Daily Market Outlook, March 28, 2022

.png)

Daily Market Outlook, March 28, 2022

Overnight Headlines

- Ukraine Willing To Be Neutral, Says Russia Wants To Split Nation

- Kyiv: In-Person Talks To Resume In Turkey Between 28th, 30th

- Putin Stokes Nuclear Fears With Atomic Weapons Warnings

- Shanghai Imposes Staggered Lockdowns To Keep Coronavirus At Bay

- China Industrial Profit Up But Mired In Single-Digit Growth

- Fed’s Best Hope Increasingly Looks Like A ‘Semi-Hard’ Landing

- Biden To Propose New Minimum Tax On Wealthiest Americans

- ECB's President Lagarde: Does Not See Risk Of Stagflation

- Hot UK Inflation Spurs Biggest Bets On Rate Cuts In 15 Years

- Yen Tumbles As BoJ Intervenes To Keep Bond Yields Pinned Down

- JGB 10Y Yield Hits 0.25%, Upper Limit Of BoJ's Yield Curve Control Policy

- Treasury 5-To-30 Year Yield Curve Inverts First Time Since 2006

- Oil Slumps As Shanghai Lockdown Raises Fears Over Drop In Demand

- Nuclear Deal With Iran Is Not Imminent Or Inevitable, US Official Warns

- US Companies Buy Back Shares In Record, $319B Auth’d This Year

- China Stocks Slide As Shanghai Lockdown Deepens Growth Concerns

The Week Ahead

- In a busy week for key global economic data, the U.S. jobs report for March, due on Friday, could impact growing expectations of a large Federal Reserve rate hike at the next policy meeting.

- The market is currently pricing in a 68% chance of a 50-basis-point hike in May. The Reuters poll forecast is for a 475,000 rise in non-farm payrolls, unemployment to ease to 3.7% from 3.8% and average hourly earnings to rise 0.4% month-on-month. Other U.S. data includes ADP jobs, final Q4 GDP, ISM manufacturing PMI, consumer confidence, home prices, and the Fed's favoured inflation gauge, the core PCE price index.

- The main data event for Europe will be flash euro zone March CPI; the poll forecast is for a 6.5% year-on-year rise after 5.9% in February. Other EZ data includes consumer confidence, industrial sentiment, unemployment and German retail sales. UK data includes Q4 GDP and current account.

- Japan's calendar is packed, with industrial production, employment, retail sales, final manufacturing PMI and the closely watched Tankan survey. Housing starts and construction orders are also due.

- China will release official manufacturing and non-manufacturing PMI for March along with the Caixin manufacturing PMI.

- Australia will be releasing retail sales and building approvals. New Zealand has no top-tier data scheduled, while Canada has January GDP.

The Day Ahead

- Equities are trading mostly lower across the Asia Pacific as concerns around the impact of high inflation and tightening monetary policy weigh on sentiment. Across China, stocks have also dipped in response to news that Shanghai will enter a staggered eight-day lockdown period, with half of the city going into lockdown over the next four days, followed by the other half for the latter four days. Ahead of the resumption of negotiation talks between Ukraine and Russia later this week, the US White House has continued its efforts of tempering comments made by the US President, insisting that the US wasn’t seeking a regime change in Russia.

- The war in Ukraine continues to cast a shadow over the global economy, particularly with the impact of rising prices – particularly for energy items – raising concerns over the outlook for consumer spending across major economies. Last week’s UK inflation print showed the annual CPI moved up to 6.2% in February, with further increases expected as the impact of higher energy prices feed through. At last week’s Spring Statement, the UK Chancellor Rishi Sunak sought to offset some of the rise in the cost-of-living squeeze by announcing a number of measures. However, even with these accounted for, the Office for Budget Responsibility (OBR) said that real incomes this year were still likely to drop at their sharpest pace since the 1950s.

- Later today, Mr Sunak will be questioned by the Treasury Committee over his Spring Statement, with the focus likely to be on whether he could have done more. The OBR’s latest Economic and Fiscal Outlook also predicted that cumulative borrowing over the forecast horizon would be lower compared with previous projections from last October. That suggests that the Chancellor has banked a large part of the fiscal improvement in the public finances from the current fiscal year (2021/22) and points to some ‘headroom’ for further giveaways in the future.

- Elsewhere, the Bank of England Governor, Andrew Bailey, is due to speak at an event in Brussels hosted by the European think tank, Bruegel. With interest rate markets expecting a sharper increase in Bank Rate this year relative to economists’ expectations, any clarity on the policy outlook could see some narrowing in this gap. On the data front, today’s focus is limited to the US trade balance for February and the Dallas Fed manufacturing survey for March.

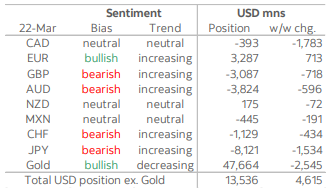

CFTC Data

- This week’s snapshot of FX positioning and sentiment among speculative investors revealed a further improvement in broader bullish sentiment, building on the rebound that emerged in last week’s data. The aggregate USD longs rose by USD4.6bn in the week to USD13.5bn, the highest since early January.

- The biggest week over week change in positioning was reflected in net CAD positioning where speculators slashed the net CAD long that the market it had been nursing over the past few weeks by USD1.8bn, even as the CAD was in the midst of one of its best rallies in a number of years. Gross CAD longs were cut sharply again in the past week while gross shorts edged fractionally higher. The CAD long liquidation was the largest, single-currency shift in positioning in this week’s CFTC data.

- Investors took a generally dim view of commodity currencies; net AUD shorts advanced nearly USD600mn this week and while net NZD longs were cut USD72mn, overall positioning in the Kiwi remains very light. Net MXN shorts were lifted USD191mn. Equally, however, haven currencies were also under pressure; net CHF shorts were boosted by USD434mn while net JPY shorts rose USD1.5bn to total USD8.1bn sizable but just the biggest bear bet on the JPY since mid-January.

- Bearish bets on the GBP rose USD718mn to just over USD3bn, as gross shorting activity increased. Investors were, however, more constructive on the EUR last week,a view that has probably been tested by this week’s price action and boosted net longs by just over USD700mn to USD3.3bn

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.1000 (584M)

- USD/JPY: 120.50 (295M), 120.70 (354M)

- GBP/USD: 1.3300 (220M), 1.3425 (210M)

- USD/CAD: 1.2545-55 (1.0BLN), 1.2650 (336M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.12 Bullish above

- EUR/USD opened 1.0985 after closing Friday -0.15% at 1.0981

- After a quiet start, USD started moving higher due to USD/JPY demand

- EUR/USD steadily sold off and broke below support at 1.0960/65 to 1.0951

- Heading into the afternoon it is settling around 1.0955

- The next level of support is the 61.8 of 1.0806/1.1137 move at 1.0932

- Resistance I at 1.1011 where the 10 & 21-day MAs converge

- Sentient is bearish due to diverging central bank expectations

GBPUSD Bias: Bearish below 1.3350 Bullish above.

- 0.2%, as continued yen weakness on yield spreads led USD north

- UST yields climbed 2yr +6bp to 2.345%, oil fell - Brent -2.3%

- Cable traded in a 1.3146-1.3179 range with solid interest all day in Asia

- Broad based market volatility likely to continue into quarter end

- Charts; momentum studies - 5, 10 & 21 daily moving averages conflict

- 21 day Bollinger bands contract - mixed signals favour range trading

- 1.3000 March and 2022 low, 1.3322 50% of Feb-Mar fall range parameters

- Last week's 1.3120 low and Asia's 1.3179 high initial support and resistance

USDJPY Bias: Bullish above 116 Bearish below

- Afternoon Asia trade sees USD/JPY tad higher to 123.26 EBS

- USD/JPY low early Asia 122.00, option barriers at 122.50, 123.00 taken out

- Specs now eyeing presumed option barriers at 123.50

- Market still very overbought but the risk to remain up to at least 125?

- "Kuroda ceiling" in 125-area, highs seen between May-August 2015

- Bidding interest likely on dips now towards 122.50 if not 123.00

- Japanese importers still have plenty of buying to do going forward

- Firm US yields supportive, Tsy 10s to new 2.557% high, now @2.513%

AUDUSD Bias: Bullish above .7100 Bearish below

- AUD/USD opened 0.7505 after closing unchanged at 0.7514 on Friday

- After trading at 0.7500 the AUD/USD slowly tracked higher

- Once again it was AUD/JPY buying that underpinned AUD/USD

- AUD/JPY was up over 0.70% in Asia after rising over 3% last week

- AUD/USD traded to 0.7524 before settling around 0.7520

- Resistance is at the Oct 29 high at 0.7555

- Support is Friday's 0.7495 low and former resistance at 0.7440

- AUD/USD trending higher with 5, 10 & 21-day MAs in a bullish alignment

- Only a break below 10-day MA at 0.7418 would suggest top is forming

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!