Crude Plunges As Bearish Sentiment Builds

OPEC+ Concerns Hit Oil

Oil prices have collapsed lower this week with crude futures down more than 6%, fast approaching a test of the YTD lows. The move comes on the back of the OPEC+ meeting over the weekend which saw the group extending current production curbs through to the end of next year. However, details of the report have been met with uncertainty, specifically plans to reintroduce 2.2 million barrels per day from October 2024 through September 2025 which some players fear will tip the market into surplus. OPEC+ did note that the flow can be halted if market conditions are impacted negatively though concerns over adherence levels from producers are offsetting this reassurance.

Softer US Econ Data

Along with the OPEC+ outcome, weaker-than-forecast US ISM manufacturing data yesterday has also hit crude sentiment. Traders are fearing a drop off in US economic levels in line with recent data. Softer growth data, weaker jobs and now cooling factory data, have combined to depress oil sentiment near-term, despite the start of the summer driving season which typically sees a spike in demand for fuel.

US Jobs Next

Looking ahead this week, traders will be looking at Friday's US jobs data. If we see any fresh weakness in these readings, this will no doubt feed into the current bearish mood among oil traders, sending crude further lower near-term.

Technical Views

Crude

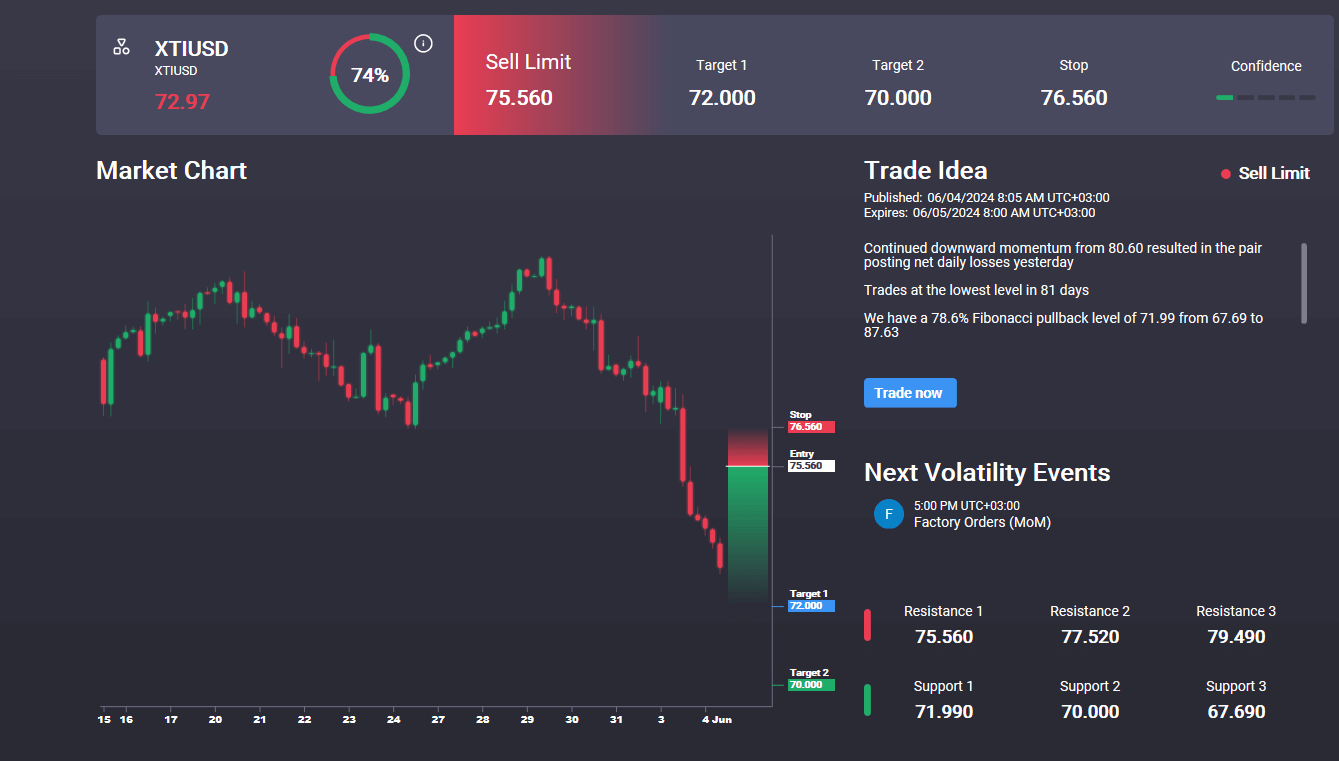

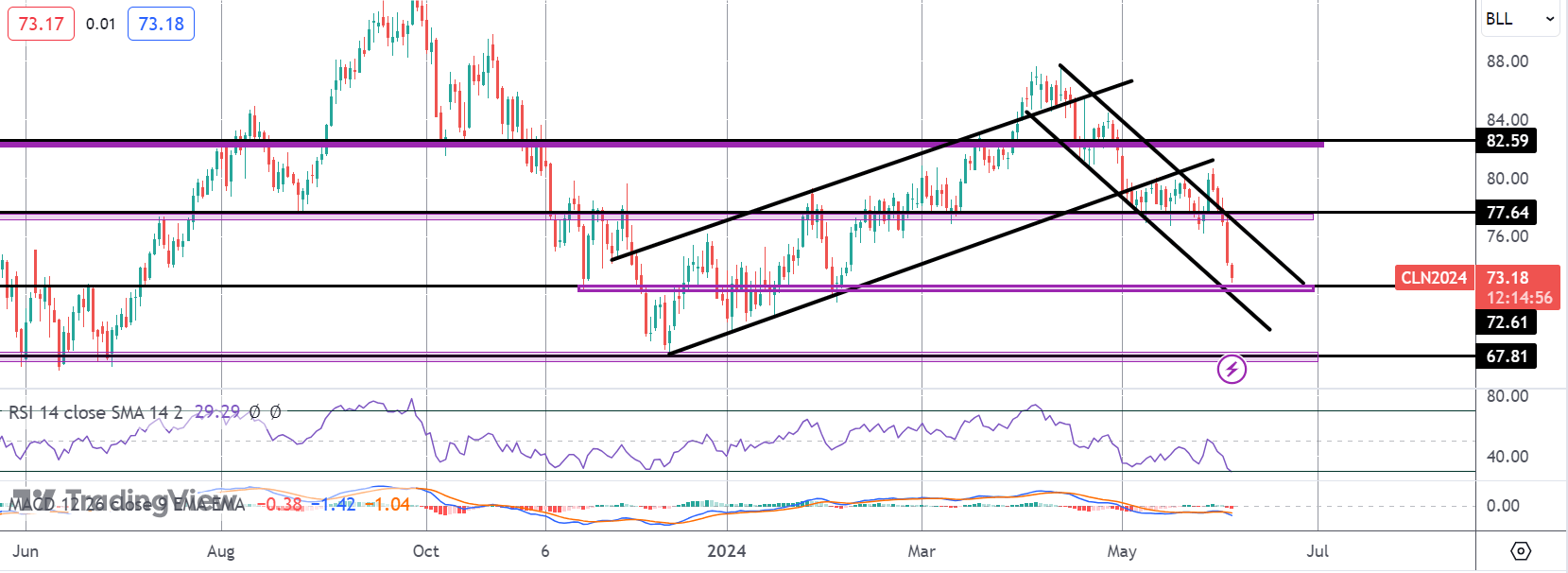

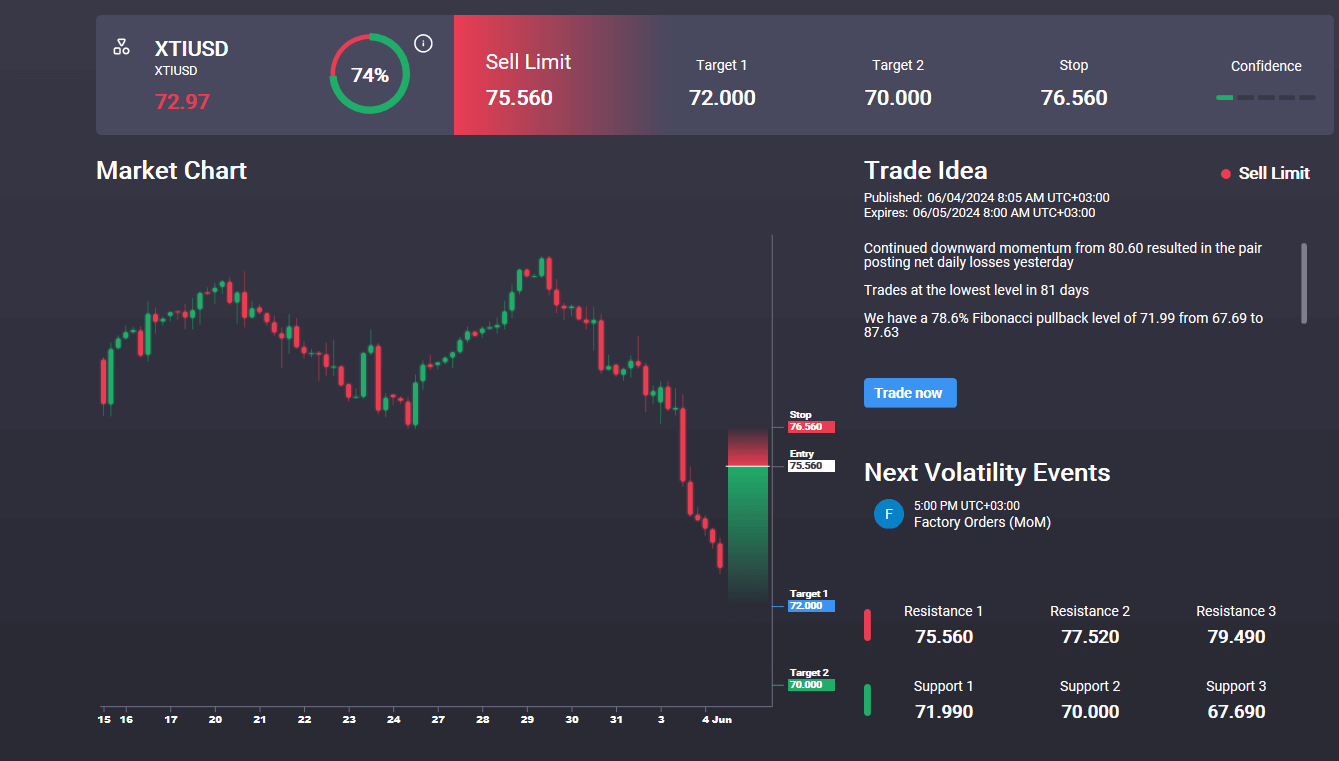

The sell off in crude has seen the market breaking sharply below the 77.64 level. Price is now testing the 72.61 level support with the bear channel lows coming in around here also. In line with bearish momentum studies readings, if we break lower here, 67.81 will be the next key support to watch. In the Signal Centre today we have a sell limit set at 75.56 suggesting a preference to stay short into any recovery from current levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.