Daily Market Outlook, February 7, 2024

Munnelly’s Market Minute…“FedSpeakers On Deck, With A Scant Data Docket”

Asian stocks were mostly positive due to a decline in global yields and further Chinese support efforts. Nikkei 225 was indecisive due to a slew of earnings and with the BoJ reportedly on track for a policy shift by April. Hang Seng and Shanghai Comp were mixed despite early momentum following the latest support efforts from China, targeting real estate financing and new energy vehicles. Chinese stocks gradually faded some of their initial gains, and the Hong Kong benchmark ultimately turned negative.

Today, Fedspeak dominates discussions as major data releases are scant, except for the US trade balance. German industrial production figures for December, released earlier this morning, underscored ongoing pressure on the sector. Industrial output in Europe’s largest economy contracted by 1.6%, surpassing forecasts for a bigger drop, resulting in production levels 3.0% lower than a year ago. This weakness contributed to the latest estimate of a 0.3% quarter-on-quarter decline in German GDP in the final quarter of 2023. The Eurozone's overall picture appears mixed, with France reporting an increase in industrial production for December last week. Spanish industrial data are expected this morning.

In the UK, no major releases are scheduled for today. However, the RICS will update its survey of the housing sector overnight. In December, the net balance of surveyors reporting higher house prices remained negative at -30%, but it was the least negative balance in over a year, aided by lower mortgage rates. Market expectations anticipate a further improvement in the net balance in January to around -22%, marking a fifth consecutive month of improvement.

Overnight, China will release inflation data. China's inflation dynamics differ from those in the US and Europe, with CPI inflation expected to remain weak and stay negative, partly due to subdued demand in the economy. Markets forecast annual CPI to be -0.5% in January, down from -0.3% in December, and for producer price inflation to remain largely unchanged at -2.6%.

Stateside, the December trade balance is anticipated to narrow to around $62 billion. Alongside, several Fed speakers, including Kugler, Collins, Barkin, and Bowman, are scheduled to appear at various events today. Their perspectives on the economic and policy outlook will be notable, but consensus suggests it's premature to declare victory on inflation. Recent robust US data also indicate that a March rate cut is now improbable. The United States Treasury will sell $42bln of 10yr notes, after selling 3s on Tuesday.

Overnight Newswire Updates of Note

ECB’s Schnabel: Lower Borrowing Costs Risk ‘Flare-Up’ Of Inflation

UK MPs Sound Alarm Over Fiscal Cost Of Unwinding Quantitative Easing

UK May Have Slipped Into Recession In Late 2023, Think-Tank Estimates

UK To Wave Through Animal Products From EU If Ports Are Overwhelmed

Fed's Harker Says A 'Soft Landing' Is In Sight As Inflation Wanes

Fed’s Mester Warns Against Cutting Interest Rates Too Soon And Too Quickly

Fed’s Kashkari Says Need To See More Progress On Inflation

Israel Aid Bill Fails In US House As Ukraine Standoff Deepens

Bank Of Canada Chief Says Rates Can’t Fix High Housing Costs

China To Help NEV Industry Respond To Foreign Trade Restrictions

Saudi Says No Israeli Ties Unless Gaza ‘Aggression’ Halted

Ford Tops Q4 Estimates, Guides Toward Strong 2024

Amgen Q4 Revenue Surges As Acquisition Boosts Results

NYCB Extends $4.5 Bln Stock Rout To Lowest Level Since 1997

NYCB’s Credit Rating Downgraded To Junk On Real Estate Concerns

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0725 (1.2BLN), 1.0800 (559M)

GBP/USD: 1.2600 (220M), 1.2660 (273M), 1.2750 (345M)

AUD/USD: 0.6450 (548M)

USD/CAD: 1.3500 (434M)

USD/JPY: 147.00 (1.1BLN), 147.75 (370M)

EUR/JPY: 157.50 (260M), 158.00 (300M)

The USD's rise has led to lower FX option trade volumes and reduced implied volatility and premiums. Demand and prices are higher for certain options, including those expiring around the February 13 U.S. CPI data and the May 1 U.S. Federal Reserve policy decision. There is also interest in buying USD/JPY options ahead of Bank of Japan policy meetings. The lack of demand for outright USD calls against most G10 currencies suggests a belief that further USD gains will be slow and limited.

CFTC Data As Of 2/02/24

USD bearish neutral -5,618

CAD neutral neutral -178

EUR bullish neutral 12,034

GBP bullish neutral 2,711 218

AUD bearish increasing -3,849

NZD neutral neutral -64

MXN bullish neutral 2,343

CHF bearish neutral -566

JPY bearish increasing -6,813

Technical & Trade Views

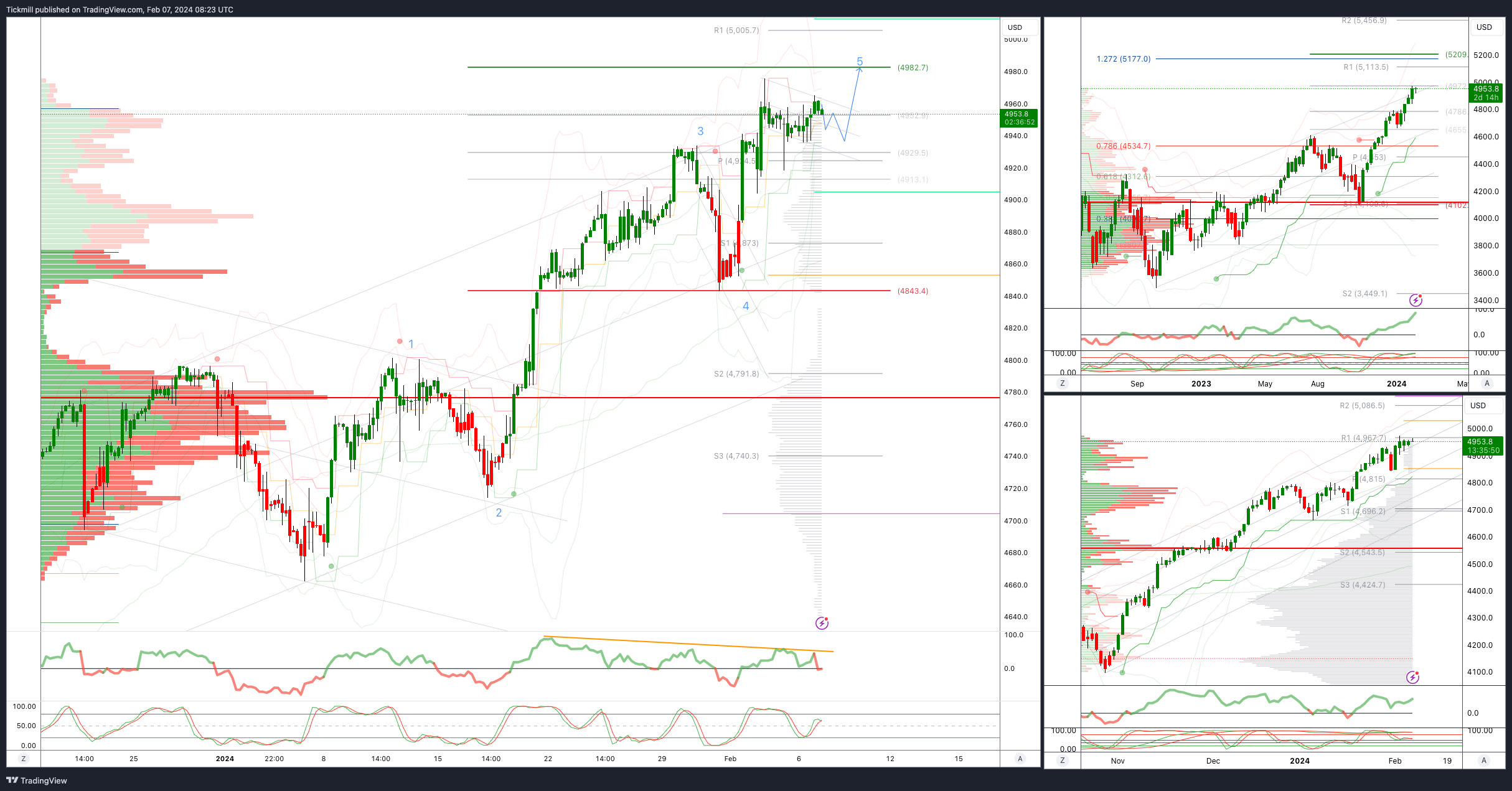

SP500 Bullish Above Bearish Below 4940

Daily VWAP bullish

Weekly VWAP bullish

Below 4900 opens 4800

Primary support 4800

Primary objective is 4981

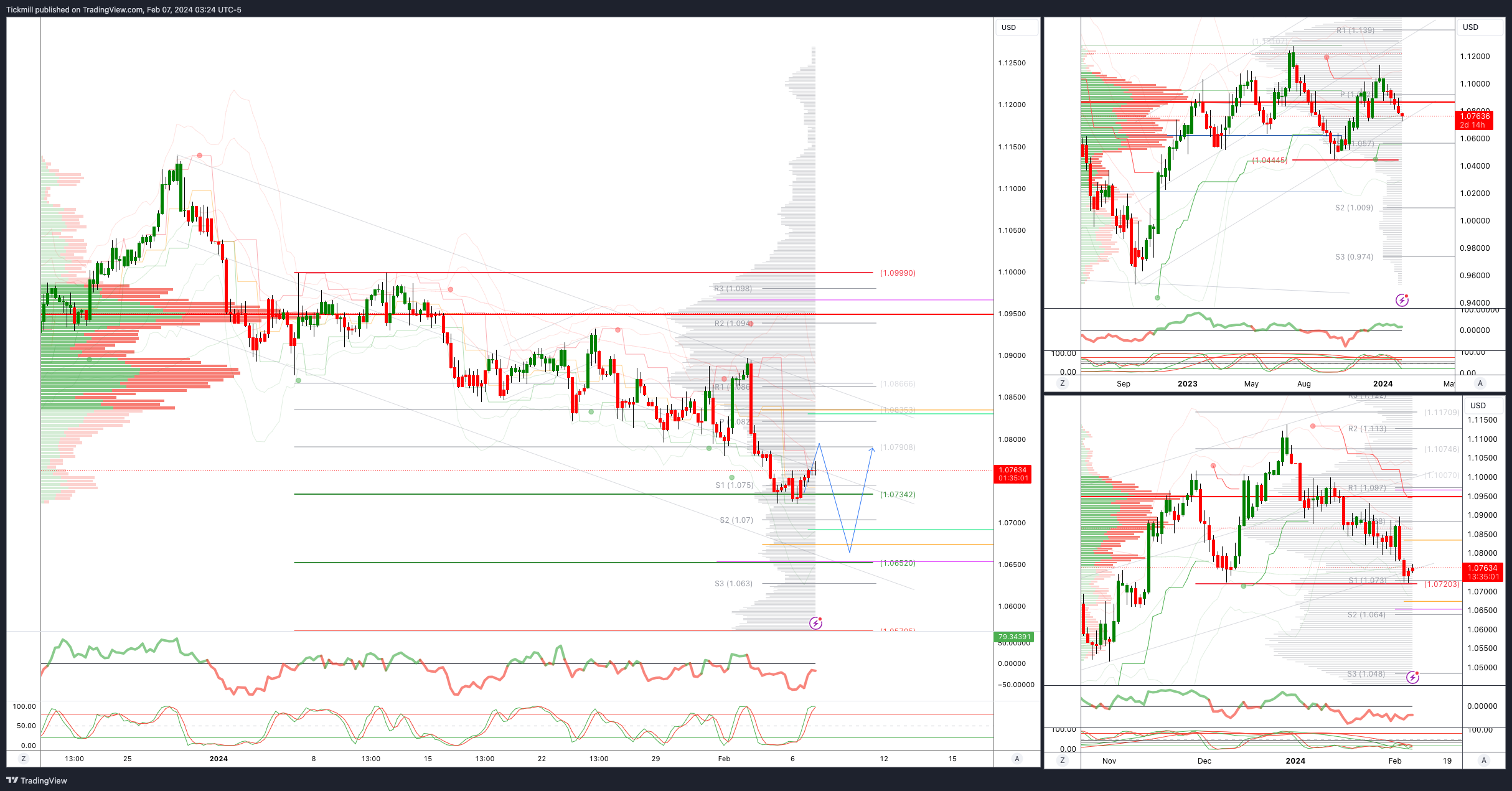

EURUSD Bullish Above Bearish Below 1.0830

Daily VWAP bearish

Weekly VWAP bearish

Above 1.109 opens 1.10

Primary resistance 1.0950

Primary objective is 1.0650

GBPUSD Bullish Above Bearish Below 1.2660

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2570 - Target Hit New Pattern Emerging

USDJPY Bullish Above Bearish Below 147.50

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149.13

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

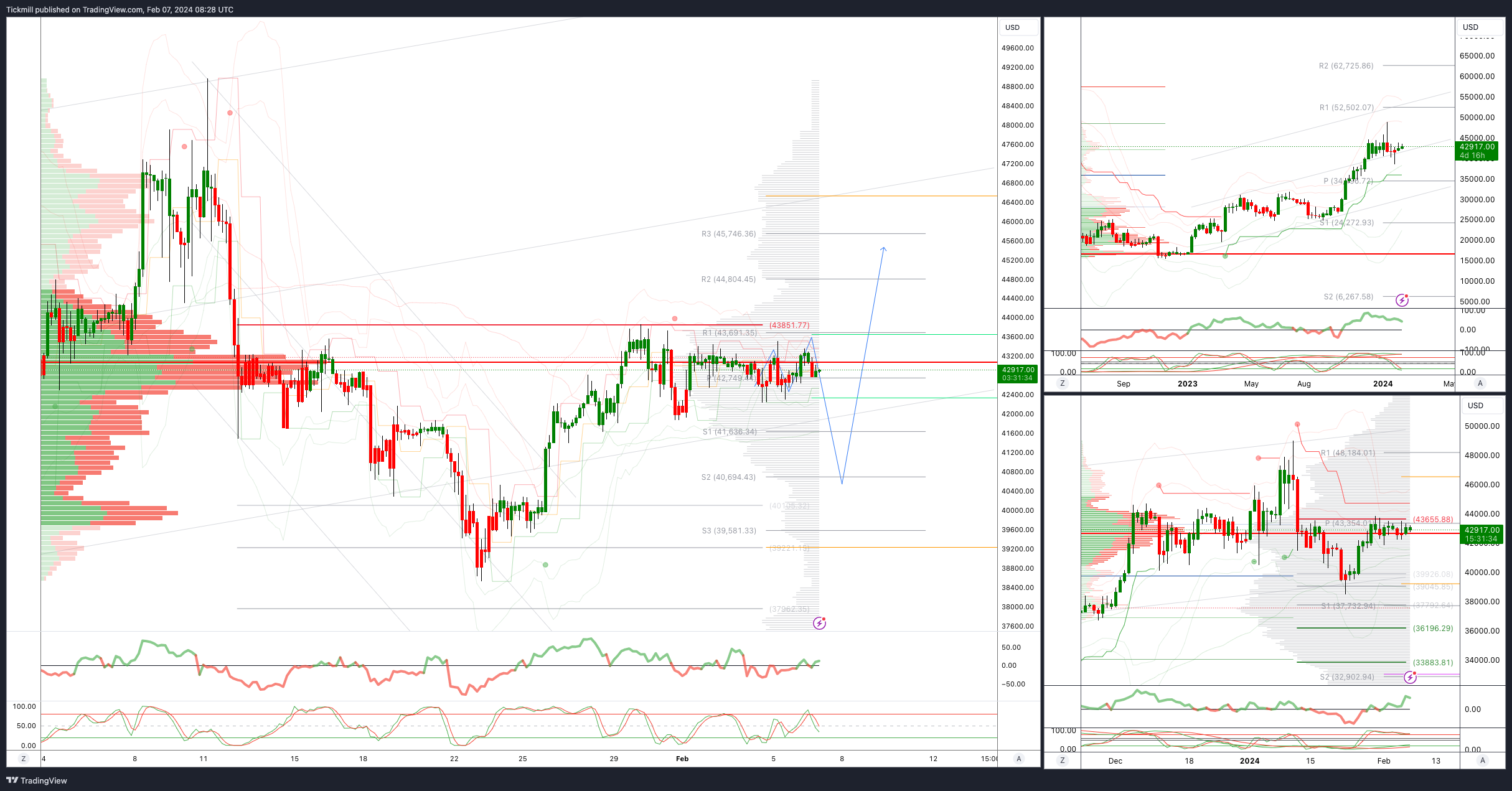

BTCUSD Bullish Above Bearish below 43850

Daily VWAP bullish

Weekly VWAP bullish

Above 43600 opens 44700

Primary resistance is 44700

Primary objective is 44700

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!