Bitcoin Testing Key Support Level on Trump Trade Fears

Bitcoin on the Brink

Bitcoin remains on watch here with the futures market down sharply from recent record highs. Price is currently sitting on a key support level which will prove pivotal in how price action develops in coming weeks. If price can hold this level and start to recover, focus will be on a fresh breakout higher. However, if we slip below current support, the market could accelerate to the downside as more longs are liquidated and speculative shorts start to increase pressure.

Risk Aversion

The move lower from recent highs was driven by fresh trade fears on the back of Trump threatening China with a heavy increase in tariffs. That move lower saw almost $20 billion in longs liquidated as traders exited positions. This echoes the broader sell off we saw across the risk complex as safe-haven assets such as gold and JPY soared higher. Indeed, for BTC, the wipe-out marks the largest ever long-liquidation event.

US/China Trade Focus

Looking ahead, focus is very much on Trump and China. With the 90-day trade truce deadline approaching on Nov 10th there is heavy two-way risk for Bitcoin. If tensions remain and no extension or deal is agreed, tariffs will rise again on Nov 10th, sinking Bitcoin along with the broader risk complex. However, if relations improve heading into the deadline and a deal or an extension is agreed, this should see BTC rallying firmly amidst a broader relief rally in risk assets.

Technical Views

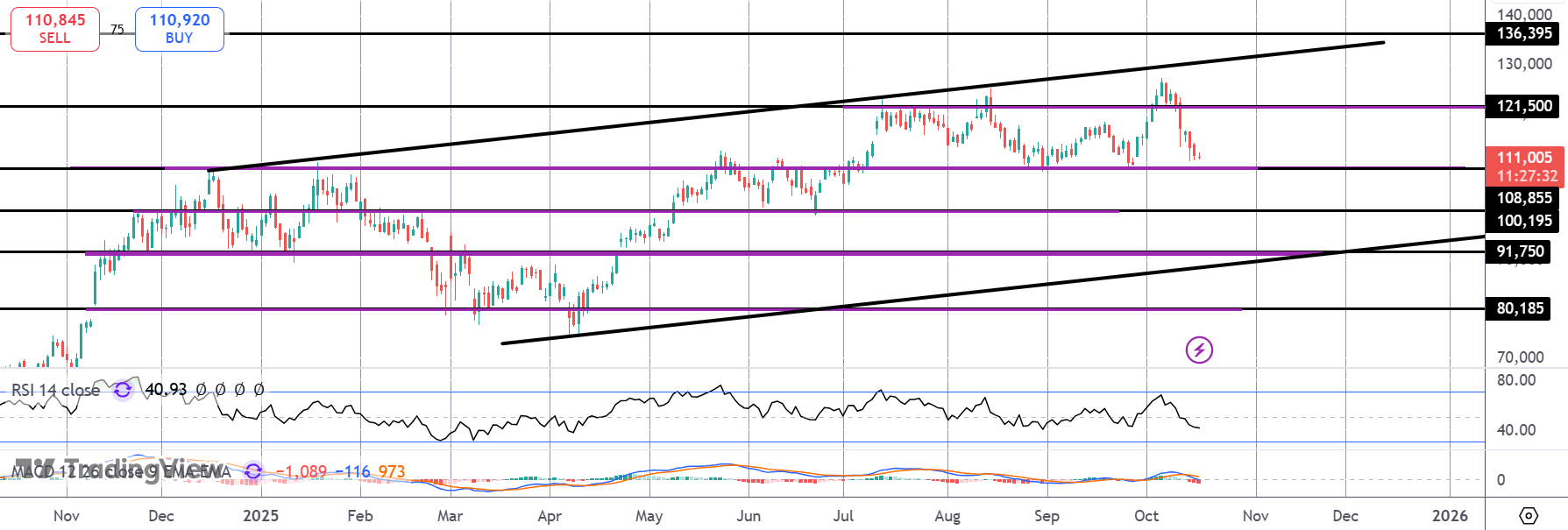

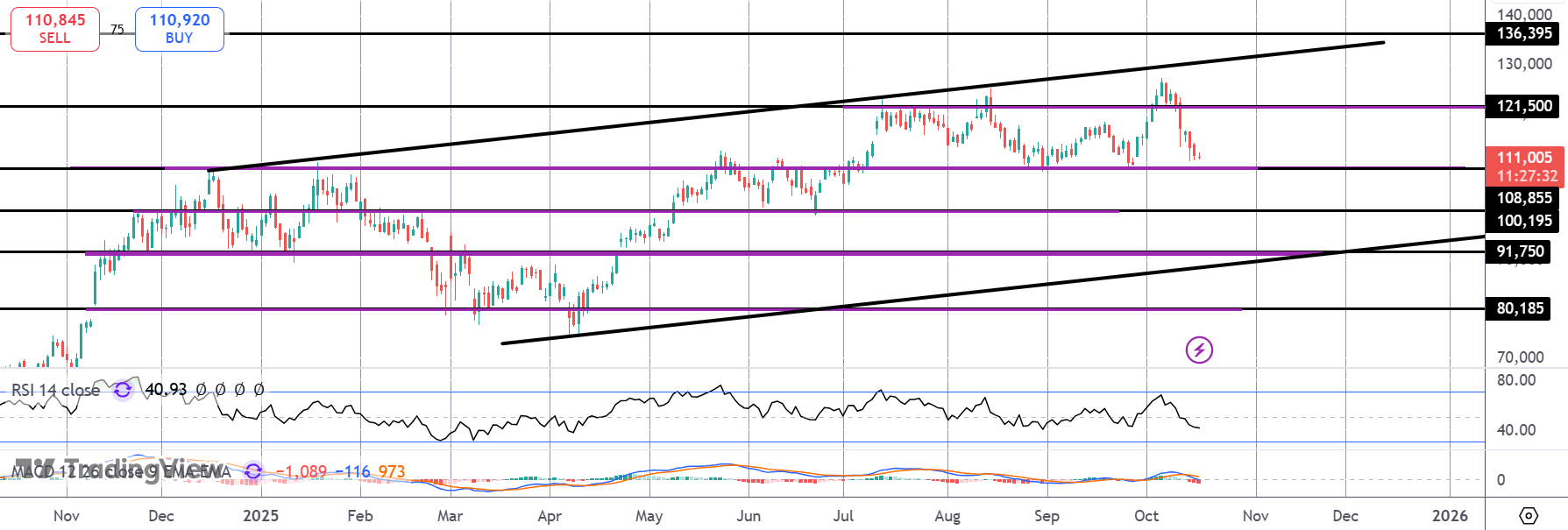

BTC

The sell off in BTC has seen the market trading back down to test the $108,855 level. This is a key support level for the market which bulls need to defend to maintain focus on a fresh ush higher towards the bull channel highs and the $136,395 level. Should we break lower, risks of a test of the channel lows are seen with the $100k level coming in before that as the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.