Chart of The Day USDCHF

Chart of The Day USDCHF

USDCHF Probable Price Path & Potential Reversal Zone

USD: U.S. stocks rose on Monday, leading major benchmarks to recovering some losses following their worst week since October. The Dow Jones rose 229 points, or 0.8%, the S&P 500 edged up by 1.6% and Nasdaq outperformed with 2.5% gain. Meanwhile, the online retail traders that drove up GameStop’s shares now shifted their focus to the silver market. Prices of the precious metal soared over 11%, hitting a daily high of 30.09 before settling at $28.80/oz. The dollar index strengthened amid a weaker euro. US yields were higher; 10Y UST yield last traded at 1.08%.Focus is now on President Biden’s proposed $1.9trillion stimulus package. A handful of Republicans met Biden to push for a much smaller $600b package. Meanwhile, Democratic congressional leaders started to lay the groundwork to pass the $1.9 trillion bill with only Democratic votes.

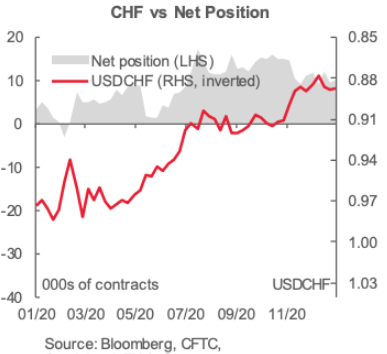

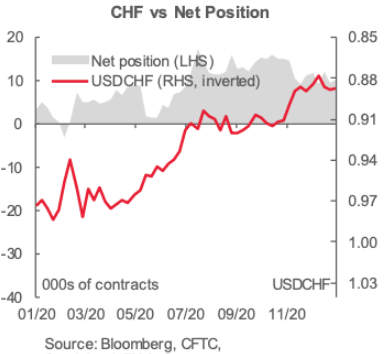

This week’s CFTC data show the first decline in the net USD short position in seven weeks, just slightly offsetting the previous week’s increase, to USD34.9bn on a relatively modest USD566mn drop off an all-time-high bearish position on the dollar last week.

CHF: The Swiss National Bank will not be deterred from its expansive monetary policy course by the United States' designation of Switzerland as a currency manipulator, Chairman Thomas Jordan said on Monday. The SNB still regards both foreign currency interventions and negative interest rates as vital to stem appreciation pressure on the Swiss franc, Jordan told SRF TV show ECO. "This designation by the Americans will have no influence on our monetary policy," Jordan said, referring to the description used by the U.S. Treasury in December. The SNB spent just over 100 billion Swiss francs ($111.51 billion) on foreign currencies in the first nine months of 2020 to slow the rise of the franc, which was sought by investors seeking safe havens."At the moment, these foreign exchange interventions are very important because we have seen great pressure on the franc, especially in the COVID crisis," he said. He said that Switzerland was in fact "anything but a currency manipulator", pointing to the appreciation of the franc over the last 12 years and low inflation.

Although Jordan said he had not yet spoken with the recently appointed U.S. Treasury Secretary Janet Yellen, talks will take place first at a technical and then political level between the two countries to explain Switzerland's position, he added. While the SNB was not a "big fan" of negative interest rates, there was no alternative because of the policy of low interest rates elsewhere, he said. If the SNB were to raise its policy rate from the current level of minus 0.75%, the franc would rise massively in value and the Swiss economy would be crippled. "We have to ... pursue a sensible monetary policy in the overall interest of the country," Jordan said

From a technical perspective the USDCHF has extended higher from its basing pattern sub .8900 counter trend long players will be looking for a test of the equality objective at .9007 which coincides with the weekly R3 pivot and daily projected range resistance. Profit taking is likely to emerge here, with the potential for a pull back to test the breakout resistance at .8925 as support as, if sufficient demand emerges here then we could see another leg higher to test monthly range resistance and the primary descending trendline resistance towards .9060 before the dominant downtrend may resume. A close through .9110 would concert he overall bearish thesis suggesting the potential for a more meaningful reversal

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!