Crude Fails To Rally Following OPEC+ News

OPEC News Lacks Bite

Crude oil prices remain mostly muted as we move through the European morning on Tuesday. Just days on from OPEC+ announcing an extension of its current production cuts, the market has failed to find any upside momentum with crude futures still hugging support at the 72.61 mark. Last week’s meeting saw OPEC+ announcing cuts of around roughly 2 million barrels per day that will last at least through the end of Q1 2024. More than half of the cuts will be shouldered by the group’s de-facto leader, Saudi Arabia.

OPEC Tensions

However, the exact level of cuts among other members is not yet known and is to be announced in due course. This meeting marked a break from tradition with the group’s secretary signalling that each producer would announce its own level of cuts rather than all members sticking to an agreed quota. As such, the news appeared to have been less impactful on markets with traders sensing that division within the groups will dilute the success of Saudi Arabia’s attempts to drive oil prices back up.

Economic Concerns

With concerns over the health of the Chinese economy, as well as a sense that the US economy is slowing down, the demand outlook for the new year has weakened materially. Given that US production remains around record highs, the current landscape looks skewed towards weaker oil prices near-term unless we see a fresh leg lower in the US Dollar.

Technical Views

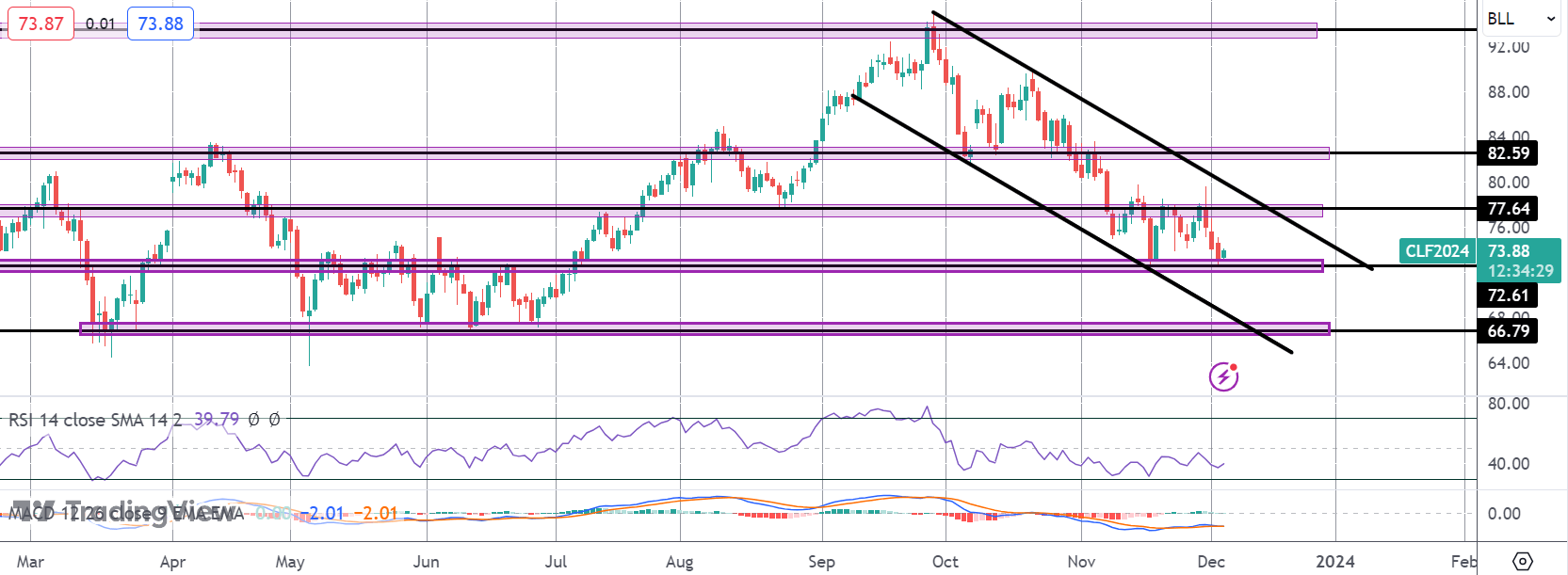

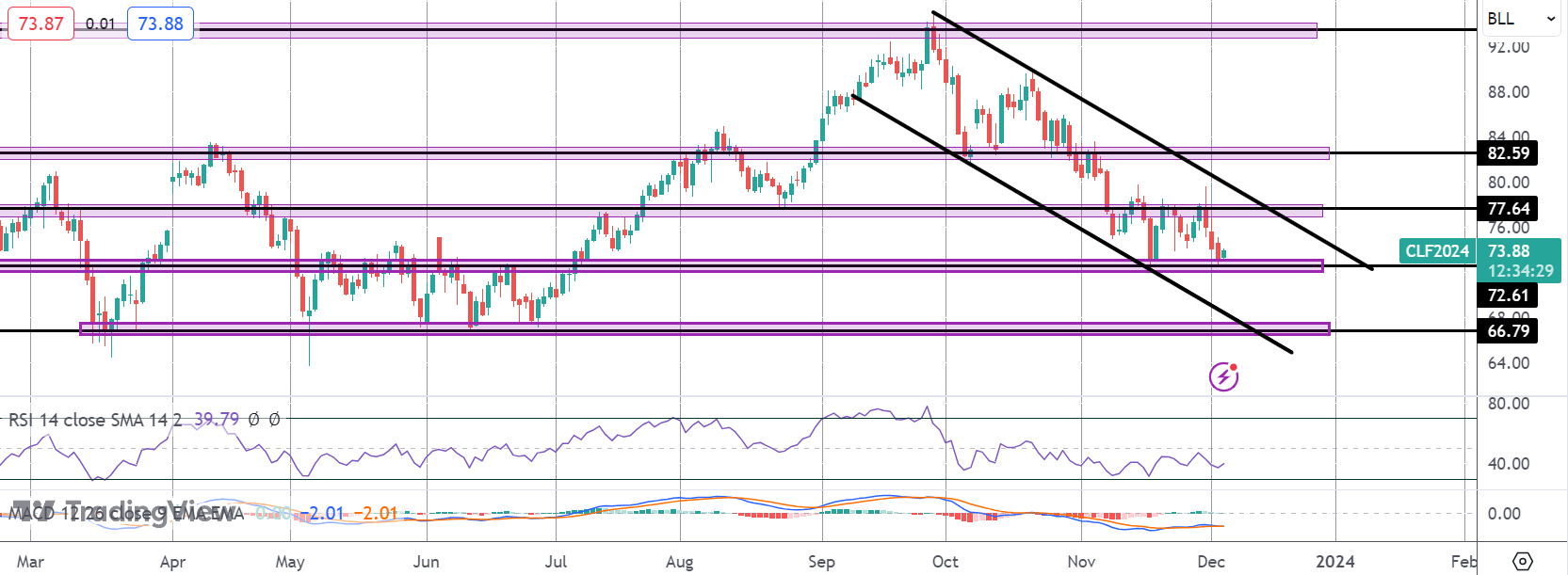

Crude

For now, crude prices remain atop the 72.61 support, still within the bear channel from YTD highs. In light of the downtrend, risks remain pointed lower while price holds below the 77.64 level, with a break of current support seen putting focus on the 66.79 level next. To the topside, a break of 77.64 opens the way for a move higher to 82.59 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.