Daily Market Outlook, January 15, 2024

Munnelly’s Market Minute…“Nikkei Tests Levels Not Seen Since 1990”

Asian stocks traded within a narrow range due to the absence of significant catalysts over the weekend. Global markets were expected to have a subdued session on Monday as a result of the extended weekend in the US. The Nikkei 225 continued its upward trend, briefly reaching the 36K handle for the first time since 1990. The Hang Seng and Shanghai Composite experienced volatility after the People's Bank of China chose not to cut its one year MLF rate. In the upcoming data-heavy week, China's Q4 GDP, December industrial production, retail sales, urban investment, unemployment, house prices, and foreign direct investment will be closely watched for their potential impact on global central bank expectations.

Last week's highly anticipated US inflation report for December showed a slight decrease in core CPI inflation to 3.9%, the lowest since May 2021. However, the headline rate, which includes food and energy prices, increased to 3.4% from 3.1%, suggesting a potentially uneven path for the inflation "last mile" decline to 2%. Despite this data and warnings from Fed officials that expectations of an early rate cut may be premature, market pricing remains inclined towards a better-than-even probability of a first rate cut in March.

This week, the focus shifts to the UK's inflation data, with today's economic data slate somewhat scant, attention will be on data from the Eurozone which should offer insights into activity trends in the area. The industrial production report for November is expected to reveal a third consecutive monthly drop in output, with a forecasted 0.3% decline. Following the data release, ECB rate-setter Holzmann is scheduled to speak at the World Economic Forum's annual gathering in Davos, where his previous comments indicated a hawkish bias. No major data releases are expected from the UK or the US today, with US markets closed for Martin Luther King Jr. day. However, the Republican caucus in Iowa will see nominees vying to be the party's representative for the 2024 US presidential election. Tomorrow morning, attention will turn to the UK's wage growth trends, providing insights into the broader inflation outlook. Forecasts suggest a further moderation in headline earnings growth to 6.6% in the three months to November, compared to 7.2% in the previous period. Similarly, regular pay growth (excluding bonuses) is expected to decline to 6.6% from 7.3%. The employment and unemployment picture, amid uncertainties and the suspension of the Labour Force Survey (LFS), will likely become clearer with a "fuller" LFS-based dataset expected in February, according to the ONS.

Overnight Newswire Updates of Note

Fed’s Bostic Warns US Progress On Inflation Is Likely To Slow

Congress Unveils Temporary Spending Bill To Avert Shutdown

US Economy To Obtain Cash Boost If Congress OKs Tax Deal

US Shoot Down Cruise Missile Fired From Houthi Area, Yemen

Yemen’s Houthi Rebels Hold Military Drills Near Saudi Border

PBoC Surprise With Key Rate Unchanged, But Add Liquidity

China's Military, Government Acquire Nvidia Despite US Ban

Taiwan Elect US-Friendly President, Defying China Warnings

ECB’s Lane Says Recalibrating Rates Too Fast Self Defeating

UK Conservatives Facing 1997-Style General Election Wipeout

UK Housing Market Heats Up With Strong Jump In Asking Prices

Commerzbank Merger Talk Return As State Mulls Company Sales

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0885-90 (1.8BLN), 1.0950 (1.3BLN), 1.1000 (1.3BLN), 1.1050 (3BLN)

GBP/USD: 1.2710 (437M), 1.2775 (260M)

AUD/USD: 0.6690 (637M). 0.6720 (268M)

NZD/USD: 0.6175 (633M), 0.6195 (581M), 0.6210 (200M)

USD/JPY: 144.00 (644M) 145.00 (730M), 145.70-80 (340M)

FX implied volatility is currently at new lows for 2024, leading to familiar ranges in the FX market since Thursday's U.S. CPI data. This environment is not conducive to holding options, especially with an extended U.S. bank holiday weekend. Benchmark one-month expiry implied volatility is at new lows in all major currency pairs. Some options, such as one-month EUR/USD, USD/CHF, and GBP/USD, may offer value compared to measures of one-month daily realized volatility, but this value depends on realized FX volatility performance over the next month. Concerns about aggressive rate cut pricing could benefit currencies like EUR, GBP, and AUD if recent forecasts are accurate. Risk reversal options in major currency pairs show a decrease in USD put-over call premiums, indicating a lower perceived risk of USD strength-driven volatility.

CFTC Data As Of 12/01/24

USD bearish increasing 12,192

CAD bearish decreasing -551

EUR bullish neutral 16,243

GBP bullish increasing 1,647

AUD bearish decreasing -2,158

NZD neutral neutral -110

MXN bullish neutral 2,606

CHF bearish neutral -644

JPY bearish neutral -4,841

Technical & Trade Views

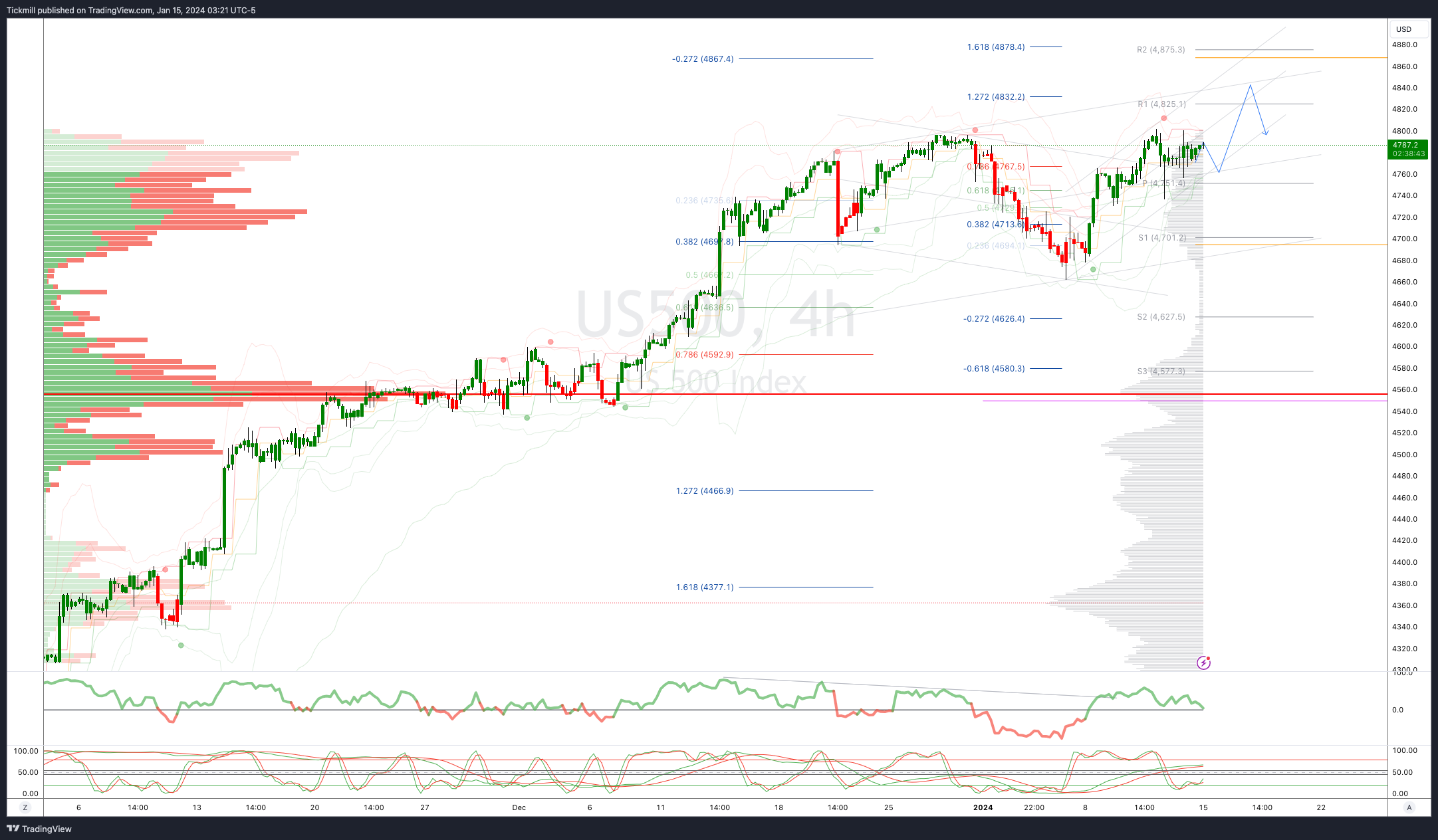

SP500 Bullish Above Bearish Below 4750

Daily VWAP bullish

Weekly VWAP bullish

Below 4730 opens 4700

Primary support 4670

Primary objective is 4830

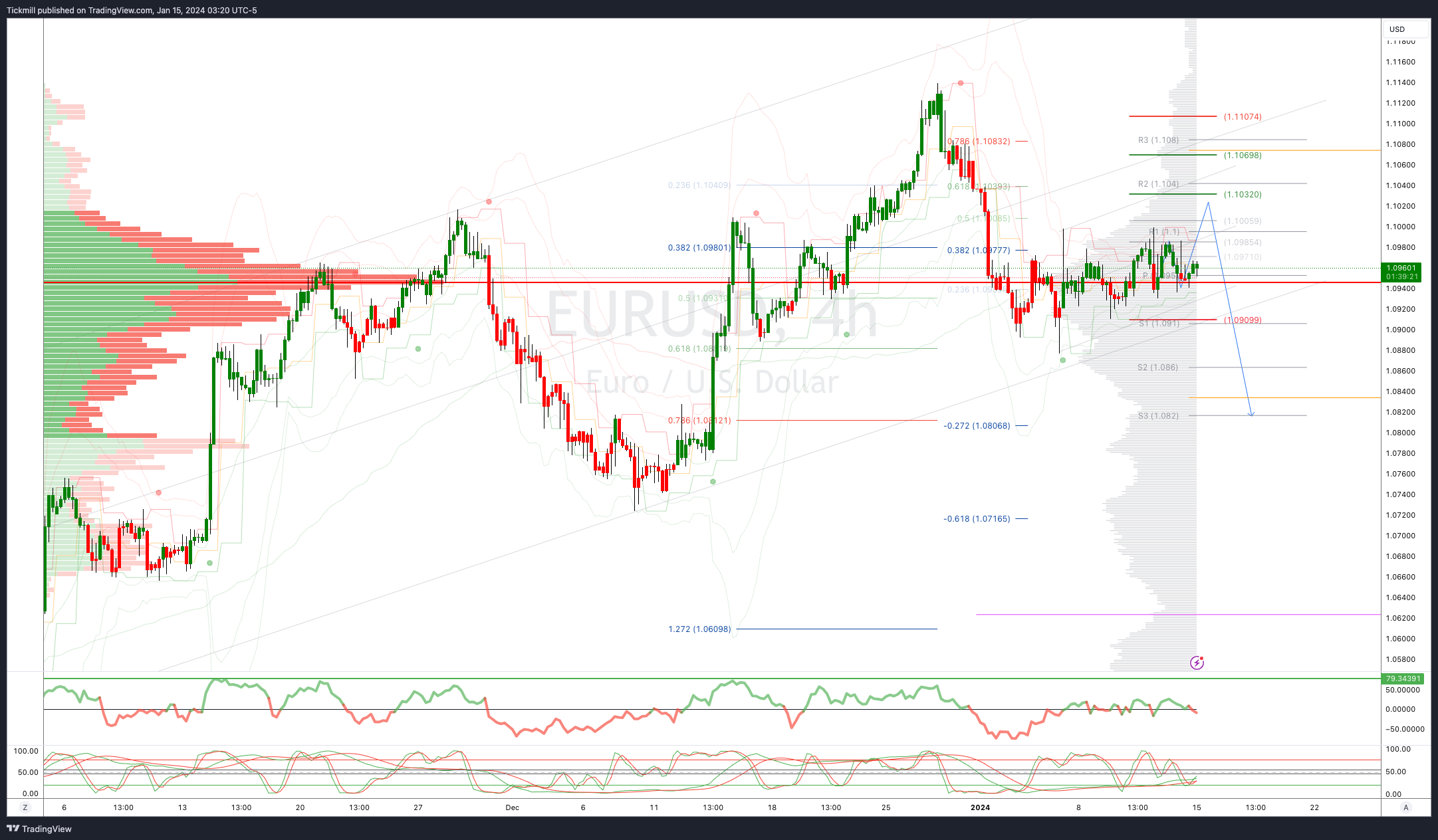

EURUSD Bullish Above Bearish Below 1.1030

Daily VWAP bullish

Weekly VWAP bullish

Above 1.1030 opens 1.1070/80

Primary resistance 1.1130

Primary objective is 1.0850

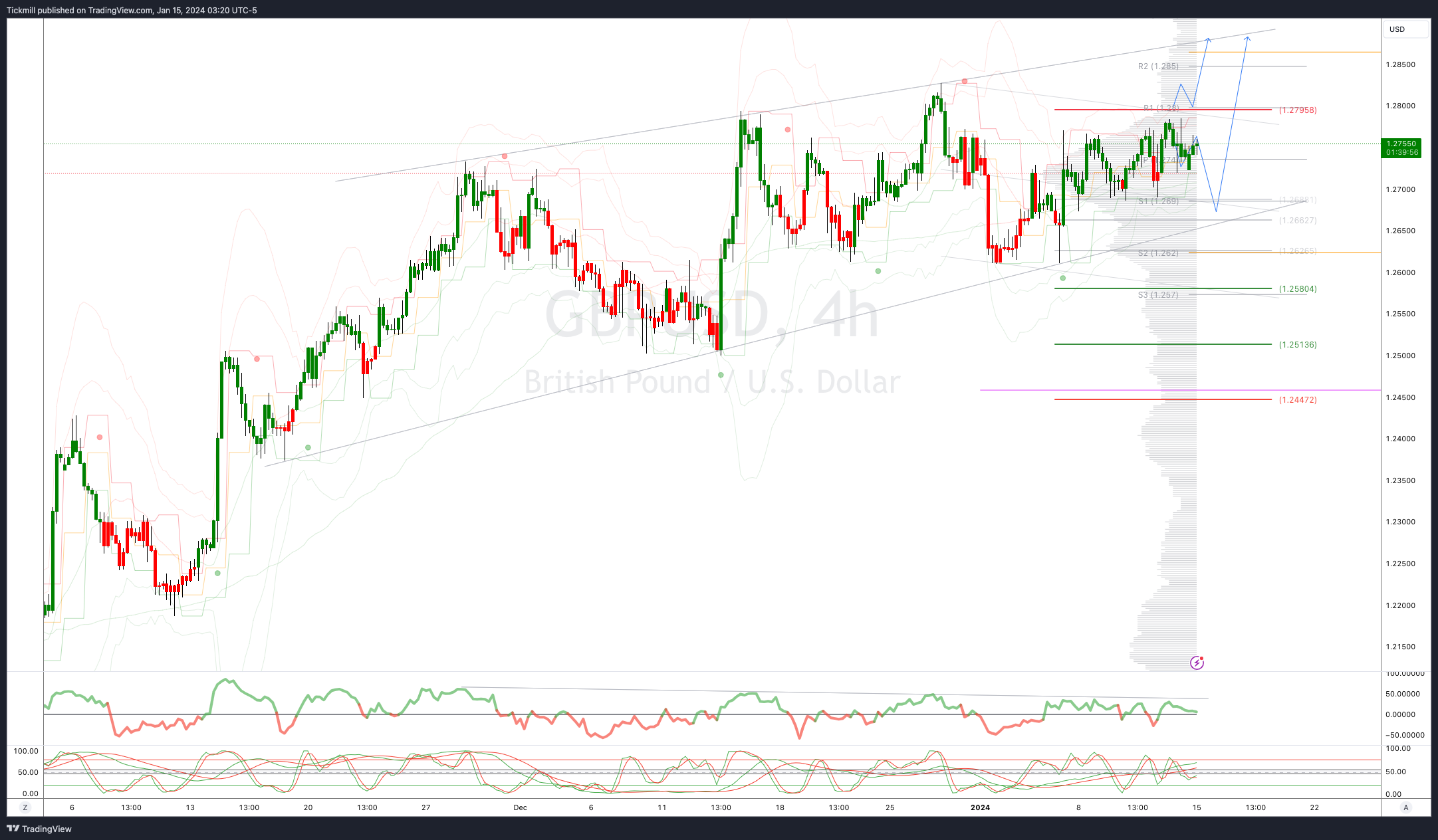

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bullish

Above 1.28 opens 1.2870

Primary resistance is 1.2820

Primary objective 1.2580

USDJPY Bullish Above Bearish Below 144

Daily VWAP bullish

Weekly VWAP bullish

Below 143.50 opens 142.50

Primary support 142.50

Primary objective is 147

AUDUSD Bullish Above Bearish Below .6750

Daily VWAP bearish

Weekly VWAP bearish

Below .6660 opens .6550

Primary support .6525

Primary objective is .6933

BTCUSD Bullish Above Bearish below 45200

Daily VWAP bearish

Weekly VWAP bullish

Below 45000 opens 44600

Primary support is 40000

Primary objective is 50000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!