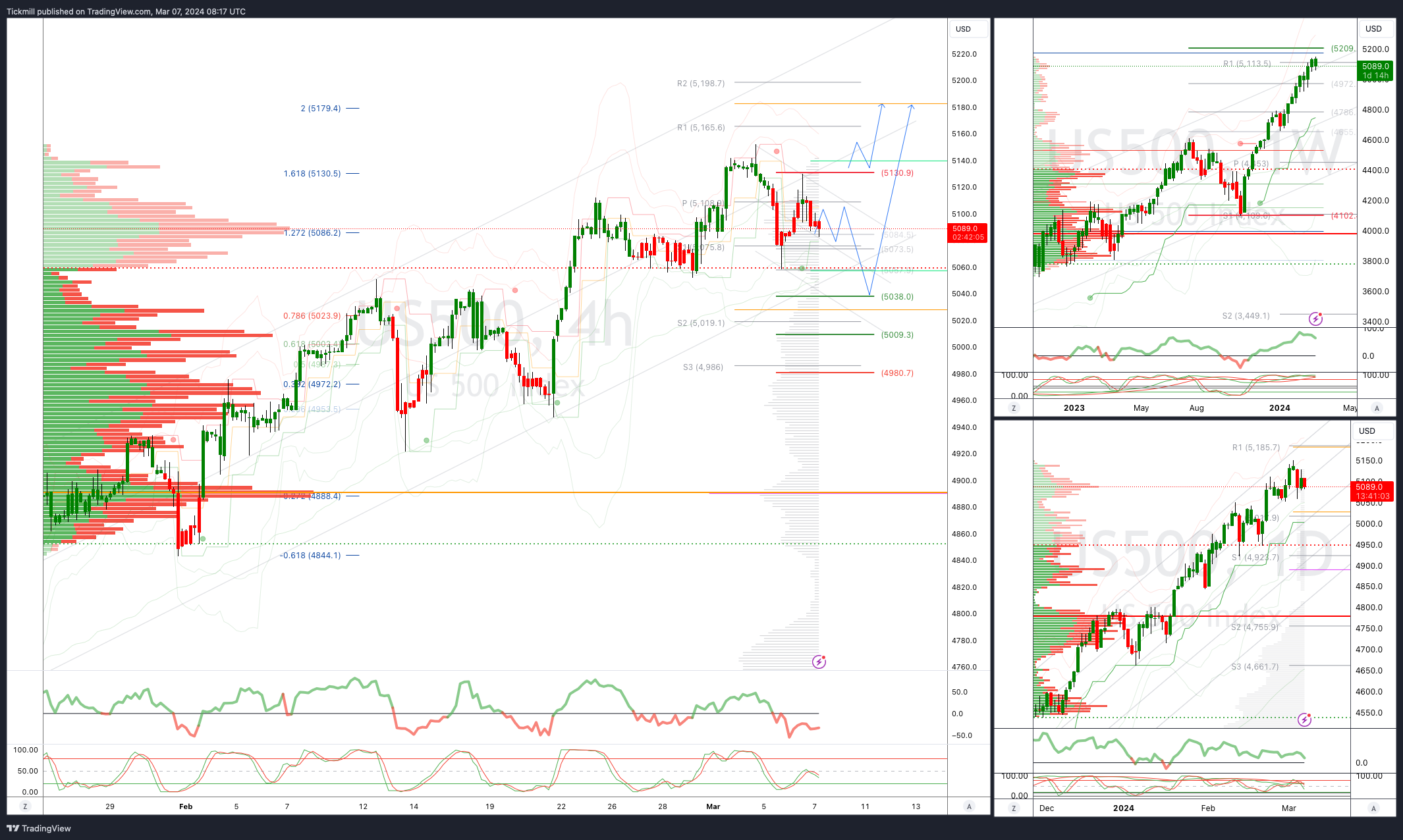

SP500 Bullish Above Bearish Below 5110

Daily VWAP bearish

Weekly VWAP bullish

Below 5050 opens 5038

Primary support 5050

Primary objective is 5180

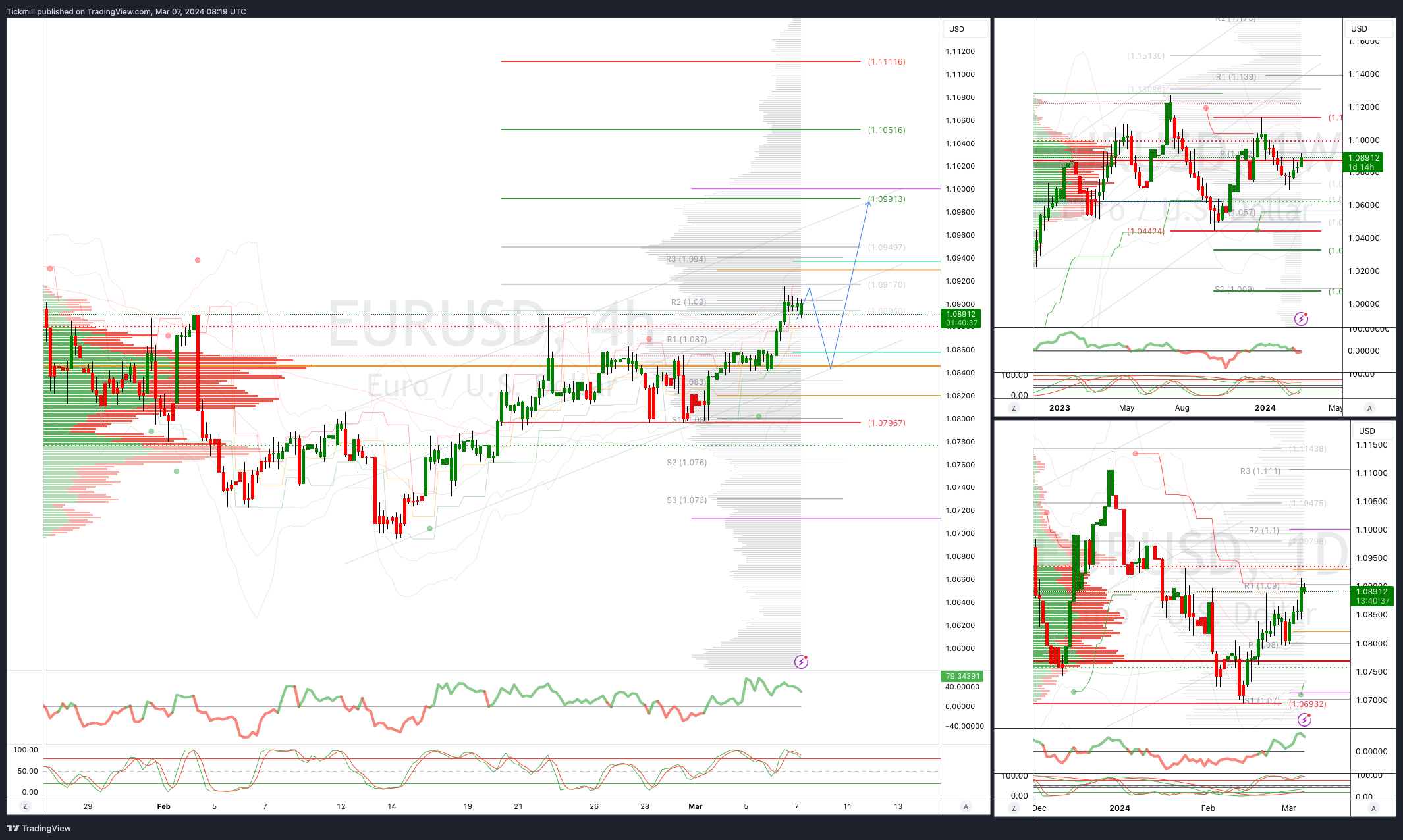

EURUSD Bullish Above Bearish Below 1.0875

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bullish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

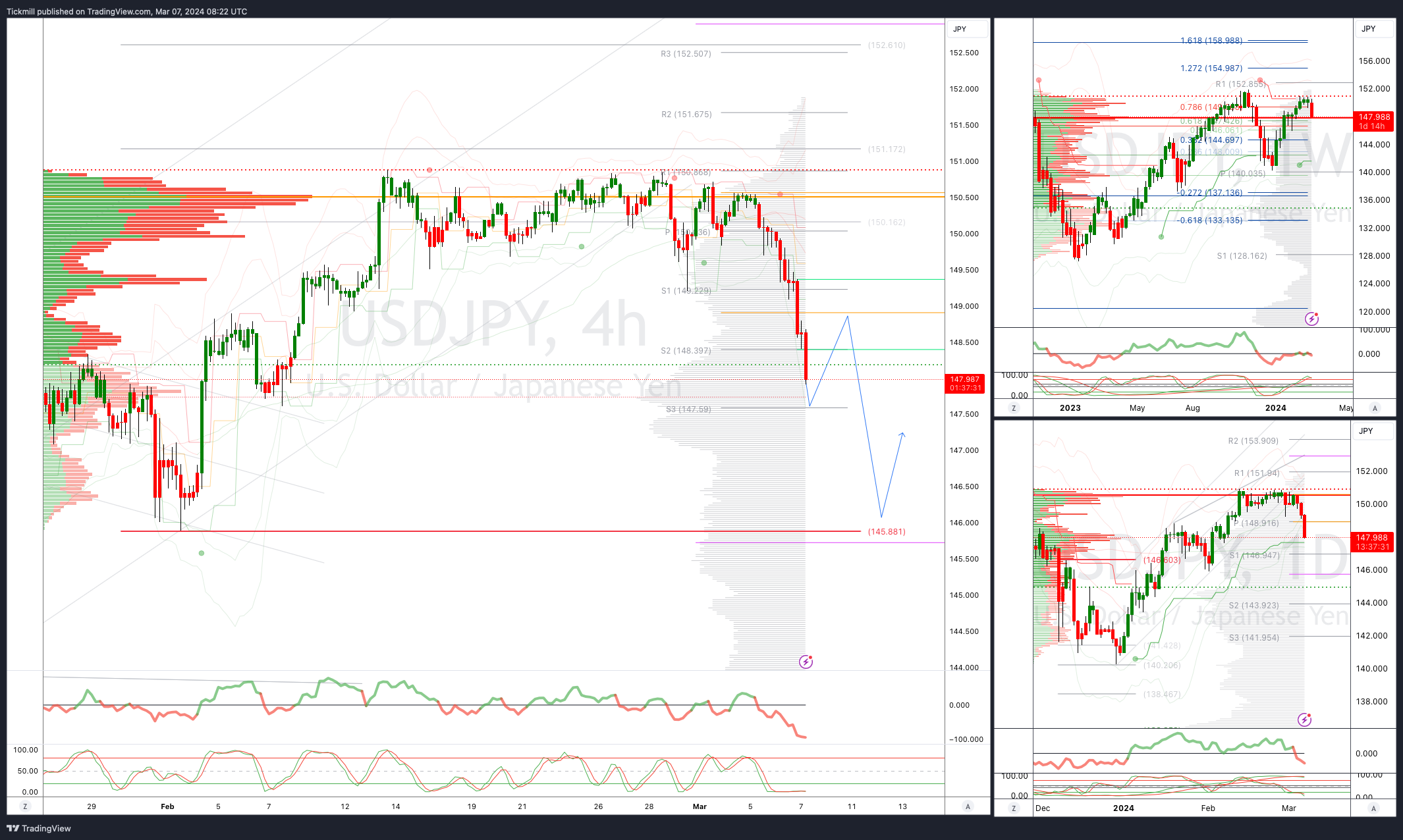

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bearish

Below 147.50 opens 145.88

Primary support 145.85

Primary objective is 152

AUDUSD Bullish Above Bearish Below .6540

Daily VWAP bullish

Weekly VWAP bullish

Above .6628 opens .6640

Primary support .6400

Primary objective is .6700

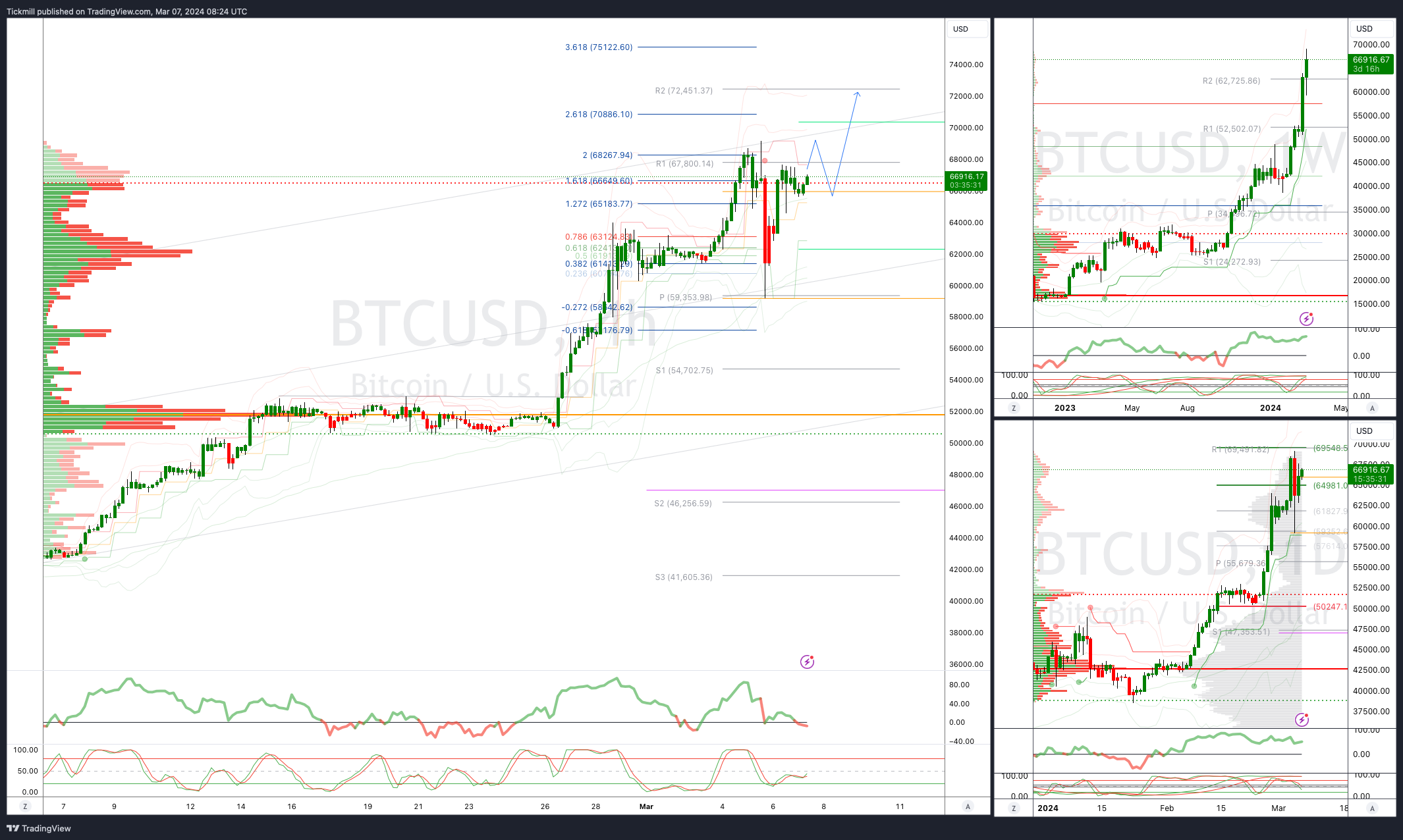

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 52800

Primary objective is 72000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!