Daily Market Outlook, July 7, 2022

Daily Market Outlook, July 7, 2022

Overnight Headlines

- Defiant UK PM Johnson Refuses To Quit, Fires Gove On Betrayal

- UK Tory MPs Fear Snap Election In Trumpian Survival Attempt

- Fed Sees ‘More Restrictive’ Rates Likely If Inflation Persists

- US Intelligence Warns China Influence Effort Against States

- Asia Manufacturers Sweat As US Mulls Tougher Tariff Rules

- China Data Show Economy Shrinking In Challenge To Target

- Shanghai Cases Rise To May Highs, Fuelling Lockdown Fear

- BoJ Seen Likely To Raise Price Forecasts, Slash Growth View

- Tokyo’s Governor Says City To Discuss Possible Covid Curbs

- Poll: Dollar Continues Dream Runs, Nothing Stands In Its Way

- Samsung’s Run Of Record Results Stall As Tech Boom Fades

- Merck In Advanced Talks To Buy Seagen In $40Bln Payment

The Day Ahead

- Concerns about global recession risks and inflation remained elevated, although tech stocks led a more constructive tone in equity markets overnight in the Asia-Pacific region. Last night, the minutes of the Fed’s 14/15 June meeting reaffirmed that ‘even more restrictive policy could be appropriate’ to tackle inflation. Following June’s 75bp increase, markets have almost priced in a further 75bp rise by the Fed later this month. In the UK, PM Johnson remains in power despite a wave of government resignations yesterday and more this morning. A new executive of the 1922 committee, representing backbench Conservative MPs, will be elected next week and could decide to amend the rules on leadership changes.

- The Bank of England’s ‘Decision Maker Panel’ survey of businesses due at 09:30BST could draw some attention today. The results, particularly around inflation expectations, may have a significant impact on the Monetary Policy Committee’s deliberations in August, as speculation mounts on whether they deliver a larger 50bp hike rather than a 25bp increase. Policymakers will be looking for signs that inflation expectations remain well anchored and indications that pressures may be easing. The last survey in May showed an expectation that inflationary pressures would eventually ease. Speeches from MPC’s Pill and Mann may provide further insights into the outlook for monetary policy. At the last meeting, Mann voted in the minority for a 50bp hike while Pill voted for 25bp. Both have emphasised the need to lean against the risk of inflationary pressures becoming embedded.

- In the Eurozone, the ECB will release the ‘account’ (minutes) of its 8-9 June policy meeting. Officials have given strong hints that interest rate lift-off – the first increase since 2011 – will occur later this month with a 25bp rise expected. The ‘account’ will be parsed for indications of a potential 50bp increase in September and discussions on measures to counter fragmentation in the Eurozone. Figures earlier this morning revealed a small rise of 0.2% in German industrial production, but significant concerns remain around supply bottlenecks and restrictions in energy.

- US economic data include the May trade balance and weekly jobless claims. The trade data should support expectations for net exports to contribute positively to Q2 GDP growth. There are indications, however, of some softening of the labour market. Initial jobless claims remain low but have ticked higher in June. The June labour market report on Friday is this week’s key release. Fed speakers include Governor Waller and St Louis Fed President Bullard.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0100 (1.08BLN), 1.0185 (408M), 1.0215-25 1.46BLN)

- 1.0275 (830M), 1.0290-00 (1.14BLN), 1.0325 (578M)

- 1.0350 (1.1BLN)

- USD/JPY: 133.95-05 (1.64BLN), 134.15 (220M), 135.00 (1.07BLN)

- 136.00 (1.07BLN) 136.15-20 (433M), 137.00 (760M)

- EUR/JPY: 144.00 (1.65BLN), 146.00 (1.6BLN)

- GBP/USD: 1.1800 (203M), 1.1950 (316M), 1.2000 (850M)

- EUR/GBP: 0.8575-85 (300M), 0.8600 (333M)

- AUD/USD: 0.6800 (363M), 0.6845-50 (670M), 0.6920 (305M)

- NZD/USD: 0.6270-80 (632M)

- USD/CAD: 1.2915 (200M), 1.2950 (390M), 1.3000 (681M)

- USD/CHF: 0.9700 (450M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.05

- Retains offered tone, USD trading 20yr highs

- EUR/USD prints 20 year lows sub 1.0

- ECB/FED policy divergence in focus

- China rise in Covid cases boosts USD safe haven bid

- ECB minutes up next

- Bears eyeing a parity test; offers seen at 1.0340/60

- 20 Day VWAP is bearish, 5 Day bearish

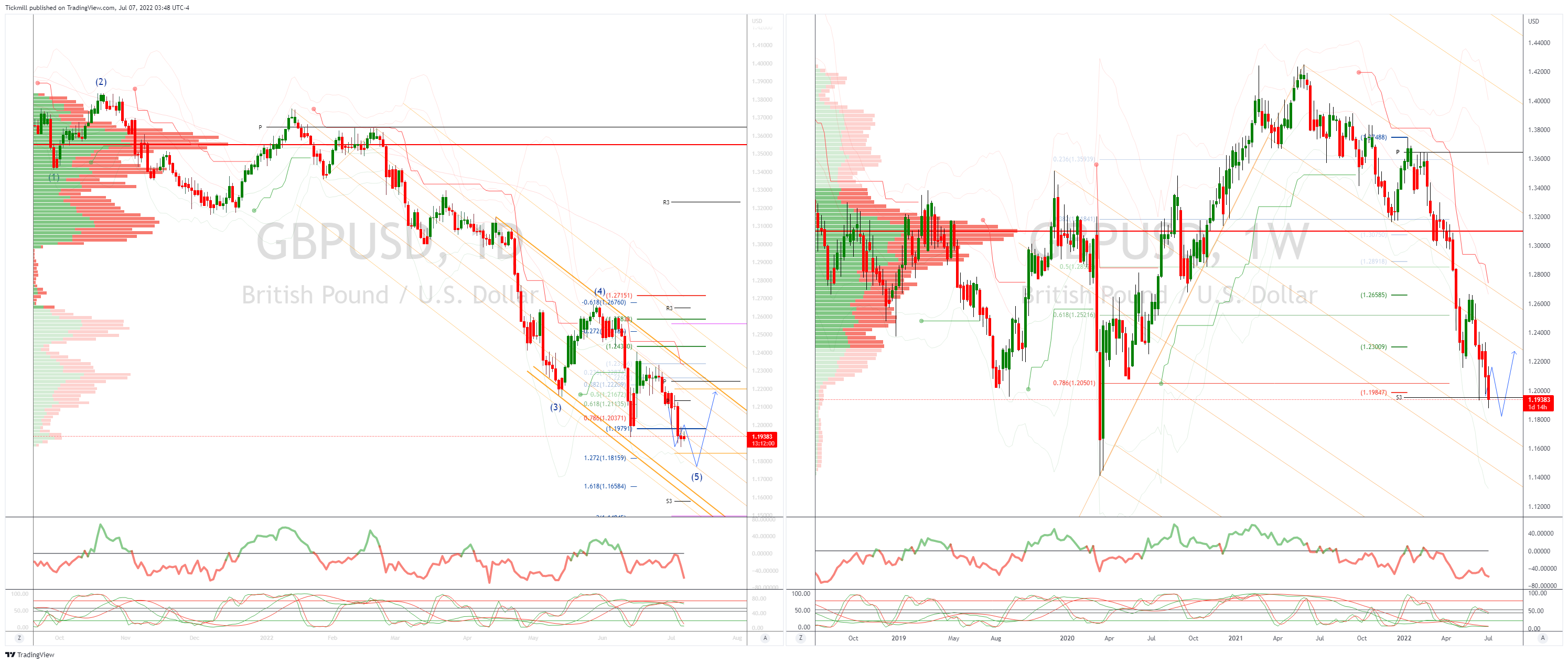

GBPUSD Bias: Bearish below 1.2150

- GBP pressured by political pantomime playing out in the UK

- Over 50 ministers and political aids have resigned from the UK Government

- GBP languishing at 2yr lows

- New Fin Min Zahawi among others urge PM to go

- Energy price inflation and recession fears weigh on GBP

- Bears breach YTD lows en-route to a test of 1.18

- Offers seen at 1.20 Bids 1.1770

- 20 Day VWAP is bearish, 5 Day bearish

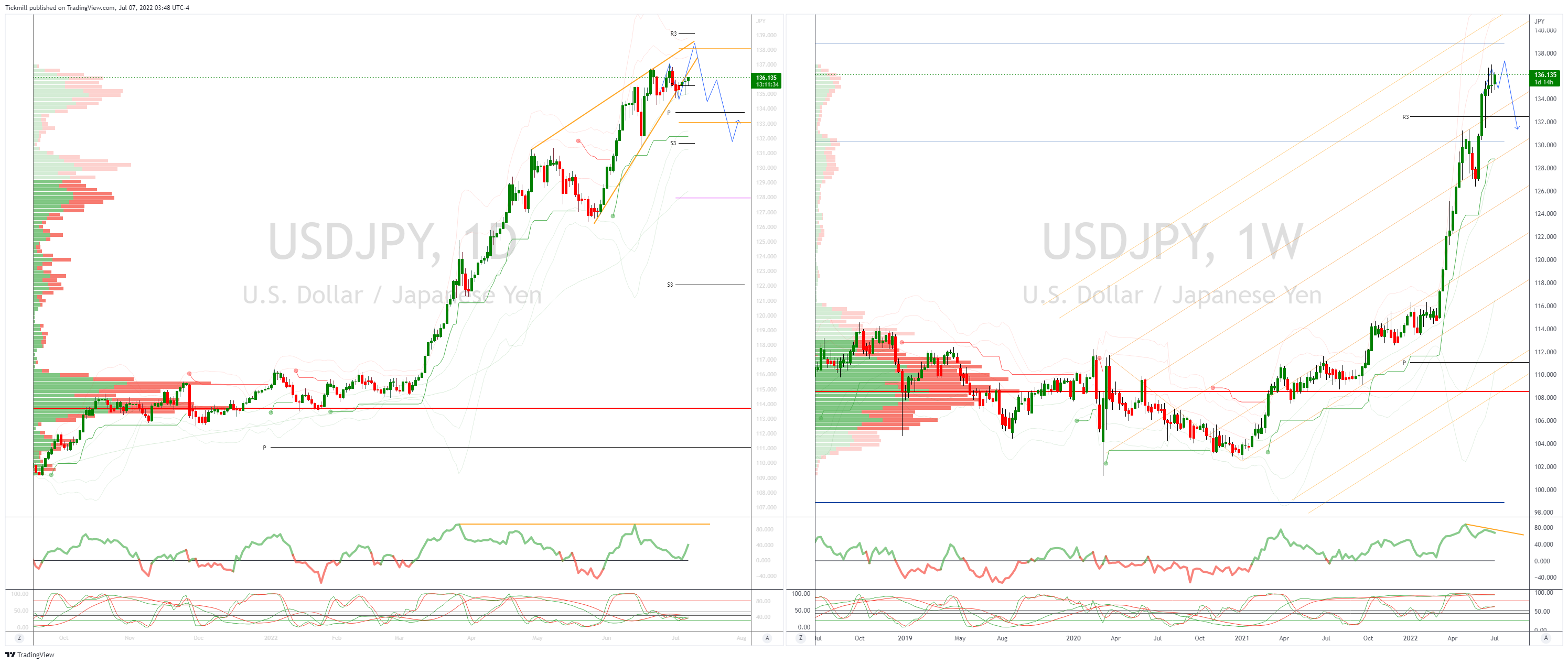

USDJPY Bias: Bullish above 134

- Lack of directional flow with US Yields still sub 3%

- Large options 134/35/36/37

- Japanese importer bids seen at 135

- Traders betting on 134/137 range trade

- US10Y 2.94 trading firmer seen as supportive for USD/JPY

- Initial offers seen at 136.55/65 stops above to see retest of 137

- Option barriers KO’s quoted at 137 remain intact

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bearish below .7050

- Recovers .68 handle as LDN opens up

- Commodity bounce supports with Copper +3% & Iron Ore +5%

- Offers seen towards .6900

- Support seen at the 50% retracement of the 0.5510/0.8007 move at 0.6758

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

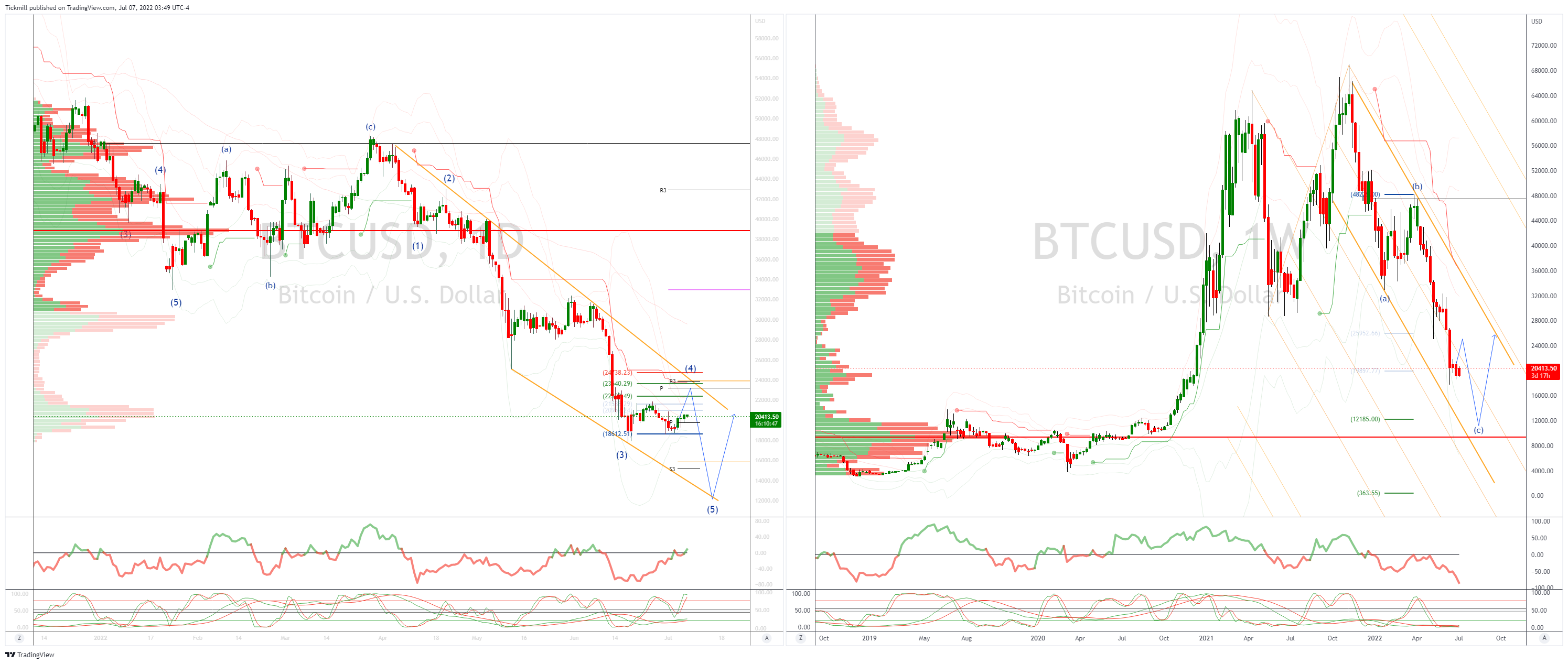

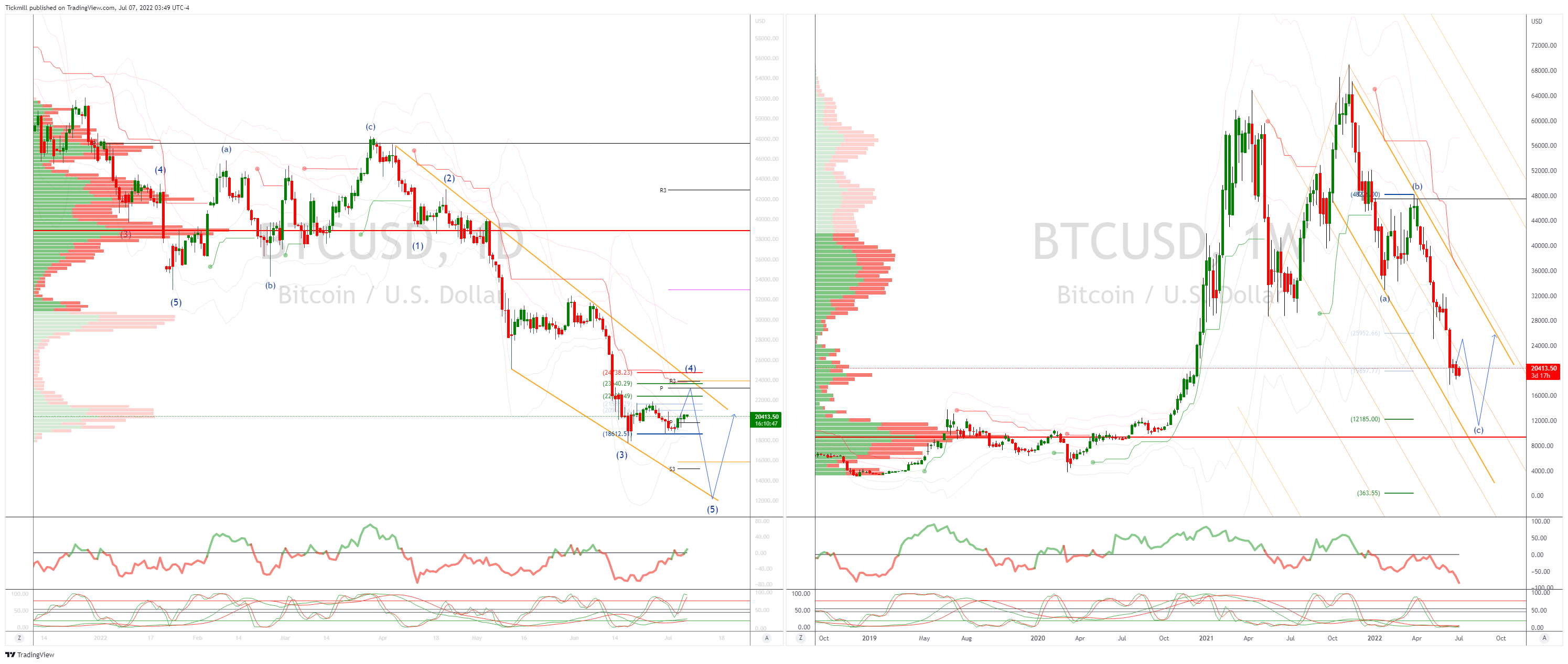

BTCUSD Bias: Bearish below 22k

- BTC continues to rotate around 20K weighing by recession fears

- Testing air above the 20 day VWAP which has flipped bullish

- 20 VWAP band contracting ready for next directional drive

- Trend remains down as within broader bearish channel beckons

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- Genesis Exchange said Wednesday it had been exposed to 3AC but mitigated losses

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!