Daily Market Outlook, January 17, 2024

Munnelly’s Market Minute…“UK Inflation Uptick Sees Sterling Higher”

Asian stocks were under pressure due to the recent rise in yields and reduced expectations of Fed rate cuts. The Nikkei 225 initially rose due to a weaker currency but later dropped from three-decade highs as it succumbed to the risk-off sentiment. The Hang Seng and Shanghai Comp also retreated due to mixed Chinese economic data, with Hong Kong particularly underperforming due to losses in tech and property sectors.

December UK CPI inflation slightly exceeded expectations, with the annual rate rising to 4.0% from November's 3.9%. This marks its first monthly increase since February. Despite this, it's crucial to note that, due to sharp declines in the previous two months, the rate still saw a significant drop in Q4 from 6.7% in September. The core rate held steady at 5.1%, while services inflation increased to 6.4% from 6.3%. Inflation might see a modest uptick in January due to the latest Ofgem price cap implementation, but markets anticipate a continued decline thereafter, potentially reaching the 2.0% target before mid-year. The Office for National Statistics will release the November UK house price index today, following a 1.2% decline in October. While some indices suggest a rebound in prices, the official numbers will be scrutinized for signs of this trend.

Today's December Eurozone CPI data, a second reading, is not expected to be revised. The initial report indicated a slight increase in headline inflation but a further decline in the core rate. Several ECB representatives will be speaking at Davos today, including ECB President Lagarde, ECB's Cipollone on "Euro Cyber Resilience", and ECB's Knot.

Stateside, a busy day for data includes retail sales and industrial production reports for December. A 0.4% rise is forecasted for retail sales during the festive month, while industrial production is expected to see a more modest 0.2% increase. Both releases will offer insights into Q4 GDP growth, expected next week. While it's anticipated that Q4 growth will slow after the robust 4.9% annualized expansion in Q3, early indications suggest solid growth. Additionally, the Fed Beige Book, featuring anecdotal economic reports, will be released today, with the previous one highlighting increased downside growth risks. Fed's Vice Chair of Supervision Barr will speak on cyber risks, Fed's Bowman on bank capital reforms, and Fed's Williams on "an Economy that Works for All: Measurement Matters".

Overnight Newswire Updates of Note

US Spending Bill To Avert Shutdown Clears First Senate Hurdle

US Set To Designate Iran-Backed Houthi Rebels As Terror Group

Bond Traders Start To Hedge Against Half-Point Fed Cut In March

China’s Economic Growth Disappoints, Fuelling Calls For Stimulus

Chinese Price Gauge Shows Longest Deflation Streak Since 1999

Polled Economists All Expect BoJ Holding In January After Quakes

Japan Manufacturers Pessimistic As Dark Clouds Hang Over China

Tory Resignations, Rebellions Expose Sunak’s Weak Grip On Party

UK Saw Strong Wage Growth In Late 2023, Jobs Site Indeed Says

EU Moves Ahead With Plans For New Naval Operation In Red Sea

Russia Call Peace Meetings Pointless, Says Plan Cannot Succeed

Global LNG Fleet Avoiding The Red Sea As More Tankers Diverted

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (1.1B), 1.0890-1.0900 (1.3B), 1.0970-75 (1.5B)

EUR/USD: 1.1000 (500M), 1.1015-25 (695M), 1.1050 (700M), 1.1060-65 (825M)

EUR/USD: 1.1070-75 (2.0B). USD/JPY: 144.00 (890M), 145.00 (370M)

USD/JPY: 145.75 (1.2B), 147.00 (425M), 147.35 (1.2B)

GBP/USD: 1.2600 (400M), 1.2625 (335M), 1.2700 (685M), 1.2715-25 (435M)

GBP/USD: 1.2795 (500M), 1.2885-1.2900 (540M), 1.2965 (730M)

AUD/USD: 0.6735 (355M), 0.6750 (940M). NZD/USD: 0.6330-50 (690M)

USD/CAD: 1.3235-40 (2.3B), 1.3375-80 (1.3B)

CFTC Data As Of 12/01/24

USD bearish increasing 12,192

CAD bearish decreasing -551

EUR bullish neutral 16,243

GBP bullish increasing 1,647

AUD bearish decreasing -2,158

NZD neutral neutral -110

MXN bullish neutral 2,606

CHF bearish neutral -644

JPY bearish neutral -4,841

Technical & Trade Views

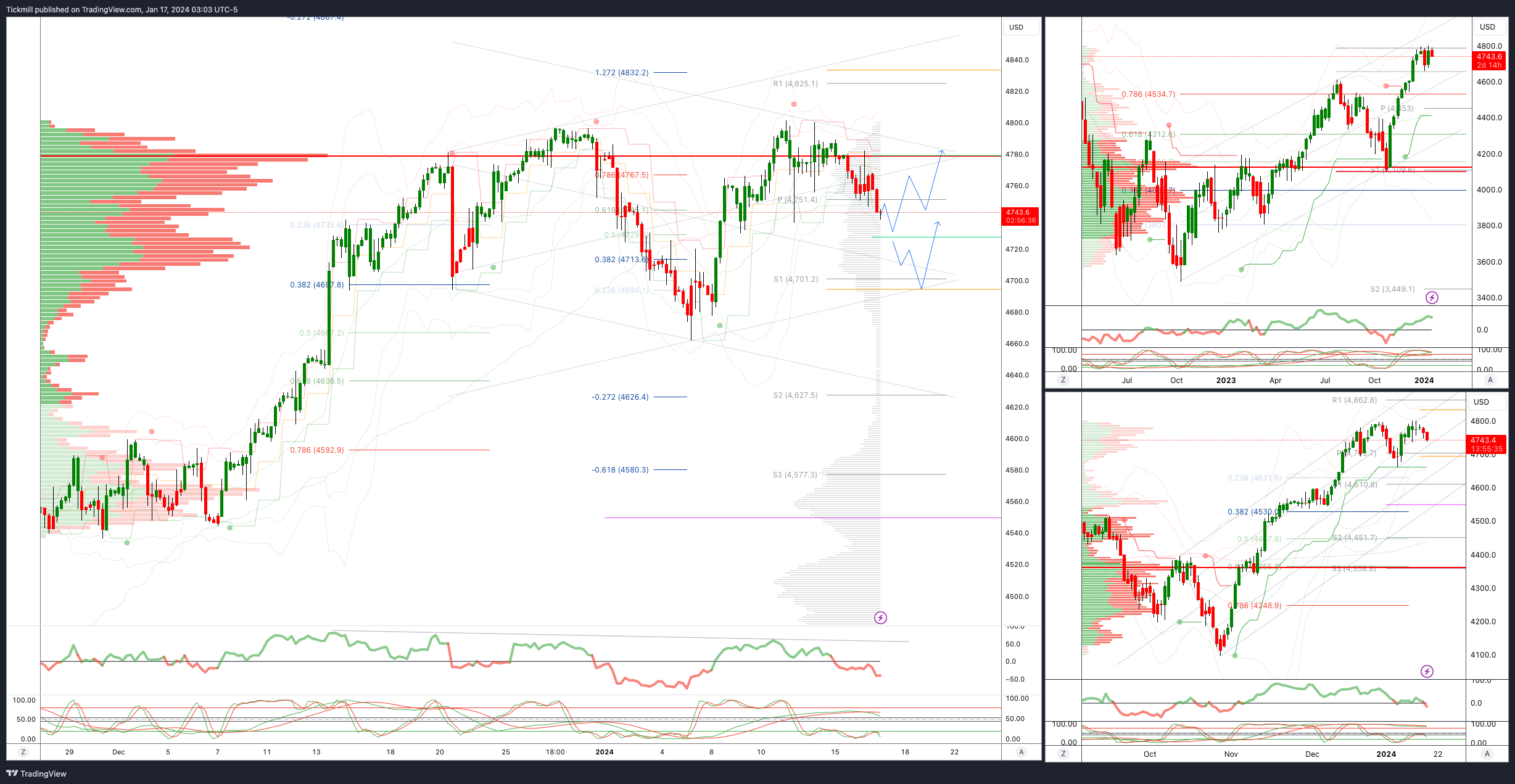

SP500 Bullish Above Bearish Below 4750

Daily VWAP bullish

Weekly VWAP bullish

Below 4730 opens 4700

Primary support 4670

Primary objective is 4830

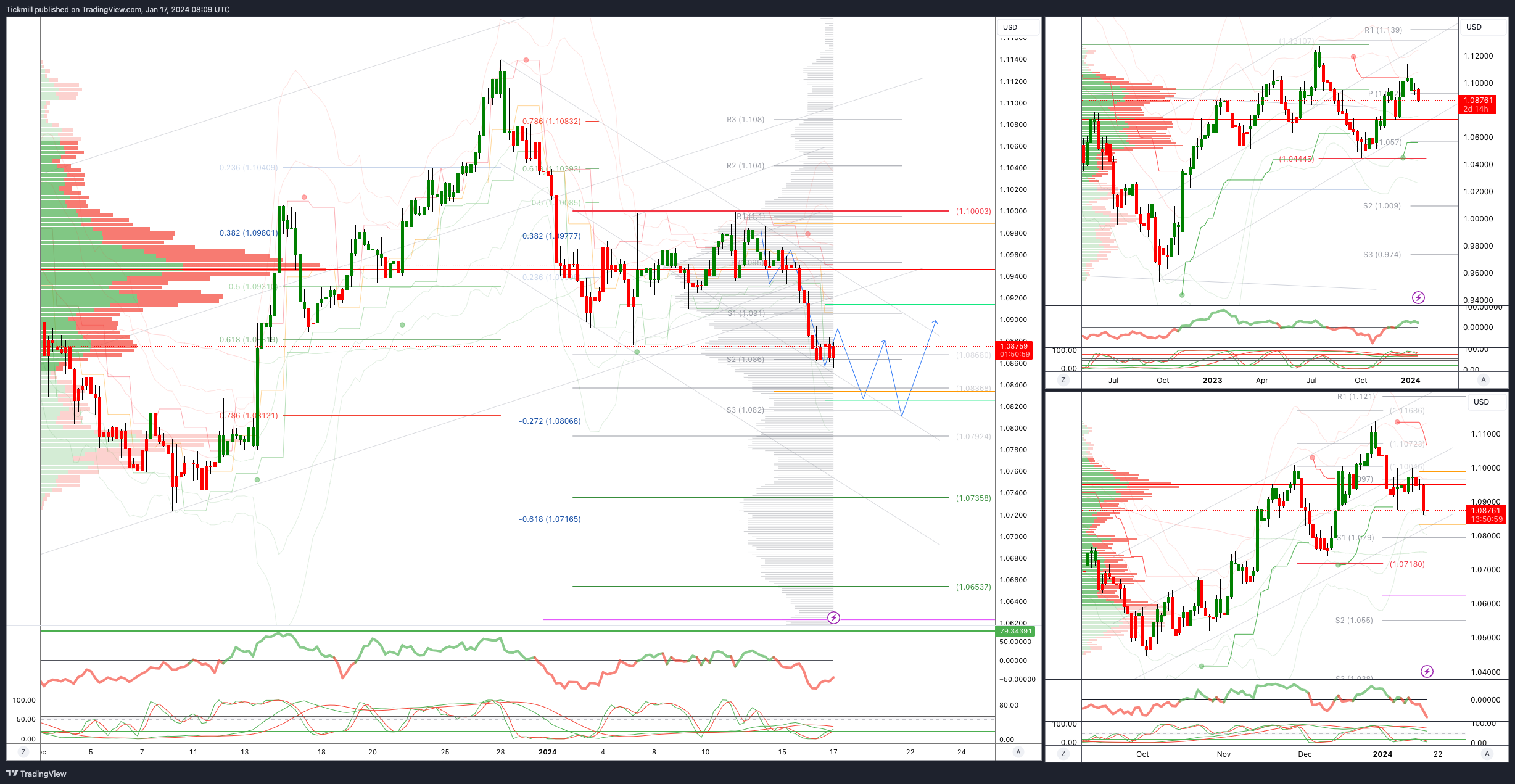

EURUSD Bullish Above Bearish Below 1.0930 - 1.0850 Target Hit - New Pattern

Daily VWAP bearish

Weekly VWAP bullish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bearish

Weekly VWAP bullish

Above 1.28 opens 1.2870

Primary resistance is 1.2820

Primary objective 1.2580

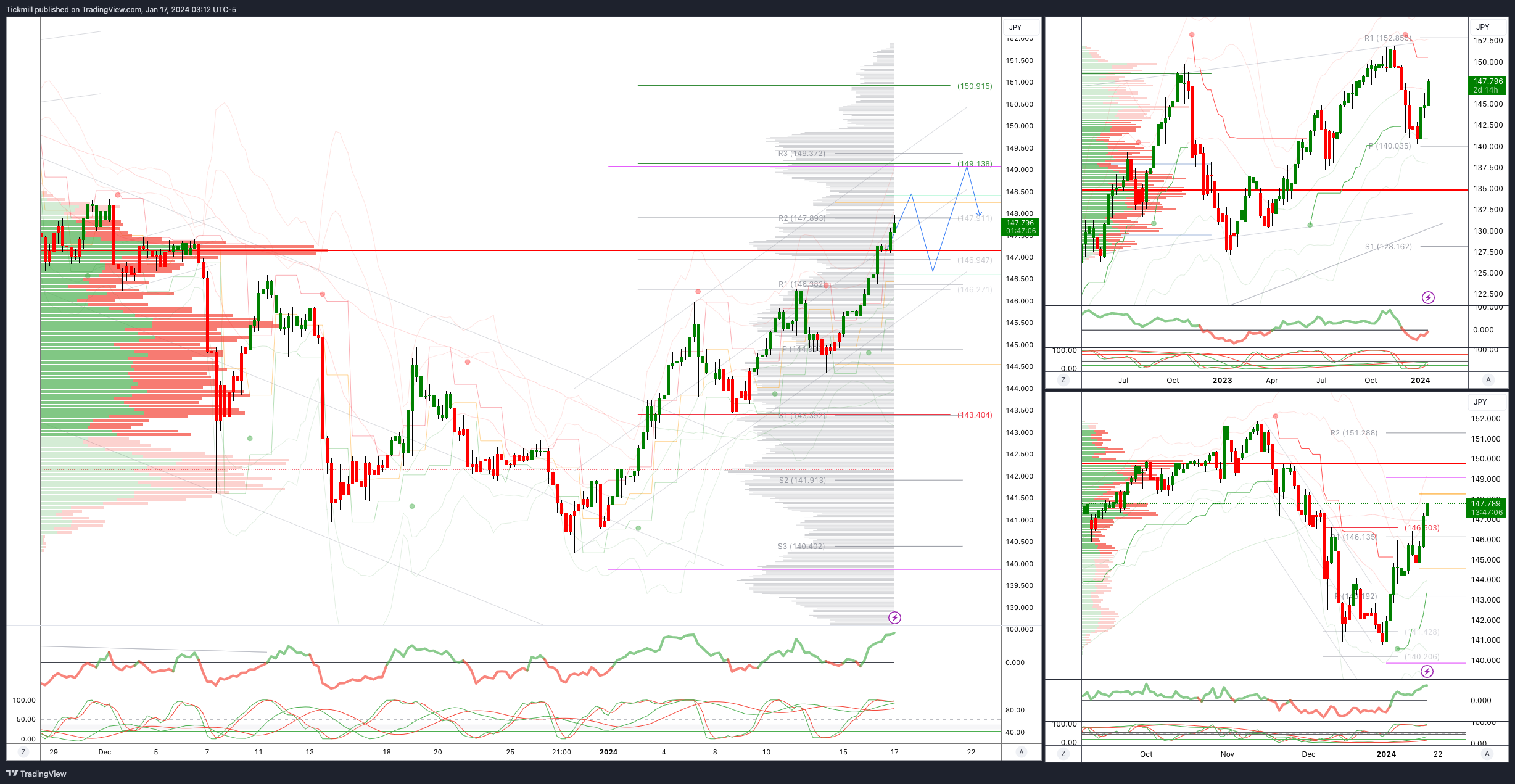

USDJPY Bullish Above Bearish Below 146.40 - 147 target Hit - New Pattern

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

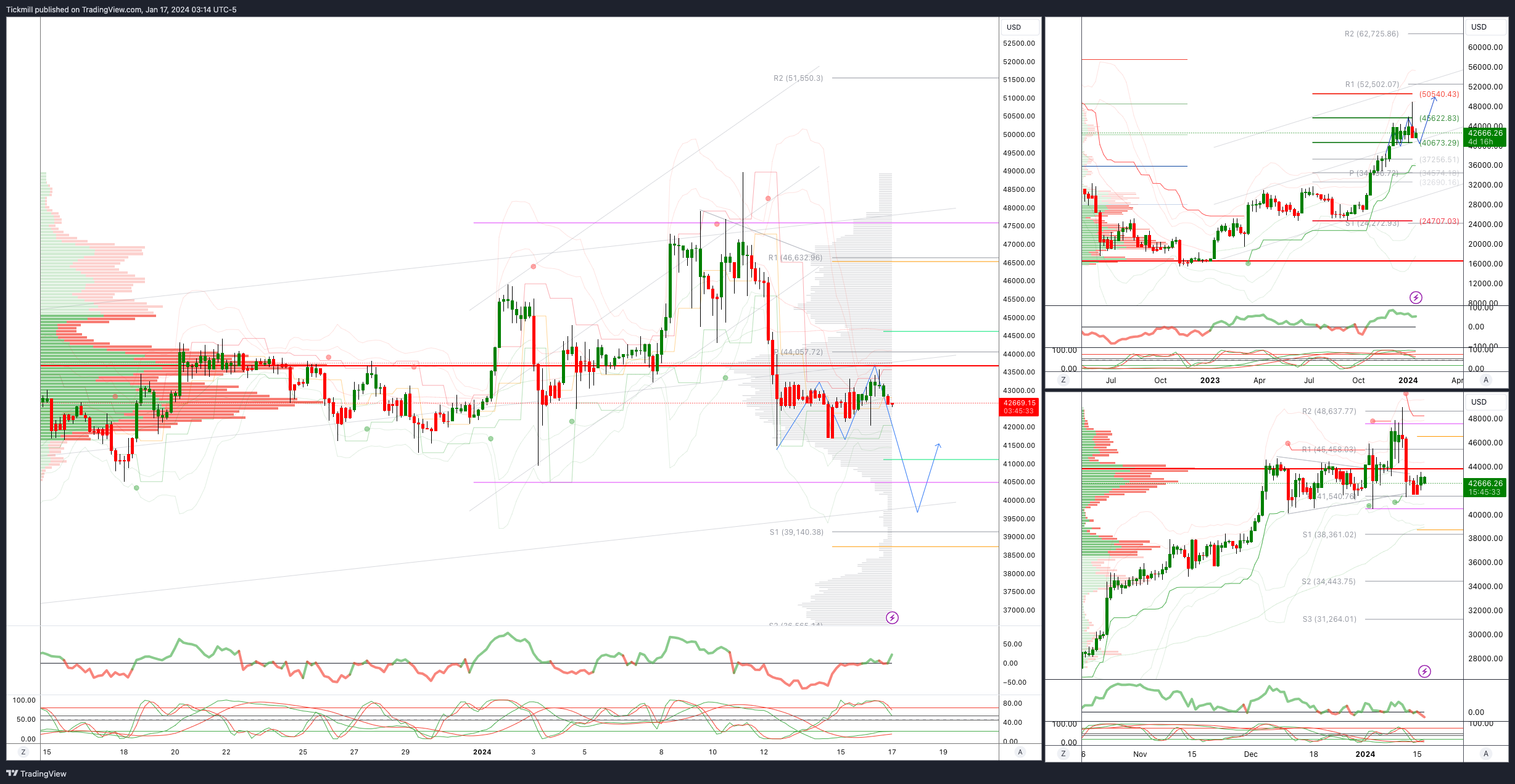

BTCUSD Bullish Above Bearish below 45200

Daily VWAP bearish

Weekly VWAP bullish

Below 45000 opens 44600

Primary support is 40000

Primary objective is 50000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!