Daily Market Outlook, January 22, 2024

Munnelly’s Market Minute…“Hang Seng Sinks To GFC Levels”

Asian stocks were mixed as Chinese stocks weakened, despite last week's record levels on Wall Street. Nikkei 225 rallied and broke above 36.5K handle ahead of tomorrow's BoJ announcement. Hang Seng and Shanghai Comp underperformed due to notable weakness in tech and property, with the Hang Seng Mainland Properties Index hitting a record low and trading back to levels not seen since 2009. Sentiment remained pressured in the mainland amid ongoing economic concerns, and the benchmark LPRs were kept unchanged, as expected. The BoJ is expected to maintain its current monetary policy THIS week, but investors are watching for any indications from Governor Ueda regarding the negative effects of negative rates, as this could signal a future change in policy. Additionally, Tokyo's CPI is likely to have decreased in January, which could further undermine the BoJ's confidence in achieving its 2% inflation target.

In the UK, despite the unexpected increase in December CPI, it still fell 0.6 percentage points below the Bank of England's forecast in the November MPR. With pay growth continuing to slow down, this should be sufficient for all MPC members to contemplate maintaining current interest rates at the February meeting. The upcoming PMI, CBI, and consumer confidence surveys next week will offer the last update on the economy before the February meeting.

The January ECB meeting on Thursday is not expected to bring any policy adjustments or announcements, but rather focus on reflecting on the upcoming year. ECB watchers are looking for the first rate cut to be moved from December to September, but there is high uncertainty, which means that no cuts this year is also a possibility. The Governing Council may discuss the first outcomes of the operational framework review, to be published later in the spring. This week, there will be a release of January business surveys. The PMIs, which are still at low levels, are expected to gradually recover, while the Ifo and INSEE are anticipated to weaken slightly.

Stateside, the upcoming 31 January FOMC meeting is the next major event for financial markets. Before that, this week's 4Q GDP and PCE inflation measures are important to consider. GDP is expected to be more resilient than previously thought after the surge in 3Q, with an estimated 1.9% growth rate, in line with potential growth. Core inflation is slowing down, but confidence in reaching and maintaining 2% is not high enough to warrant near-term rate cuts.

Overnight Newswire Updates of Note

Ron DeSantis Drops Out Of 2024 Presidential Race, Endorses Donald Trump

Tim Scott Endorses Donald Trump In Blow To Nikki Haley

China Leaves Lending Benchmark LPRs Unchanged As Expected

Japan’s Baseline Forecasts Show Government Missing Budget Goal

Japan Premier Slips In Polls After Disbanding Tarnished Faction

Fed's Daly: Policy In A 'Good Place,' Risks 'Balanced'

EU Tackles New $20 Bln Plan To Boost Ukraine Military Aid

All Parts Of UK Hit By Economic Stagnation Since 2010, Says Think-Tank

Netanyahu Rejects Conditions For Hostage Release, After Hamas Report

Libya Restarts Production, Exports From Biggest Oil Field

TSMC To Launch Chipmaking Plant In Japan, But US Plant To Face Delays

ADM Places CFO On Leave, Cuts Earnings Forecast Amid Probe

ExxonMobil Sues To Block Shareholder Climate Petition

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (535M), 1.0850 (578M), 1.0900 (252M), 1.0935 (274M)

1.0975 (300M), 1.1000 (840M)

USD/CHF: 0.8530 (350M), 0.8660-70 (435M)

GBP/USD: 1.2650 (440M). EUR/GBP: 0.8600-15 (300M)

AUD/USD: 0.6535 (800M), 0.6575-80 (1BLN), 0.6600-05 (819M)

USD/CAD: 1.3450-60 (521M)

USD/JPY: 147.45-50 (628M), 148.00-10 (1.3BLN), 148.50 (873M), 149.50 (687M)

FX option implied volatility is declining due to lower levels drawing demand for protection against increased risk of realized FX volatility from interest rate divergence and a potential Trump election win. Buyers are seeking FX volatility protection after the March 30 U.S. Federal Reserve policy announcement, with options expiring after the November 5 U.S. election also seeing increased demand. Lower implied volatility means cheaper options, reflecting the lack of conviction within recent FX ranges. There is a growing risk of a USD/JPY setback, leading to a preference for owning downside strikes. Dealers also highlight the pending U.S./Japan rate divergence as a potential volatility risk.

CFTC Data As Of 12/01/24

USD bearish decreasing -9,298

CAD bearish increasing -992

EUR bullish decreasing 14,150

GBP bullish increasing 2,443

AUD bearish increasing -3,151

NZD neutral neutral -177

MXN bullish neutral 2,370

CHF bearish neutral -542

JPY bearish neutral -4,803

Technical & Trade Views

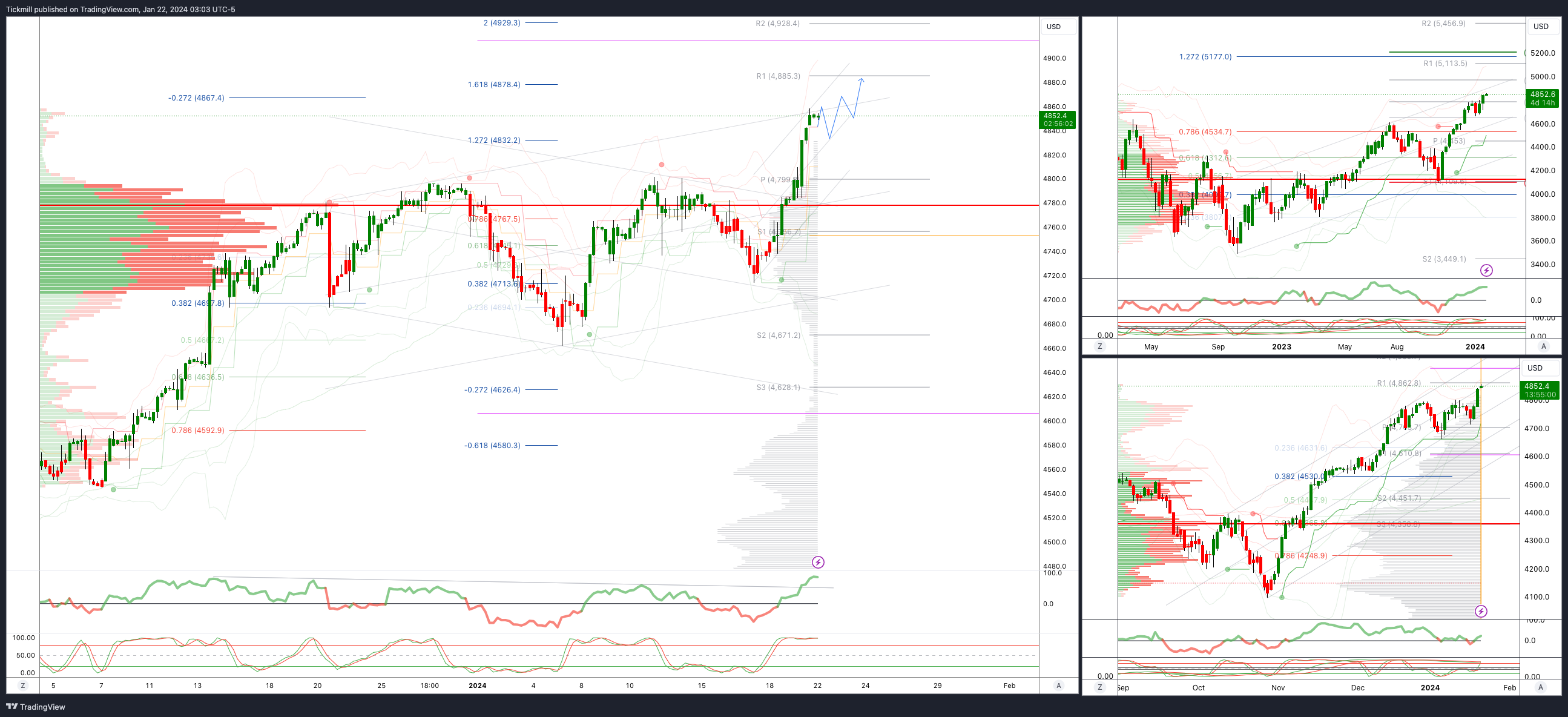

SP500 Bullish Above Bearish Below 4810 - 4830 Target Hit - New Pattern In Play

Daily VWAP bullish

Weekly VWAP bullish

Below 4800 opens 4750

Primary support 4700

Primary objective is 4830

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

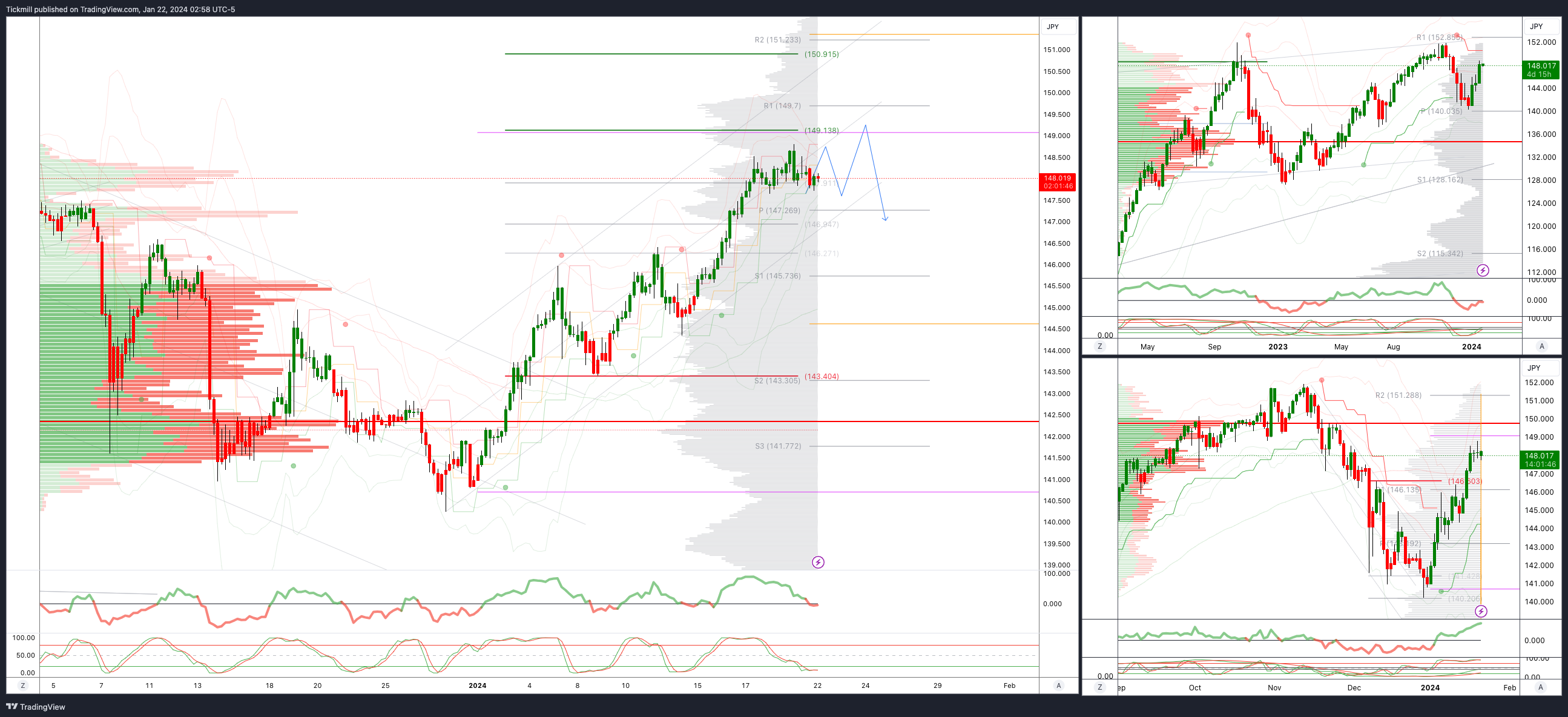

USDJPY Bullish Above Bearish Below 146.40

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bullish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

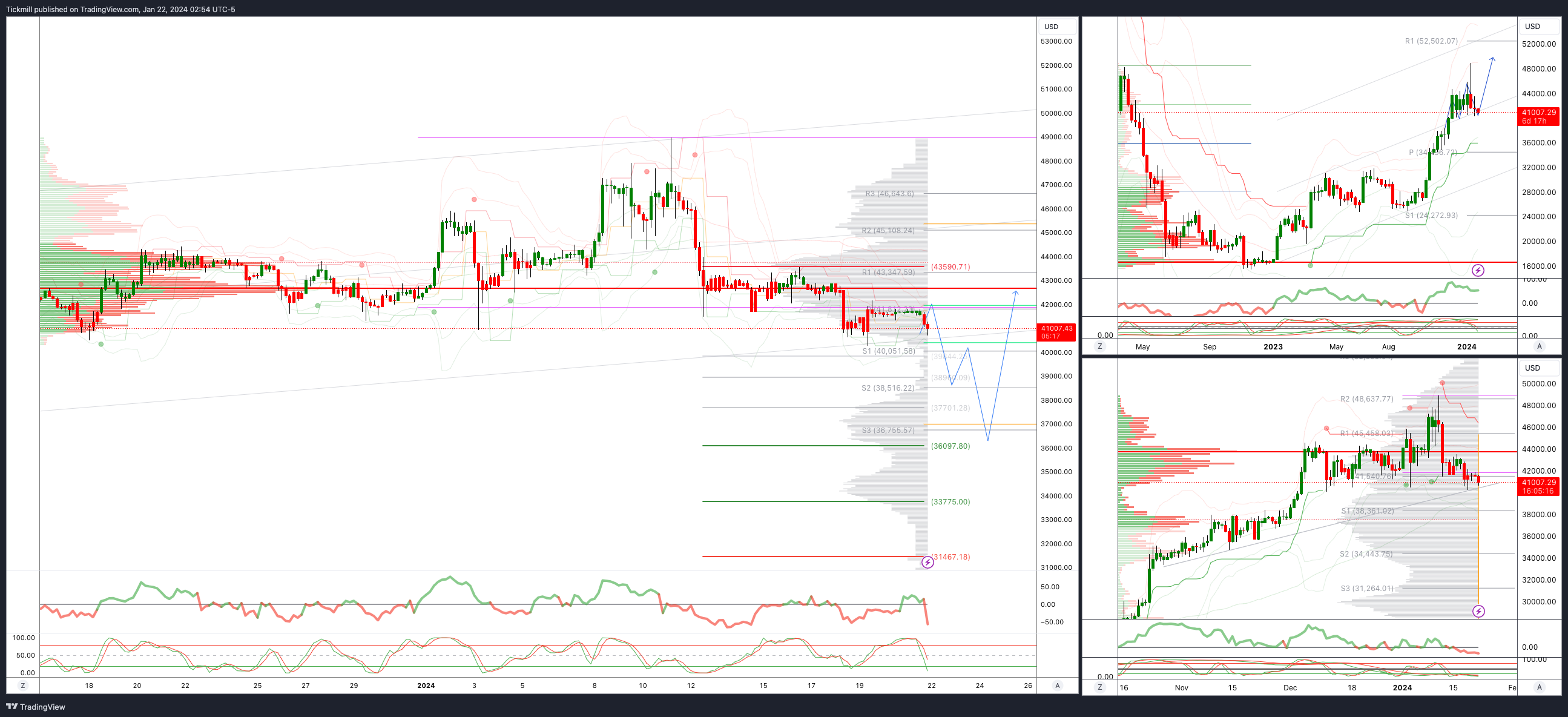

BTCUSD Bullish Above Bearish below 43600

Daily VWAP bearish

Weekly VWAP bearish

Above 43590 opens 46000

Primary support is 40000

Primary objective is 36097

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!