Daily Market Outlook, June 21, 2022

Daily Market Outlook, June 21, 2022

Overnight Headlines

- Fed's Bullard (2022 voter) expects economic expansion to continue this year and that the Fed must meet market expectations for rate hikes

- EU member states to formally grant Ukraine candidate status later this week

- U.S. Treasury Sec Yellen says gasoline tax holiday worth considering as anti-inflation tool

- U.S. Treasury Sec Yellen in talks with allies on Russian oil price cap

- Japan PM Kishida comments monetary policy must be considered holistically

- Japan FinMin Suzuki says wiill respond to FX moves appropriately if necessary

- Australia RBA fllags more rate rises, 75 bp moves unlikely, to stick to 25-50 bps

- RBA concedes yield target exit was disorderly, damaging

- APAC stocks gained across the board broadly constructive global risk tone

- European equity futures are indicative of a higher open Eurostoxx 50 +0.6%

- Crude futures continued to nurse some of Friday's heavy losses

- Bitcoin makes gains with price action relatively stable around the 21000 level

The Day Ahead

- Asian equity markets are mostly up this morning, but Chinese indices are lagging following reports of Covid outbreaks in Macau and Shenzhen. Following a meeting with former US Treasury Secretary Summers, US President Biden said a US recession was not inevitable. However, Summers warned of a significant chance of stagflation. The EU and China are reported to be planning high-level talks on the economy and climate change. Australian central bank head Lowe confirmed that Aussie inflation is expected to peak at about 7% in Q4. He said he will do what’s needed to return inflation to the 2-3% target but that market interest rate expectations are excessive.

- Today’s data calendar is light. However, the monthly CBI industrial survey will provide an indication of recent trends in the factory sector. The May reading for this survey painted a more upbeat picture of demand conditions than its PMI equivalent as it saw both overall orders and export orders at their highest levels of the year. However, less positively it also showed inflationary pressures still very elevated. Today’s June reading comes two days ahead of Thursday’s PMI results for the same month.

- Overall readings on US economic activity remain mixed enough for it to be unclear whether growth is as yet slowing significantly in response to higher interest rates. However, one sector that certainly seems to be showing an impact is housing as both construction and sales seem to have rolled over. Existing home sales, for example, have fell in four out of the last five months up to April and markets expect another sizeable decline occurred in May.

- Possibly of most interest amongst today’s central bank speakers will be the first of two speeches this week by Bank of England Chief Economist Pill. In an interview last week following the BoE’s 0.25% interest rate rise he seemed to drop hints that he might favour a larger hike in August. So today’s comments will be watched for any further indications.

- UK CPI data for May, due early Wednesday, will provide further evidence on the extent of near-term inflationary pressures. Expect annual headline inflation to remain at 9% reflecting a further pickup in petrol and food prices offset by some easing in ‘core’ inflation. The detail of the change in ‘core’ prices will probably be of particular interest to the BoE as it looks for signs of whether inflationary pressures are broadening out or not. There may be indications of this in in services price inflation, which markets forecast to have risen again, but expect that to be offset by a deceleration in goods price inflation.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0470-80 (824M), 1.0495-00 (340M)

- 1.0560-65 (320M), 1.0575-85 (1.0BLN), 1.0650 (470M)

- USD/JPY: 134.00 (1.35BLN), 134.40-50 (685M),

- GBP/USD: 1.2350(229M). EUR/GBP: 0.8440-50 (340M)

- AUD/USD: 0.6850-60 (720M), 0.6895-00 (540M)

- 0.7000 (1.2BLN), 0.7010-15 (727M), 0.7025 (330M)

- 0.7070 (402M). NZD/USD: 0.6500 (369M)

- USD/CHF: 0.9715-20 (310M). EUR/CHF: 1.0100 (347M)

- 1.0250 (895M), 1.0270-75 (330M). AUD/JPY 95.00 (609M)

- USD/CAD: 1.2925-30 (317M)

Technical & Trade Views

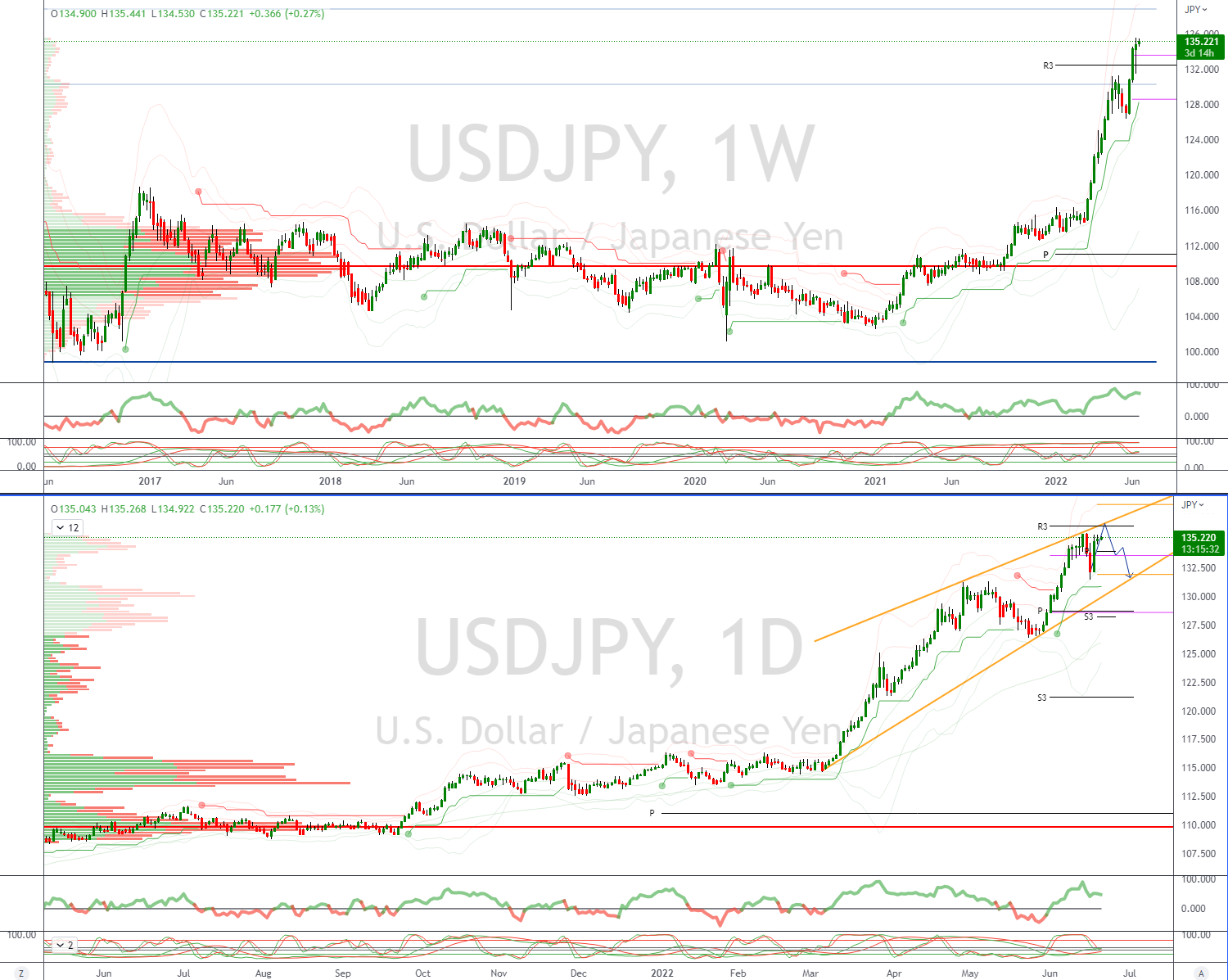

EURUSD Bias: Bearish below 1.07 Bullish above

- EURUSD is trading at highs above 1.0540’s as London traders join the session

- USD remains offered in a quiet session with US public holidays yesterday

- ECB Lagarde wiill stick to rate-hike plans, must nip fragmentation risk in the bud

- Initial offers are seen at 1.0560 ahead 1.0615

- Bids eyed towards 1.0450 ahead of cycle lows

- Daily VWAP is bearish

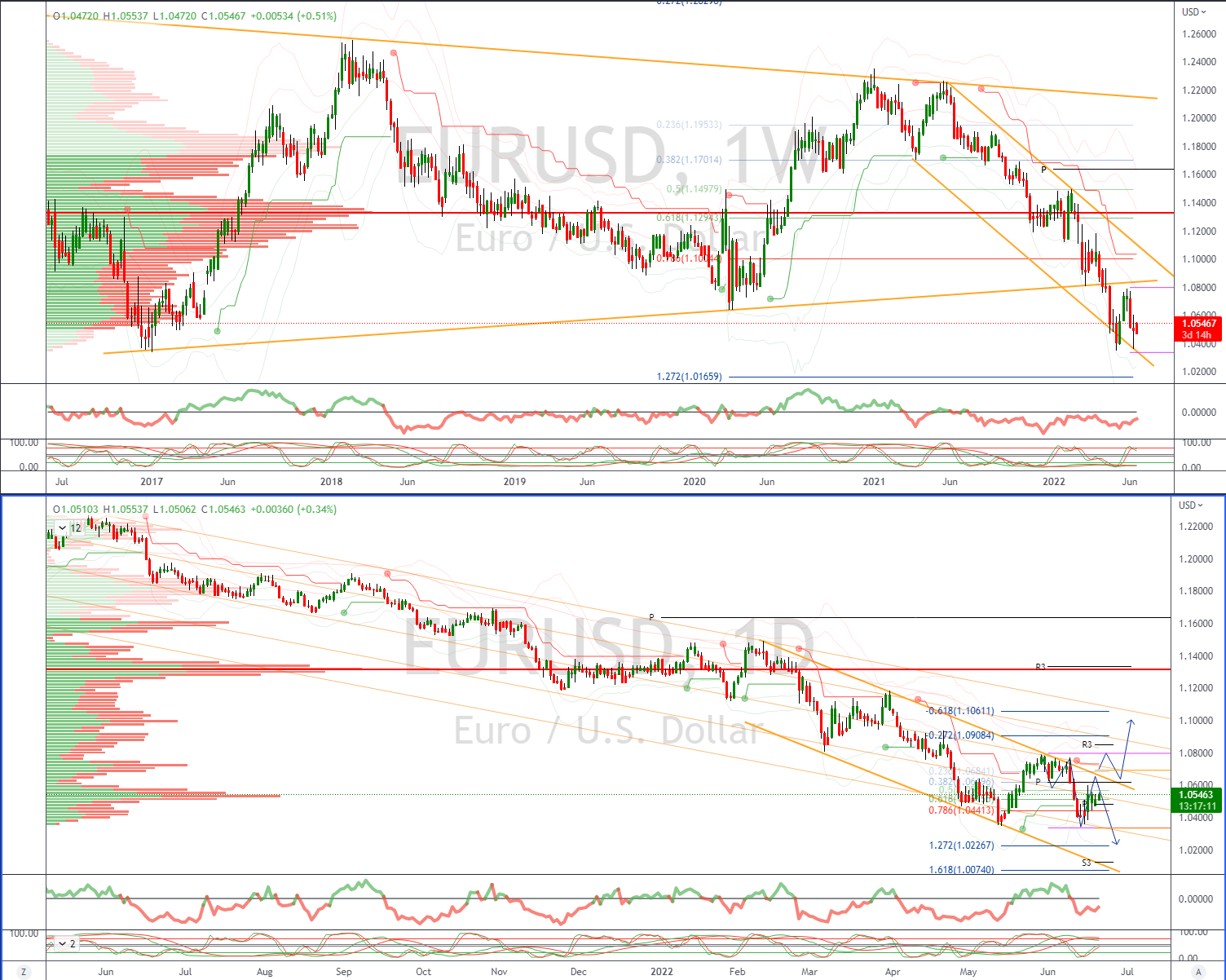

GBPUSD Bias: Bearish below 1.26 Bullish above.

- GBPUSD trades towRDA 1.23 as the London session gets going

- Technically cable held a 50% retracement of last week's advance

- BoE Mann, weak GBP makes case for big rate hike, risk of permanently higher inflation

- Headline risk comes with Inflation and retail sales later in the week

- Less volatility likely today following last week's fireworks around the BOE

- Resistance remains sited at 1.2410

- Support eyed at 1.2180

- Daily VWAP is bearish

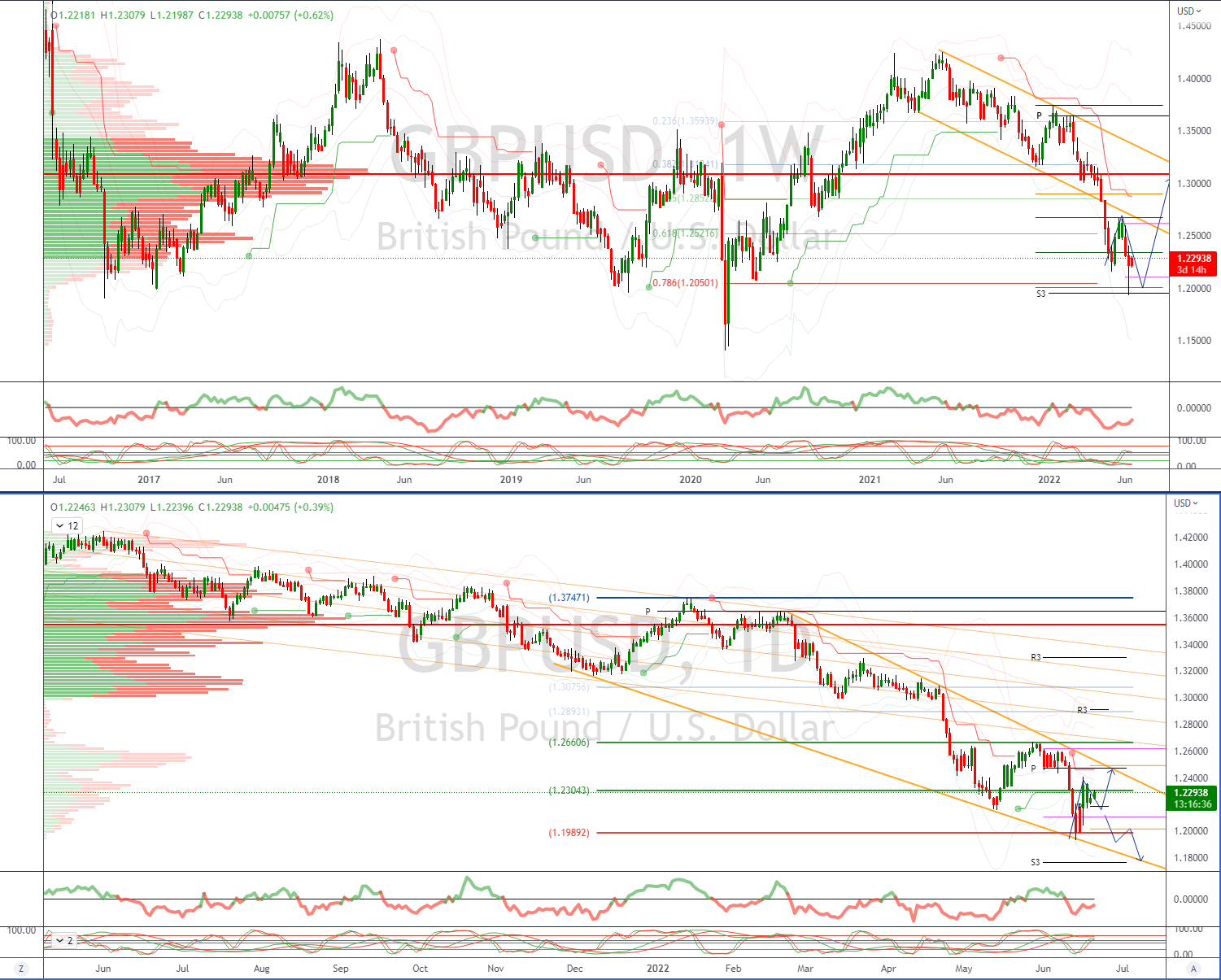

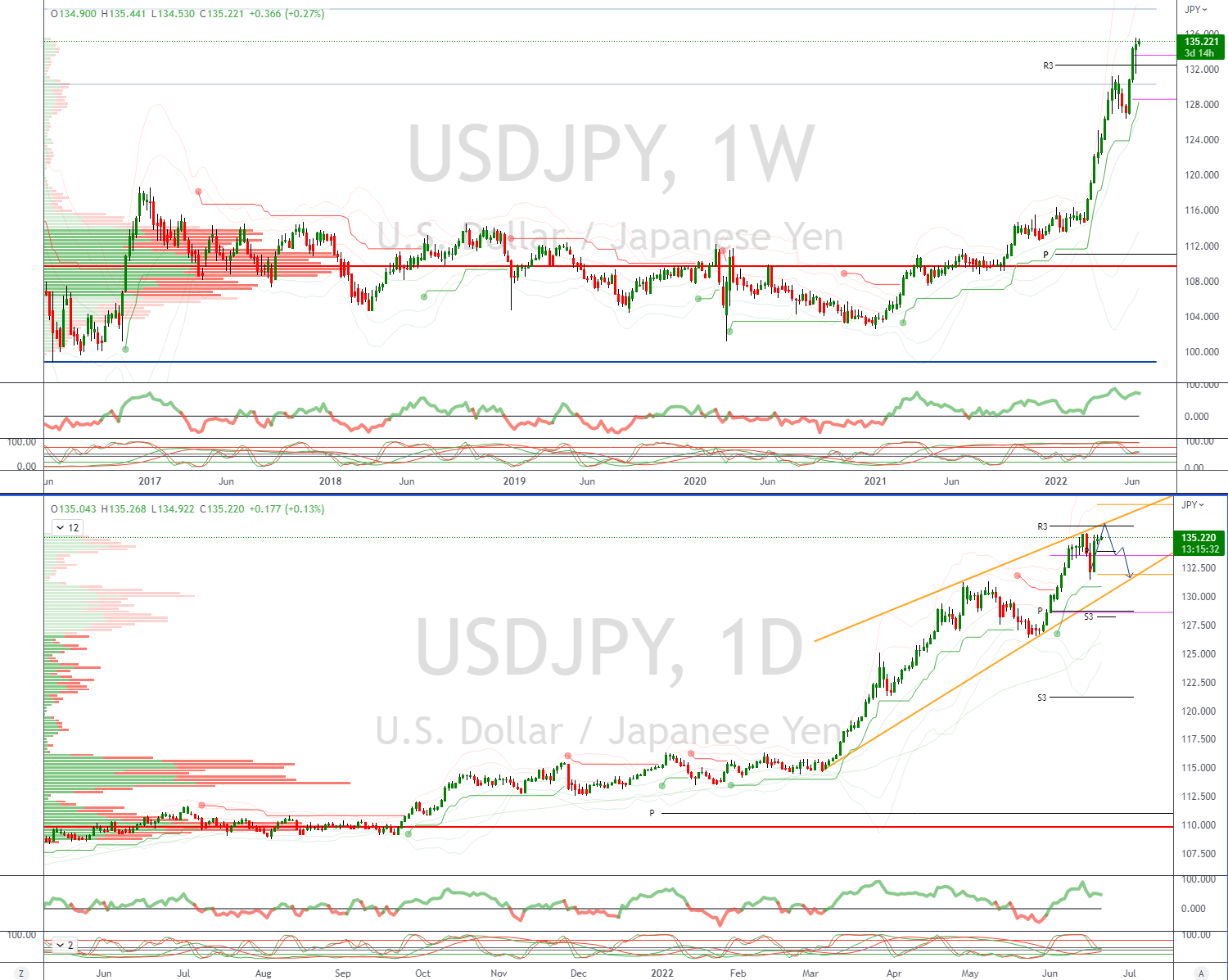

USDJPY Bias: Bullish above 132 Bearish below

- Retains bid tone, reduced range in Asian trade

- UDJPY muted action in unison with US Yields.

- Headline risk FED Cheif Powell speech Wednesday

- More Importer bids seen towards 134

- Exporter offers cap ahead of 136

- Daily VWAP is bullish with strong support back at 132

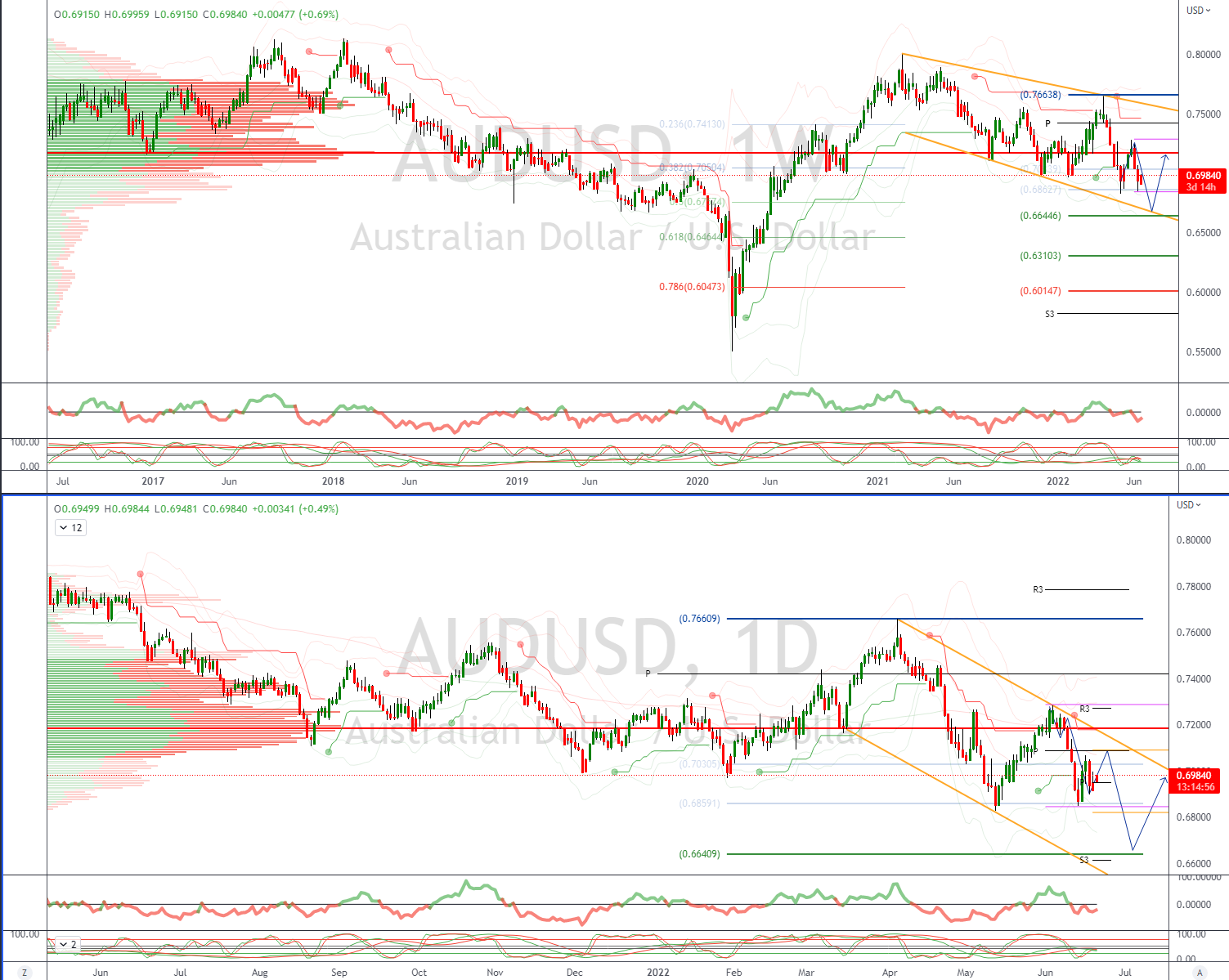

AUDUSD Bias: Bullish above .7200 Bearish below

- Aussie catches bid as global risk sentiment steadies

- RBA Governor Lowe ‘Australians should be prepared for further interest rate increases’

- After early pullback AUD again trades back above .6970

- Continued concerns regarding global growth likely to cap

- Offers seen towards .7075, bids eyed back at .6900

- Daily VWAP is bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!