Daily Market Outlook, April 3, 2024

Munnelly’s Macro Minute…

“Powell Comments The Macro Catalyst Of The Day ”

On Wednesday, Asian stock markets are experiencing widespread losses, influenced by the negative trends in global markets. This was triggered by the rise in US Treasury yields due to strong economic data, raising worries about the future of interest rates. The latest data from the US revealed higher-than-expected growth in job openings, manufacturing, and factory orders in February. Equity markets globally are feeling the heat as investors reassess global interest rate expectations ahead of Fed Chair Powell’s upcoming appearance and Friday’s US labor data. Presently, markets are factoring in just under 70 basis points of US rate cuts for the year, slightly below the Fed’s projection of 75 basis points of reductions as per the ‘dot plot’. Despite Fed officials Mester and Daly reaffirming that three rate cuts (75 basis points) remain the baseline, they highlighted that robust economic activity reduces the urgency for immediate easing.

With a quiet day in the UK, attention shifts to European and US data. In the Eurozone, Eurostat’s initial estimate is expected to indicate a decline in March inflation to 2.5% from February’s 2.6%, aligning with recent disappointing national data from Germany and France. Core CPI inflation is also expected to hit a two-year low of 3.0% or less. However, the Eurozone unemployment rate, projected to stay steady at 6.4%, will keep policymakers alert to potential wage pressures, suggesting an early rate cut at the next ECB policy update is premature.

Stateside, eyes are on a couple of data releases ahead of Friday’s crucial labor market report. Firstly, the ADP employment report, though historically unreliable, is monitored for insights into Friday’s jobs data. Expect an increase of 180,000 for ADP private sector payrolls compared to the expected 225,000 for Friday’s official payrolls. Secondly, the US ISM services survey, a barometer of March economic activity, is expected to show a modest rise to 53.2 from 52.6, maintaining its expansion streak. Market focus also hones in on remarks from Fed policymakers, particularly Chair Powell's scheduled economic outlook speech. While recent Fed statements have been ambiguous regarding future policy, Powell’s remarks last Friday indicated no urgency for rate cuts. Nonetheless, markets still anticipate a first reduction in June, albeit with less certainty surrounding subsequent moves in the latter half of the year.

Overnight Newswire Updates of Note

Federal officials view three rate cuts as ‘reasonable’ for this year.

Federal Reserve’s Mester suggests that it is possible that the data could support a rate cut in June.

General Motors’ Q1 US sales decrease due to lower commercial deliveries, but surpass Toyota’s sales, while Japanese sales increase.

The US Steel union rejects Nippon Steel’s request for takeover support.

A US senator urges Biden to investigate alleged ties between Nippon Steel and China.

Yellen plans to visit China and press counterparts on the threat of excess factory capacity.

Biden and Xi's call addresses tensions involving the Philippines and Taiwan.

The Bank of Japan maintains the same amount of bond buying as in the previous offer.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0695 (583M), 1.0750-60 (819M), 1.0780-85 (1BLN),

1.0800 (436M), 1.0815-25 (1.8BLN)

USD/CHF: 0.8950 (1.3BLN), 0.9000 (1.35BLN), 0.9075 (442M)

GBP/USD: 1.2400 (541M), 1.2570-75 (345M), 1.2590 (187M)

EUR/GBP: 0.8500 (280M), 0.8570-75 (232M). USD/CAD: 1.3595-1.3600 (666M)

AUD/USD: 0.6510-20 (1.1BLN). NZD/USD: 0.5900 (809M)

USD/JPY: 147.33 (9.7BLN), 150.50 (460M), 151.50-55 (675M)

152.00 (474M), 152.40-50 (700M)

Historical trends show that EUR/USD FX option implied volatility typically decreases in April, then rebounds in May. Recent market movements suggest a potential repeat of this pattern. The EUR/USD option implied volatility premium for USD calls over puts has reached its peak for 2024, indicating that increases in EUR/USD implied volatility are linked to gains in the USD, and vice versa. Any recovery in the EUR/USD spot rate is likely to suppress implied volatility, which has recently seen a slight rebound from its pre-Easter and two-year lows. Benchmark one-month, three-month, and one-year EUR/USD FX option implied volatilities have all increased from their two-year lows, with upcoming U.S. data potentially impacting the USD and EUR/USD volatility. A retreat in the USD could lead to decreased implied volatility and present buying opportunities for a potential rebound in May.

CFTC Data As Of 29/03/24

Japanese Yen net short position is -129,106 contracts.

Euro net long position is 31,194 contracts.

British Pound net long position is 35,170 contracts.

Swiss Franc posts net short position of -21,968 contracts.

Bitcoin net short position is -1,075 contracts.

Technical & Trade Views

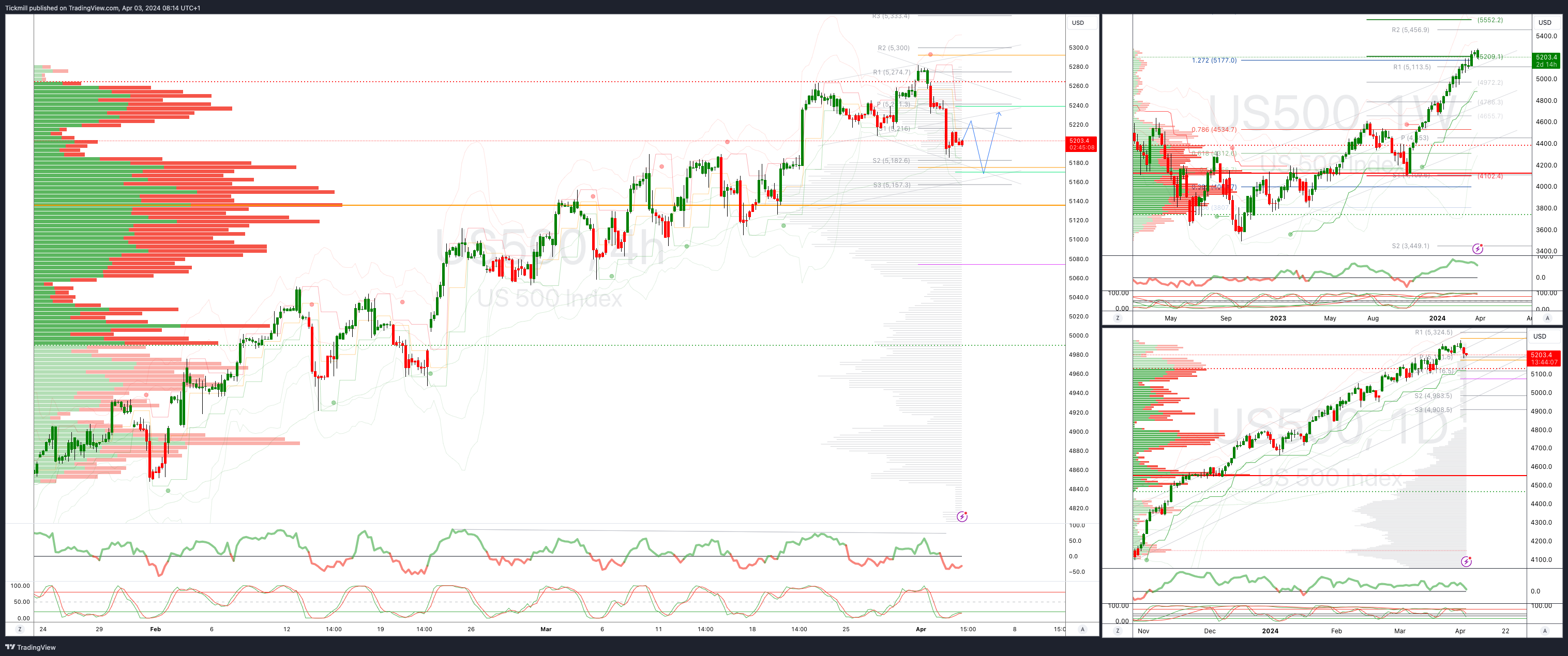

SP500 Bullish Above Bearish Below 5220

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5160

Primary support 5160

Primary objective is 5300

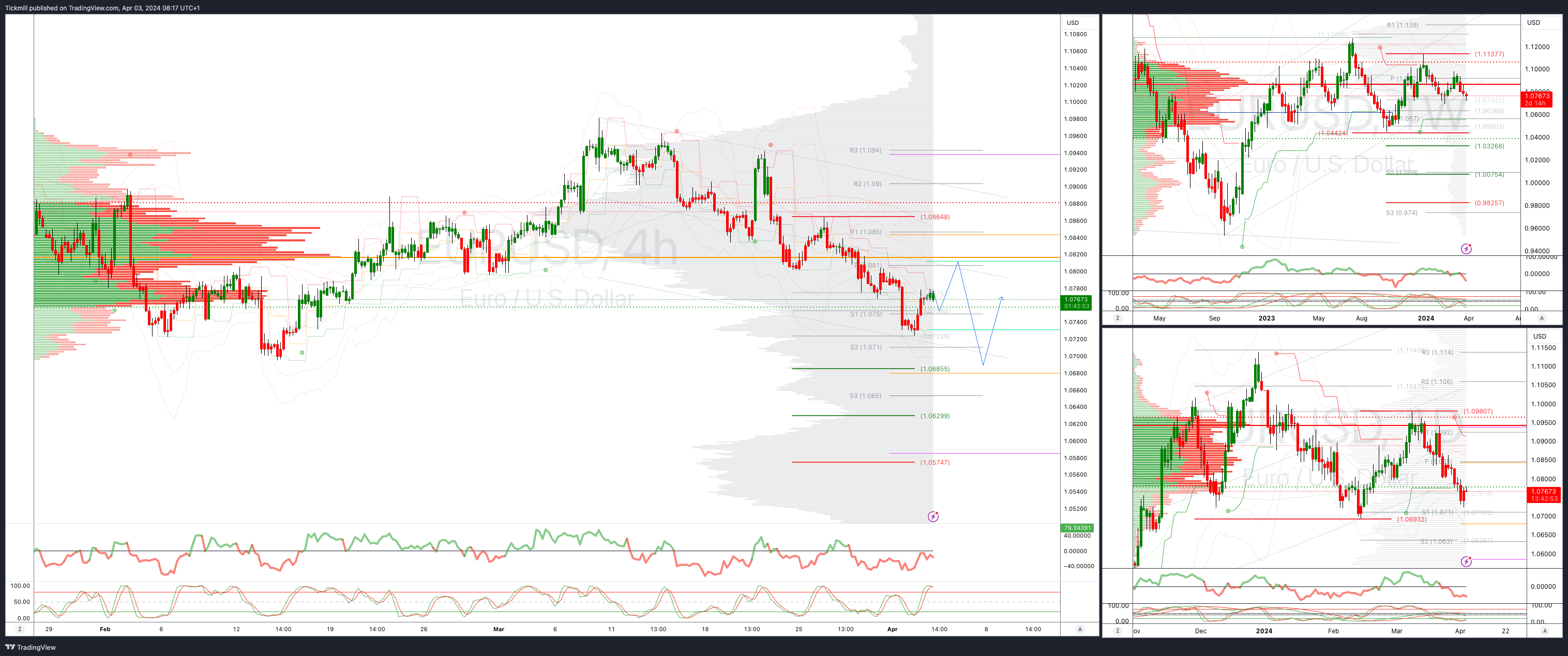

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0690 opens 1.0630

Primary support 1.0690

Primary objective is 1.0540

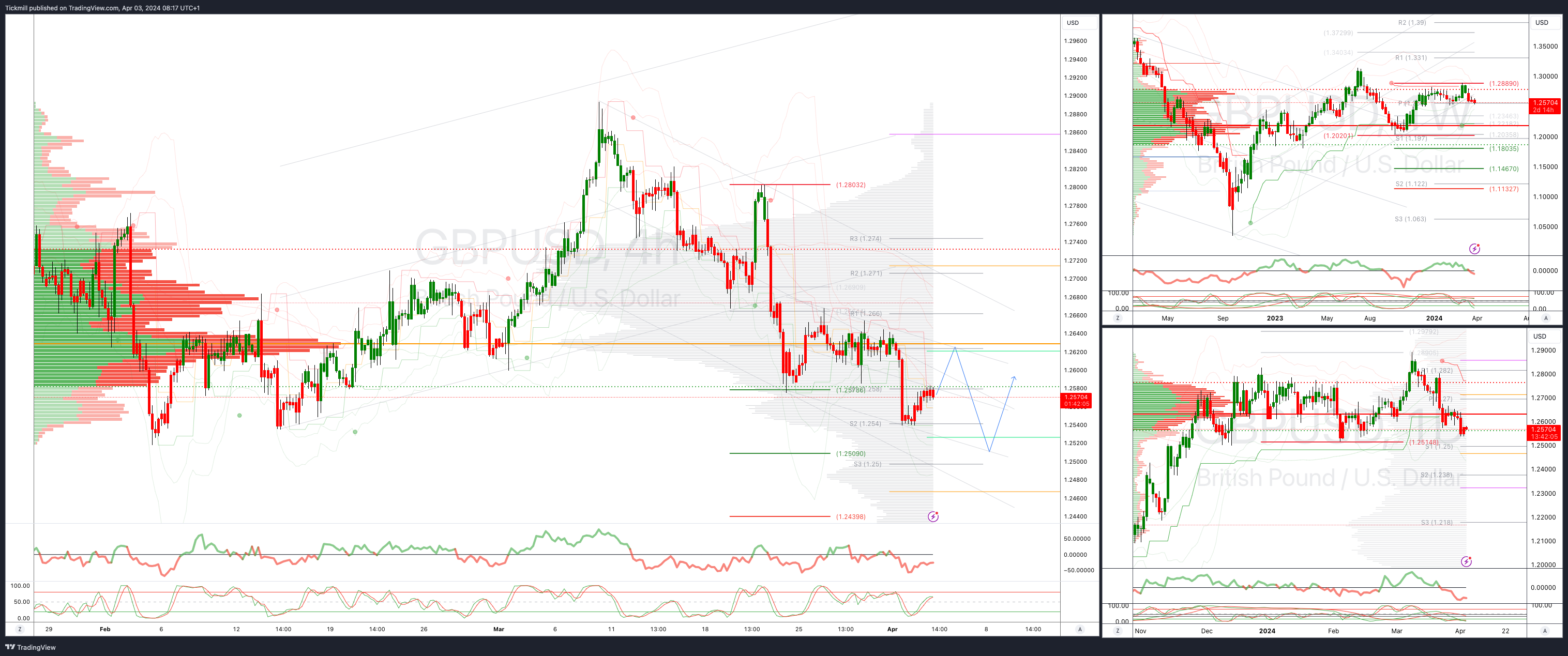

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2500

Primary objective 1.29 (Potential Objective Change Developing)

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

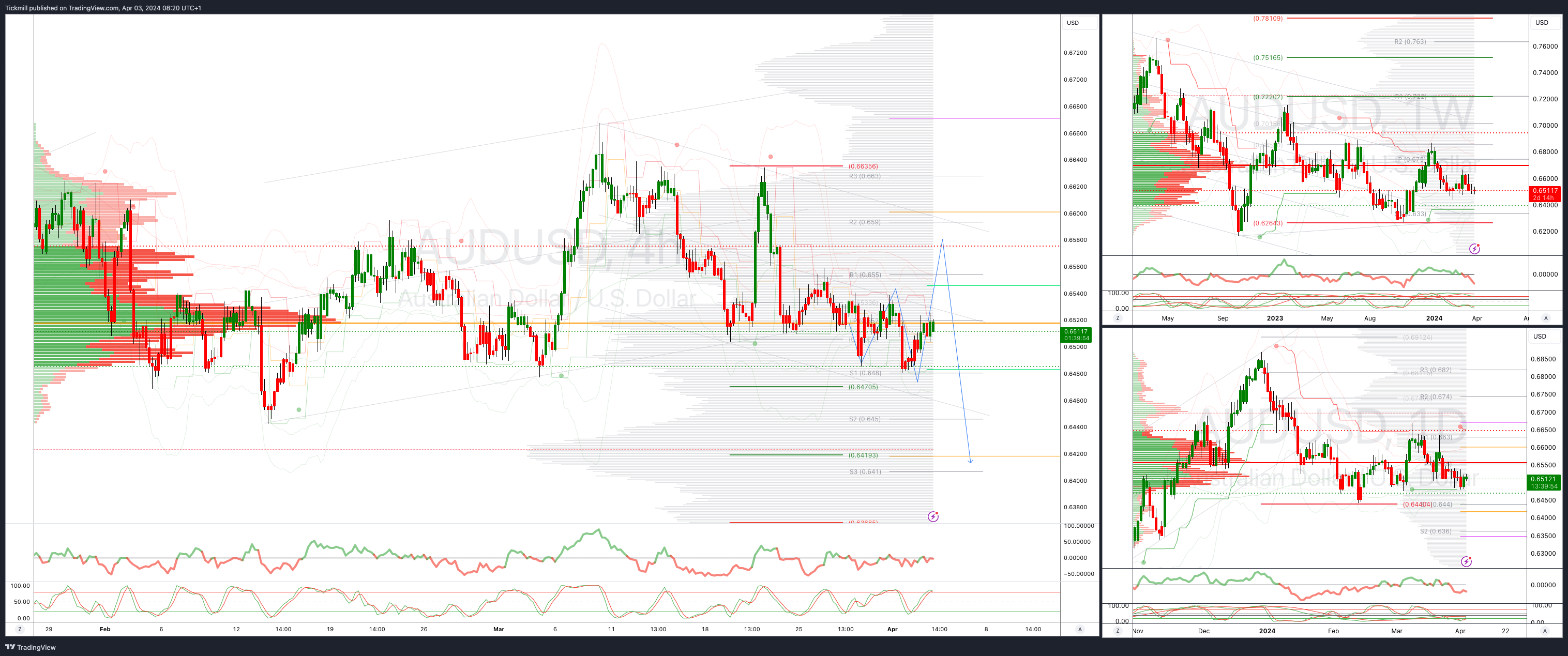

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bullish

Weekly VWAP bearish

Below .6460 opens .6420

Primary support .6477

Primary objective is .6700 (Potential Objective Change Developing)

BTCUSD Bullish Above Bearish below 65000

Daily VWAP bearish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!