Daily Market Outlook, March 4, 2024

Munnelly’s Market Minute…

“China Sentiment Supported By Congress Hopes”

Asian Equities and European stock futures are on the rise, echoing last week's strong performance on Wall Street. Expectations of potential stimulus measures from Chinese authorities at the 14th National People’s Congress contribute to positive sentiment. The annual session of the National People’s Congress begins, focusing on government proposals to support the economy, including setting a potentially challenging growth target for 2024, possibly unchanged from 5% in 2023. Oil prices have surged following OPEC+'s decision to extend production cuts by about 2 million barrels a day until the end of June.

In global markets this week, attention will be focused on the US monthly jobs report on Friday and Fed Chair Powell’s semi-annual testimony to Congress on Wednesday and Thursday. Recent adjustments in financial markets indicate a reduction in US monetary policy easing expectations, with projections now suggesting three rate cuts in 2024. This shift reflects signs of resilient economic growth and easing inflation trends. Powell is expected to align with current market expectations without significantly altering them.

In the UK, Chancellor Hunt's Spring Budget on Wednesday represents a pivotal event before the general election. Despite increased fiscal headroom of around £25bn compared to £13bn estimated in November, limited scope for fiscal handouts may exist due to pressure to increase public spending. However, the Budget presents a crucial opportunity for the Conservatives to narrow the polling gap with Labour.

Today's data docket features the Eurozone Sentix investor confidence survey for March as the sole data release. ECB’s Holzmann and the Fed’s Harker are scheduled to deliver speeches. Overnight, the BRC UK retail sales monitor will offer insights into retail activity amid challenging weather conditions in February.

Overnight Newswire Updates of Note

OPEC+ Members Extend Production Cuts In Bid To Boost Oil Price

US Funding Bill Blocks China From Buying Oil From SPR

Hunt Announces UK Manufacturing Funding In Budget Growth Push

Japan Govt Mulls Declaring Official End To Deflation

Fund Managers Downplay RBA Risks To Pile On Aussie Short Bets

Economy Set To Lead Agenda For China’s Top Political Advisory Body

Japan Corporate Capital Spending Jumps 16.4% In Q4

Bitcoin Breaches $64,000 Briefly As ETF Demand Lures Traders

Japan’s Nikkei 225 Breaches Key 40,000 Level For First Time

BofA’s Subramanian Is Latest On Wall Street To Boost S&P 500 Target

Apple Cut From Goldman’s Conviction List As Shares Underperform

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0865 (EU1.6b), 1.0800 (EU1.31b), 1.0850 (EU759m)

USD/JPY: 148.30 ($954.5m), 150.35 ($903.2m), 149.00 ($831m)

AUD/USD: 0.5855 (AUD780m), 0.6400 (AUD352.7m), 0.6370 (AUD300m)

USD/CAD: 1.3195 ($1.03b), 1.3310 ($706.8m), 1.3410 ($532m)

USD/CNY: 7.2500 ($758.4m), 7.4400 ($719.4m), 7.1000 ($302m)

GBP/USD: 1.1150 (GBP500m), 1.2500 (GBP406.8m)

CFTC Data As Of 20/02/24

Euro net long position is 62,854 contracts

Japanese yen net short position is -132,705 contracts

Swiss franc posts net short position of -11,981 contracts

British pound net long position is 46,358 contracts

Bitcoin net short position is -1,967 contracts

Equity fund managers cut S&P 500 CME net long position by 5,157 contracts to 942,123

Equity fund speculators increase S&P 500 CME net short position by 14,679 contracts to 434,512

Technical & Trade Views

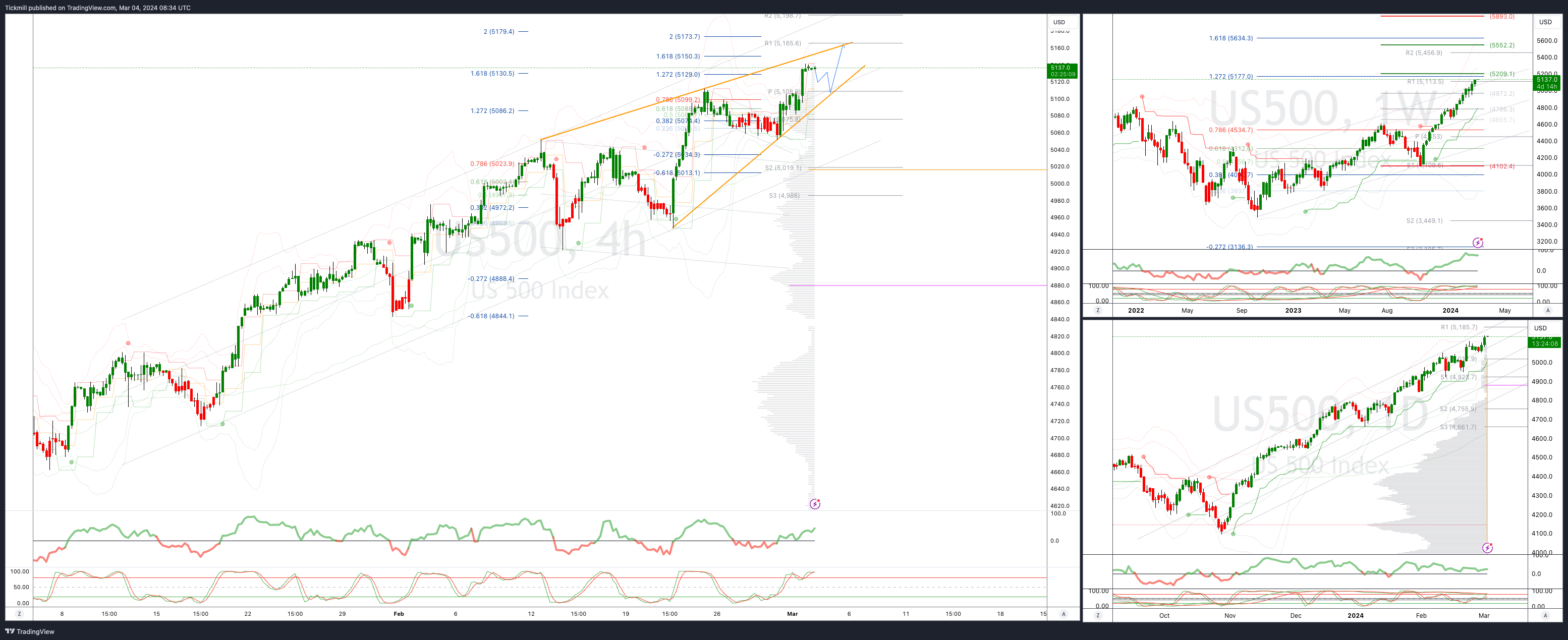

SP500 Bullish Above Bearish Below 5110

Daily VWAP bullish

Weekly VWAP bullish

Below 5030 opens 5000

Primary support 5050

Primary objective is 5165

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.095

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bullish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

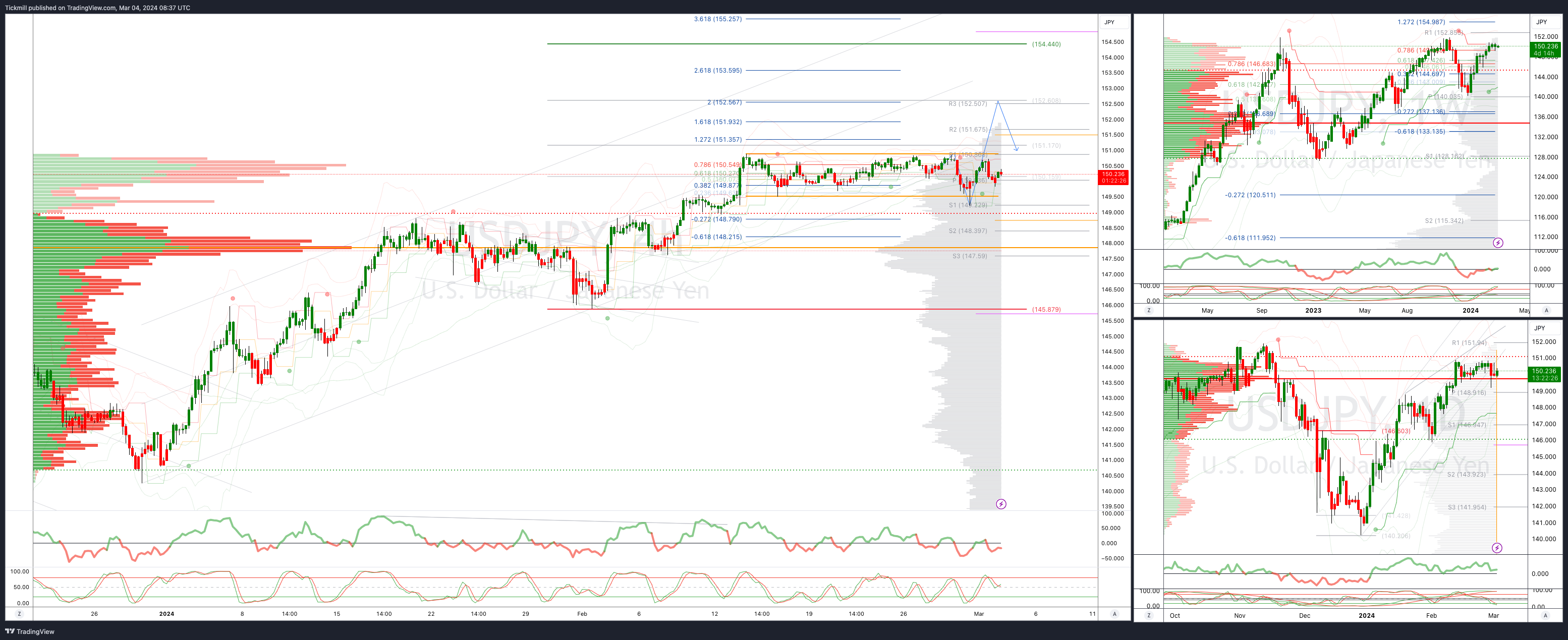

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

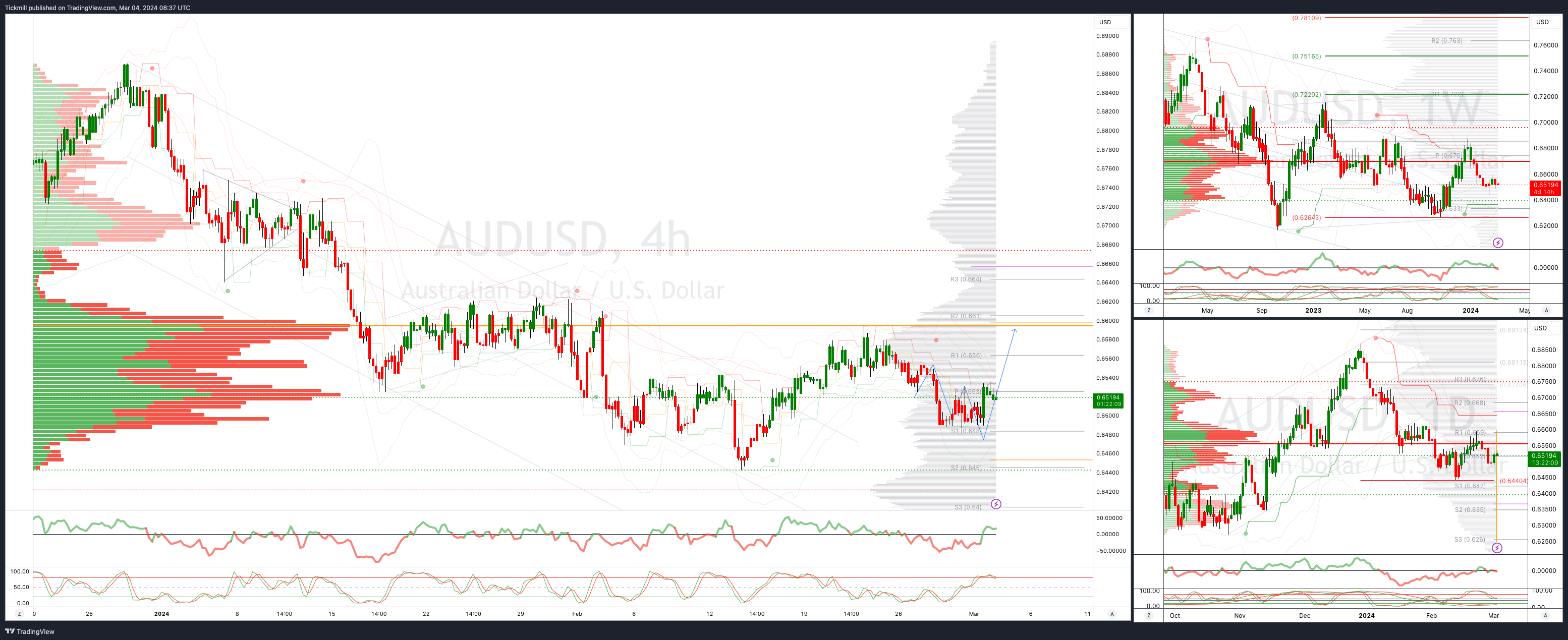

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6440

Primary support .6440

Primary objective is .6700

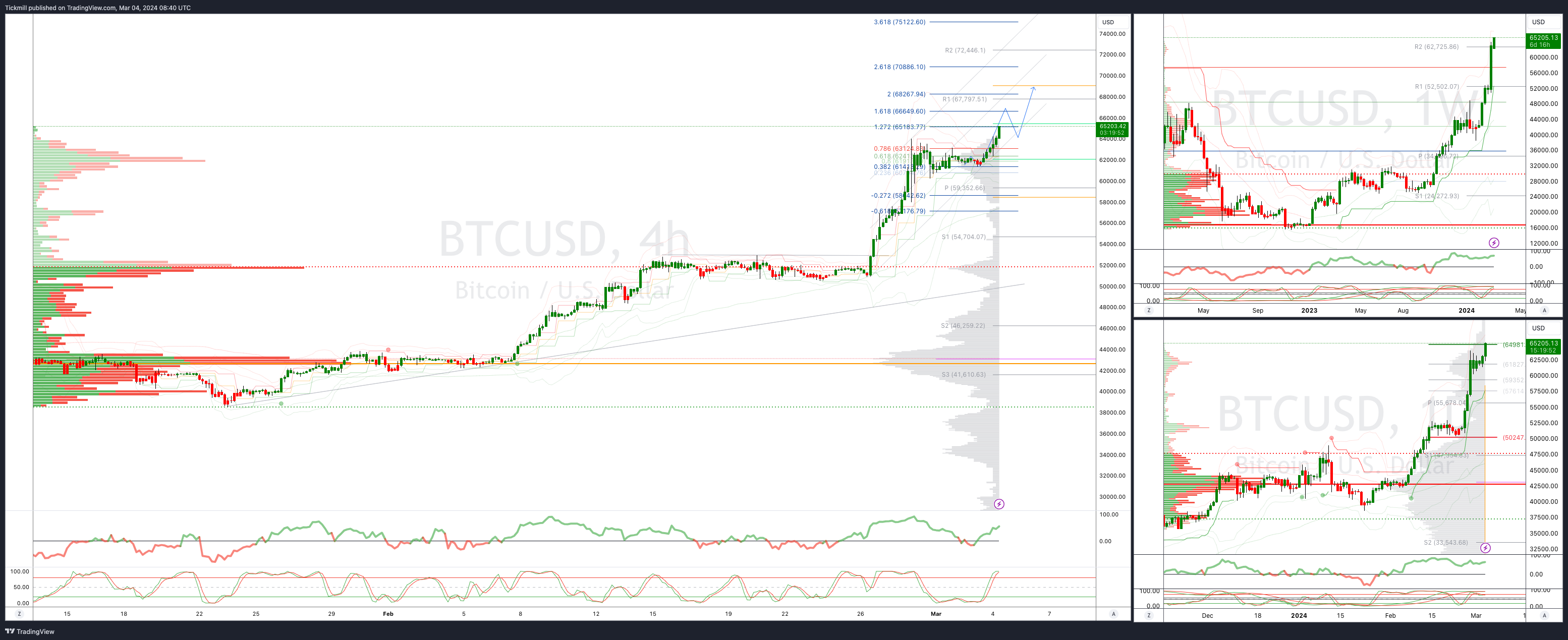

BTCUSD Bullish Above Bearish below 58400

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 50000

Primary objective is 66000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!