Chart of the Day NZDJPY

Chart of the Day NZDJPY

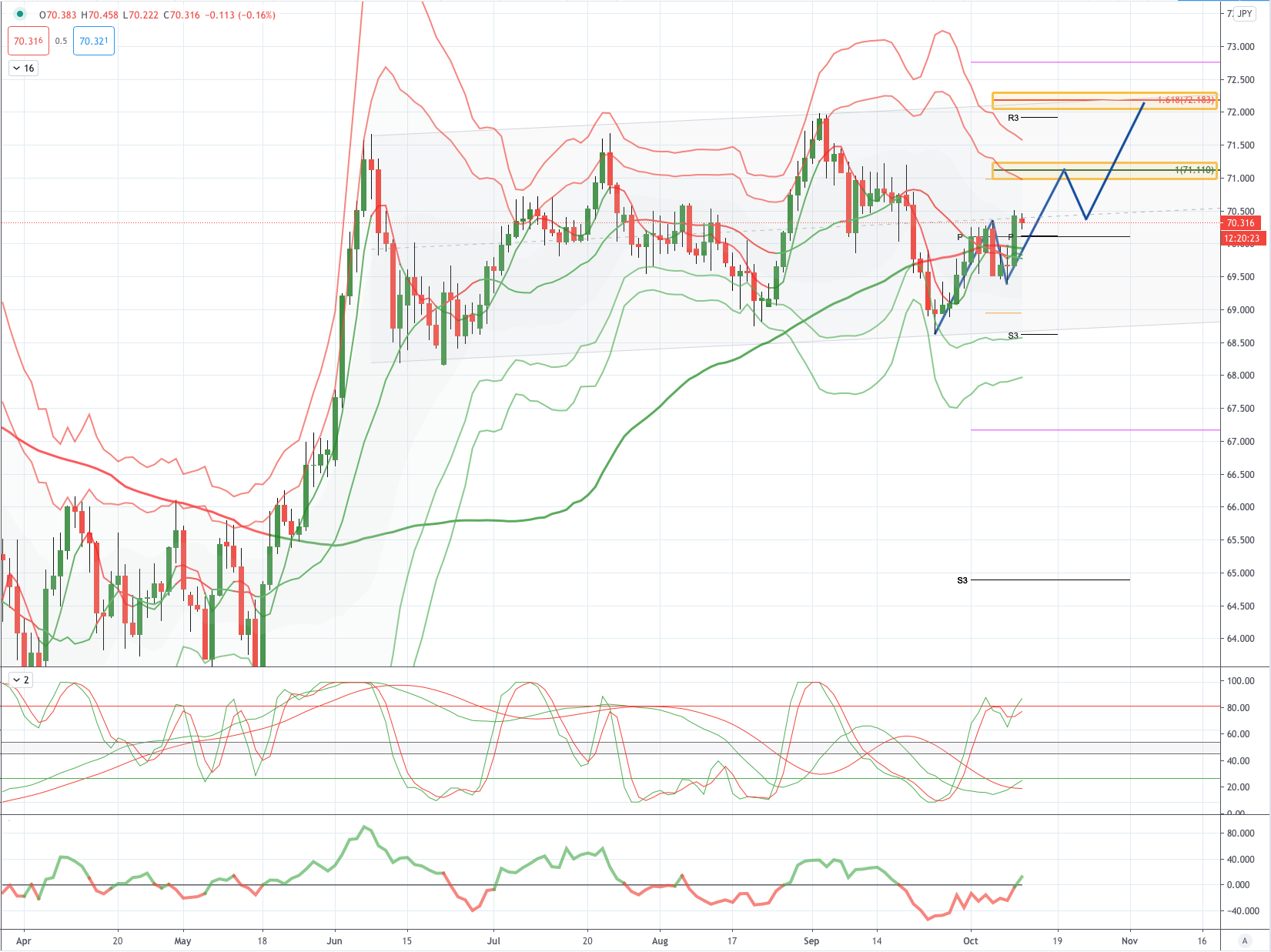

NZDJPY Potential Reversal Zone - Probable Price Path

NZD: The US economic stimulus plan is expected to reach a consensus, and the market's risk aversion atmosphere has declined. China reduces forward foreign exchange risk reserves, the People's Bank of China announced a reduction in the forward foreign exchange risk reserve, which weighed on the New Zealand dollar this morning. According to CFTC data, as of last Tuesday, the net long positions of New Zealand dollars held by institutional investors more than doubled weekly to nearly 4,300; the net short positions of New Zealand dollars held by leveraged funds increased by about 500 to nearly 1,900

JPY: Japan core machine orders surprised with gains; factories still in deflation: Japan core machine orders, a key gauge of business investment rose 0.2% MOM in August, better than analysts’ forecast of a 1% decline. This follows after a surge in orders in the previous month. Despite the recent rebound, orders were still 15.2% YOY lower compared to the same month last year, its fifth straight month of double-digit YOY decline. Produce price index fell 0.2% MOM in September (Aug: +0.1%) translating to a 0.8% YOY decline (Aug: -0.6%) as Japan’s factories remained in deflation.

From a technical and trading perspective, the NZDJPY has continued to demonstrate resilience after a successful test and hold of projected trend channel support above 68.50, price is currently trading above the monthly and weekly pivot following Friday’s key reversal pattern, as such, bullish exposure should be rewarded ona breach of overnight highs initially targeting a test of the equality objective sighted at 71.11, through here bulls will set their sites on projected trend channel resistance and the 1.61 extension of the pull back to 69.50 at 72.18. On the day only a close sub 69.70 would concert he bullish thesis

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!