Chart of the Day US500 (S&P500)

Chart of the Day US500 (S&P500)

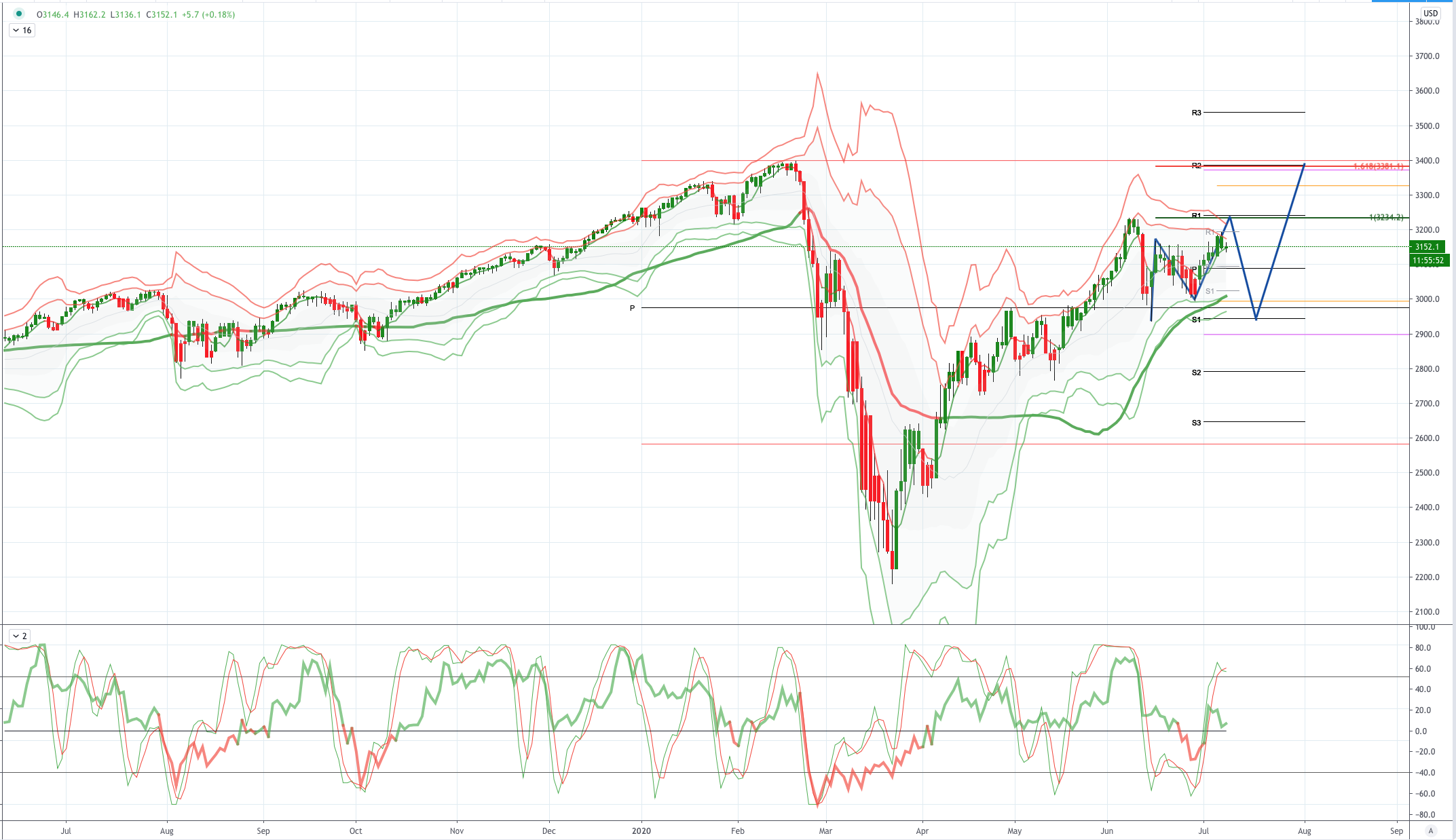

US500 (S&P500) Potential Reversal Zone - Probable Price Path

Risk retreat? The S&P500 broke a five day winning streak and retreated 1.08%, led by airlines, while VIX rose to 29.43. Fed’s Bostic warned that business leaders and consumers are getting worried about the second Covid-19 wave as there is a “real sense that this might go on longer than we had hoped”. Fed’s Mester suggested “ if we don’t get further fiscal support things won’t come back as well as they could”, whereas Clarida also opined that “there is more that we can do” if we need to, whether in terms of forward guidance or balance sheet. The UST bonds bull-flattened with the 10-year bond yield down to 0.65%. The $46b of 3-year notes fetched a record low yield of 1.39%. The 3-month LIBOR fell to a fresh 5-year low of 0.2684% amid likely unwinding of quarter-end funding pressures. Elsewhere, RBA kept its policy rate static at 0.25% as widely anticipated, while affirming its bond buying program, albeit it warned that the outlook remains “highly uncertain” and accommodative policies will be maintained for as long as required.

The White House wants Congress to pass another stimulus package by the first week of August before the summer recess. Meanwhile, US has formally withdrawn from the World Health Organisation. The JOLTS job openings unexpectedly rose from a revised 4.996m in April to 5.397m in May, mostly in accommodation and food services, retail, and construction.

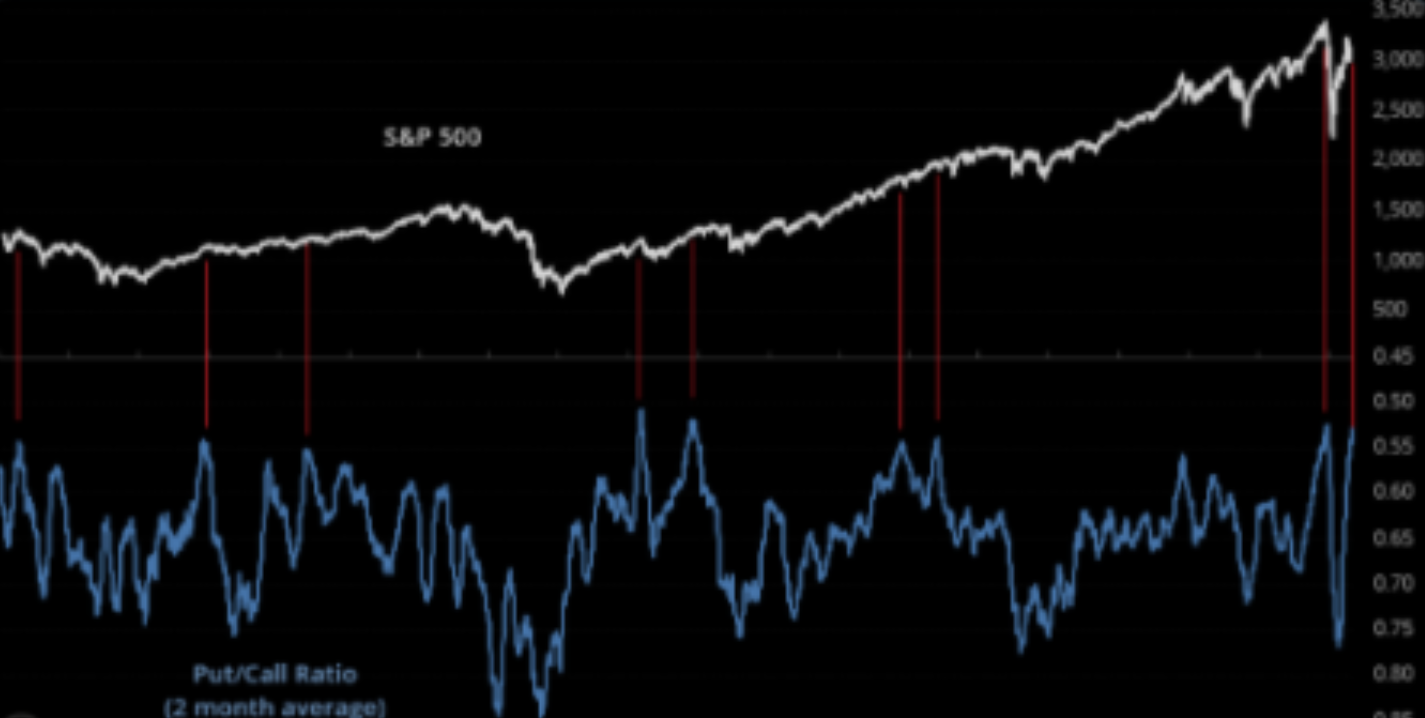

From a technical and trading perspective, the S&P500 looks poised to test the pivotal 3234 level which represents prior cycle highs and the current equality objective, a measured move from the June low. Bears will be watching for key reversal patterns on the daily timeframe to encourage the view of a summer range resistance, setting the stage for a pullback to test range support at 2930. It is noteworthy that S&P put to call ratio on a 2month rolling average basis is extremely elevated such instances over the last 20year sa have preceded market corrections and even crashes as witnessed in March. Whilst not anticipating another crash here there is certainly the potential to mark a summer range high which would support the thesis of a range support test.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!