UK CPI Soars Again

The latest UK economic data today makes for troubling reading. CPI was seen spiking higher to 11.1% in October, well above the 10.7% the market was looking for. Marking a full 1% jump from the prior month, this reading brings UK inflation back to its highest level in 41 years. The BOE had noted that there would be some lag in the policy adjustments it’s made this year though, today’s data will leave many questioning how long that lag will be and whether the BOE has done enough?

Energy Prices Rise Despite Cap

Looking at the breakdown of the data, the biggest upside contributions once again came from energy prices. Gas and electricity process were seen rising 129% and 66% respectively. Notably, the increases would have been significantly higher if not for the energy cap with overall CPI projected to have been somewhere closer to 14%. Food and drink prices were seen soaring again by almost 17% y/y, their biggest increase since the late 70’s. In terms of downward contributions, transport costs slowed to 9% from 11% prior, while second hand car sales fell 3% y/y.

Economic Outlook Darkening

The near-term outlook for the UK economy on the back of the data is bleak. Data earlier this week showed unemployment creeping back up. While wages were seen rising, they’re still at a far lower pace than inflation meaning that real wages are falling further as CPI accelerates. Tomorrow’s UK budget is expected to further worsen the situation for households and businesses with spending cuts and widespread tax hikes planned.

BOE In Focus

The fear now is that the BOE is going to have to tighten more aggressively at the December BOE meeting. The BOE had signalled last time around a preference to reduce the pace of tightening given the weaker state of the UK economy. However, with CPI still rising above BOE forecasts there seems to be little option. The Russia -Ukraine war is showing no signs of slowing down and with the UK government potentially removing the energy cap in April next year, the BOE needs to bring inflation down or risk price hikes becoming entrenched at elevated levels, making their task more difficult.

Technical Views

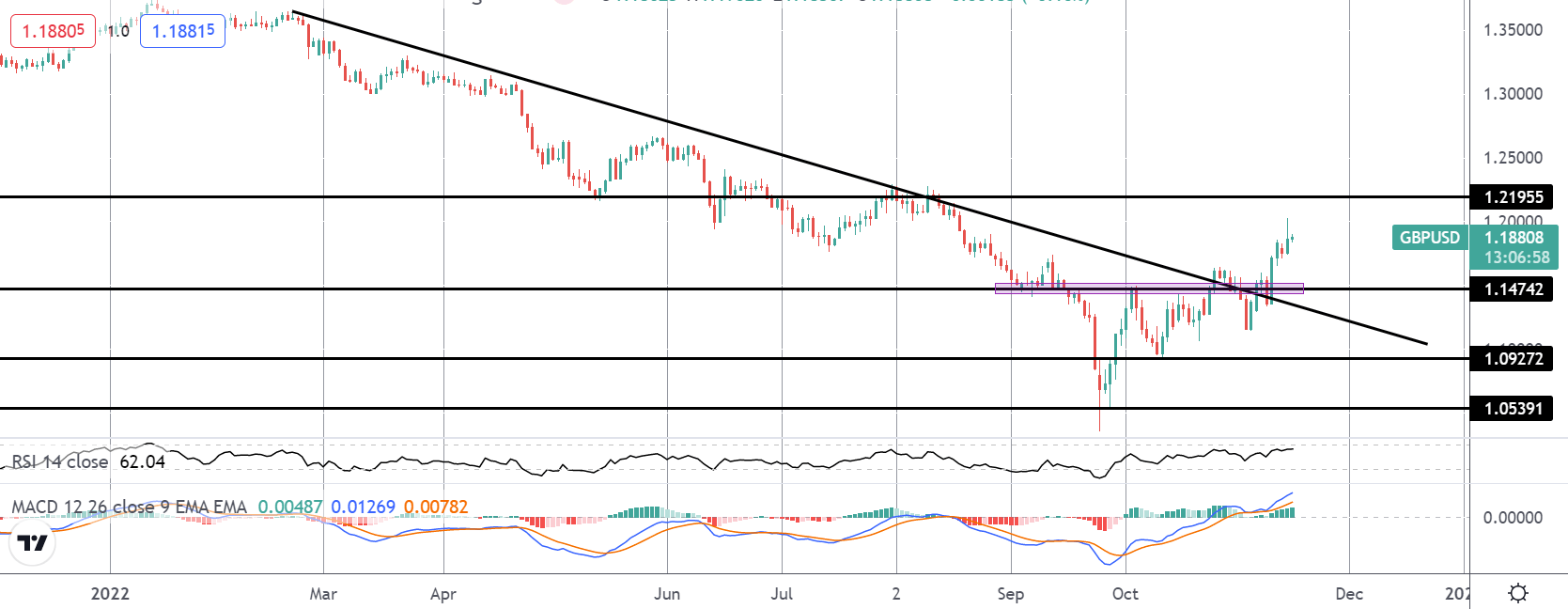

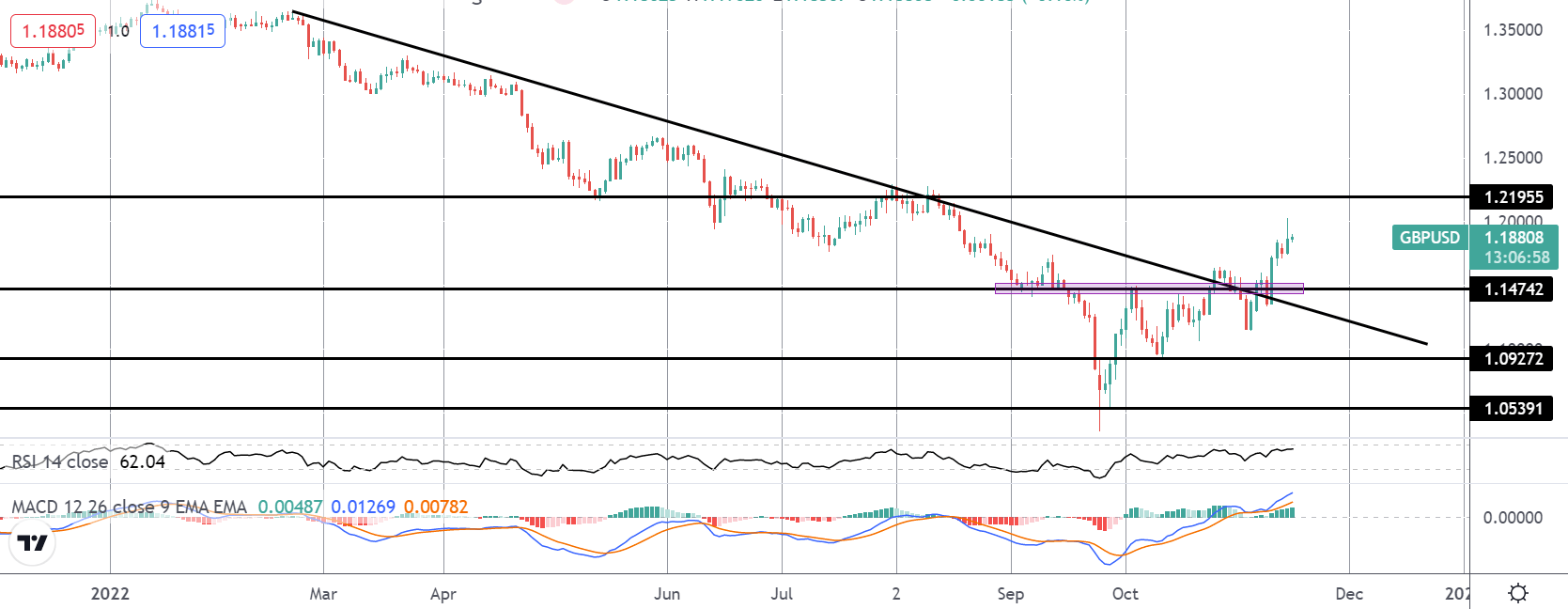

GBPUSD

The breakout above the bear trend line and above the 1.1474 level has seen the market trading up towards the 1.2195 level. With both MACD and RSI bullish, the focus is on a test of this level next while price holds above the broken trend line as support. With the retail market only around 65$ short, there is still plenty of room for the move to gather more momentum.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.