Daily Market Outlook, March 30, 2021

Daily Market Outlook, March 30, 2021

Asian equity markets are mixed, as Treasury yields climbed and markets take note of the progress in the US vaccine deployment with President Biden indicating that 90% of adults will be inoculated by 19 April. Investors are also assessing an expected announcement of a major US infrastructure plan on Wednesday. In the UK, PM Johnson said he is ‘hopeful’ that another lockdown will not be necessary and that the roadmap out of lockdown remains on schedule, including next month’s reopening of non-essential retail.

The Lloyds Business Barometer, released this morning, showed UK business confidence in March at 15, the highest level for over a year. Staffing levels also turned positive for the first time since March 2020. The results reflect progress in the vaccine rollout, the government’s roadmap out of lockdown and extended support in the Budget.

Early tomorrow morning (7am), the UK Q4 GDP report is a second estimate that is not expected to be revised from the initial reading of a 1.0% rise. However, it will provide further information on household finances and, in particular, the savings rate. This has climbed sharply during the pandemic primarily due to forced saving driven by a lack of spending opportunities. It points to the possibility of strong pent-up consumer demand that will likely be released later this year.

German state CPIs through the morning and the preliminary national estimate at 1pm will provide more clarity on how big the jump in Eurozone March inflation (due on Wednesday) is likely to be. French numbers are also due tomorrow morning. Look for Eurozone headline CPI to accelerate to 1.5% from 0.9%, driven by energy prices.

Eurozone economic confidence surveys for March are also out this morning. The flash consumer confidence was already released last week and was stronger than expected, rising to a 13-month high of -10.8. Look for improvements too in industrial confidence and services confidence, and for the overall economic sentiment index to increase to 96.0. Nevertheless, the ECB is stepping up its bond purchases to counter a potentially tightening of financial conditions.

In the US, the Conference Board measure of consumer confidence is expected to rise for a third consecutive month. Look for an increase to 96.0 from 91.3, supported by fiscal stimulus measures and an improving labour market. Markets will also focus on China PMIs which will be released early tomorrow morning and are predicted to improve.

CitiFX Quant Month End Flows

We are publishing this unscheduled update of month-end FX hedge rebalancing flows because the signal has changed to a moderate USD sell.

· Based on 24 March asset index closes we had previously estimated roughly balanced USD rebalancing needs. The MSCI US equity index has gained 2.12% since then, out-performing most other major markets. This has tilted the estimated net USD rebalancing flow towards a sell as foreign investors need to hedge gains in US equities. The strength of this month’s signal is below the historical norm, measuring 0.4 standard deviations on average.

· A combination of strong Japanese asset performance and our assumption of low hedge ratios employed by Japanese investors gives a sell-signal for JPY, almost entirely driven by foreigners’ needs to hedge gains in Japanese assets.

· The discrepancy between the JPY sell and buy-signals for other currencies suggests that EURJPY, GBPJPY and other JPY crosses may also move higher ahead of this month-end.

· There are no major data releases scheduled ahead of the month-end fix.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

Larger Option Pipeline

EUR/USD: Mar31 $1.1770-75(E1.0bln), $1.1800(E1.2bln), $1.1850(E1.2bln-EUR puts), $1.1900(E1.8bln), $1.1920-25(E1.7bln), $1.1945-56(E1.3bln), $1.2000(E1.0bln); Apr01 $1.1850(E1.1bln-EUR puts)

USD/JPY: Apr01 Y106.80-85($1.6bln-USD puts)

GBP/USD: Mar31 $1.3800(Gbp921mln-GBP puts)

EUR/GBP: Mar31 Gbp0.8515-25(E925mln-EUR puts), Gbp0.8540-50(E1.0bln-EUR puts), Gbp0.8600(E1.26bln)

AUD/USD: Mar30 $0.7960(A$1.1bln); Mar31 $0.7500(A$1.3bln), $0.7680-00(A$1.6bln), $0.7750-60(A$1.8bln), $0.7770-80(A$1.3bln), $0.7790-0.7800(A$1.1bln)

USD/CAD: Apr01 C$1.2450($1.5bln), C$1.2600-10($1.25bln-USD puts), C$1.2660-75($1.2bln)

USD/CNY: Apr02 Cny6.58($1.2bln)

USD/TRY: Apr06 Try6.60($916mln)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 bearish below

EURUSD From a technical and trading perspective, the failure to recapture 1.20 on the upside leaves the 1.1830 lows exposed, through here bears will press for a test of the yearly pivot at 1.1720.

Flow reports suggest light offers through the 1.1800 area with weak stops on a move through the 1.1820 area with limit with light offers then running through the 1.1840-60 area before stronger offers start to appear on a test through the 1.1880 level and stronger through the 1.1900 area. Downside bids into the 1.1740-50 area and then increasing on a dip through the 1.1720-1.1680 level with congestion through to the 1.1600 area.

GBPUSD Bias: Bullish above 1.3750 bearish below

GBPUSD From a technical and trading perspective, the loss of 1.3750 is a significant development opening a move to test a corrective equality objective 1.3550, only a close back through 1.39 would suggest the correction lower is complete.

Flow reports suggest downside congestion around the 1.3660-40 area with stronger bids on any push towards the 1.3600 level and weak stops likely on a dip through opening to a deeper move, Topside offers through light through to the 1.3800 level with congestion through to the 1.3850 area before opening up to light offers and weak stops through the 1.3900 level and then stronger congestion

USDJPY Bias: Bullish above 107.30 targeting 109.85

USDJPY From a technical and trading perspective, as 108.30 continues to attract demand bulls will target a test of pivotal 109.85 ahead of the yearly R1 pivot at 110. UPDATE...upside objective achieved look for any initial foray through 110 to prompt a profit taking pullback to retest bids to 108.50

Flow reports suggest topside congestion is likely to soak up some of the weak stops above the 110.00 and like the previous spikes at the beginning of last year any move is likely to find resistance above and continuing through the 110.20 with break out stops likely to be a little more nervous, downside bids light through to the 108.00 level with weak stops on any retrace through the 107.80 level and opening a dip to the 106.00 area possible over the coming week

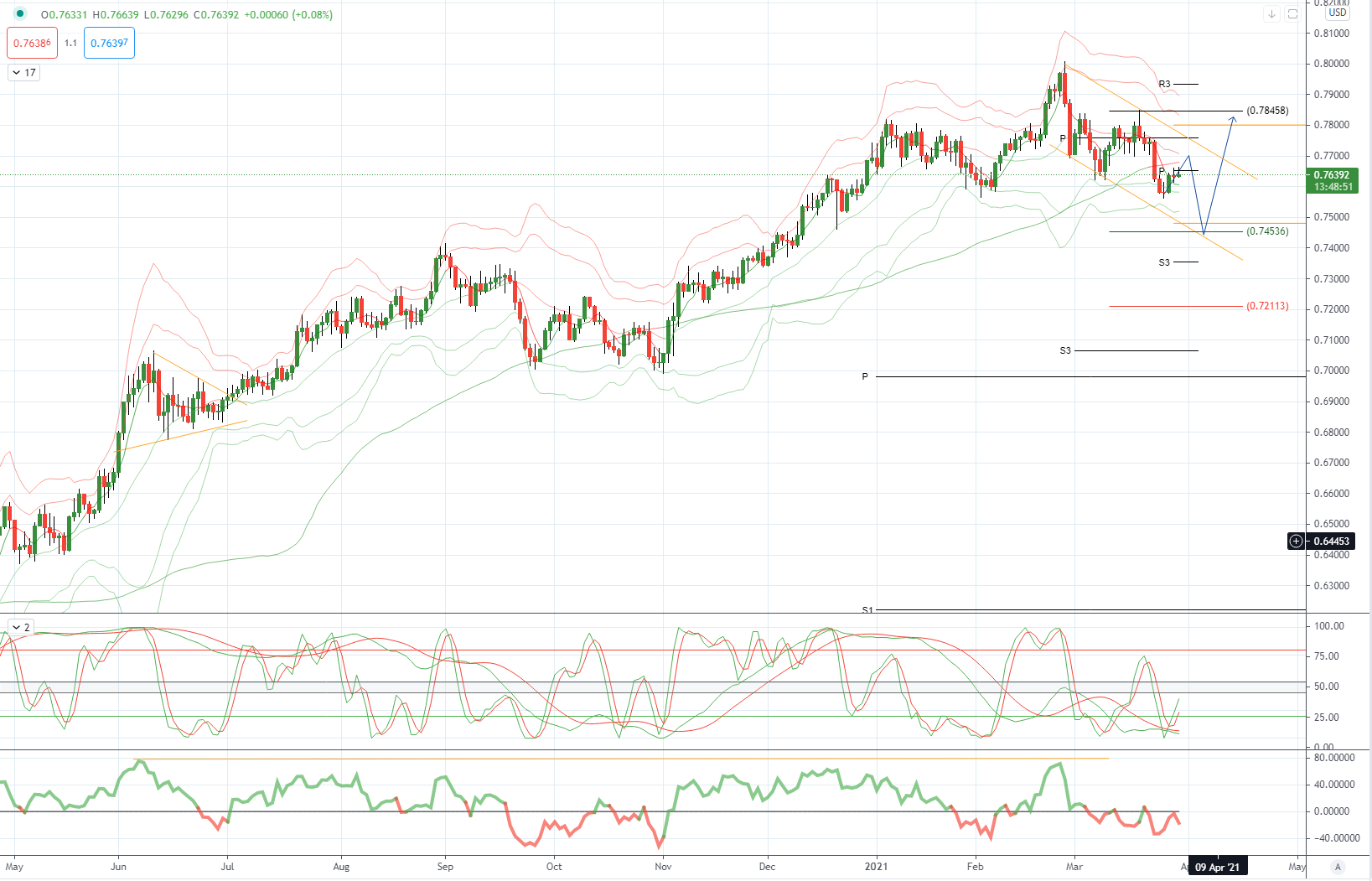

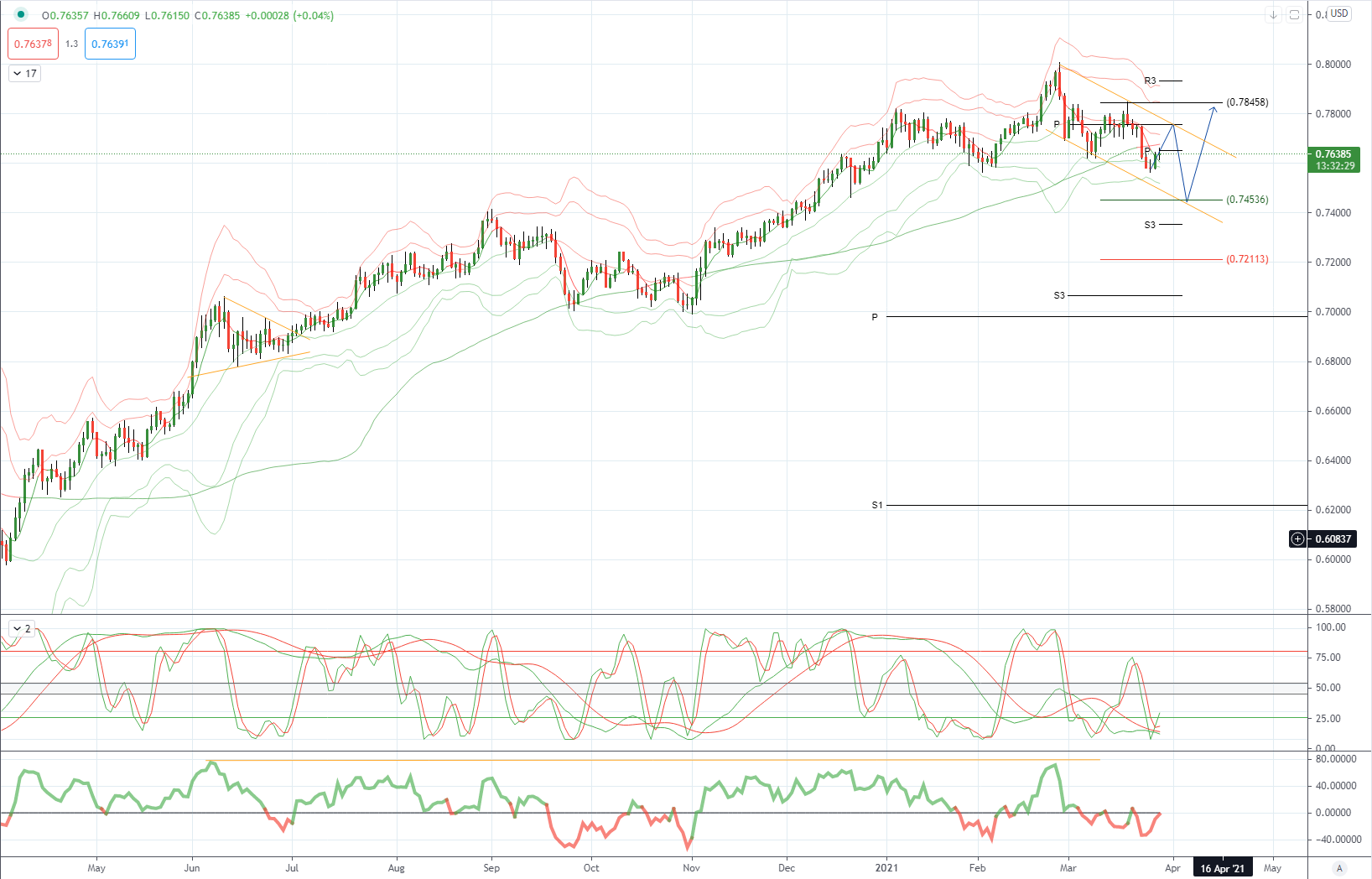

AUDUSD Bias: Bullish above .7560 bullish targeting .8200

AUDUSD From a technical and trading perspective, as .7820 contains upside attempts there is potential for a head & shoulders pattern to develop, a loss of pivotal .7560 would open a move to test trend support at .7400 next

Flow reports suggest light topside offers through to the 0.7700 area with weak stops on a move above the 0.7720 area Then stronger offers through to the 0.7840-60 area and then increasing offers onwards through 0.7900, with the offers likely to continue through to the 0.7950 area and likely increasing resistance through to the 0.8000 levels, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!