Daily Market Outlook, February 2, 2024

Munnelly’s Market Minute…“Mega Tech Earnings Boost Equities, Focus Shifts To Jobs Data”

Prior to the release of the monthly US labor report later today, most equity markets in the Asia-Pacific region are experiencing gains. This is due to strong performances in the tech sector after the US market closed,both Amazon (AMZN) and Meta Platforms (META) saw significant increases in their stock prices following their earnings reports on Thursday. as well as optimism about a global economic soft landing and expectations of impending interest rate cuts despite central banks advocating for patience.

Today, the focus is on the US labor market report for January, following the recent policy updates from the Fed and the Bank of England. Both central banks hinted at potential interest rate reductions, with the Fed being more proactive in this respect. However, they also emphasized the need for further evidence on inflation progress before making any decisions. It is likely that any rate cuts will be gradual, in contrast to the rate hikes of the past few years.

The forecast for today's US nonfarm payrolls suggests a rise of 200k in January, slightly higher than the consensus forecast of 185k. While this is a slight decrease from December's 216k, it still indicates solid job growth. Some analysts have mentioned the unusually cold weather in January as a potential downside risk to these forecasts. The unemployment rate is expected to remain at 3.7%, and the annual wage growth rate is anticipated to stay at 4.1%. Overall, the US labor market remains strong, supporting the case for the Fed to approach interest rates cautiously, as indicated by Chair Powell.Market expectations for a March rate cut by the Fed have slightly decreased, with a probability of about 1-in-3 at present. However, a rate cut in May is fully expected, with around 150bps of reductions anticipated by 2024.

In the UK, a potential first rate cut by the BoE is not fully priced in until June, with expectations of just over 100bps of reductions this year, less than those anticipated for the Fed and the ECB. BoE Chief Economist Pill is scheduled to speak today, which may provide further insights into the UK interest rate outlook. ECB’s Centeno, the Governor of the Bank of Portugal, is also scheduled to speak this morning.

Overnight Newswire Updates of Note

Japan's Govt Interest Costs Seen More Than Doubling Over Next Decade

N. Korea Fires Several Cruise Missiles Off West Coast

Fed’s Powell Will Discuss Interest Rates, Inflation On 60 Minutes Sunday

Bank Term Funding Borrowings Edge Lower After Fed Raised Rate

IMF Chief Says Fed Rate Cuts Are Better Late Than Early

BoC’s Macklem Cites Bond Demand As Source Of Canada Repo Stress

JPMorgan Says Exit Five-Year Treasury Bets, Bank Angst Overdone

Meta Shares Jump As Investors Cheer Dividend And $50 Bln Buyback

Apple Revenue Boosted By iPhone Sales And Record Services Growth

Amazon Quarterly Sales Surge On Strong Holiday Shopping

Intel Delays $20 Bln Ohio Project, Citing Slow Chip Market

SK Hynix Favours Indiana Over Arizona For $15 Bln Chip Site

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0700 (455M), 1.0750-55 (500M)

1.0875-80 (300M)

USD/JPY: 144.00 (381M), 145.00 (585M),

146.00 (253M), 147.00 (269M), 148.25 (200M)

148.50-65 (749M)

EUR/JPY: 159.50 (200M), 161.50 (335M)

AUD/USD: 0.6550 (200M), 0.6670 (200M), 0.6680-90 (359M)

NZD/USD: 0.6080 (941M)

USD/CAD: 1.3285-00 (697M), 1.3310-20 (1.26BLN)

1.3330 (480M), 1.3345-55 (509M)

USD/ZAR: 18.9700 (445M)

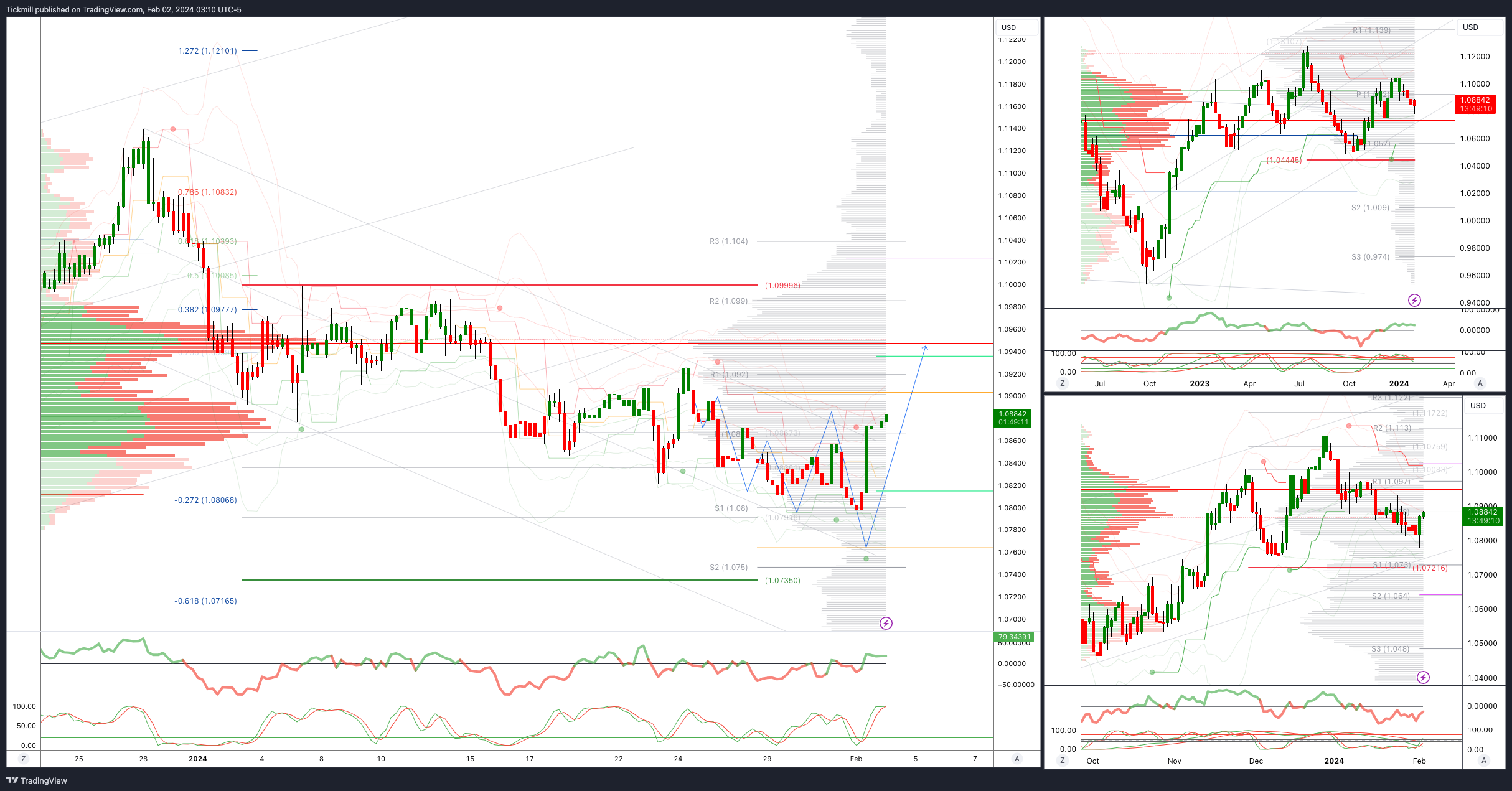

The rally in EUR/USD has the potential to reach 1.1200. Traders significantly reduced their bets on a rise after the drop from the peak of 1.1139 on December 28. Bets on a rise almost halved before the drop this week. The pair was oversold at the low of 1.0780 on Thursday, but then jumped to 1.0887 ahead of the NFP data. Declines in gas and oil prices are providing support for EUR/USD. A familiar pattern is indicating a significant increase.

CFTC Data As Of 12/01/24

USD bearish increasing -9,298

CAD bearish increasing -992

EUR bullish decreasing 14,150

GBP bullish increasing 2,443

AUD bearish increasing -3,151

NZD neutral neutral -177

MXN bullish neutral 2,370

CHF bearish neutral -542

JPY bearish neutral -4,803

Technical & Trade Views

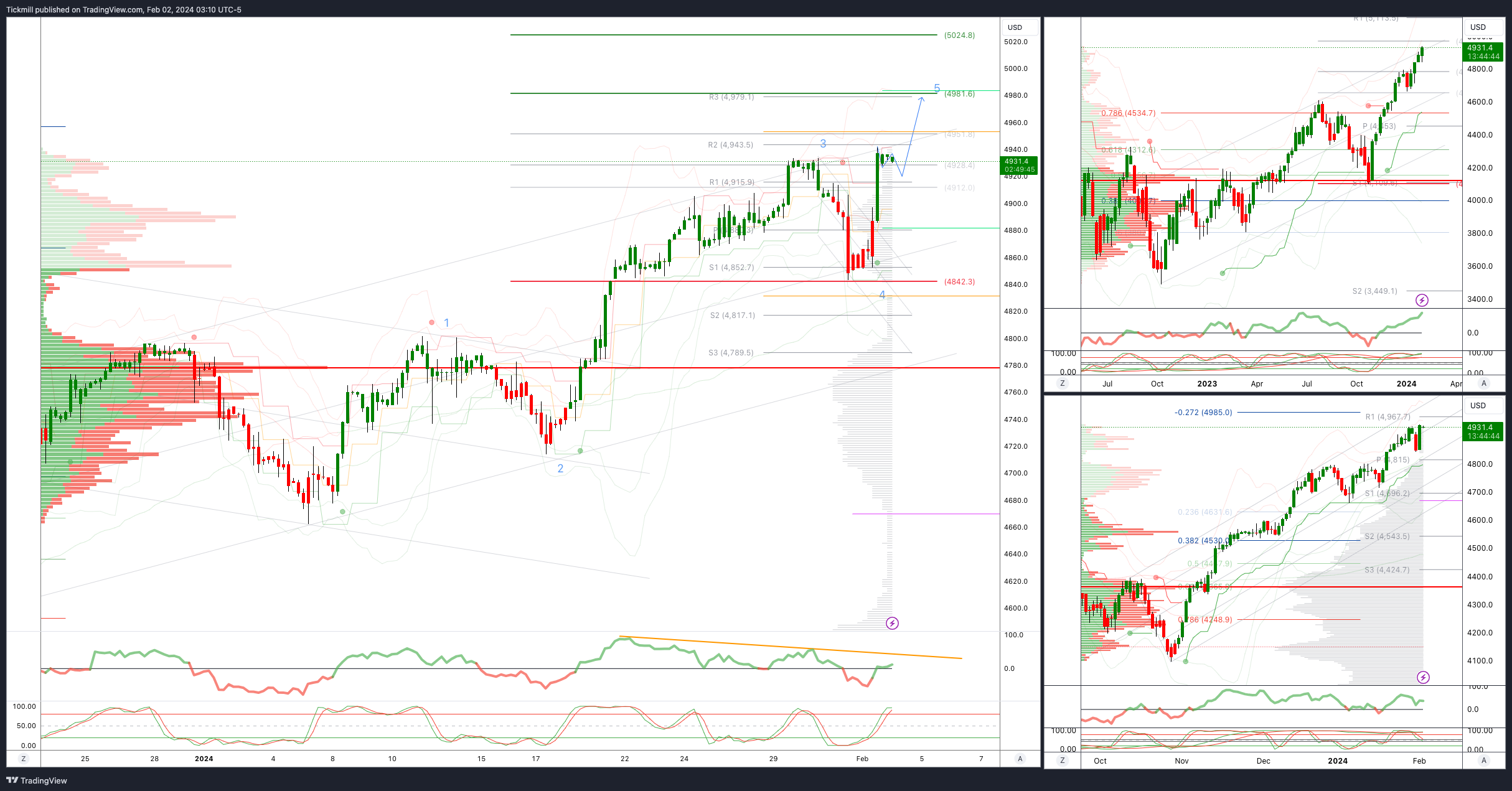

SP500 Bullish Above Bearish Below 4900

Daily VWAP bearish

Weekly VWAP bullish

Below 4900 opens 4800

Primary support 4800

Primary objective is 4981

EURUSD Bullish Above Bearish Below 1.0875

Daily VWAP bullish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

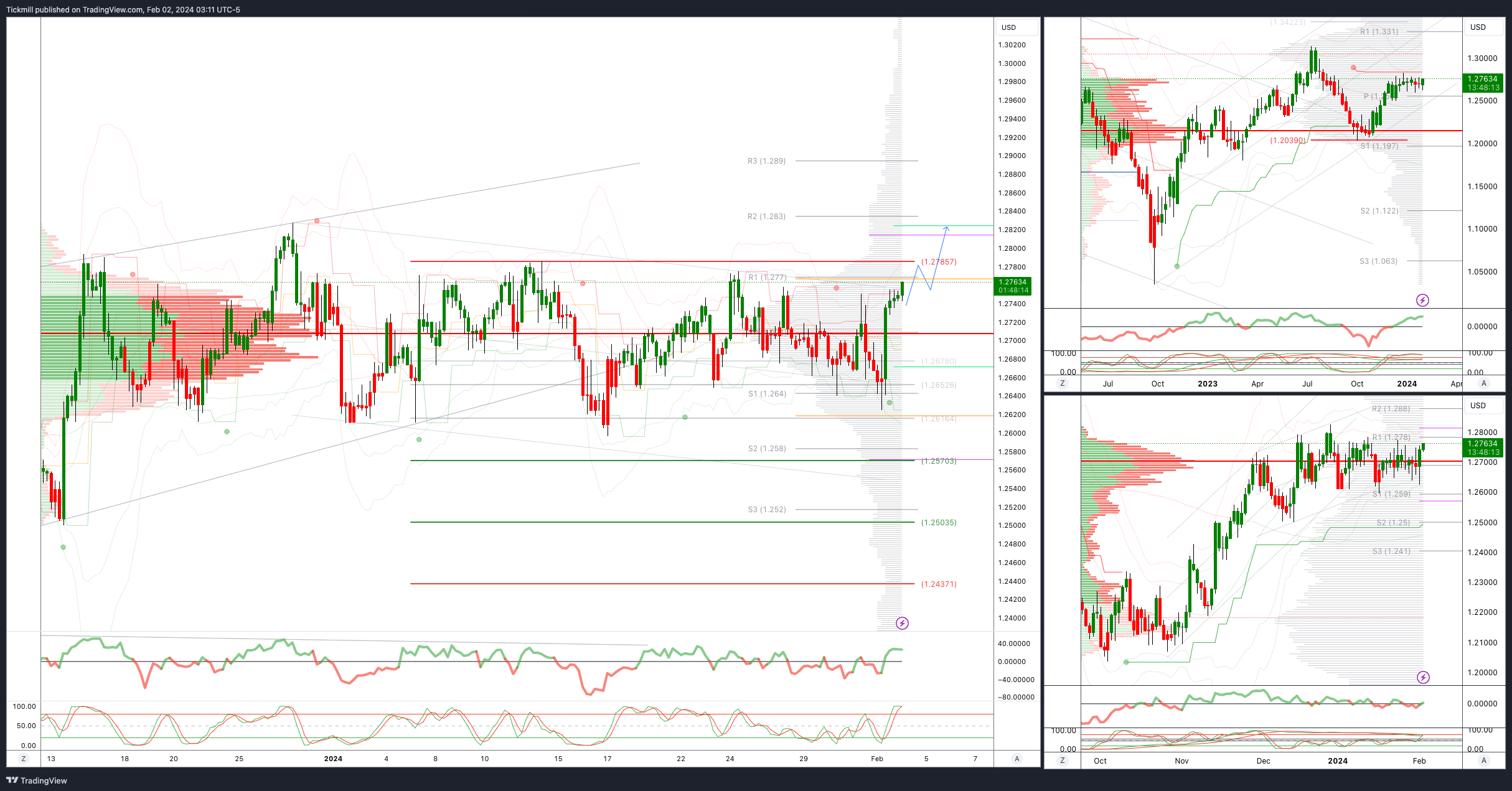

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bullish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

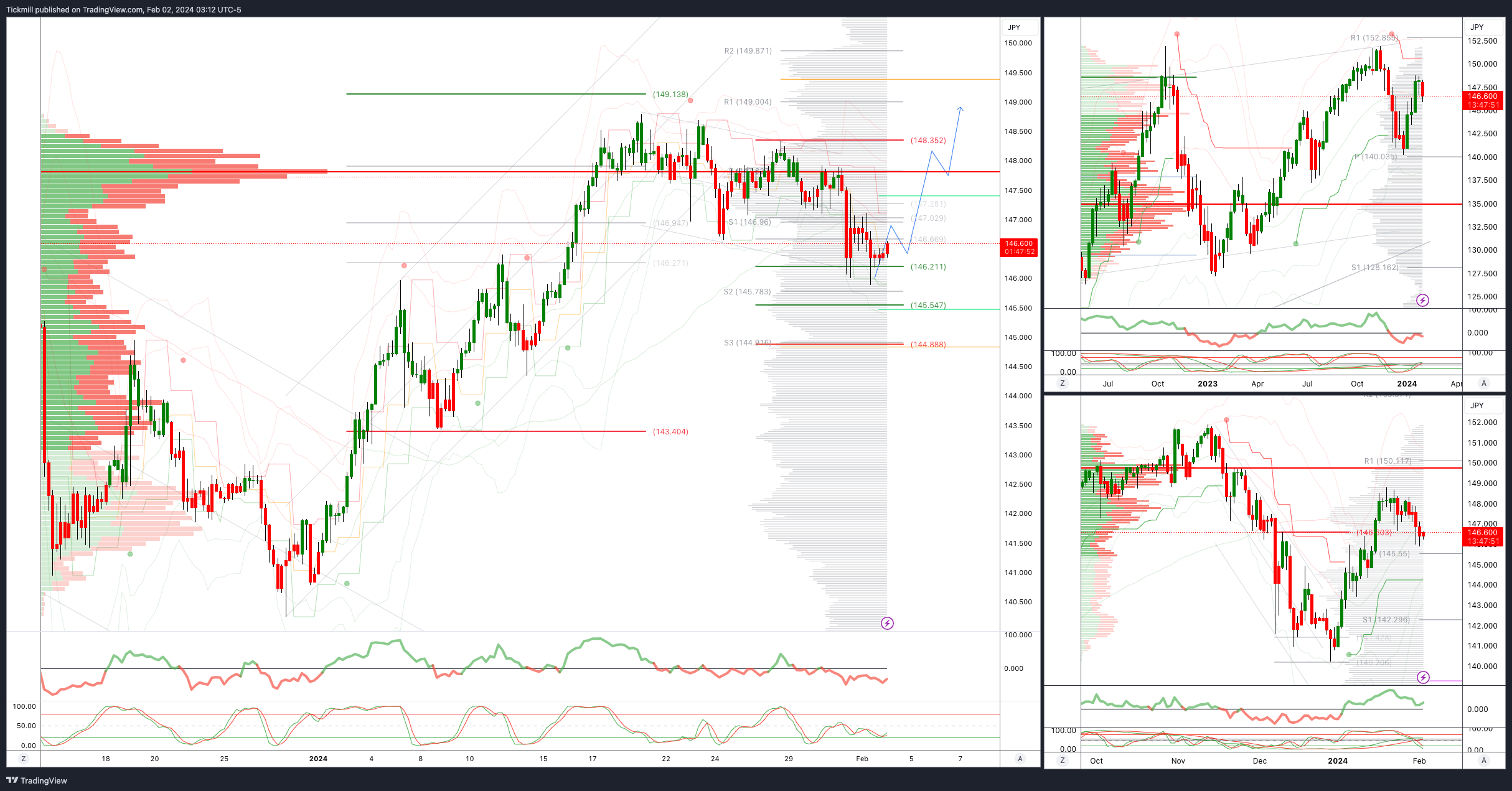

USDJPY Bullish Above Bearish Below 146

Daily VWAP bearish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

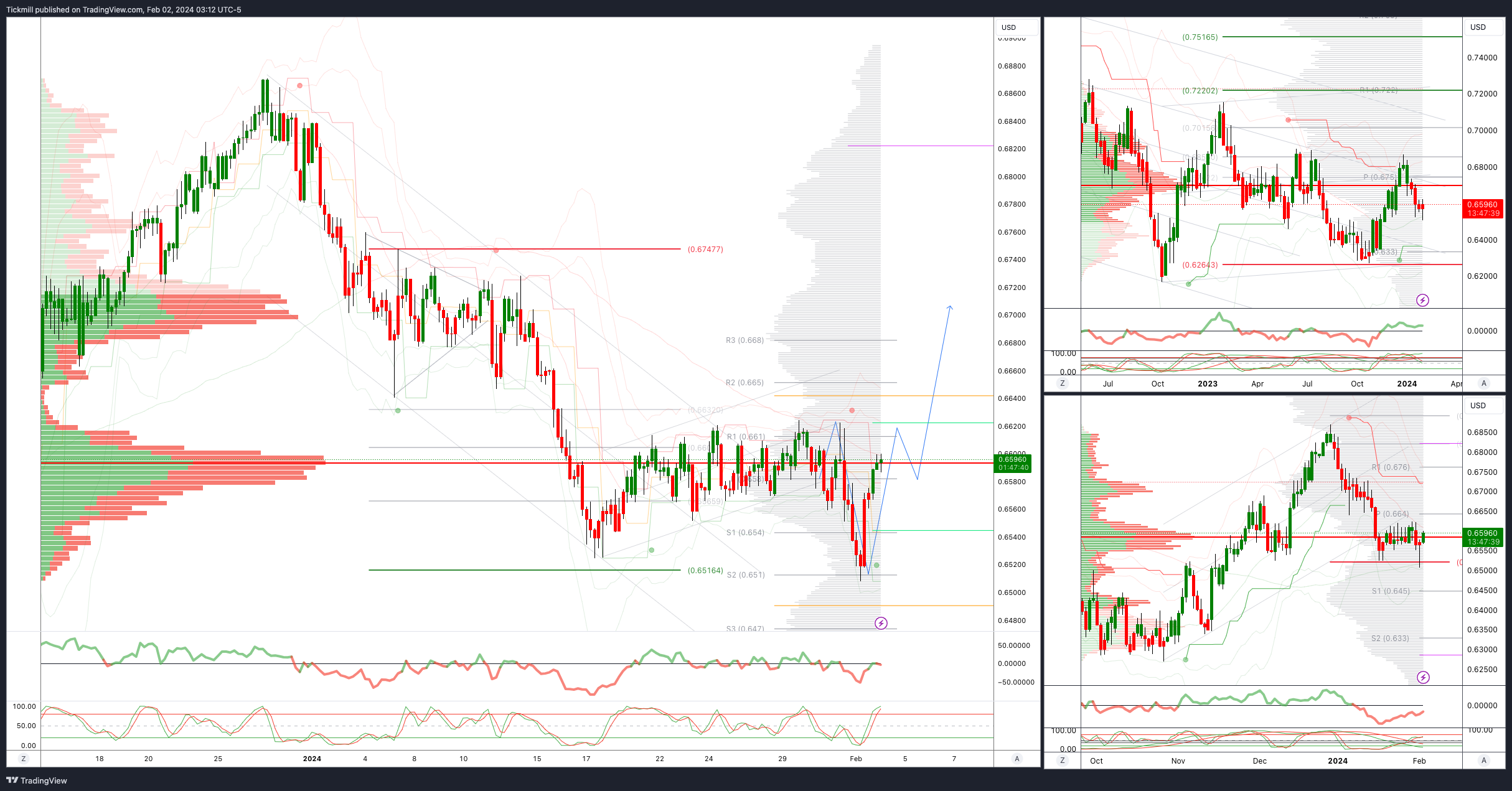

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6440

Primary support .6525

Primary objective is .6933

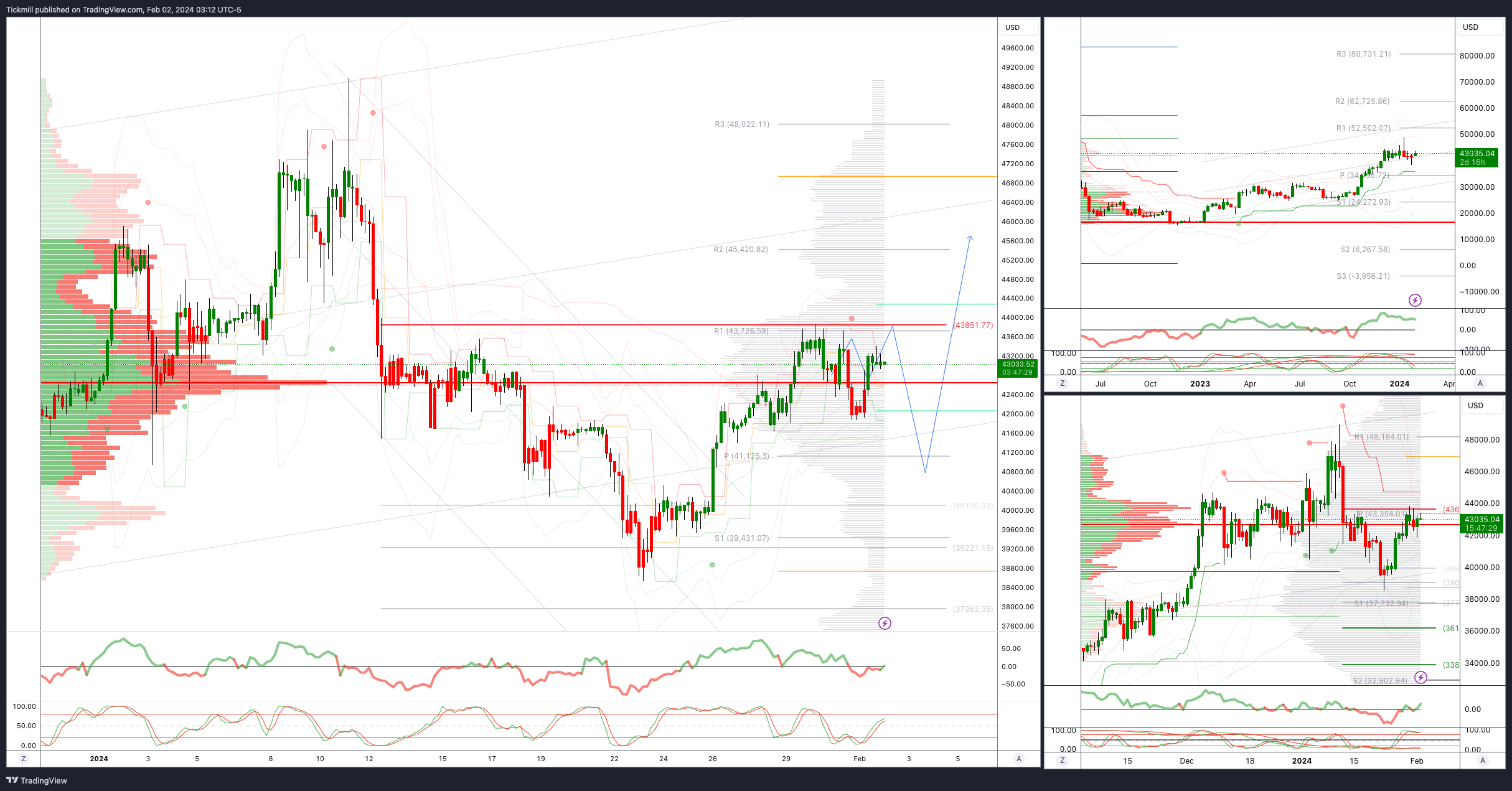

BTCUSD Bullish Above Bearish below 43850

Daily VWAP bullish

Weekly VWAP bullish

Above 43600 opens 44700

Primary resistance is 44700

Primary objective is 44700

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!