Daily Market Outlook, February 7, 2022

.png)

Daily Market Outlook, February 7, 2022

Overnight Headlines

- Lawmakers Signal Stopgap Spending Bill Needed As Talks Continue

- House Passes Chips Bill As Republicans Air Soft-On-China Gripes

- US Restores Sanctions Waiver To Iran, Nuclear Talks In Final Phase

- White House Warns Russian Attack On Ukraine Possible 'Any Day'

- ECB's Knot Sees First Interest Rate Hike In Fourth Quarter Of 2022

- Boris Johnson Seeks Reset Over 'Partygate' With Time Running Out

- Chinese Services Activity Expands At Slowest Rate In Five Months

- Australia Posts Record Quarterly Retail Sales In A Boost To GDP

- Chinese Stocks Head For Best Post-Lunar Holiday Gain Since 2019

- Amazon And Nike Are Evaluating Separate Bids To Buy Peloton

- Oil Turns Higher On Tight Supply Fears, Shrugging Off Iran Talks

The Week Ahead

- U.S. January consumer inflation data is squarely in focus after Treasury yields rose to two-year highs on Friday, as inflation concerns force major central banks to make a hawkish pivot.

- Core CPI is expected to rise 5.9% year-on-year from 5.5% in December. A hotter-than-expected inflation reading on Thursday will likely fuel hawkish Federal Reserve expectations, sending U.S. bond yields higher and possibly cause more volatility in equity markets. Other data out of the U.S. includes December trade numbers and preliminary February University of Michigan consumer sentiment.

- In Europe the focus will be on German data, which includes industrial production, trade and current account – as well as CPI. Markets will also monitor comments from European Central Bank officials after President Christine Lagarde's hawkish surprise last week. It will be a busier week for UK data, with IP, trade balance and Q4 GDP on tap.

- China reopens after a week-long holiday, with Caixin services PMI and FX reserves due. January credit data may also be released this week. Japan data includes trade balance, current account and household spending.

- Australia NAB business survey is due later in the week. New Zealand has no top-tier data this week while Canada's calendar is limited to trade data.

CFTC Data

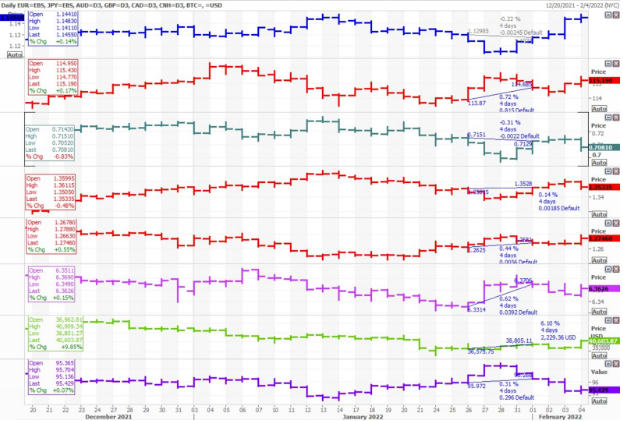

- USD net spec long dips; JPY, AUD shorts trimmed, GBP short grows - 04 Feb 2022

- USD net spec long reduced in Jan 26-Feb 1 period, $IDX +0.31%

- EUR specs sold 1,844 contracts now long 29,716; EUR was down 0.22% in period

- Yen specs cut USD long, +7,633 contracts amid USD rise of 0.72% in period

- GBP sold hard despite GBP$ flattish in period, specs -15,842 contracts

- AUD specs +3,444 contracts, AUD$ -0.31%; CAD spec long increased to +18,264

- BTC buyers bottom-fish, position flips to +141 as specs buy 175 contracts

- Data dated as EUR, USD rallied after Thursday ECB hawkish lean; US NFP beat

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.1200-15 (412M), 1.1300 (275M), 1.1360 (292M) 1.1500 (667M)

- USD/JPY: 114.50 (930M), 115.00 (572M), 115.65-70 (550M) 16.00 (259M). GBP/USD: 1.3400 (649M)

- EUR/JPY: 127.05 (378M). AUD/USD: 0.7080 (259M) 0.7100 (210M).

- NZD/USD 0.6700 (368M)

- AUD/NZD: 1.0600 (1.36BLN)

- USD/CAD: 1.2440-50 (710M), 1.2690 (269M), 1.2730-40 (630M) 1.2760 (220M)

- EUR/NOK: 10.00 (400M), 10.0700 (375M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- EUR/USD dip – buyers are banking on 1.1426 to hold

- EUR/USD dips to 1.1432 from Fri close 1.1451; pivotal

- If 100 DMA support at 1.1426 holds, EUR might bounce

- That would also keep Bollinger uptrend channel intact

- But a close above 1.1439 more convincing

- That would also place it back above 50% retracement line

- UST yields ebbing after NFP-induced surge; 10y 1.901%

GBPUSD Bias: Bearish below 1.36 Bullish above.

- GBP does little in Asia, on hold against other major currencies

- Cable 1.3517-40, still trading tad heavy, above 1.3500, 1.3504 low Friday

- Descending 100-DMA at 1.3509, Ichi cloud below between 0.3375-1.3495

- 200-HMA at 1.3488, extent of any further downside for now?

- GBP591 mln 1.3400 option expiries today, well below current levels

- Tomorrow to see 1.3500-10 GBP868 mln, 1.3560 1.45 bln, to help contain?

- Recent push up in UK yields supportive, Gilt 10s @1.410%

- GBP/JPY 155.72-156.09, relatively buoyant amidst broad JPY weakness

- On hold between 157.76 top Jan 5, 153.00-34

- EUR/GBP relatively bid, Asia 0.8455-63

- ECB Pres Lagarde talk tonight a major focus going forward

USDJPY Bias: Bullish above 114.50 Bearish below

- USD/JPY sees good two – way flows into/post – Tokyo fix

- USD/JPY on back foot early with Nikkei off 350+ pts after TSE open

- From 115.32 to 115.14 on in tandem with the Nikkei

- Nikkei since seeing some bounce, good Tokyo fix demand, USD/JPY to 115.33

- Pair still relatively bid, good demand seen on dips from various players

- Upside still limited on Japanese exporter, spec long offers

- Decent amounts tipped at 115.50, 60, 70, trailing higher

- $550 mln option expiries at 115.65-70 strikes too

AUDUSD Bias: Bearish below 0.7250 Bullish above

- Slips lower as USD attains bid tone in Asia

- AUD/USD opened around 0.7075/80 after falling 0.88% after US jobs data...

- After trading at 0.7070 it rebounded to 0.7084 on light AUD/JPY demand

- Later in the morning the EUR/USD fell and AUD/USD eased to 0.7065/70

- It is at the session low heading into the afternoon

- E-mini futures are 0.35% lower and underpinning USD sentiment

- Resistance is at the 10-day MA at 0.7091 and 55-day MA at 0.7166

- Support is at Friday's 0.7050 low and break may see a test below 0.7000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!