Daily Commodity Coverage: 30 Sep, Monday

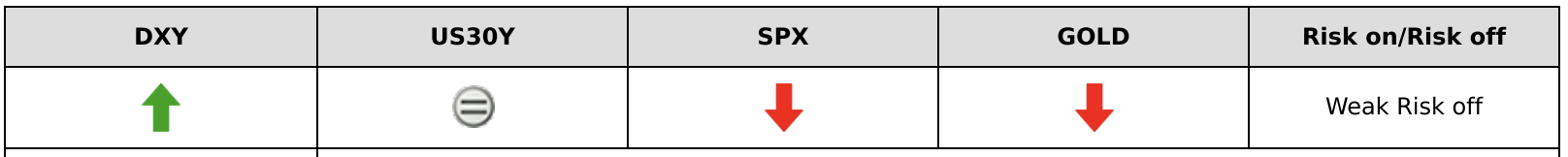

Asia stock market are poised for a mixed start after U.S. stock market slipped on Friday. Wall Street capped a choppy week with a second straight weekly loss for the S&P 500 Friday as worries about a potential escalation in the trade war between the U.S. and China erased early gains.

The market has seen new wave of risk aversion on Friday as news release that the White House is discussing ways to restrict U.S. capital flows into China. Those restrictions could include delistingChinese companies from US stock exchange and preventing US government pension funds from investing in the Chinese market. However, later during the weekend, a US Treasury official said there are no current plans to stop Chinese companies from listing on US exchanges. This may not be enough to calm investors down as the tensions still remain before the meeting in October. Hang Seng and Nikkei futures are indicating a low open today. Risk sentiment stays risk-averse.

Technical Analysis:

Fundamental Analysis:

USDCHF | Neutral | ★★☆

30 Sep: Same as JPY, CHF rallied on Friday as the market turns risk-off due to the trade tensions escalation. But later during the weekend, a US Treasury official said there are no current plans to stop Chinese companies from listing on US exchanges after Trump administration said to restrict U.S. capital from China. This may not be enough to calm investors down as the tensions still remain before the meeting in October. Hang Seng and Nikkei futures are indicating a low open today. Today CHF will have a calendar free day, while risk sentiment still stays risk-averse and CHF could consolidate at the high level.

NZDUSD

Technical Analysis:

Fundamental Analysis:

NZDUSD |Bullish↑ | ★☆☆

30 Sep: Kiwi edged lower against the USD at the open of the Asian trading session. Despite New Zealand ANZ business confidence showing that the current business conditions domestically did slightly better than expected. This is probably due to the trade war uncertainty, coupled with the fact that the greenback benefits from safe-haven demand and upbeat data. RBNZ's Governor Adrian Orr comments in statement release of it's 2018-2019 Annual Report mentions that "New Zealand's economy has proved resilient through a period of weakening global growth and heightened global uncertainty". We remain bullish on NZD for now.

USDCAD

Technical Analysis:

Fundamental Analysis:

USDCAD |Neutral | ★☆☆

30 Sep: The Loonie strengthened against the USD early during the opening of the Asian trading session. The key support at around 1.324 has finally been broken and it seems that the pair's downside momentum starting to pick up. While there are no major news over the weekends that could have affected the CAD, coupled with oil prices generally trading sideways, this could be due to pure technicals. However we note that most leveraged funds have switched to a net CAD short given data release by the CFTC. We have an important domestic GDP data release tomorrow and we keep our eyes peeled on that. We turn neutral on the CAD.

USDNOK

Technical Analysis:

Fundamental Analysis:

USDNOK |Bullish↑ | ★☆☆

30 Sep: Last week the release of the registered unemployment data shows that the unemployment rate decreased from 2.3% to 2.2% as expected in September. While there is a decline in seasonal effect, the overall trend is still heading downwards. With oil prices now moving sideways, the main driver of the NOK should be domestic data. Later today there will be a central bank currency purchase announcement and also core retail sales. We turn bullish on the NOK.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Desmond Leong runs an award-winning research firm (The Technical Analyst finalists 2018/19/20 for Best FX and Equity Research) advising banks, brokers and hedge funds. Backed by a team of CFA, CMT, CFTe accredited traders, he takes on the market daily using a combination of technical and fundamental analysis.