Crude Softens Despite Huge EIA Deficit

Huge EIA Deficit Seen

Oil prices are looking a little cooler today as fears over the health of the US economy have seen the futures market pulling back from highs. The dip comes despite data from the EIA yesterday confirming a massive 12.2-million-barrel drawdown in commercial crude stores last week. The fall in inventory levels was a sharp shift from the prior week’s roughly 4-million-barrel gain and much deeper than the 0.4-million-barrel deficit expected. The data serves as fresh evidence of growing demand in the US as summer driving and travel season begins. However, a slew of negative data out of the US has taken the shine off the reading.

Fears Over Weak US Data

A jump in jobless figures alongside a weakening in both the ISM manufacturing and services PMIs has raised fears of a downturn in the US. For oil traders, the drop in manufacturing is particularly worrying, given the weakness we’ve also seen in Chinese industrial data recently. While simultaneous drop in USD is a positive for oil, economic fears are offsetting some of the bullishness. Looking ahead, focus will be on US jobs data tomorrow. Given the reaction we’re seeing to current US data weakness, any downside surprise tomorrow is likely to weigh on oil prices here.

Technical Views

Crude

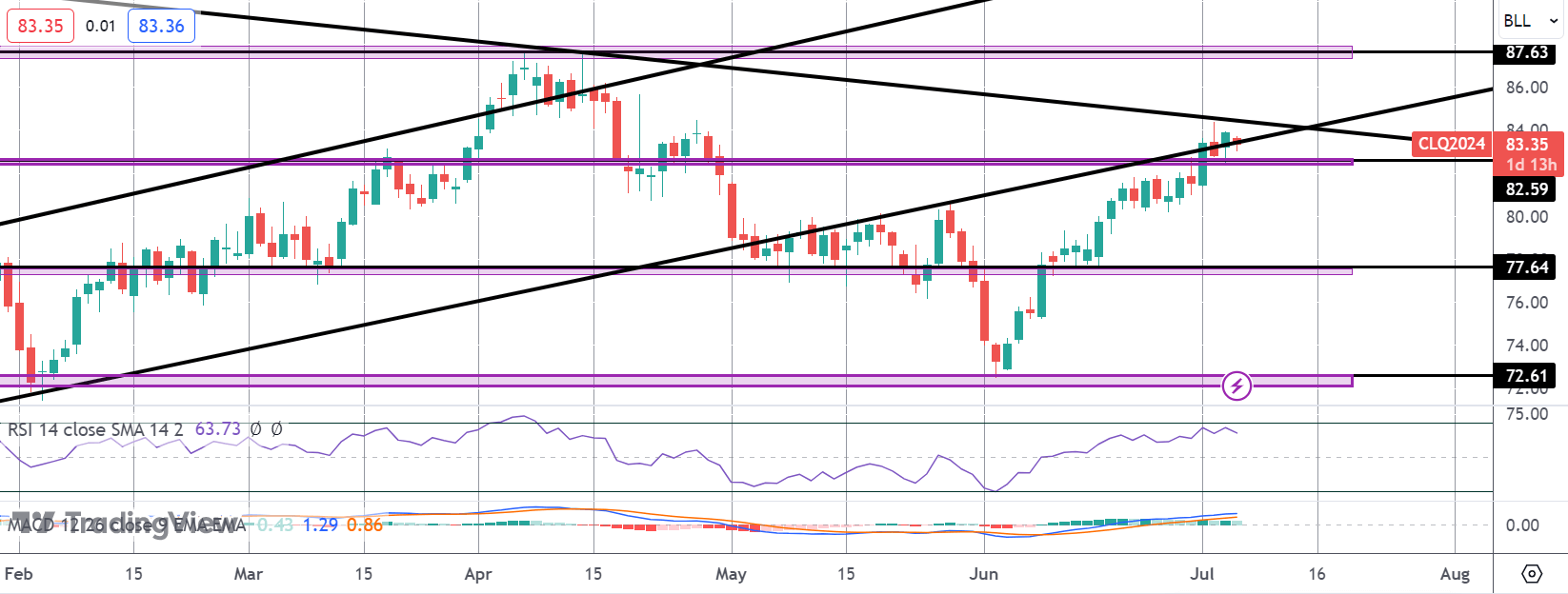

The rally in crude has seen the market breaking back above the 82.59 level. Price is currently testing resistance at the underside of the bull channel and the bear trend line from last year’s highs. With momentum studies bullish, a break above here opens the way for a test of 87.63 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.