Chart of The Day NZDJPY

Chart of the Day NZDJPY

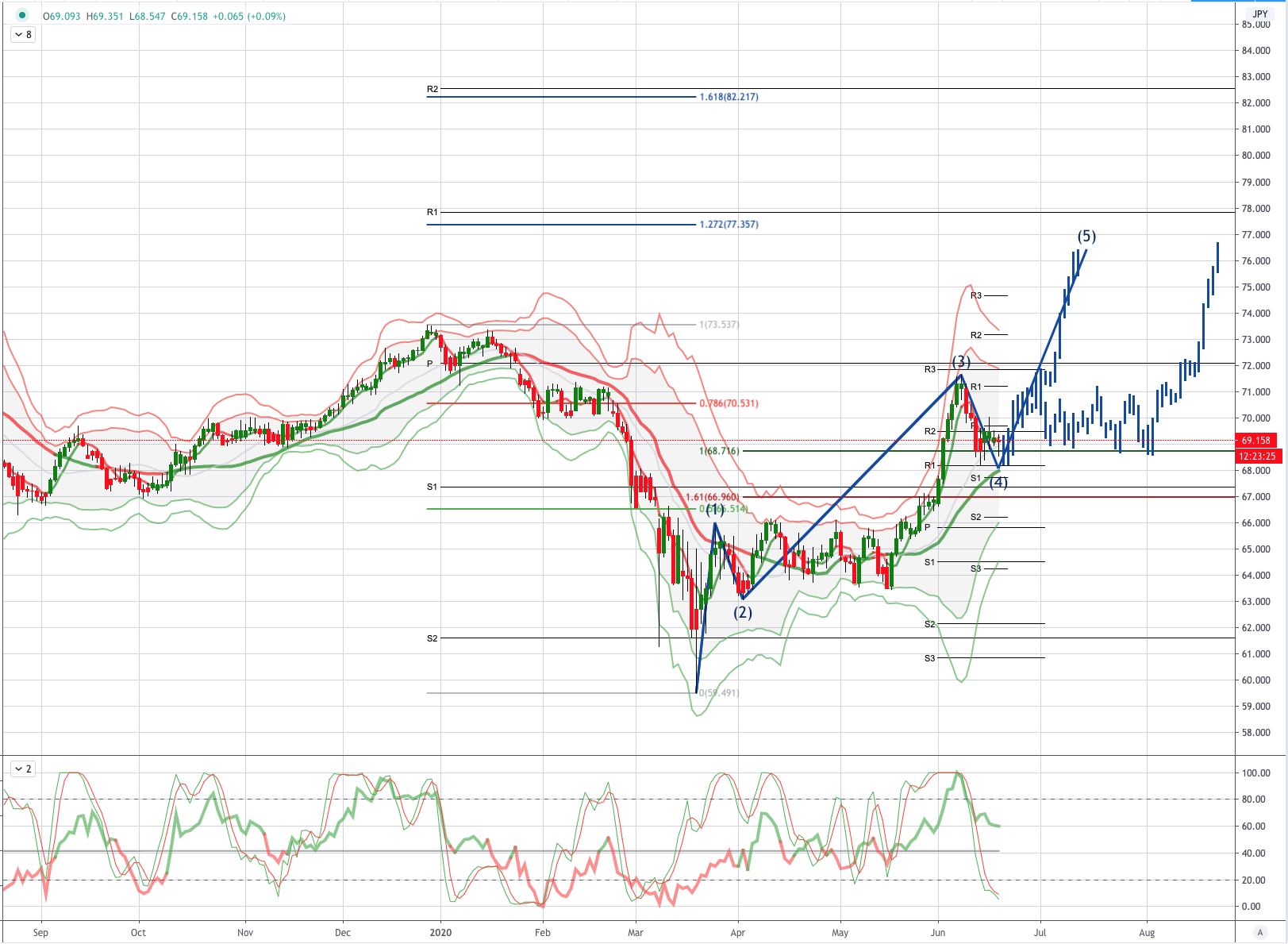

NZDJPY Potential Reversal Zone - Probable Price Path

So far, markets have been content to put aside concerns about the rise in COVID-19 cases in several US states (including Florida and Texas) and the re-emergence of the virus in Beijing. New COVID-19 cases in Florida increased 3.3% yesterday, bringing the rolling seven-day total to its highest level on record, but the state’s Governor said he didn’t intend to stop the reopening of the economy. In Beijing, there were another 31 cases reported yesterday linked to a cluster at the city’s largest food market, bringing the total to 137. Schools have been shut in the city and almost 70% of flights out of Beijing were cancelled yesterday but the authorities have so far taken a more targeted approach to containing its spread (compared to the lockdown imposed in Wuhan).

NZD:There was a further steepening in the NZ government bond curve yesterday, a day after the record $7b May2024 bond syndication (which attracted a huge $14b orderbook). The new 2024 bond yield fell 4bps on its first full day of trading, while 10-year+ bond yields rose by 2 to 5bps. There was less movement in the swap market, with swap rates falling 1-2bps across the curve, even at longer maturities. Governor Orr spoke to CNN but there wasn’t much new information from the interview. Orr reiterated that fiscal policy was the key policy lever for the country in its COVID-19 response, with monetary policy assisting, and that there were a range of policy options the RBNZ could take (including increasing the size and scope of QE, negative interest rates and long-term lending to banks) if it needed to provide more support down the line.

JPY:Earlier this week, the BOJ left policy on hold as widely expected, though did produce a slightly more dovish take on the outlook. At the moment, the Yen is trying to figure out its next move, and a lot of this will come down to the direction in US equities. Looking ahead, key standouts on the calendar come in the form of US initial jobless claims, and the Philly Fed.

From a technical and trading perspective, the NZDJPY has continued to test and hold pivotal symmetry swing support sighted at 68.70. As this level continues to attract bids there are two possible , ultimately bullish, scenarios. The base case is that bullish exposure should be rewarded ona breach of 69.50, as price advances it is important to pay attention to how price responds at the former cycle highs, sufficient supply here could be a precursor to more bullish consolidation similar to the April/May phase,however, without sufficient supply at the former cycle high then bulls can expect further upside initially targeting 73.50 enroute to the primary upside objective of 77.35

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!