Chart of The Day EURUSD

Chart of the Day EURUSD

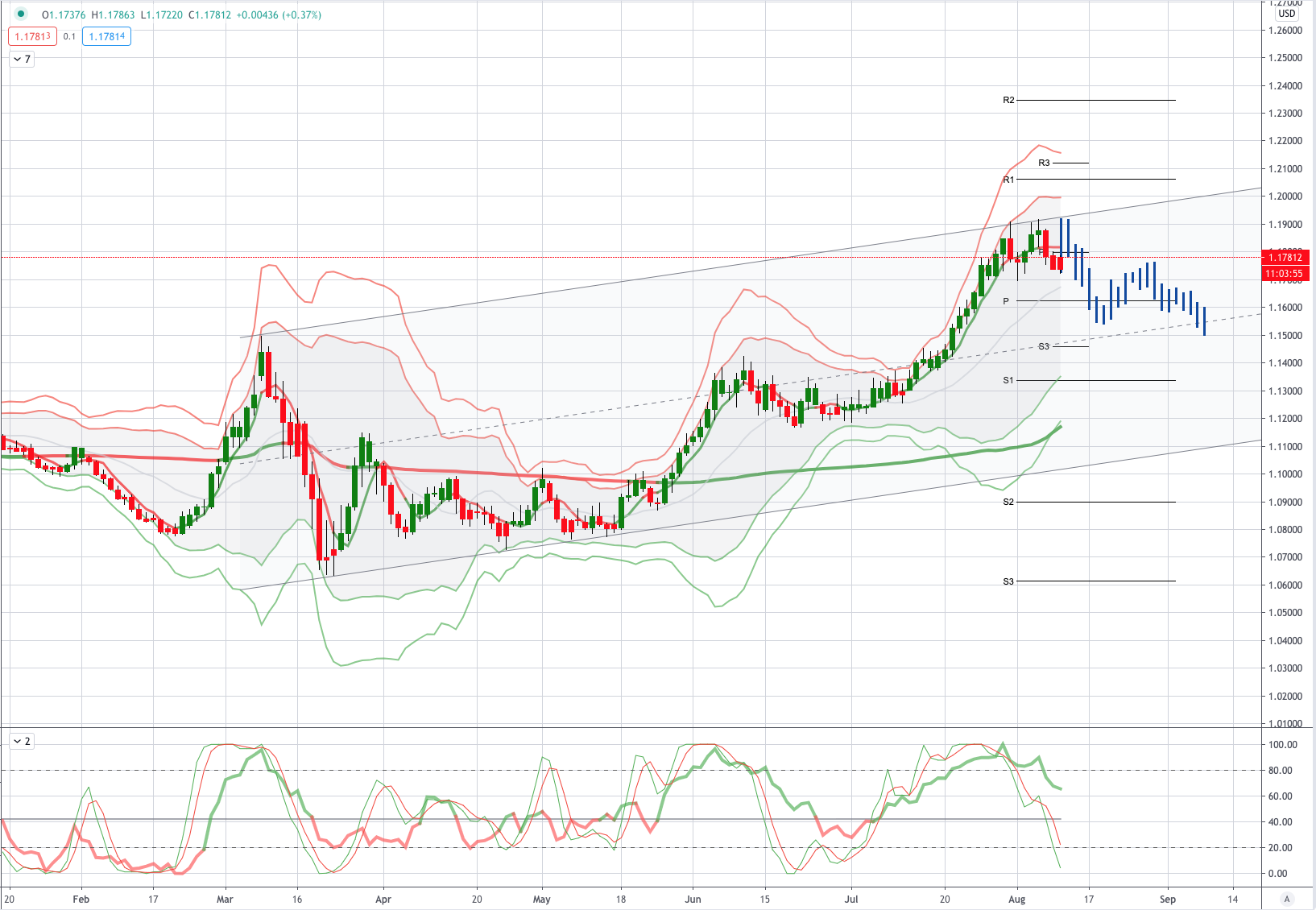

EURUSD Potential Reversal Zone - Probable Price Path

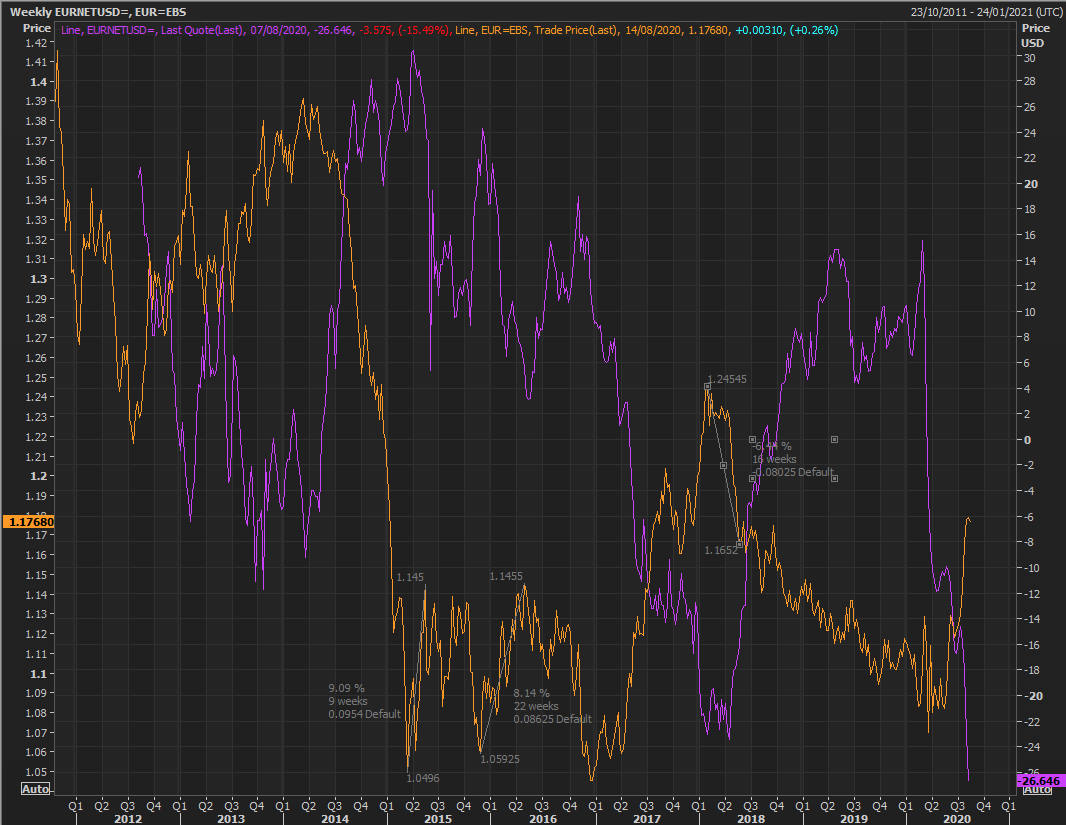

According to Reuters positioning data EURUSD longs have reached a record 22.6 billion euros. One larger bet has been made; shorts in 2015 reached EUR 25.6 billion. Two other bets reached 20 billion: shorts reached 20.8 billion at the end of 2015 and longs reached 20 billion in 2018. All those bets led to big corrections, most of them swiftly. The record short was reached in April 2015. EURUSD rallied 1.0496-1.1450 between March and May 2015. EURUSD based at 1.0593 in November 2015 and reached 1.1455 by late April 2016. When traders bet big on a rally in 2018, the longs peaked in April but reached almost 20 billion by February. EURUSD peaked in February at 1.2556, falling to 1.1652 by the end of May. Current bets have also been made fast, flipping from a 13.2 billion-euro short position in February. The net switch of 35.8 billion is the fastest and biggest change in betting recorded.

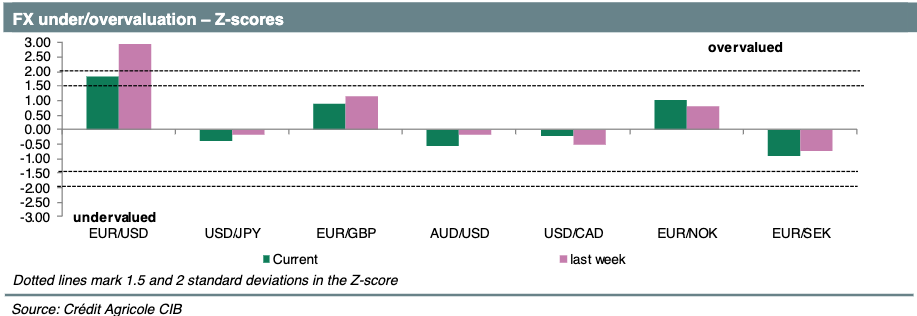

Crédit Agricole note while USD weakness continued for most of last week, an upside surprise in US non-farm payrolls data as well as an easing in risk sentiment as another round of US economic stimulus looked in doubt saw the USD recover some losses late last week. The FAST FX model still lost -0.19%last week being short EURUSD and is up 12.20% over the past year with a hit rate of 64%. The model judges that EURUSD is still overvalued and has entered another short EURUSD position with a stop-loss of -1.71% and a take-profit level of 1.1492.The FAST FX model estimates EURUSD’s fair value is currently 1.1492, which is significantly higher than the previous week’s estimate of 1.1318. US retail sales and the progress of negotiations on another round of US stimulus will be important for the outcome of this trade.

From a technical and trading perspective, the EURUSD spiked the 1.1830/50 cofluent resistance zone, with sentiment and positioning stretched in the near term. Another Friday’s key reversal candlestick pattern has flipped the daily chart bearish, as such bearish exposure should now be rewarded on a breach of 1.1750, using 1.1850 as an invalidation point, bears will now initially target a test of symmetry swing support sighted at 1.1620 enroute to the primary corrective objective sighted at 1.1500

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!