Crude Testing Make-Or-Break Level

China Stimulus Boost Oil

Oil prices are holding below a key market level today as traders brace for the latest EIA inventories data. A rally off the YTD lows has seen the futures market trading back up to retest the underside of the broken 72.61 level. This week, news of a huge wave of China stimulus including both fiscal and monetary easing, has helped lift sentiment in oil markets. Additionally, rising uncertainty around the prospect of an Israel-Hezbollah ground war in Lebanon is adding to upside risks for oil as tensions there continue to mount.

US Recession Risks

Despite the current upside drivers, the demand outlook remains a key headwind for crude prices. China stimulus is certainly an encouraging development given that weakening Chinese demand has been a major driver of crude downside this year. However, with US data continuing to worsen, focus is shifting to perceived recession risks in the US, curtailing the current upside we’re seeing in oil.

Manufacturing Decline Deepens

This week, the US manufacturing sector was seen falling deeper into negative territory, along with other key readings weakening also. A weaker USD, as a result of increased Fed easing expectations, should be positive for oil prices. However, as focus begins to settle more on recession risks, this upside impact is being offset, creating tricky conditions for oil prices.

EIA Data Up Next

Looking ahead today, the latest EIA data should offer some direction. The market is looking for a further drawdown around the 1.3 million bpd level. If seen, on the back of the prior week’s 1.6 million bpd, this should keep crude prices supported today.

Technical Views

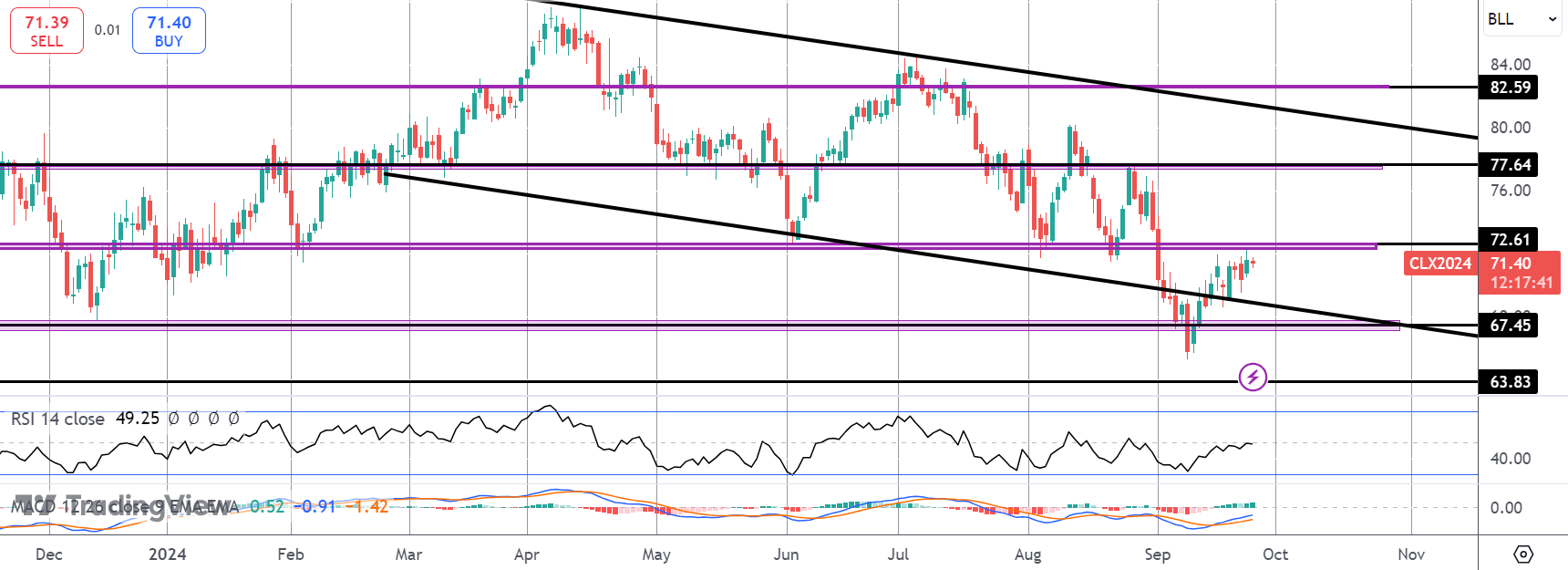

Crude

The rally in crude has stalled for now into the 72.61 level. This is a key pivot for the market. Back above here, bulls will be targeting a test of 77.64 next. To the downside, 67.45 is key support which, if broken, opens the way to 63.83 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.