Crude Plunges On Israel/Iran News

Middle East Impact

Oil prices cratered lower on Tuesday as traders reacted to the latest developments in the Middle East. According to reports, Israeli PM Netanyahu has bowed to pressure from the US and agreed to a limited strike on Iran. Where previously, oil and nuclear facilities were said to be targets, Israel has said it will now focus its attack on military sites only. The news has allayed supply disruption fears for now, with oil selling off accordingly. However, the situation remains highly volatile and oil sites could still end up being affected, in which case oil prices will be vulnerable to upside spikes.

Weak China Outlook

The slide in oil this week is also being coloured by a weaker outlook on China. Recent stimulus efforts have failed to drive a sustained improvement in sentiment on the world’s second largest economy. Weaker inflation figures at the start of the week underscored the ongoing weakness in the Chinese economy, keeping the oil demand outlook subdued for now.

Fed Impact

Crude futures are now down more than 10% from last week’s highs. Adding to bearish pressure is the ongoing strength in USD. Traders have scaled back their Fed easing expectations on the back of recent data strength and less-dovish Fed commentary, keeping propped up. While the Dollar holds onto recent gains, oil prices are likely to struggle to rebound.

Technical Views

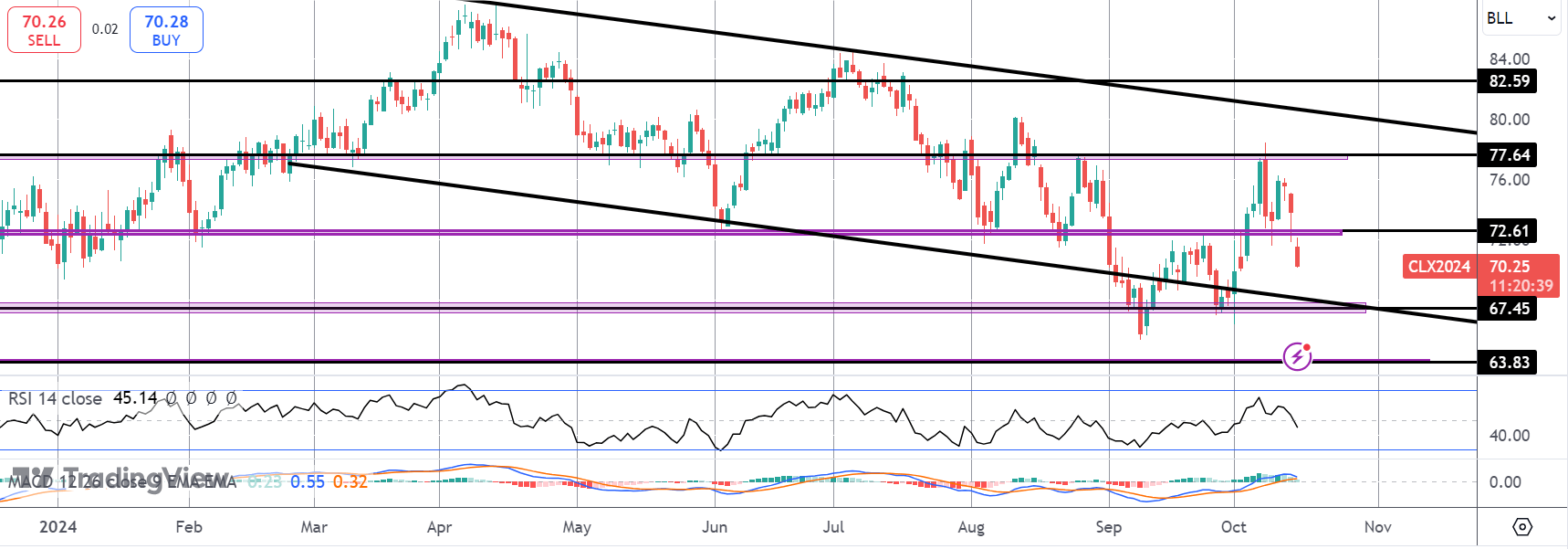

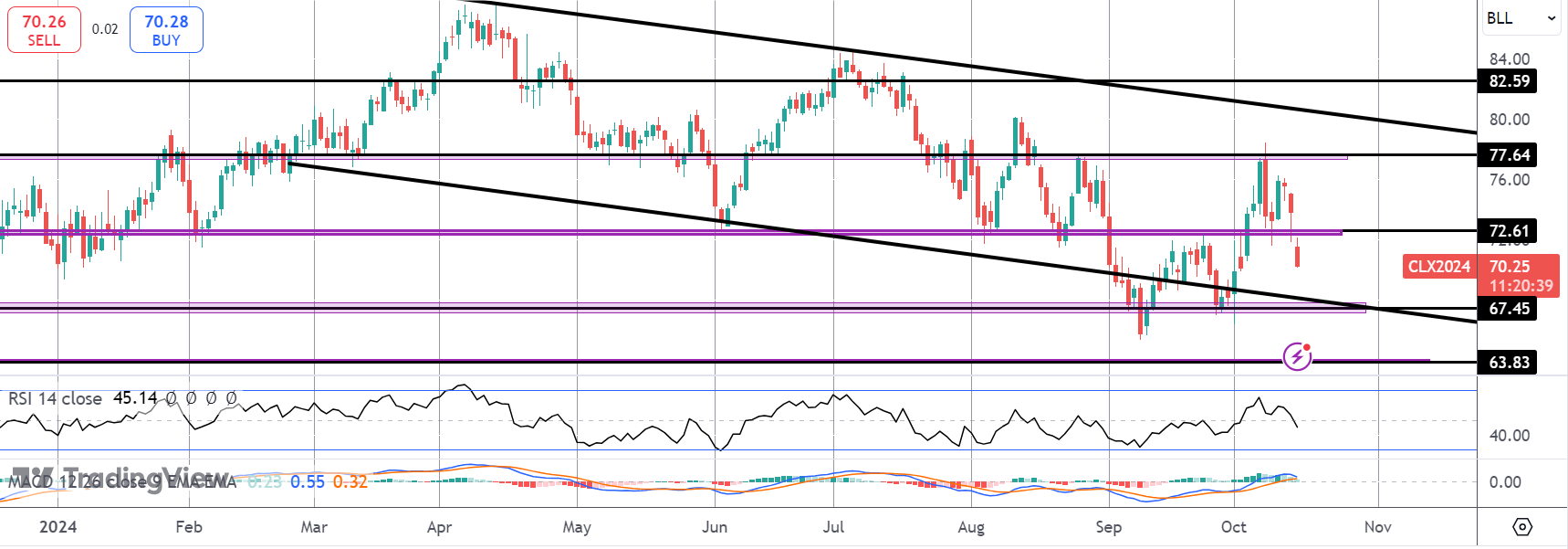

Crude

The failure at the 77.64 level has seen the market reversing sharply lower. Price is now trading below the 72.61 level and while below here, focus is on a continuation lower and a test of the 67.45 level and bear channel lows next, in line with falling momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.