Daily Market Outlook, March 22, 2021

Daily Market Outlook, March 22, 2021

Equities across the Asia Pacific were mostly trading lower overnight, amid a modest decline in risk sentiment. This follows the firing of Turkey’s central bank chief by President Erdogan, in response to last week’s larger-than-expected interest rate hike. At one point, the Turkish Lira had dropped by more than 15%, boosting demand for safe haven currencies. Closer to home, EU officials suggested that future exports of the AstraZeneca vaccine to the UK might be blocked until the drug maker has fulfilled its delivery obligations to the bloc. This comes amid encouraging figures from the UK over the weekend, which showed that more than half of the adult population had now received their first vaccination.

Amid the modest easing in risk sentiment, US Treasury yields have moved away from the recent highs reached last week, but are still elevated. This followed signals from policymakers at the Fed (and the BoE) that they are largely comfortable with the rise in bond yields in recent months because they reflect greater optimism about an economic recovery rather than an undue tightening of financial conditions.

In contrast, the ECB has stepped up the pace of asset purchases to contain bond yield rises. The release of the latest weekly data on bond holdings by the ECB later today will be closely watched following its commitment to buying at a “significantly higher pace”. The difference in approach between the ECB and the US & UK reflects the relative risks to the economic outlook, which in turn relate to trends in Covid infections, the speed of the vaccination rollout and also fiscal stimulus measures.

Covid cases are rising in Germany and France resulting in stricter or extended containment measures, while the vaccine deployment has been much slower than in the UK and the US. In the absence of any major data release today, comments from a number of central bank speakers may add further colour to the debate around these dynamics. The data focus is limited to the US existing home sales report for February. Poor weather is expected to have depressed activity last month, with sales of existing homes expected to be down 2.5%. However, regional data – particularly across those areas less affected by the bad weather – may show more buoyant trends.

Meanwhile, early tomorrow morning, expect the latest UK labour market report to show that the unemployment rate remained steady at 5.1% in January, although employment is predicted to have fallen by 215k in the latest three months. The Office for Budget Responsibility expects the unemployment rate to peak at 6.5%, lower than previously predicted, following the extension of the furlough scheme to the end of September.

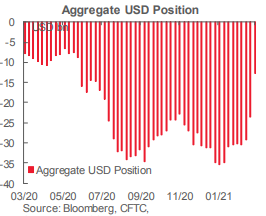

CFTC Data

After a period of relatively dry CFTC reports, this week’s data showed some very significant shifts in positioning and sentiment. The aggregate USD short position, reflected in the overall positioning in currencies covered in the report, plunged nearly USD11bn this week to USD12.7bn, nearly halving last week’s total. This is the smallest aggregate USD short position since June. Speculative accounts continue to pare back net EUR shorts but, for once, that was not the whole story.

Last week’s data showed speculative accounts slashing net JPY longs aggressively; this week's data showed the accumulation of a large net JPY short (USD4.5bn—a USD5.3bn swing over the week). The net short (equivalent of nearly 40k contracts) is the biggest net JPY short position seen in these data in around a year. But the swing over the week is the biggest 1- week change in positioning against the JPY in 10 years. Data show no gross JPY long exposure at all this week—which is highly unusual.

Net EUR shorts were cut back by a fairly sizeable USD1.8bn in the week while net CHF longs were pared USD1.3bn; GBP longs were reduced by USD461mn, to further boost overall USD short-covering. The commodity currencies continue to generate little, significant interest. Net CAD longs were little changed on the week at USD824mn in total. Net NZD longs were cut USD1.2bn (more USD short-covering) to take the overall market risk here to zero. Net AUD longs remain modest (USD590mn) and were also very little changed on the week. Net MXN positioning tilted away from neutral somewhat on the week as speculators moved exposure (USD715mn) to the short side from flat. Net gold longs rose USD1.1bn to USD31.2bn

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

Larger Option Pipeline

USD/JPY: Mar23 Y107.95-108.00($2.3bln), Y108.12($1.8bln)

AUD/NZD: Mar23 N$1.0785-90(A$1.7bln)

NZD/USD: Mar22 $0.7080(N$1.1bln), $0.7400(N$1.0bln)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 bearish below

EURUSD From a technical and trading perspective, the failure to recapture 1.20 on the upside leaves the 1.1830 lows exposed, through here bears will press for a test of the yearly pivot at 1.1720. Only a move back through 1.20 would reduce downside pressure opening a test of the monthly pivot from below at 1.2085

Flow reports suggest topside offers weak through to the 1.1940-60 area with stronger offers then increasing through to the 1.2000 level with weak stops through the level and stronger offers into the 1.2050 level. downside bids light through to the 1.1800 area with weak stops through the 1.1780 level before stronger bids appear through the 1.1750 level and increase on a test into the 1.1720 level.

GBPUSD Bias: Bullish above 1.3750 targeting 1.44

GBPUSD From a technical and trading perspective,a retest of 1.3750 pivotal trend support has seen fresh demand develop as this level continues to attract support bulls will target a retest of cycle highs en route to 1.44 upside objective.

Flow reports suggest downside bids into the 1.3800 level with weak stops likely on a dip through the 1.3780-40 levels with congestion likely to soak up much of the selling through to the 1.3700 level with possibly strong congestion then around the 1.3700 level increasing into the 1.3650 level before being able to make a move to the 1.3600 area and strong bids again. Topside light through the 1.3900 level with minimum stops and the market then seeing offers through the 1.3950 area and increasing into the 1.4000 level with stronger stops through the level and increasing offers from 1.4050-1.4100 level.

USDJPY Bias: Bullish above 107.30 targeting 109.85

USDJPY From a technical and trading perspective, as 108.30 continues to attract demand bulls will target a test of pivotal 109.85 ahead of the yearly R1 pivot at 110.

Flow reports suggest topside congestion is likely to soak up some of the weak stops above through to the 109.50 area where strong congestion is likely to appear and increasing offers into the 110.00 and like the previous spikes at the beginning of last year any move is likely to find resistance above and continuing through the 110.00 with break out stops likely to be a little more nervous, downside bids light through to the 108.00 level with weak stops on any retrace through the 107.80 level and opening a dip to the 106.00 area possible over the coming week

AUDUSD Bias: Bullish above .7560 bullish targeting .8200

AUDUSD From a technical and trading perspective, as /7820 contains upside attempts there is potential for a head & shoulders pattern to develop, a loss of pivotal .7560 would open a move to test trend support at .7400 next

Flow reports suggest topside offers through to the 0.7840-60 area and then increasing offers onwards through 0.7900, with the offers likely to continue through to the 0.7950 area and likely increasing resistance through to the 0.8000 levels, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!