Daily Market Outlook, April 11, 2022

.png)

Daily Market Outlook, April 11, 2022

Overnight Headlines

- Fed’s Mester Sees Inflation Rate More Than 2% In 2023

- US To Supply Ukraine With ‘Weapons It Needs’ Vs Russia

- China Inflation Beats Forecasts On Oil, Covid Disruptions

- China Quickens Nuclear Buildup Over Fear Of US Conflict

- Shanghai Covid Cases Top 26,000 As City Outbreak Rises

- BoJ Official Warn Against Excessively Volatile Yen Moves

- EU Countries Remain In Dispute Over Russian Energy Ban

- EU Tense As Le Pen Heads To Second Clash With Macron

- Germany's Labour Minister Warns Growth To Drop To 1.5%

- Finland And Sweden Set To Join Nato As Soon As Summer

- US 10-Year Yield Rises To 2.75% For First Time Since 2019

- US Banks Set For Hit To Revenues As Deal Making Lessens

The Day Ahead

- Emmanuel Macron’s word of caution to his supporters is being echoed by investors after preliminary results from the first round of French presidential elections gave him a better-than-expected lead over Marine Le Pen. They express relief that the first hurdle has been crossed, but remain cautious that his nationalist rival still has a chance at the April 24 runoff. Here is what traders, economists and strategists say about Sunday’s results and what lies ahead. “While Macron seems likely to win, there is still plenty of uncertainty for the second round and we can expect a lot of noise and a lively campaign to keep markets nervous in the next two weeks. The outcome of the first round should lift the euro, the CAC 40 Index and other French domestic plays, financials in particular,” said Barclay

- The next four weeks, leading up to an annual Victory Day celebration in Moscow — are a crucial and intensely dangerous period in Russia's war on Ukraine, US officials and others familiar with Russian military history tell Axios. May 9 is a major holiday in the Russian Federation, with the country closing down each year to mark its World War II victory over the Nazis. That makes it a deadline with significant symbolism in Russian domestic politics. Any momentum would feed a push westward toward Kyiv. A senior Defense Department official told Axios on Thursday the US and other allies are rushing myriad forms of military assistance to Ukraine knowing the stakes of the next month. Ukrainian Foreign Minister Dmytro Kuleba pleaded for all forms of weaponry ahead of the Russian assault.

- Economists see a growing risk of recession as the relentlessly strong US economy whips up inflation, likely bringing a heavy-handed response from the Federal Reserve. Economists surveyed put the probability of the economy being in recession sometime in the next 12 months at 28%, up from 18% in January and just 13% a year ago. “Risk of a recession is rising due to the series of supply shocks cascading throughout the economy as the Fed lifts rates to address inflation,” said Joe Brusuelas, chief economist at RSM US LLP. Economists slashed their forecast for growth this year. On average they see inflation-adjusted gross domestic product rising 2.6% in the fourth quarter of 2022 from a year earlier, down a full percentage point from the average forecast six months ago.

- The implications of a potentially quicker withdrawal of US monetary policy stimulus continue to dominate global financial market attention. In particular, the question remains whether the US central bank can tame high inflation without triggering an economic downturn. With the Fed is increasingly concerned about inflationary pressures broadening out to services, a 50bp rise at the next policy update on 4 May now seems likely and is fully priced in by markets. The Fed is also expected to approve a ‘runoff’ of it $9tn balance sheet to the tune of $95bn a month, a pace which implies a reduction of over $1tn a year. Ahead today, the Fed’s Bostic, Bowman and Waller are due to give remarks at a Fed Listens event, while Evans will discuss the economy and monetary policy.

CFTC Data

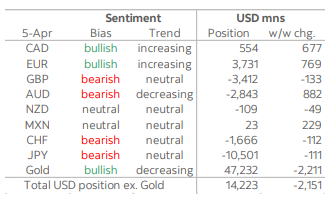

- CFTC data for the week through Tuesday reflect some tempering in the overall bullish bet on the USD that had been building over the past few weeks. Aggregated positions across the major currencies we monitor in this report reflect non-commercial accounts cutting their USD long position by a little over USD2.1bn, to total USD14.2bn.

- Investors added somewhat to net EUR longs over the past week, taking the EUR bull bet up USD769mn to total USD3.7bn or around 27.3k contracts, close to where positioning has stabilized since mid-March. Speculative accounts also turned mildly bullish on the CAD, building a modest net long of USD554mn. Investors have been reluctant to commit to a firm view on the CAD over the past few months, however, and positioning has pivoted closely around flat since August; this week’s data suggests investors are still undecided on the CAD’s prospects.

- AUD net short covering represents the biggest positioning change over the week (and, along with the build up of net EUR longs, accounts for the bulk of the move against the USD). Net AUD shorts were cut USD882mn in the week to USD2.8bn. Note that net AUD shorts have been cut by the equivalent of some 54k contracts since peak bearishness (91k contracts) in January.

- Positioning changes elsewhere were very limited; net GBP shorts were lifted USD133mn in the week while net CHF shorts were increased by USD112mn. Net JPY shorts, which represent the biggest single currency bet in these data, grew by a similar amount to stand at USD10.5bn, close to the recent peak seen in October. Net positioning in the NZD and MXN remains largely flat and showed little change on the week. Outside of the major currencies, net gold longs were pared USD2.2bn to USD47.2bn.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: EUR amounts

- 1.0825 711m

- 1.0850 617m

- 1.0975 450m

- 1.0995 3.2b

- 1.1050 368m

- GBP/USD: GBP amounts

- 1.3195 330m

- 1.3220 452m

- USD/JPY: USD amounts

- 121.50 325m

- 123.00 425m

- 123.25 355m

- 124.00 936m

- 125.00 400m

- USD/CHF: USD amounts

- 0.9300 250m

- USD/CAD: USD amounts

- 1.2350 599m

- 1.2395 595m

- 1.2475 528m

- 1.2500 589m

- 1.2635 350m

- 1.2650 975m

- 1.2665 581m

Technical & Trade Views

EURUSD Bias: Bearish below 1.12 Bullish above

- Eurozone money markets price in around 70 bps of ECB rate hikes by December, compared to 65 bps on Friday

- EU's Foreign Min. Borrell: Sanctions are always on the table.

- German DAX futures -0.7%UK FTSE futures -0.3%Stocks are pretty much continuing the more sluggish mood.

- While below 1.0950 focus remains on the downside.

- Bears target a test of 1.0711.

- A short squeeze through 1.1040 needed to change the near term bearish lean.

GBPUSD Bias: Bearish below 1.3350 Bullish above.

- United Kingdom Gross Domestic Product (MoM) below forecasts (0.3%) in February: Actual (0.1%)

- UK: Real GDP grows by 0.1% in February vs. 0.3% expected

- GBP trades heavy with an offered tone post data.

- Bears target a test of 1.2920’s as the next downside objective

- Focus remains on the downside while 1.31 is defended from above

USDJPY Bias: Bullish above 120 Bearish below

- USD/JPY is up 0.6% on the day with the latest jump helped by the ongoing rout in the bond market.

- The Treasury's 10-year yield hits 2.75% for the first time since 2019.

- BoJ's Uchida: The Bank of Japan will closely monitor the impact of currency movements on Japan's economy and prices.

- BOJ cuts assessment for 8 of 9 Japanese regions in latest regional economic report.

- Upside breach of 1.26 opens the way for test of 126.18

- Focus remains firmly on the upside while 1.24 is defended from below

AUDUSD Bias: Bullish above .7300 Bearish below

- AUD/USD eyes three-week’s low at 0.7400 amid aggressive Fed’s tightening bets

- AUD/USD drops to to session lows as China’s CPI lands at 1.5%

- Australian federal election will be held on May 21

- A loss of .7390 would set the course for a deeper correction to test pivotal .7290

- While .7290 acts a support focus remains on the upside. A daily close below would be a bearish development.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!