Daily Market Outlook, July 13, 2022

Daily Market Outlook, July 13, 2022

Overnight Headlines

- IMF Cuts US 2022 GDP Growth Forecast To 2.3% VS June Est. 2.9%

- EURUSD Clings To Parity As Markets Await U.S. Inflation Data

- Twitter Sues To Force Tesla CEO Elon Musk To Complete $44bn Deal

- New Zealand Hikes Rate By Half-Point, Signals More Tightening

- Bank Of Korea Joins Jumbo Hikers As Inflation Fight Heats Up

- Japan Business Mood Subdued On Chip Shortage, Raw Material Costs

- Fed's Barkin Says 'Definitely' Sees Signs Economy Is Softening

- BoE Gov Bailey Pledges To Bring UK Inflation Back Down To 2% Target

- UK Economy Needs More Than Tax Cuts, Warn Three Reports

- Oil Steadies After Tumbling Below $100 On Concerns Over Demand

- API Shows Crude, Fuel Stocks Rise In Latest Week - RTRS Sources

- Asian Shares Bounce, Markets On Edge Ahead Of U.S. Inflation Data

- Google Pulls Back Hiring In Face Of Economic Uncertainty - Insider

The Day Ahead

- Asian equity markets are mostly modestly higher this morning, partly erasing yesterday’s declines. Overnight, the Reserve Bank of New Zealand increased interest rates again by 50bp to 2.5%, as policymakers focus on combating inflation. The Bank of Korea stepped up the pace of tightening with a 50bp increase in interest rates to 2.25%, the highest level for eight years.

- Data released this morning showed UK GDP in May rose by 0.5%m/m stronger than the consensus forecast. It was the biggest increase since January but is likely a reflection of the extra working day in May because one of the month’s usual bank holidays was moved to June for the Queen’s Platinum Jubilee. There were solid rises in industrial production and construction output, and a smaller rise in services. However, June GDP (due next month) will likely fall due to the two Jubilee bank holidays and will probably result in a contraction in Q2 GDP growth overall.

- US CPI inflation for June is the key data release today. Expect annual headline CPI to rise again to 8.8%, a new four- decade high reflecting rising energy and food prices. Annual core inflation is expected to ease for a third straight month to 5.8%. Base effects, however, mean that annual core CPI could pick up again in Q3 to offset any downward pressures on headline inflation from the recent fall in the oil price. Today’s CPI data, together with Friday’s retail sales and the University of Michigan consumer sentiment survey, could have a significant impact on Federal Reserve’s decision about how much to raise interest rates. Markets are currently almost fully priced for the Fed to increase interest rates by another 75bp to a 2.25-2.50% range later this month.

- The Bank of Canada is expected to increase interest rates today by 75bp to 2.25%, the highest level since 2008. Financial markets have fully priced that outcome and anticipate Canadian policy rates rising to 3.5% by year-end.

- Eurozone industrial production figures for May will receive limited attention. Expect a 0.5%m/m rise, flattered by a strong rebound in Ireland. The monthly data for the largest Eurozone countries showed broadly flat output in Germany and France and falls in Italy and Spain. Yesterday’s German ZEW survey of finance professionals showed a decline in their expectations for the economic outlook to the weakest level since 2008 on concerns about energy supplies, ECB rate rises and the Covid situation in China.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0195-00 (1.04BLN), 1.0235 (256M)

- USD/JPY: 136.00 (860M), 137.35 (400M), 138.00 (600M)

- EUR/JPY: 137.00 (936M), 138.00 (661M), 139.00 (823M)

- GBP/USD: 1.1710 (252M), 1.2035 (1.15BLN)

- EUR/GBP: 0.8470 (220M), 0.8570 (294M)

- EUR/CHF: 0.9975 (200M)

- AUD/USD: 0.6800 (329M). NZD/USD: 0.6180 (794M)

- USD/CAD: 1.3000 (1.57BLN)

Technical & Trade Views

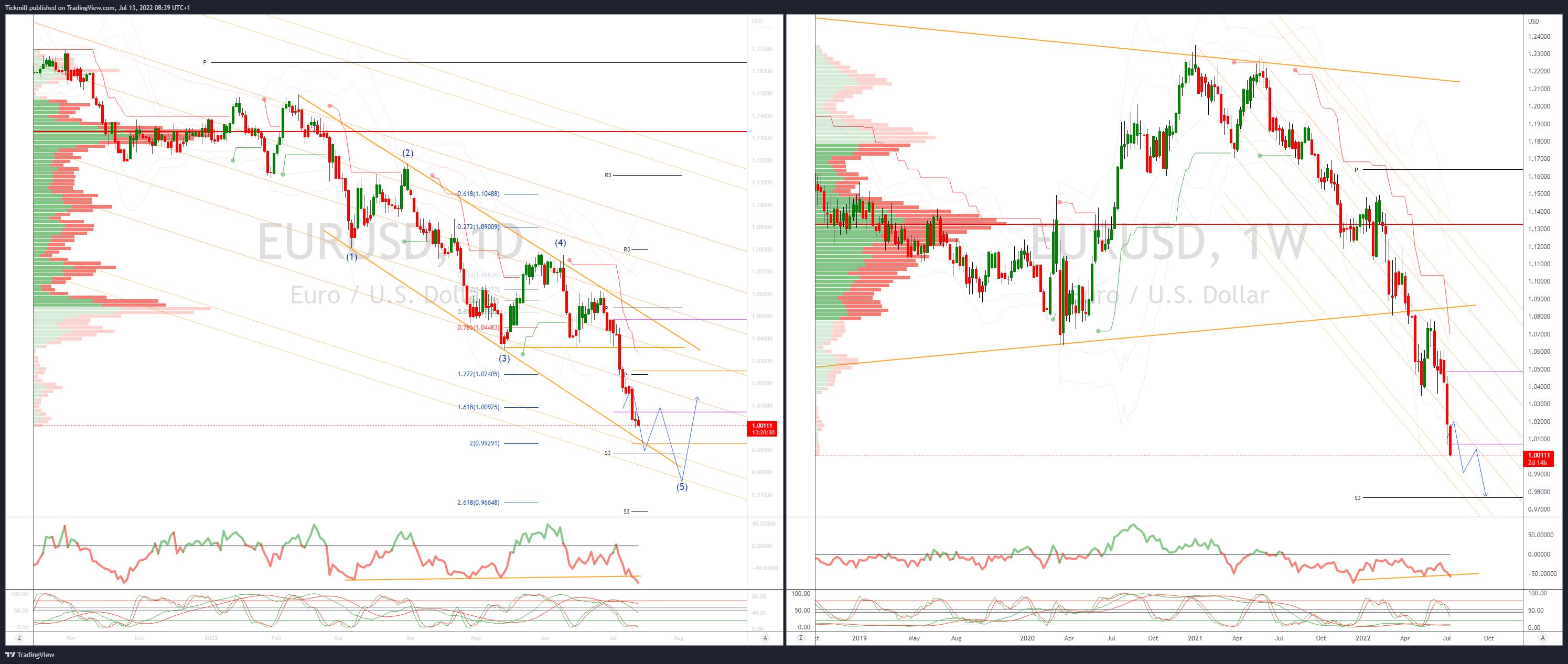

EURUSD Bias: Bearish below 1.05

- Remains offered just above parity

- Today’s CPI next catalyst and could drive a sustained break of parity

- Energy price and supply concerns seen as principle driver

- Upside capped by US Yields on increasing Fed rate hike bets

- ECB/FED policy divergence remains in focus

- Bids eyed below parity .9950 offers sitting above 1.0050

- 20 Day VWAP is bearish, 5 Day bearish

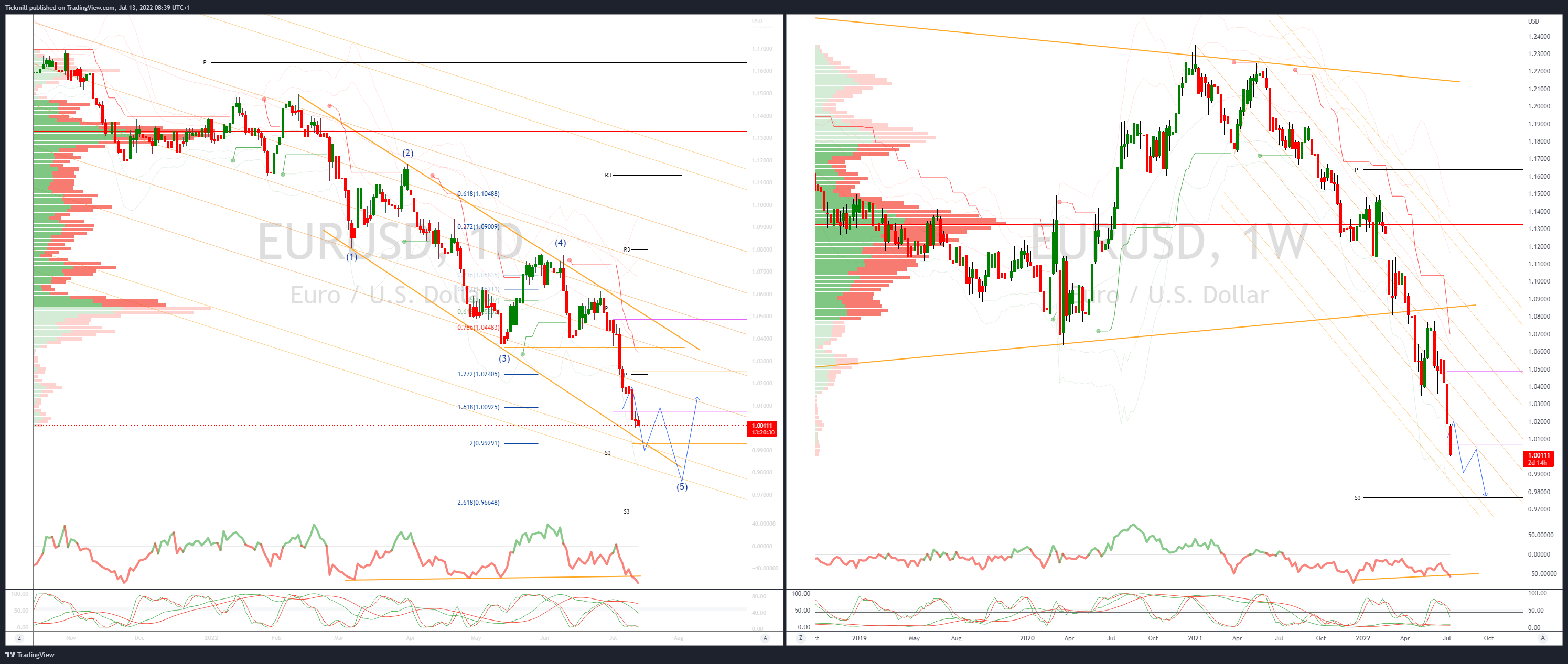

GBPUSD Bias: Bearish below 1.2150

- GBP catches small bid on GDP beat

- Huge 1.15Bln options at 1.2035 roll off today

- BoE seen as sidelined in August adding to downside pressure on sterling

- Energy price inflation, recession fears and political unknowns weigh on GBP

- Offers seen at 1.20 Bids 1.1720

- 20 Day VWAP is bearish, 5 Day bearish

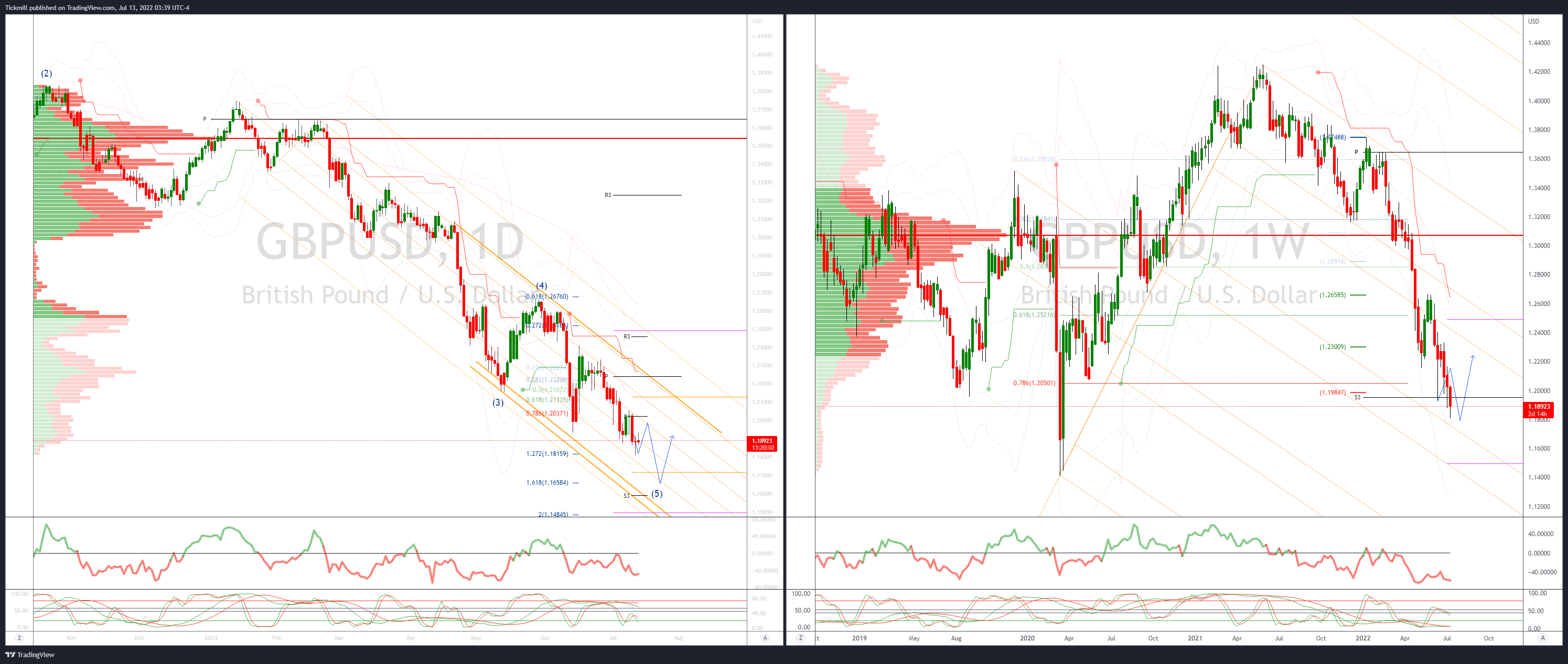

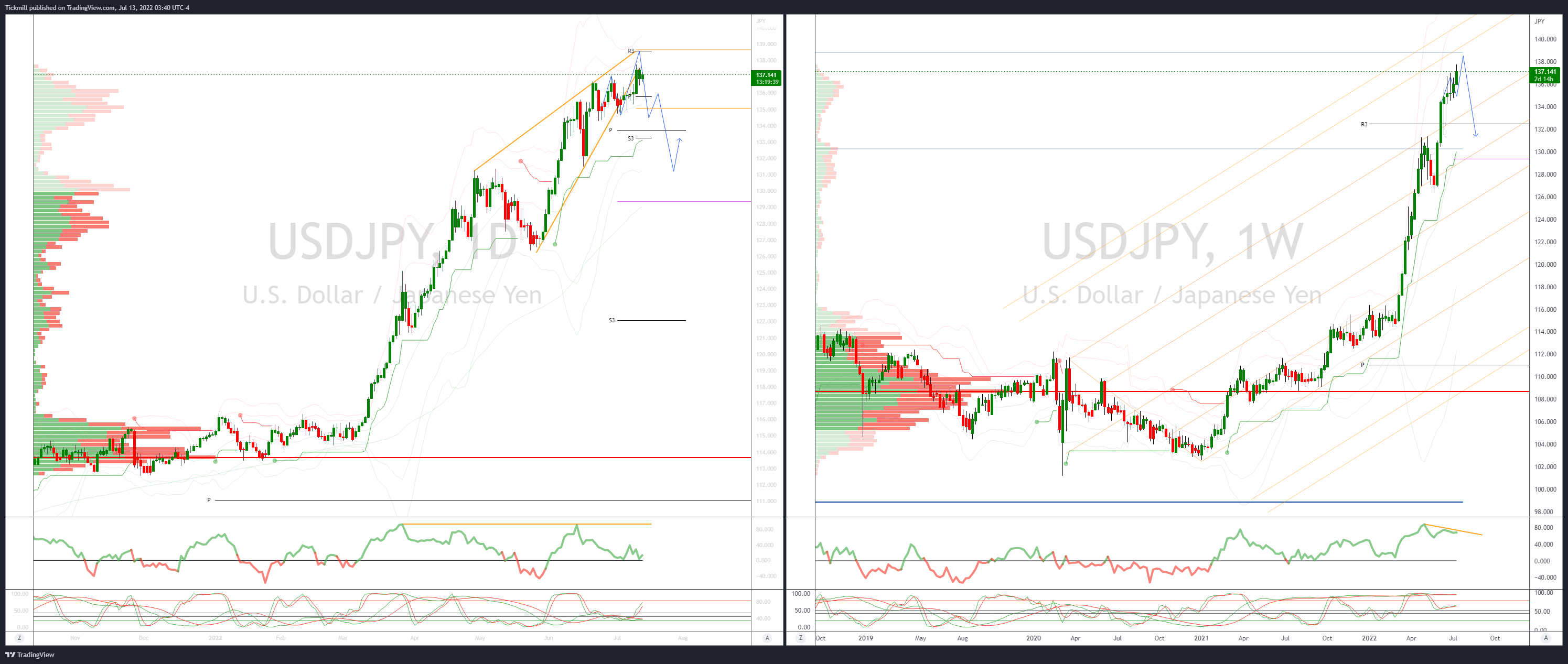

USDJPY Bias: Bullish above 134

- USDJPYbid in Asian session supported by Importer buying

- Market awaits US CPI traders betting on a hot print

- Japanese importer bids seen just below 137

- Traders see range expansion 135/140

- US10Y trade back below 3%

- Offers seen at 138.60 bids 136.30

- 20 Day VWAP is bullish, 5 Day bullish

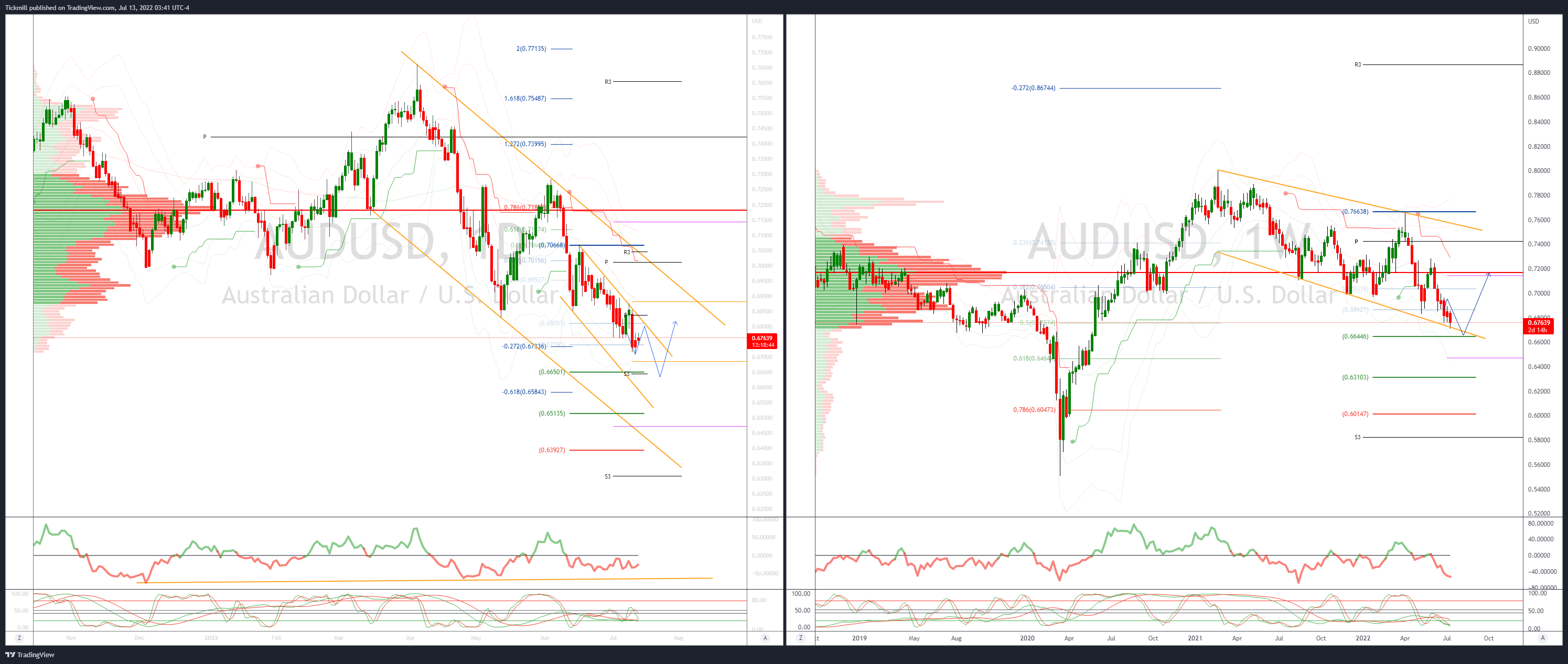

AUDUSD Bias: Bearish below .7050

- AUD recovers as shorts cover ahead of CPI headline risk

- AUD supported on steadying risk sentiment, China markets break a three day loss

- Fresh Covid concerns out of China still a headwind

- Commodity losses likely cap upside Copper, Oil and Iron Ore remain soft

- Offers seen at .6830’s with bids tipped at .6685

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

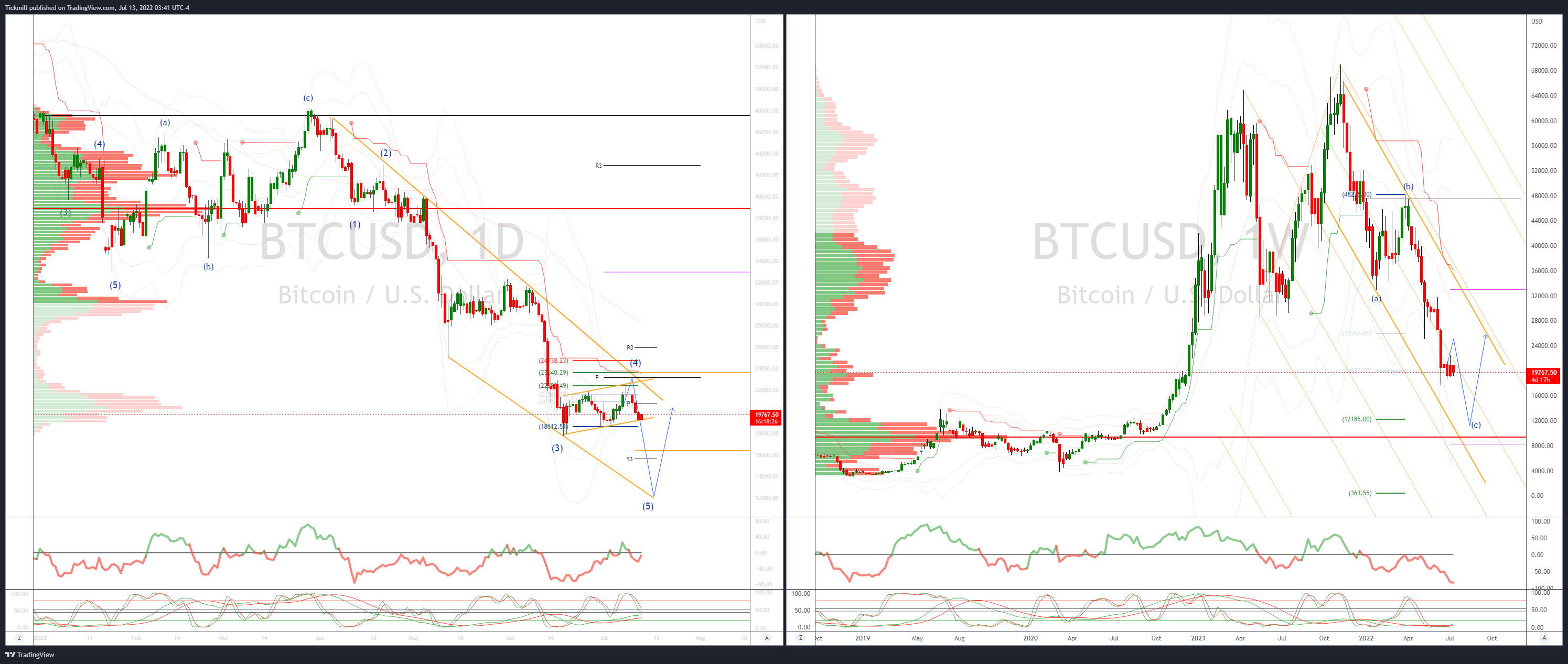

BTCUSD Bias: Bearish below 22k

- BTC falls for third day, better risk tone adds some support

- US inflation data likely to drive the next leg

- BTC continues to trade lower setting up a pivotal test of 19k

- 20 VWAP band contracting ready for next directional drive, currently pointing south

- Trend remains down within broader bearish channel

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- Concerns regarding increasing Crypto scandals and scams leave BTC vulnerable

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!